Technical analysis - Page 237

October 6, 2021

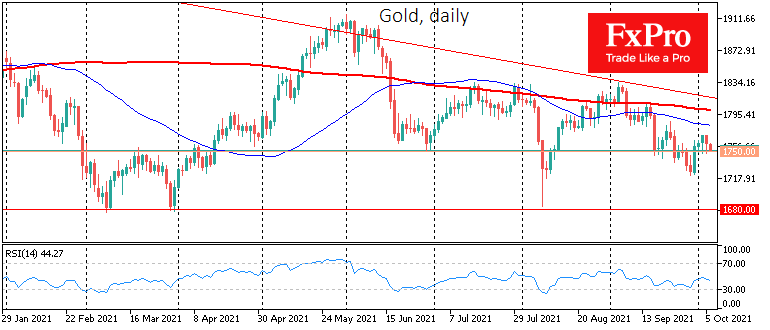

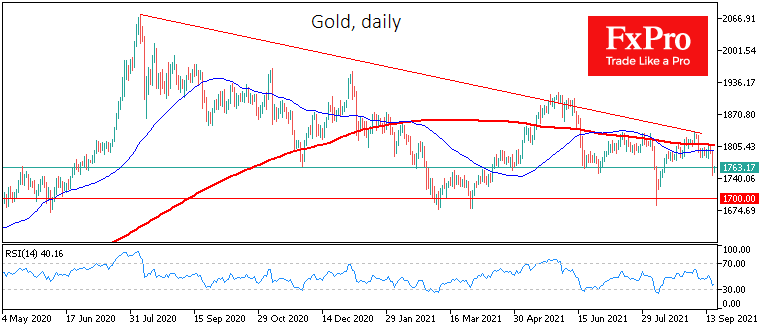

Gold’s near-term prospects are bleak, but observations on the price dynamics indicate cautious buying for the longer term, limiting the downside potential. In early September, the sellers, with a strong move, brought the gold back below the significant 50 and.

October 5, 2021

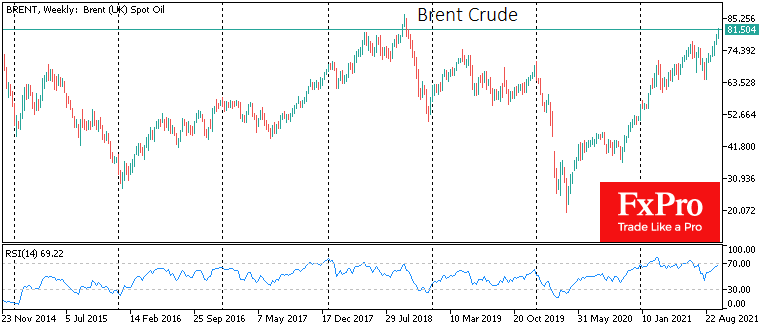

OPEC has not accepted calls to accelerate oil production quotas amid a rally in gas and coal prices in Europe and Asia, boosting oil prices. WTI prices renewed their 7-year highs, climbing above $78 at one point. The gains for.

