Technical analysis - Page 308

October 30, 2020

• Wheat falling sharply • Likely to reach 580.00 Wheat falling sharply after the recent downward reversal from the major resistance zone lying at the intersection of the two resistance trendlines of the weekly up channels from 2019 and 2016..

October 30, 2020

• Cotton reversed from resistance area • Likely to fall to 68.00 Cotton continues to fall strongly after the earlier downward reversal from the major resistance zone located between themulti-month resistance level 72.00 (which started the strong downtrend in January),.

October 30, 2020

• Adobe broke support zone • Likely to fall to 431.70 Adobe falling sharply after the earlier breakout of the support zone lying at the intersection of the support level 460.00 (which reversed the price multiple times in September) and.

October 30, 2020

• CADJPY reversed from support area • Likely to rise to 79.40 CADJPY recently reversed up from the support zone located between themulti-month support level 78.00 (former resistance from August, which has been reversing the price from June), lower daily.

October 29, 2020

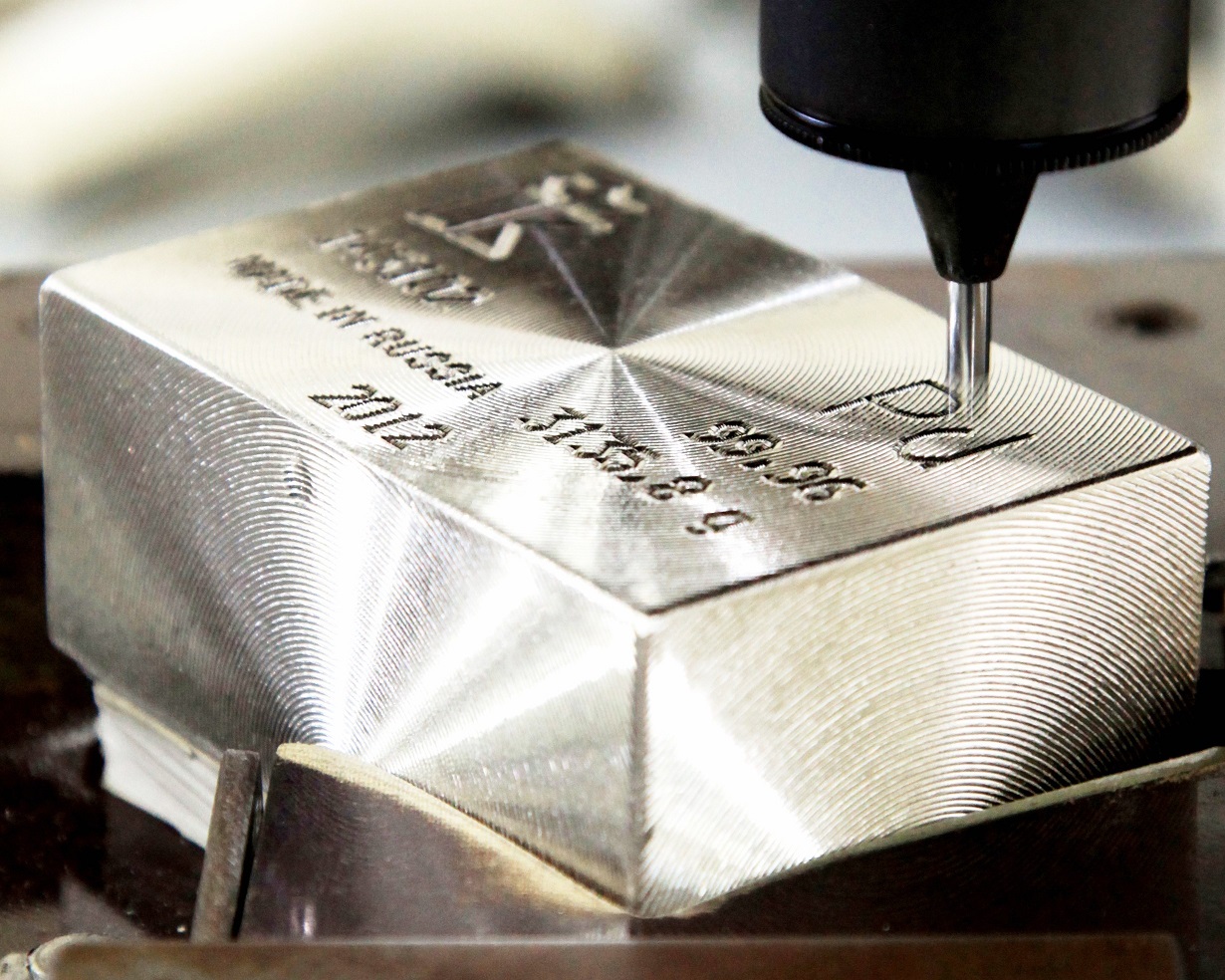

• Palladium falling inside wave c • Likely to reach 2185.00 and 2150.00 Palladium continues to fall inside the sharp impulse wave c, which started earlier from the resistance area lying between the resistance level 2450.00 (which has been reversing.

October 29, 2020

• NZDUSD reversed from resistance area • Likely to fall to 0.6550 NZDUSD recently reversed down from the resistance area lying between the resistance level 0.6680 (which stopped the previous impulse wave (1) earlier this month) and the upper daily.

October 29, 2020

• USDJPY reversed from support area • Likely to rise to 105.00 USDJPY recently reversed up from the the support area lying between the pivotal support level 104.00 (monthly low from September) and the lower daily Bollinger Band. The upward.

October 29, 2020

• EURJPY broke support area • Likely to fall to 121.00 EURJPY recently broke the support area lying between the key support level 122.60 (low of the previous short-term impulse wave A) and the 38.2% Fibonacci correction of the upward.

October 29, 2020

• Soy broke daily up channel • Likely to fall to 1040.00 Soy continues to fall inside the sharp corrective wave (ii), which started earlier with the daily Shooting Star which formed in the resistance area lying between the resistance.

October 28, 2020

• France120 broke support area • Likely to fall to 3465.00 France120 opened with the downward gap today which broke below the support area lying at the intersection of the major support level 3700.00 (monthly low from September and June).

October 28, 2020

• USDCAD broke daily down channel • Likely to rise to 1.3335 USDCAD recently broke the resistance trendline of the daily down channel from the end of September – which accelerated the active impulse wave 3. The pair today broke.