Technical analysis - Page 2

February 13, 2026

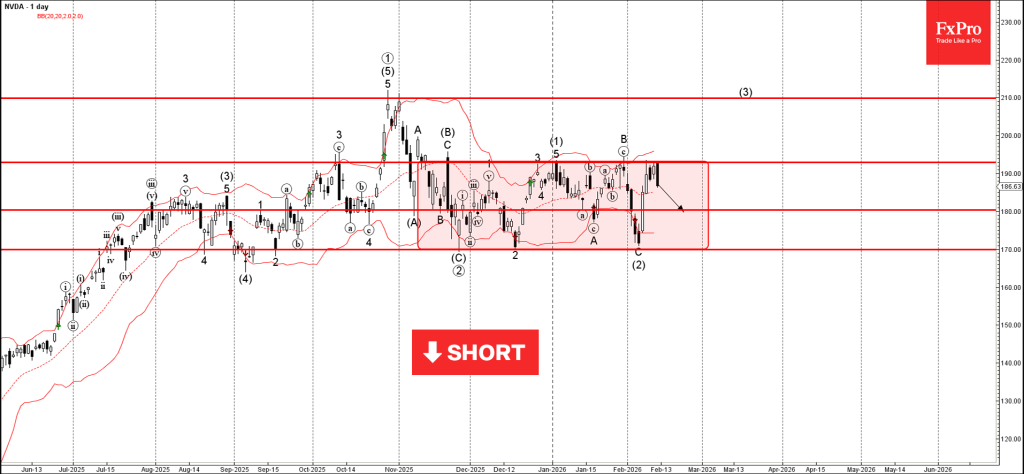

Nvidia: ⬇️ Sell – Nvidia falling inside sideways price range – Likely to fall to support level 180.00 Nvidia recently reversed down from the strong resistance level 192.92 (upper border of the sideways price range inside which Nvidia has been.

February 13, 2026

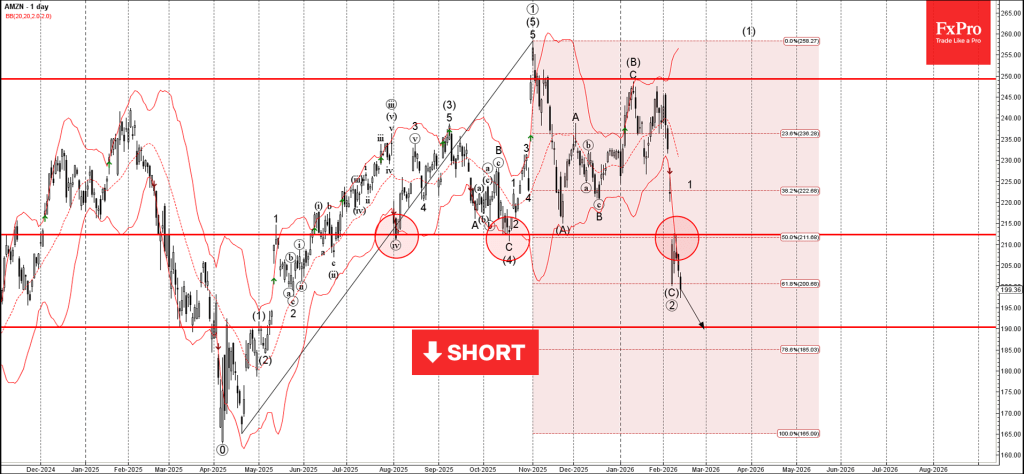

Amazon: ⬇️ Sell – Amazon reversed from pivotal resistance level 212.30 – Likely to fall to support level 190.00 Amazon recently reversed down from the pivotal resistance level 212.30 (former strong support from August and October, acting as the resistance.

