Technical analysis - Page 198

July 21, 2022

• GBPUSD reversed from resistance area • Likely to fall to support level 1.1800 GBPUSD currency pair recently reversed down from the resistance area lying between the resistance level 1.2030 (which stopped the previous wave (ii), as can be seen.

July 20, 2022

• Nasdaq 100 broke resistance level 12180.00 • Likely to rise to resistance level 12920.00 Nasdaq 100 index recently broke the resistance area located at the intersection of the resistance level 12180.00 (which stopped the previous waves (a) and (i),.

July 20, 2022

• GBPNZD reversed from support level 1.9135 • Likely to rise to resistance level 1.9400 GBPNZD recently reversed up from the pivotal support level 1.9135 (which has been reversing the pair from the middle of April), strengthened by the lower.

July 19, 2022

• FTSE 100 reversed from support level 7020.00 • Likely to rise to resistance level 7357.00 FTSE 100 index recently reversed up from the key support level 7020.00 (which has been reversing the pair from the middle of June), strengthened.

July 19, 2022

• AUDUSD broke key resistance level 0.6870 • Likely to rise to resistance level 0.6960 AUDUSD currency pair recently broke above the key resistance level 0.6870 (which stopped wave (iv) at the start of this month). The breakout of the.

July 18, 2022

• EURCHF reversed from support area • Likely to rise to resistance level 0.9960 EURCHF currency pair recently reversed up from the support area located between the key support level 0.9850 and the lower daily Bollinger Band. The upward reversal.

July 18, 2022

• Brent reversed from support area • Likely to rise to resistance level 105.00 Brent crude oil recently reversed up from the support area located between the key support level 95.00 (former monthly low from March), lower daily Bollinger Band.

July 15, 2022

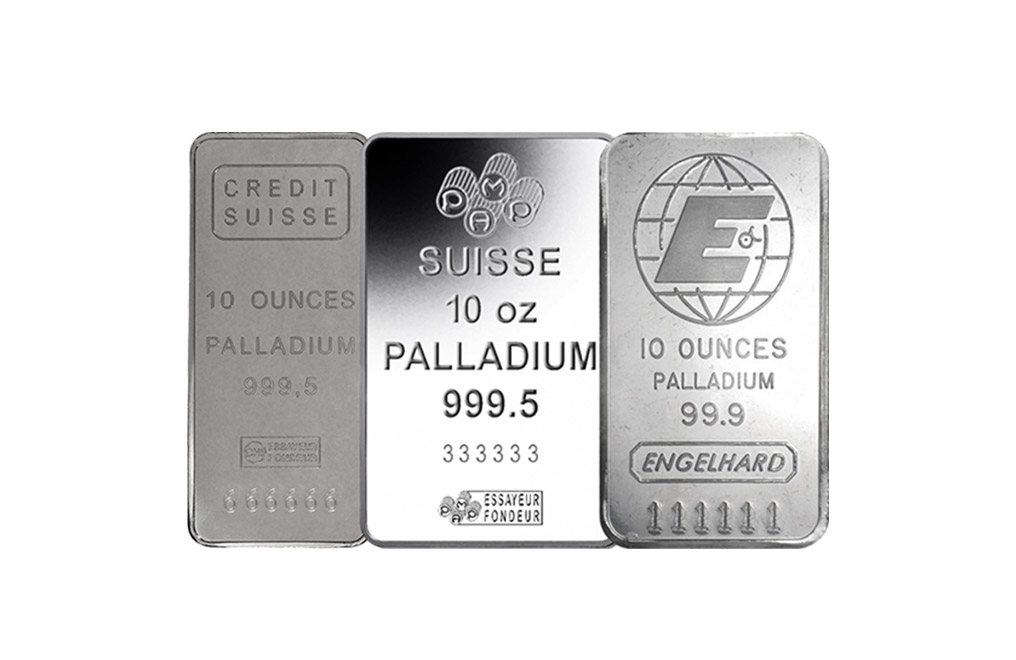

• Palladium under bearish pressure • Likely to fall to support level 1765.00 Palladium under the bearish pressure after the price broke the support level 1900.00 intersecting with the support trendline of the daily up channel from the middle of.

July 15, 2022

• EURJPY reversed from support level 138.00 • Likely to rise to resistance level 140.00 EURJPY currency pair recently reversed up with the Bullish Engulfing from the key support level 138.00, standing near the lower daily Bollinger Band and the.

July 15, 2022

• USDCAD reversed from resistance level 1.3200 • Likely to fall to support level 1.3000 USDCAD currency pair recently reversed down from the key resistance level 1.3200, standing far above the upper Bollinger Band. The downward reversal from the resistance.

July 14, 2022

• Gold broke pivotal support level 1725.00 • Likely to fall to support level 1684.00 Gold recently broke below the pivotal support level 1725.00 (former multi-month support from last September). The breakout of the support level 1725.00 is aligned with.