Technical analysis - Page 301

November 27, 2020

• Vale rising inside weekly upward impulse sequence (3) • Likely to reach 15.40 Vale opened with the upward gap following the earlier breakout of the two powerful resistance levels 13.60 (monthly high from January) and 14.15 (former multi-month high.

November 26, 2020

• Copper rising inside impulse waves (iii), 3 and (3) • Likely to reach 350,00 Copper continues to rise inside the sharp upward impulse waves (iii), 3 and (3) – which previously broke above the key resistance 320,00 (which stopped.

November 26, 2020

• GBPNZD under bearish pressure • Likely to fall to 1,9000 GBPNZD under bearish pressure after the earlier conclusive breakout of the key support 1.9110 (which has been reversing the price from the middle of July). The breakout of the.

November 26, 2020

• GBPCHF reversed from long-term resistance level 1.2200 • Likely to fall to 1.2030 GBPCHF recently reversed down from the strong long-term resistance level 1.2200 (which has been repeatedly reversing this currency pair from the end of April as can.

November 26, 2020

• EURCHF reversed from resistance level 1.0880 • Likely to fall to 1.0785 EURCHF previously reversed down from the key resistance level 1.0880 (which has been reversing this currency pair from the start of July), standing near the upper daily.

November 26, 2020

• Morgan Stanley reversed from support level 57,50 • Likely to rise to 67,5 Morgan Stanley earlier reversed up from the key support level 57,50 (former multi-month high from January) – which signalled the continuation of the active impulse waves.

November 26, 2020

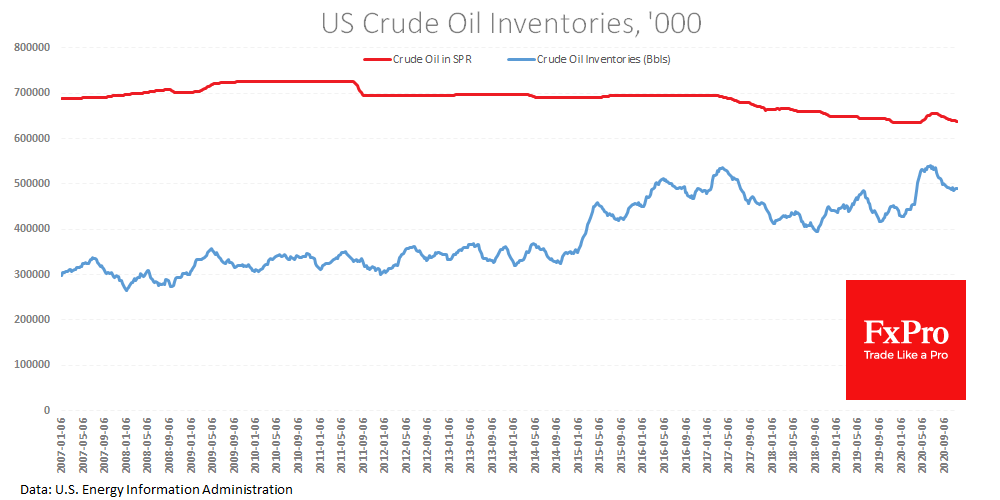

Oil is developing a growth on Thursday morning, increasing more than 8% so far this week and adding one third from the lows at the beginning of the month. Brent’s growth momentum yesterday and the renewal of highs since March.

November 25, 2020

• NZDUSD continues multi-month uptrend • Likely to rise to 0.7100 NZDUSD continues to rise inside the minor upward impulse sequence 3, which earlier reversed up sharply from the support level 0.6900, intersecting with the upper trendline of the daily.

November 25, 2020

• USDCAD reversed from key support level 1.3000 • Likely to rise to 1.3165 USDCAD previously reversed up from the key support level 1.3000, which has been reversing this currency pair from the end of August (as can be seen.

November 25, 2020

• Brent rising inside impulse wave C • Likely to rise to 50.00 Brent continues to rise inside the sharp upward impulse wave C, which previously broke the powerful resistance level 46.60 (monthly high from August) and the resistance trendline.

November 25, 2020

• Sugar falling inside minor impulse wave 1 • Likely to reach 14.500 Sugar continues to fall inside the minor impulse wave 1 which started previously from the powerful resistance area near the key resistance level 15.50. The resistance area.