February 12, 2026

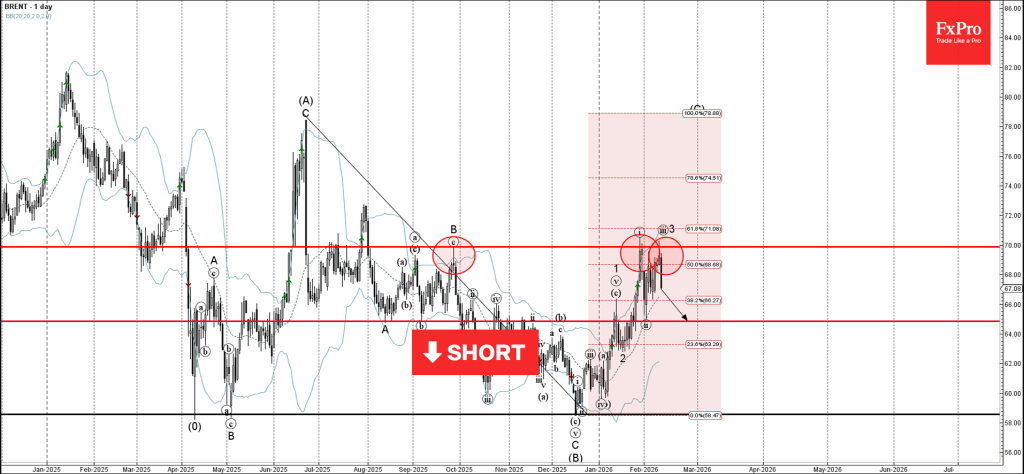

Brent Crude Oil: ⬇️ Sell – Brent Crude Oil reversed from resistance zone – Likely to fall to support level 64.85 Brent Crude Oil recently reversed down from the resistance zone between the round resistance level 70.00 (which has been.

February 12, 2026

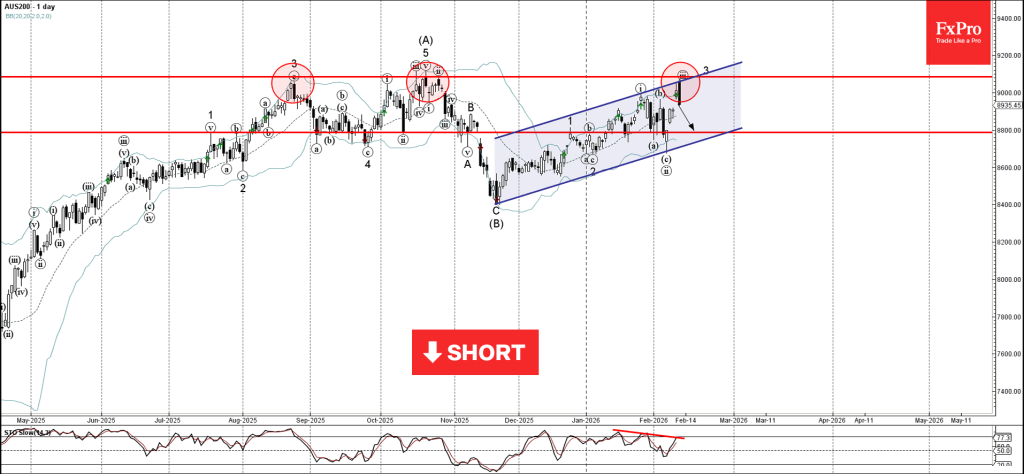

AUS200 Index: ⬇️ Sell – AUS200 Index reversed from resistance zone – Likely to fall to support level 8800.00 AUS200 index today reversed down from the resistance zone between the resistance level 9085.00 (which has been reversing the price from August),.

