Technical analysis - Page 208

May 6, 2022

• Standard Chartered reversed from resistance zone• Likely to fall to support level 5.510 Standard Chartered earlier reversed down from the resistance zone lying between the multi-month resistance level 5.8 (which stopped the sharp uptrend in February) and the upper.

May 6, 2022

• EUR50 broke the support zone• Likely to fall to support level 3600.00 EUR50 index recently broke the support zone lying between the key support level 3700.00 (which stopped wave (i) at the end of April) and the 50% Fibonacci.

May 6, 2022

• GBPAUD reversed from support level 1.7200• Likely to rise to resistance level 1.7493 GBPAUD currency pair recently reversed up sharply from the key support level 1.7200 (which stopped wave 1 at the start of April). The upward reversal from.

May 6, 2022

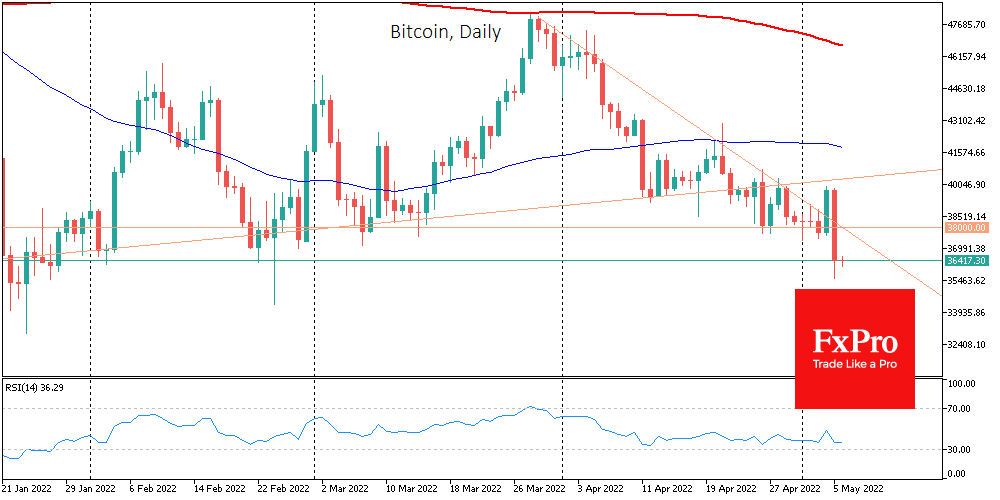

Bitcoin was down more than 10% intraday on Thursday, stabilising at $36.4K from the end of the day and losing 8.3% overnight. Ethereum lost 6.7% in the last 24 hours, while other leading altcoins in the top 10 fell from.

May 5, 2022

• USDJPY reversed from support area• Likely to rise to resistance level 131.20 USDJPY recently reversed up strongly from the support area located between the key support level 128.90 (former resistance from last month) and the 50% Fibonacci correction of.

May 5, 2022

• Nikkei 225 reversed from resistance area• Likely to test support level 26500.00 Nikkei 225 index recently reversed down from the resistance area located between the key resistance level 27425.00 (which has been reversing the price from last month), upper.

May 5, 2022

• GBPUSD falling inside impulse waves (iii),3 and (3)• Likely to fall to support level 1.2250 GBPUSD currency pair recently broke the key support level 1.2670 (low of wave (B) from the end of 2020). The breakout of the support.

May 4, 2022

• Dow Jones reversed from support level 32460.00• Likely to rise to resistance level 35000.00 Dow Jones recently reversed up from the key support level 32460.00 (which has been reversing the index from the start of this year), standing near.

May 4, 2022

• USDCAD reversed from key resistance level 1.2890• Likely to fall to support level 1.2750 USDCAD recently reversed down strongly from the key resistance level 1.2890 (which has been reversing the price from last August), standing near the upper daily.

May 3, 2022

• Platinum reversed from support zone• Likely to rise to resistance level 960.00 Platinum recently reversed up strongly from the powerful long-term support level 900.00 (which has been reversing the price from last September), standing near the lower daily Bollinger.

May 3, 2022

• CADCHF reversed from resistance level 0.7620• Likely to fall to support level 0.7535 CADCHF currency pair today reversed down from the key resistance level 0.7620, standing near the upper daily Bollinger Band and the resistance trendline of the daily.