Technical analysis - Page 263

April 20, 2021

• GBPUSD reversed from resistance level 1.400 • Likely to fall to support level 1.3900 GBPUSD recently reversed down from the key resistance level 1.4000 (which has been steadily reversing the pair for the last few trading weekly) – standing.

April 20, 2021

• USDCAD reversed from support level 1.2475 • Likely to rise to resistance level 1.2600 USDCAD recently reversed up from the pivotal support level 1.2475 (which has been reversing the price for the last few trading sessions) – strengthened by.

April 19, 2021

• Amazon reversed from pivotal resistance level 3425.00 • Likely to fall to support level 3320.00 Amazon earlier reversed down from the pivotal resistance level 3425.00 (former monthly high from February) – strengthened by the upper daily Bollinger Band. The.

April 19, 2021

• Palladium broke long-term resistance level 2755.00 • Likely to rise to resistance level 3000.00 Palladium under the bullish pressure after the price broke above the key long-term resistance level 2755.00 (which has been steadily reversing the price from the.

April 19, 2021

• EURGBP reversed from resistance level 0.8700 • Likely to fall to support level 0.8550 EURGBP recently reversed down from the resistance level 0.8700 (which has been steadily reversing the price from the end of February) – strengthened by the.

April 19, 2021

• GBPAUD reversed from key support level 1.7800 • Likely to rise to 1.8080 GBPAUD recently reversed up from the key support level 1.7800 (which has been reversing the price from the star of March) – standing near the lower.

April 19, 2021

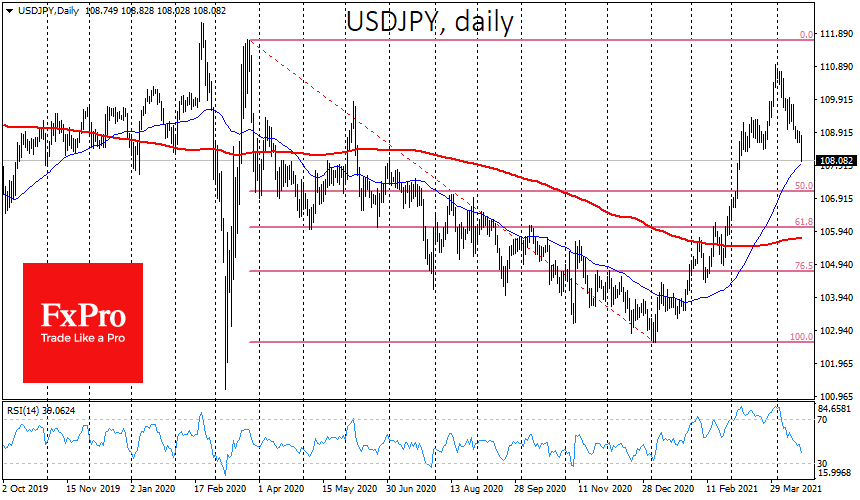

The Dollar remains under moderate pressure at the start of the new week. The Japanese yen continues to recoup losses from the beginning of the year, with USDJPY falling to 108.00 this morning, an area of four-week lows. GBPUSD is.

April 16, 2021

• NZDCAD reversed from resistance level 0.8980 • Likely to fall to support level 0.8885 NZDCAD currency pair recently reversed down from the resistance level 0.8980 (former strong support from the start of December) intersecting with the upper daily Bollinger Band.

April 16, 2021

• Dax broke resistance 15300.00 • Likely to rise to resistance level 16000.00 Dax index continues to rise strongly after the price broke above the pivotal resistance 15300.00 (which has been reversing this index in the last few trading sessions)..

April 16, 2021

• GBPJPY reversed from support level 149.65 • Likely to rise to resistance level 151.00 GBPJPY recently reversed up from the multi-candle support level 149.65 (which has been steadily reversing this currency pair from the start of this month). The.

April 16, 2021

• GBPNZD reversed from support level 1.9245 • Likely to rise to resistance level 1.9450 GBPNZD currency pair recently reversed up from the support level 1.9245 (former resistance from the end of February) intersecting with the lower daily Bollinger Band and.