Technical analysis - Page 202

June 22, 2022

• NZDCAD reversed from resistance level 0.8280• Likely to fall to support level 0.8065 NZDCAD currency pair earlier reversed down from the key resistance level 0.8280 – standing close to the 61.8% Fibonacci correction of the downward impulse from May..

June 22, 2022

• AT&T rising inisde corrective wave (2)• Likely to rise to resistance level 20.77 AT&T earlier reversed up from the key support level 18.80 – standing close to the lower daily Bollinger Band and the 61.8% Fibonacci correction of the.

June 22, 2022

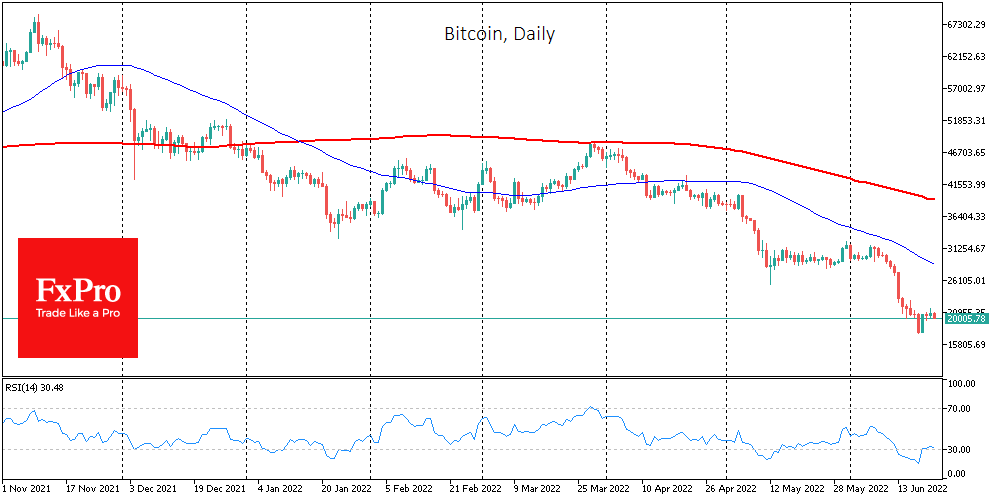

Bitcoin rallied from $20.5K to $21.6K during the day on Tuesday but later reversed to decline and went back on Wednesday morning. Ether corrected deeply, losing 4.4% over the last 24 hours. The top ten altcoins showed mixed dynamics, ranging.

June 21, 2022

• USDJPY broke key resistance level 135.50• Likely to rise to resistance level 137.25 USDJPY currency pair today broke above the key resistance level 135.50 (which stopped the earlier minor impulse wave 1 at the start of June). The breakout.

June 21, 2022

• Brent reversed from key support level 111.80• Likely to rise to resistance level 115.00 Brent crude oil earlier reversed up from the key support level 111.80 (former strong resistance from April and May) – which completed the earlier correction.

June 20, 2022

• USDCAD reversed from resistance level 1.3075• Likely to fall to support level 1.2940 USDCAD currency pair just reversed down from the strong resistance level 1.3075 (former top of the impulse wave 1 from the start of May) – standing.

June 20, 2022

• EURJPY reversed from support level 139.30• Likely to rise to resistance level 144.00 EURJPY currency pair just reversed up from the key support level 139.30 (former strong resistance from the middle of April). The upward reversal from the support.

June 16, 2022

• AUDNZD reversed from resistance level 1.1160• Likely to fall to support level 1.1030 AUDNZD currency pair just reversed down from the key resistance level 1.1160 (top of the previous impulse wave 1 from the start of May). The resistance.

June 16, 2022

• FTSE 100 broke key support level 7166.00• Likely to fall to support level 7050.00 FTSE 100 index under the bearish pressure after the price broke the key support level 7166.00 (which has been reversing the index from the start.

June 16, 2022

• CADCHF broke support level 0.7600• Likely to fall to support level 0.7550 CADCHF currency pair recently broke the key support level 0.7600 and the 61.8% Fibonacci correction of the upward wave (B) from May. The breakout of the support.

June 15, 2022

• Platinum reversed from support level 920.00• Likely to rise to resistance level 960.00 Platinum recently reversed up from the support level 920.00 (which is the upper border of the support zone which has been reversing the price from the.