Technical analysis - Page 230

November 26, 2021

• USDCHF under strong bearish pressure • Likely to fall to support level 0.91000 USDCHF under the strong bearish pressure today after the price reversed down from the strong resistance level 0.9365, intersecting with the upper daily Bollinger Band. The.

November 26, 2021

• Dow Jones broke support level 35000.00• Likely to fall to support level 34250.00 Dow Jones index continues to fall after the earlier breakout of the key support level 35000.00, intersecting with the 50% Fibonacci correction of the upward price.

November 25, 2021

• Unilever broke daily down channel • Likely to rise to resistance levels 39.60 and 40.75 Unilever continues to rise after the earlier breakout of the resistance trendline of the daily down channel from August – inside which the price.

November 25, 2021

• Barclays reversed from support zone • Likely to rise to resistance level 1.976 Barclays recently reversed up from the support zone lying between the long-term support level 1.8915 (former multi-month high from April), lower daily Bollinger Band and the.

November 25, 2021

• EURNZD broke resistance zone • Likely to rise to resistance level 1.9500 EURNZD currency pair recently broke the resistance zone lying between the key resistance level 1.6345 (top of the previous corrective wave (iv)) and the 38.2% Fibonacci correction.

November 25, 2021

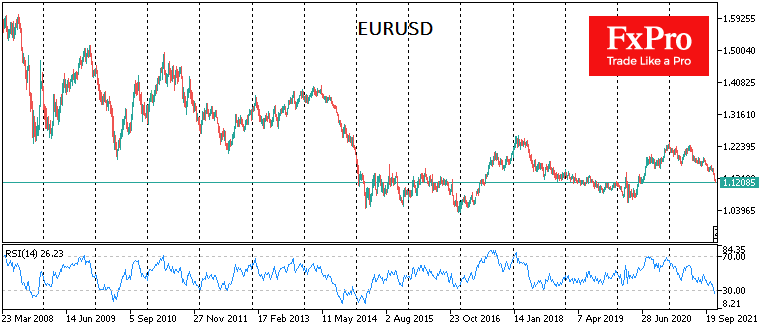

The Euro fell against the dollar to 1.1200, a new 16-month low, having lost more than 4% in the last four weeks. The downward trend in the single currency accelerated in November on the divergence between Fed and ECB policies..

November 24, 2021

• GER50 index broke support zone • Likely to fall to support level 34200.00 GER50 index recently broke the support zone lying between the key resistance level 34700.00 (low of the previous minor wave 2 from October) and the 50%.

November 24, 2021

• GBPNZD broke resistance zone • Likely to rise to resistance level 1.9500 GBPNZD currency pair recently broke the resistance zone lying between the key resistance level 1.9265 (top of the previous wave (a)), channel line from August and the.