October 4, 2021

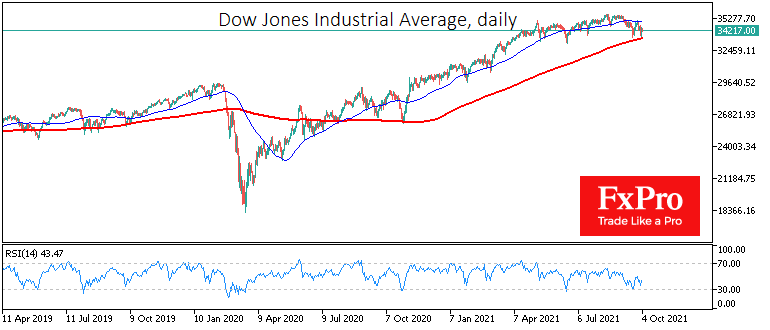

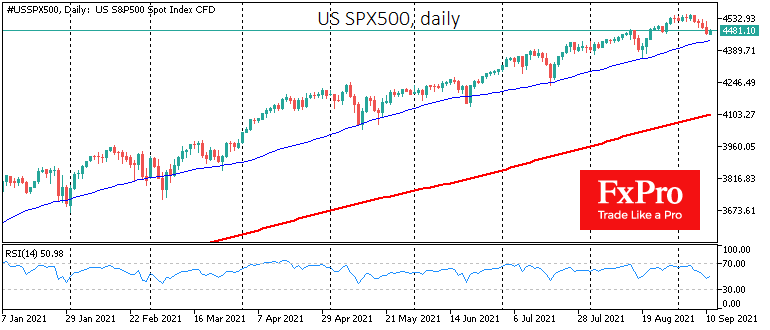

The bulls in the US stock markets seem to reverse the single-digit negative sentiment and close the week with major indices rising more than 1%. Increased demand for risky assets put pressure on the dollar. Still, investors and traders should.

October 1, 2021

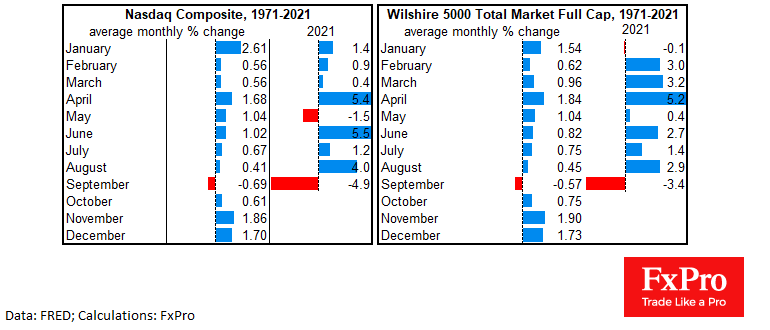

September confirmed its title as the worst month of the year for US equities. Seasonal patterns suggest a much more optimistic view of the market outlook for the rest of the year. However, investors should not rush to stock purchases.

September 30, 2021

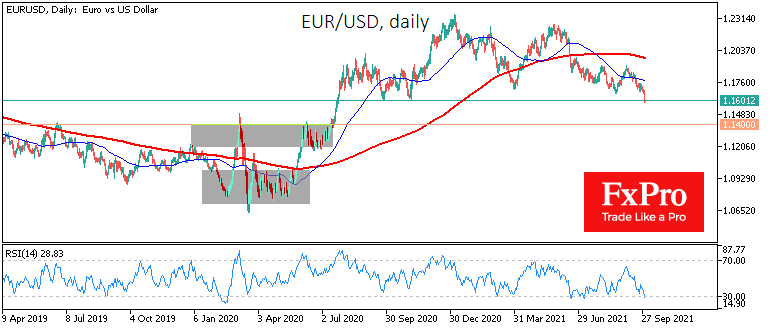

One by one, Dollar bulls beat out stops in one key currency pair, taking the US currency to multi-month highs. The dollar index climbed to a high of precisely one year, reaching 94.4 by advancing against its main rivals, the.

September 28, 2021

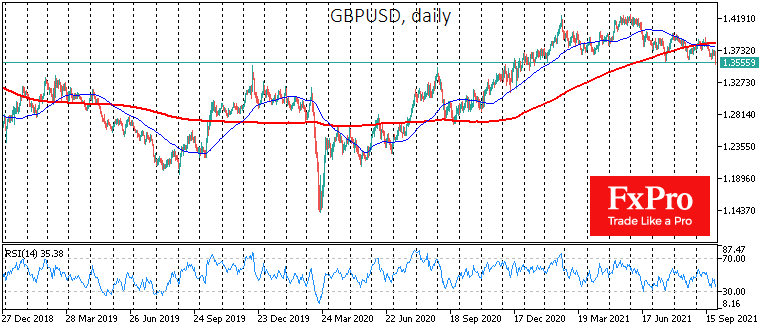

The British Pound is losing 1.15% on Tuesday, slipping to an eight-month low at 1.3540, as supply chain chaos had a more substantial impact on the currency now than the hawkish comments from the Bank of England last week. Particularly.

