Technical analysis - Page 268

April 2, 2021

• GBPAUD reversed from support level 1.8115 • Likely to reach resistance level 1.8260 GBPAUD recently reversed up from the support level 1.8115 (former strong resistance from February and March – acting as support after it was broken earlier). The.

April 2, 2021

• Platinum reversed from support zone • Likely to reach resistance level 1237.00 Platinum recently reversed up from the support zone lying between the support level 1150.00 (former resistance from January – acting as support after it was broken earlier).

April 2, 2021

• NZDUSD reversed from resistance level 0.7030 • Likely to fall to support level 0.6940 NZDUSD recently reversed down from the resistance level 0.7030 (former strong support from last December). The resistance area near the resistance level 0.7030 is strengthened.

April 2, 2021

• EUR50 broke major resistance level 3865.00 • Likely to rise to resistance level 4000.00 EUR50 index earlier broke above the major resistance level 3865.00 (former monthly high from February) intersecting with the daily up channel from December. The breakout.

April 2, 2021

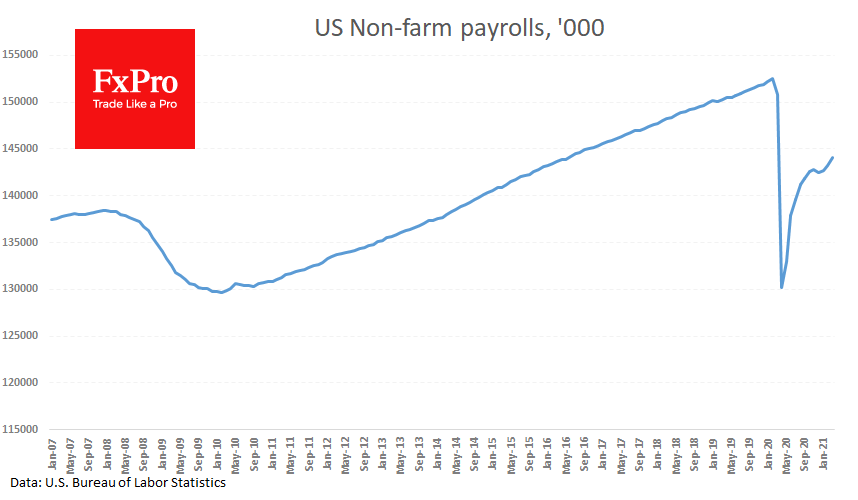

Employment in the USA rose by 916,000, better than the average forecast of 650,000. An additional positive signal from the labour market is that the average working week rose to 34.9 hours, a repeat of the highs of January and.

April 1, 2021

• AUDNZD reversed from resistance area • Likely to fall to support level 1.08150 AUDNZD recently reversed down from the resistance area located between the resistance level 1.0900 (strong barrier from September of 2020) and the upper daily Bollinger Band..

April 1, 2021

• Silver reversed from support area • Likely to rise to resistance level 26.65 Silver recently reversed up from the support area lying between the support level 24.00 (which has been reversing the price from December) lower daily Bollinger Band.

April 1, 2021

• USDCHF reversed from 0.9460 • Likely to fall to support level 0.9380 USDCHF recently reversed down from the long-term resistance level 0.9460 (former monthly high from July) – strengthened by the upper daily Bollinger Band. The downward reversal from.

April 1, 2021

• EURCHF reversed from resistance area • Likely to test support level 1.1000 EURCHF falling after the pair reversed down from the resistance area lying between the resistance level 1.1110 (which reversed the price multiple times from the start of.

April 1, 2021

• Microsoft broke resistance level 240.00 • Likely to rise to resistance level 245.00 Microsoft recently broke the resistance level 240.00 (which is the upper boundary of the sideways price range inside which the price has been trading from last.

March 31, 2021

• Gold reversed from key support level 1680.00 • Likely to reach resistance level 1720.00 Gold recently reversed up from the key long-term support level 1680.00, which has been reversing the price from the middle of April of 2020 –.