February 11, 2026

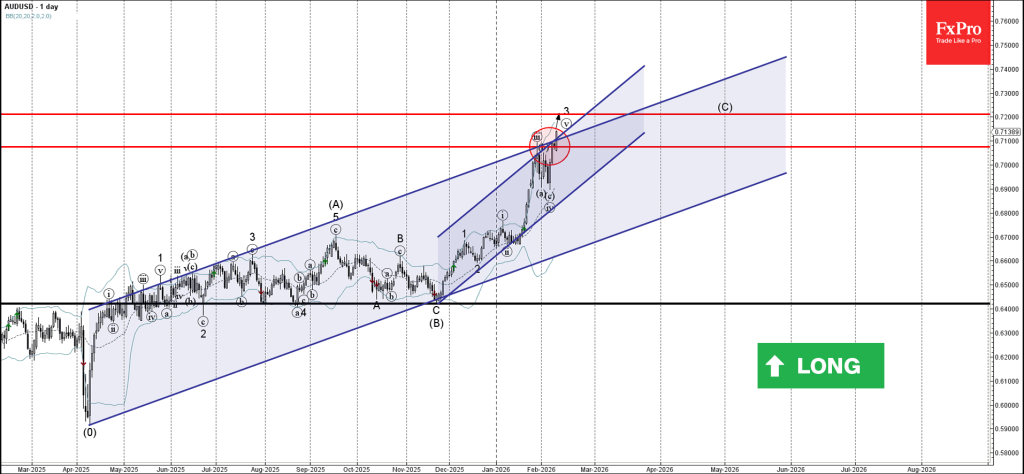

AUDUSD: ⬆️ Buy – AUDUSD broke resistance zone – Likely to rise to resistance level 1.7200 AUDUSD currency pair recently broke the resistance zone between the resistance level 0.7075 (top of wave iii from January) and the two daily up channels from.

February 11, 2026

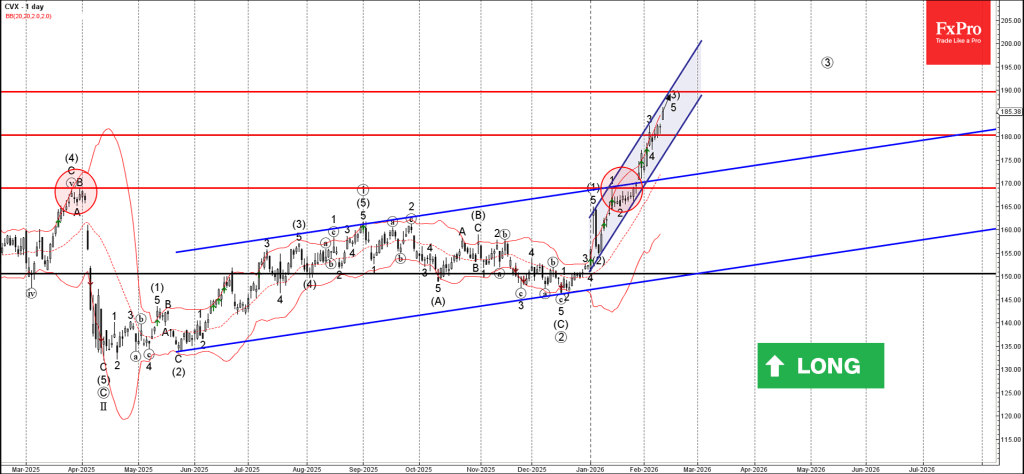

Chevron: ⬆️ Buy – Chevron broke resistance level 180.00 – Likely to rise to resistance level 190.00 Chevron has been rising sharply in the active impulse wave 5, which previously broke the resistance level 180.00 (top of wave 3 from.

