Technical analysis - Page 281

February 15, 2021

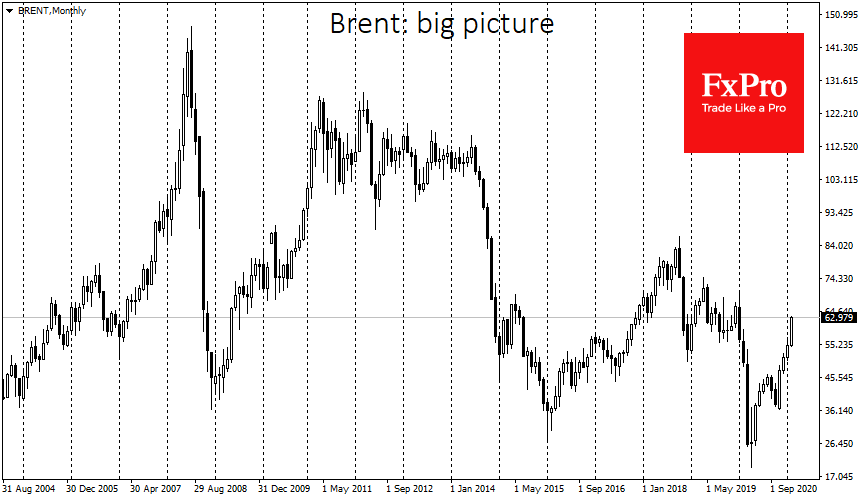

Brent prices surpassed the $63 mark in early trading on Monday, bringing this month’s growth to 15%. Middle East geopolitical tensions drove the latest impulse. The Saudi-led coalition in Yemen said it had intercepted a drone of the Iranian-backed Husit.

February 12, 2021

• CHFJPY reversed from long-term resistance level 117.80 • Likely to reach support level 116.65 CHFJPY currency pair recently reversed down from the long-term resistance level 117.80 (which has been steadily reversing the price from last August as can be.

February 12, 2021

• AUDNZD rising inside upward correction (ii) • Likely to reach resistance level 1.0835 AUDNZD continues to rise inside the sharp upward correction (ii) which started earlier from the key support level 1.0550, standing near the lower daily Bollinger band.

February 12, 2021

• NZDUSD falling inside sideways price range • Likely to reach support level 0.7100 NZDUSD recently reversed down from the pivotal resistance level 0.7250 (upper boundary of the sideways price range inside which the pair has been trading from the.

February 12, 2021

• Cocoa reversed from support level 2435.00 • Likely to reach resistance level 2660.00 Cocoa recently reversed up from the key support level 2435.00 (which has been reversing the price from the middle of December) – standing near the lower.

February 12, 2021

• Goldman Sachs rising inside impulse wave (3) • Likely to reach resistance level 310.00 Goldman Sachs continues to rise inside the steadily upward impulse wave (3) which starred earlier from the key support level 270.00, standing near the 38.2%.

February 11, 2021

• Sugar reversed from resistance level 16.65 • Likely to correct down to 16.00 Sugar under bearish pressure after the price failed to hold the ground above the resistance level 16.65 (which stopped the previous impulse wave (i) in December)..

February 11, 2021

• GBPNZD reversed from resistance level 1.9165 • Likely to test support level 1.8925 GBPNZD recently reversed down from the pivotal resistance level 1.9165, which has been steadily reversing this currency pair from the start of December. The resistance area.

February 11, 2021

• USDCAD under bearish pressure • Likely to test support level 1.2600 USDCAD currency pair under bearish pressure after the price broke the support level 1.2710 (low of the daily Bullish Engulfing from the end of January) standing close to.

February 11, 2021

• AUDUSD broke daily down channel • Likely to reach resistance level 0.7800 AUDUSD recently broke the resistance trendline of the daily down channel from the start of January (which encloses the previous minor ABC correction 2). The breakout of.

February 11, 2021

• ConocoPhillips reversed from resistance level 47.5 • Likely to fall to support level 42.50 ConocoPhillips recently reversed down from the key resistance level 47.5 (former monthly high from January and the top of the previous correction 2) – standing.