Technical analysis - Page 192

September 1, 2022

• GBPUSD broke key support level 1.1800 • Likely to test major support level 1.1455 GBPUSD currency pair under the bearish pressure after the earlier breakout of the key support level 1.1800 (low of the previous medium-term impulse wave (3))..

September 1, 2022

• EURCAD reversed from resistance level 1.3200 • Likely to fall to support level 1.3000 EURCAD currency pair recently reversed down from the resistance level 1.3200, intersecting with the upper Bollinger Bond and the 38.2% Fibonacci correction of the downward.

August 31, 2022

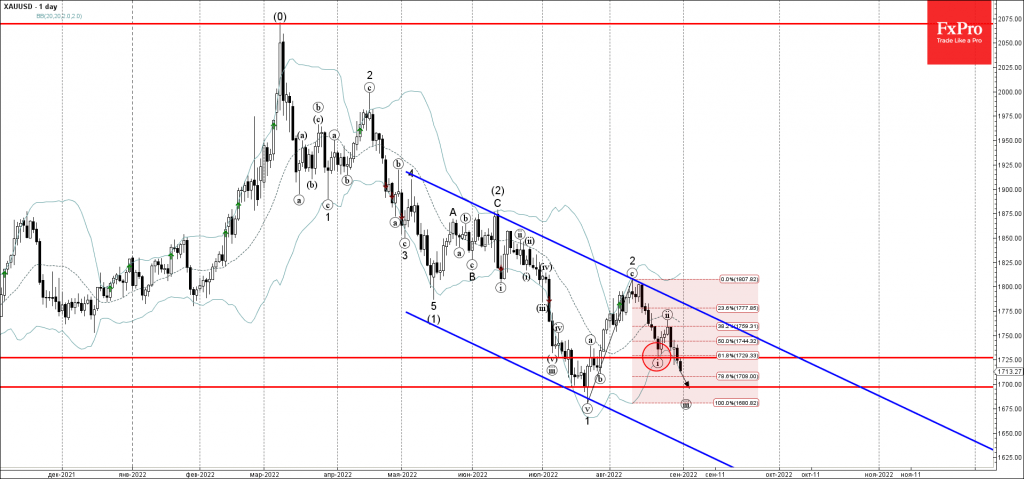

• Gold broke support level 1725.00 • Likely to fall to support level 1700.00 Gold recently broke the support level 1725.00 intersecting with the 61.8% Fibonacci correction of the upward correction 2 from July. The breakout of the support level.

August 31, 2022

• WTI reversed from resistance level 95.00 • Likely to fall to support level 86.25 WTI crude oil recently reversed down with the Bearish Engulfing from the resistance level 95.00 (which has been reversing the pair from the start of.

August 30, 2022

• CHFJPY reversed from resistance level 143.00 • Likely to fall to support level 141.35 CHFJPY currency pair recently reversed down from the key resistance level 143.00 (which stopped the previous impulse waves (5) and (B)) intersecting with the upper.

August 30, 2022

• GBPCHF reversed from support level 1.1290 • Likely to rise to resistance level 1.1420 GBPCHF currency pair recently reversed up from the support level 1.1290 (which stopped the previous minor impulse wave (i) earlier this month) standing near the.

August 29, 2022

• EURGBP broke key resistance level 0.8510 • Likely to rise to resistance level 0.8585 EURGBP currency pair recently broke the resistance level 0.8510 (which stopped the pair earlier this month) intersecting with the 50% Fibonacci correction of the earlier.

August 29, 2022

• USDJPY broke key resistance level 137.30 • Likely to rise to resistance level 140.00 USDJPY currency pair recently broke the key resistance level 137.30 (which stopped the previous minor impulse wave 3 earlier this month). The breakout of the.

August 26, 2022

• AUDCHF reversed from key resistance level 0.6710 • Likely to fall to support level 0.6650 AUDCHF currency pair recently reversed down from the key resistance level 0.6710 (which has been steadily reversing the price from the start of July),.

August 26, 2022

• General Electric reversed from resistance level 80.00 • Likely to fall to support level 75.00 General Electric recently reversed down from the round resistance level 80.00 (which has been reversing the price from the start of May), intersecting with.

August 26, 2022

• EURAUD reversed from support level 1.4325 • Likely to rise to resistance level 1.4470 EURAUD currency pair recently reversed up from the key support level 1.4325 (which stopped the previous sharp downward impulse wave (5) in April). The support.