February 11, 2026

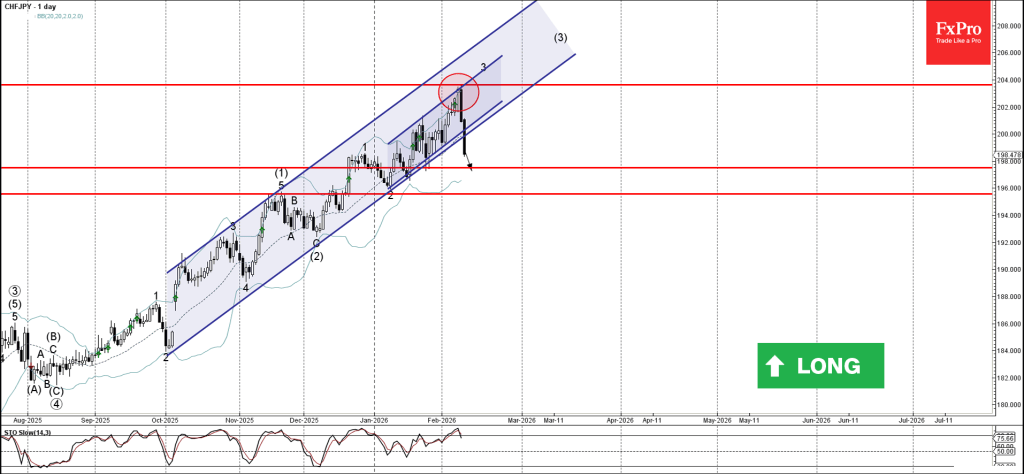

CHFJPY: ⬇️ Sell – CHFJPY broke 2 daily up channels – Likely to fall to support level 197.50 CHFJPY currency pair recently reversed down with the daily Japanese candlesticks reversal pattern Evening Star from the resistance area between the key.

February 11, 2026

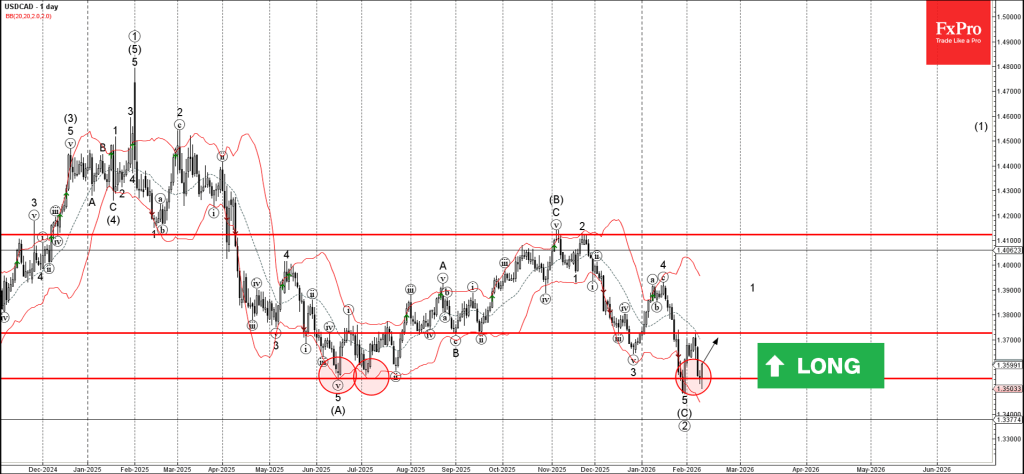

USDCAD: ⬆️ Buy – USDCAD reversed from long-term support level 1.3545 – Likely to rise to resistance level 1.3725 USDCAD currency pair recently reversed from the support area between the strong long-term support level 1.3545 (which has been reversing the.

February 11, 2026

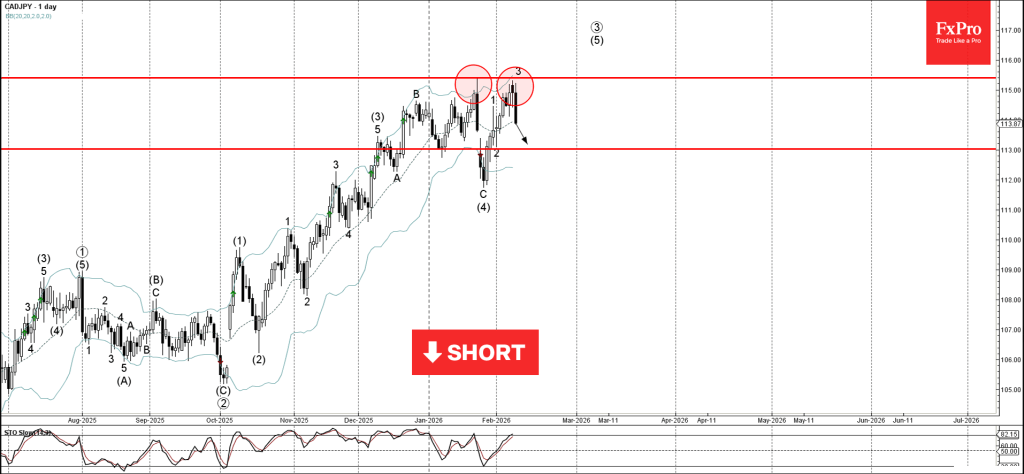

CADJPY: ⬇️ Sell – CADJPY reversed from resistance area – Likely to fall to support level 113.00 CADJPY currency pair recently reversed from the resistance area between the key resistance level 115.40 (former monthly high from January) and the upper.

