Technical analysis - Page 232

November 12, 2021

• General Motors broke round resistance level 60.00 • Likely to rise to resistance level 64.

November 12, 2021

• Moody’s Corporation reversed from support level 385.50 • Likely to rise to resistance level 406.

November 12, 2021

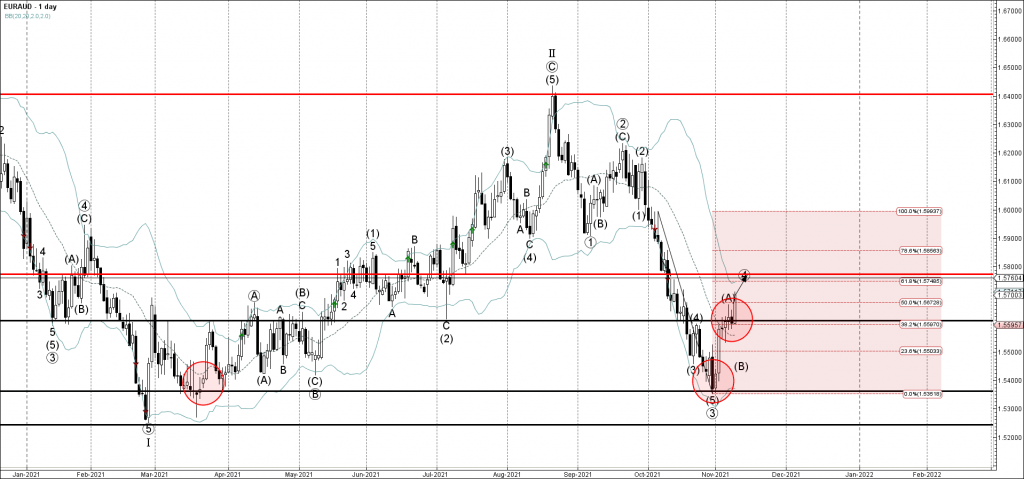

• EURCAD reversed from resistance level 1.4450 • Likely to fall to support level 1.

November 11, 2021

• Citibank reversed from support level 66.80 • Likely to rise to resistance level 70.

November 11, 2021

• AUDCAD reversed from support level 0.9130 • Likely to rise to resistance level 0.

November 11, 2021

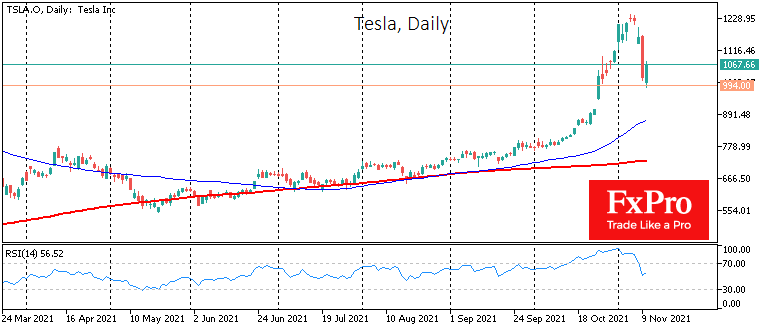

Tesla shares took a severe hit early in the week, retreating 20% from last week’s peak levels to $987 at the start of trading on Wednesday. The price later rebounded to $1067, but it was walking on the edge of.

November 10, 2021

• Gold broke strong resistance level 1832.00 • Likely to rise to resistance level 1860.

November 10, 2021

• GBPCAD reversed from key resistance level 1.6870 • Likely to fall to support level 1.

November 9, 2021

• Visa reversed from resistance level 220.00 • Likely to fall to support level 205.