September 23, 2021

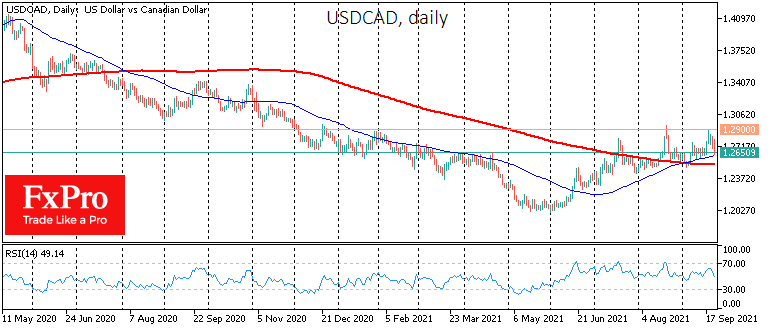

USDCAD is losing around 1% on Thursday, pulling back to 1.2640. The pair faced significant resistance on the approach to 1.2900 at the start of the week, but bears stopped the pair from moving higher since last December. USDCAD has.

September 20, 2021

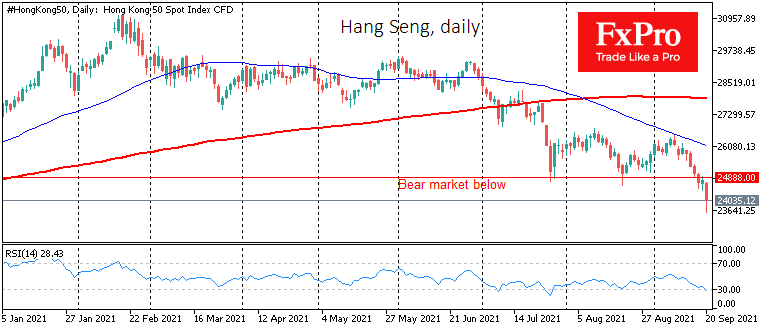

Global markets closed last week on the back foot, and no significant positive factors emerged in Asian trading, increasing the flight to safety. The Hang Seng lost as much as 4.5% in the first four hours of trading today, cutting.

September 17, 2021

Strong US data revived bets on an imminent QE rollback from the Fed, supporting the dollar and causing bond yields to rise. The news triggered a more than 2% plunge in gold prices, four times the amplitude of the dollar’s.

September 15, 2021

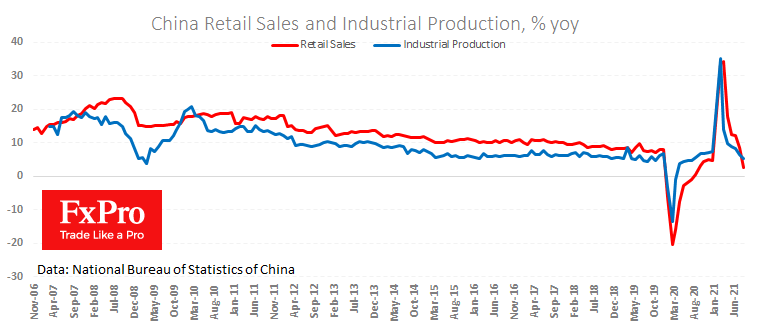

Once again, decline prevails on the stock markets. US indices closed lower for the fifth trading session out of the last six. Chinese statistics added to the anxiety in the markets on Wednesday morning, failing to meet the forecasts. Most.

September 13, 2021

Demand for risk assets in financial markets continues to shrink with two significant drivers. Firstly, sentiment is undermined by the sustained sell-off in equities that has dominated the week during the US trading session. Secondly, China is not backing down.