February 11, 2026

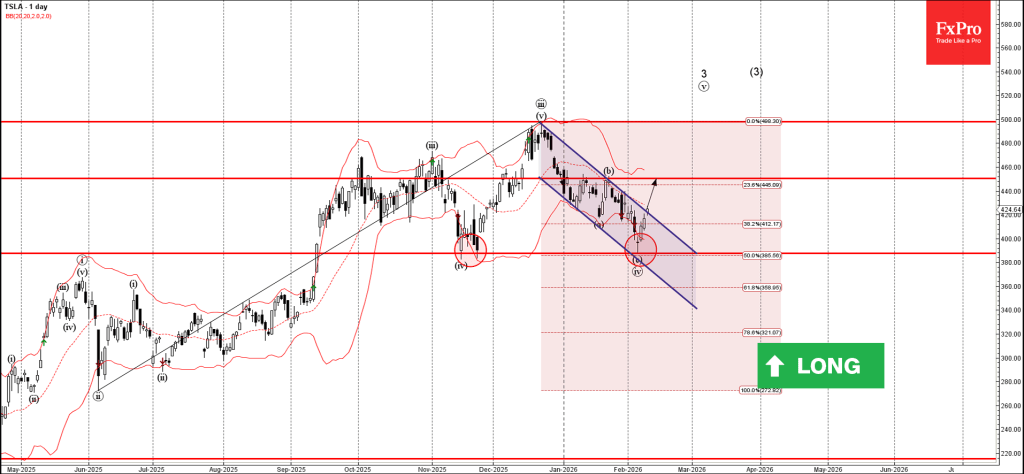

Tesla: ⬆️ Buy – Tesla broke daily down channel – Likely to rise to resistance level 450.00 Tesla today broke the resistance trendline of the daily down channel from December, which enclosed the previous minor ABC correction ii. The price.

February 10, 2026

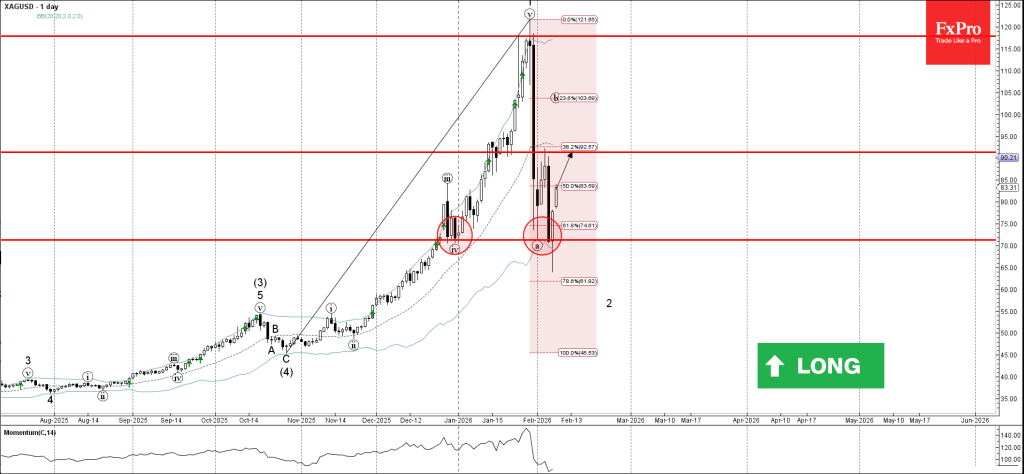

Silver: ⬆️ Buy – Silver reversed from strong support level 71.25 – Likely to test resistance level 91.30 Silver recently reversed from the support area between the strong support level 71.25 (which stopped previous corrections iv and a), lower daily.