Technical analysis - Page 278

March 11, 2021

• Cotton reversed from support level 83.04 • Likely to rise to resistance level 89.06 Cotton recently reversed up with the daily Piercing Line reversal pattern from the key support level 83.04 (former monthly high from January). The support zone.

March 11, 2021

• AUDCHF reversed from resistance level 0.7225 • Likely to fall to support level 0.7100 AUDCHF today reversed down from the resistance level 0.7225 (which has been reversing the price the end of February). The pair is lily to form.

March 11, 2021

• Dow Jones broke key resistance level 32100.00 • Likely to rise to resistance level 33000.00 Dow Jones Industrial Average Index recently broke through the pivotal resistance level 32100.00 (which stopped the previous impulse wave 1 at the end of February)..

March 11, 2021

• CHFJPY broke resistance level 117.00 • Likely to rise to 117.80 CHFJPY recently broke the resistance level 117.00 (which was set as the likely upward target in our earlier forecast for this currency pair). The breakout of the resistance.

March 11, 2021

• Boeing broke resistance level 242.00 • Likely to reach resistance level 260.00 Boeing recently broke through the resistance level 242.00 (former multi-month high from December – which stopped the previous impulse wave (5)). The breakout of the resistance level.

March 10, 2021

• EURGBP reversed from support area • Likely to reach resistance level 0.8650 EURGBP recently reversed up from the support area surrounding the strong support level 0.8550 (which reversed the price with the daily Hammer at the end of February)..

March 10, 2021

• Platinum reversed from support area • Likely to rise to resistance level 1220.00 Platinum recently reversed up from the support zone located between the key support level 1135.00 (former resistance from January), lower daily Bollinger Band and the 38.2%.

March 10, 2021

• NZDCAD reversed from support level 0.9000 • Likely to reach resistance level 0.9100 NZDCAD recently reversed up from the round support level 0.9000 (which reversed the pair multiple times in December) – standing outside of the the lower daily.

March 10, 2021

• Dax broke key resistance level 14200.00 • Likely to rise to resistance level 15000.00 Dax continues to rise strongly after the index broke the key resistance level 14200.00 (which stopped the two previous waves in February – 1 and.

March 10, 2021

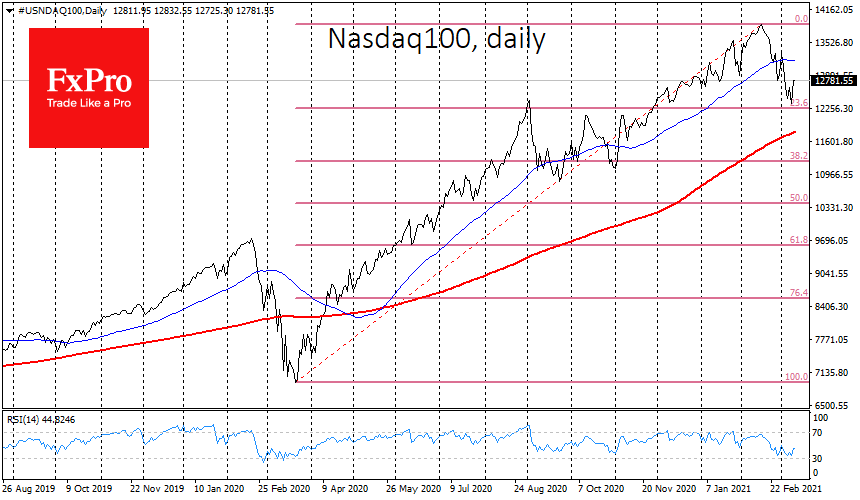

The markets have taken a U-turn. Stock markets returned sharply to growth on Tuesday afternoon, following shares in technology companies. A significant 20% jump in Tesla shares and a 4% rise in Apple and Amazon pulled the Nasdaq up 3.7%..

March 9, 2021

• GBPJPY broke key resistance level 150.00 • Likely to reach resistance level 152.00 GBPJPY continues to rise after the earlier breakout of the key resistance level 150.00 (which stopped the previous minor impulse wave (i) at the end of February)..