Technical analysis - Page 18

November 21, 2025

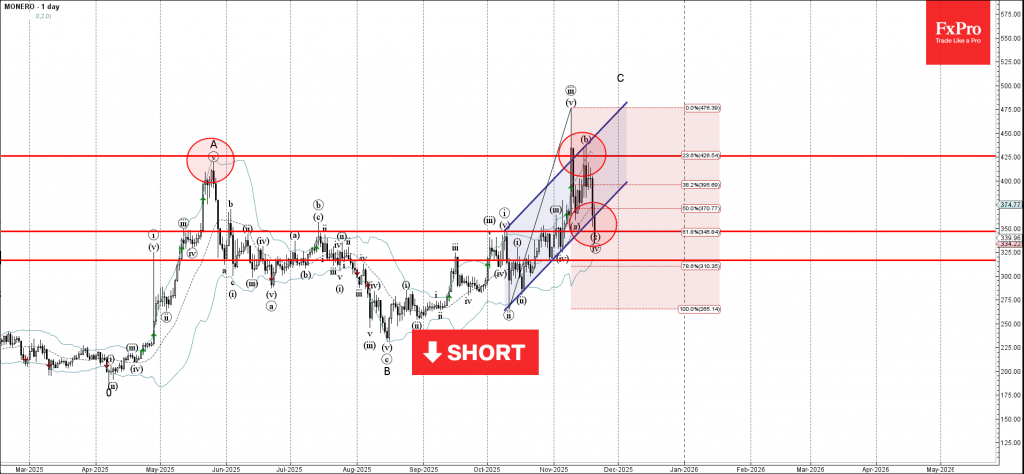

Monero: ⬇️ Sell – Monero broke pivotal support level 350.00 – Likely to fall to support level 316.00 Monero cryptocurrency recently broke the pivotal support level 350.00 intersecting with the 61.8% Fibonacci correction of the upward impulse from the start.

November 21, 2025

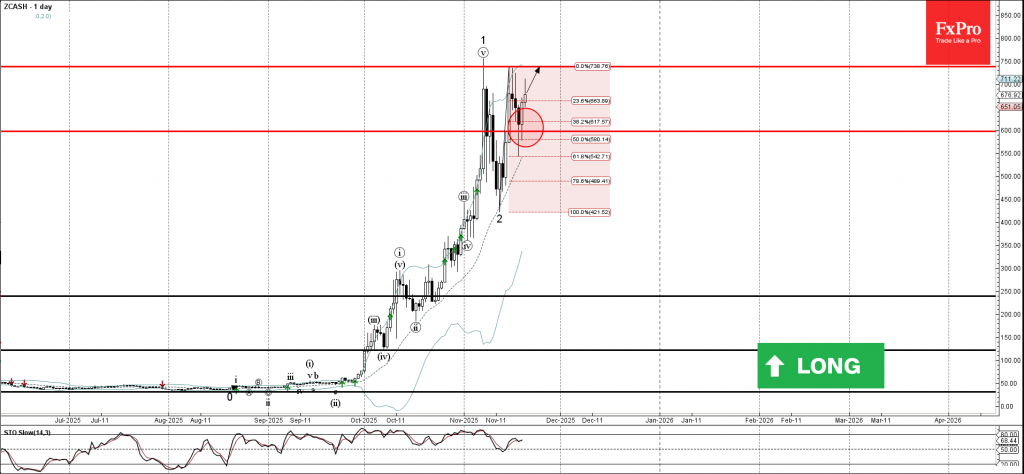

Zcash: ⬆️ Buy – Zcash reversed from round support level 600.00 – Likely to rise to resistance level 738.00 Zcash cryptocurrency recently reversed up from the round support level 600.00 intersecting with the 38.2% Fibonacci correction of the upward impulse.

November 19, 2025

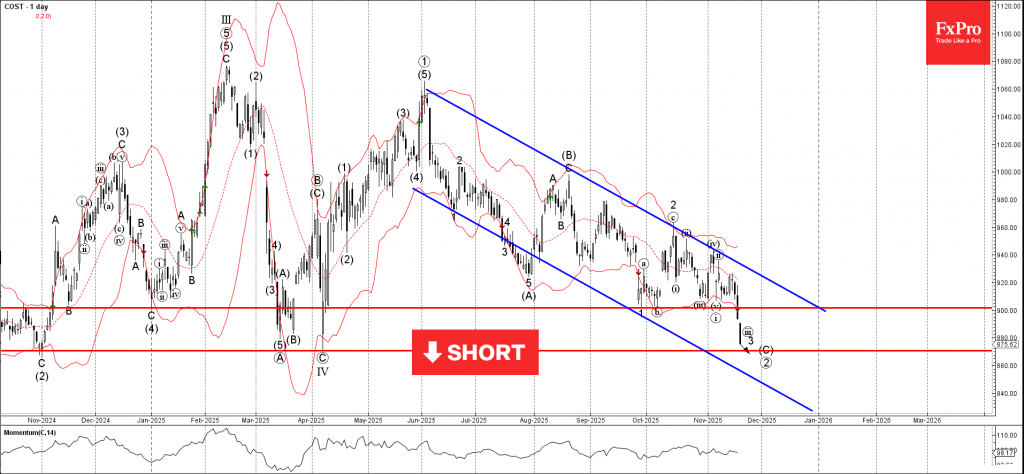

Costco: ⬇️ Sell – Costco broke round support level 900.00 – Likely to fall to support level 870.00 Costco recently broke sharply below the round support level 900.00 (which stopped the previous waves a and b in September and October)..

November 19, 2025

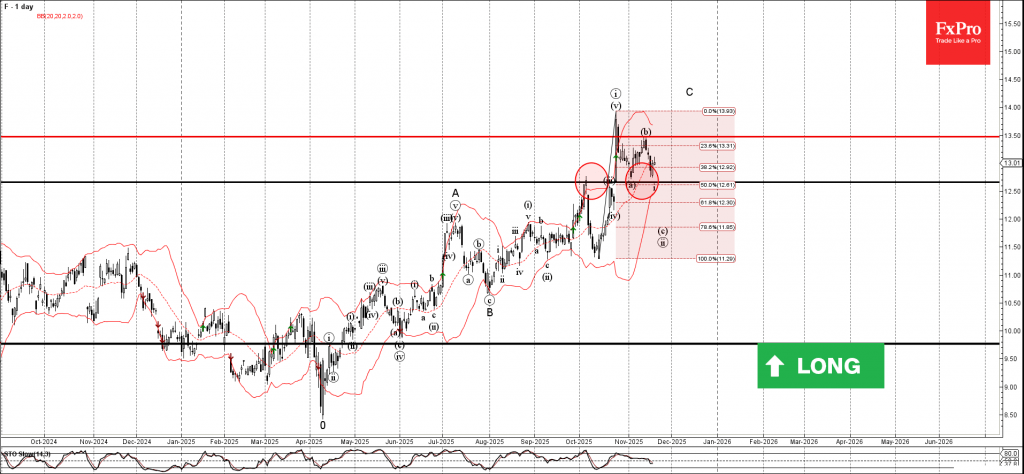

Ford: ⬆️ Buy – Ford reversed from pivotal support level 12.65 – Likely to rise to resistance level 13.50 Ford recently reversed from the support zone between the pivotal support level 12.65 (former resistance from the start of October), lower.

November 19, 2025

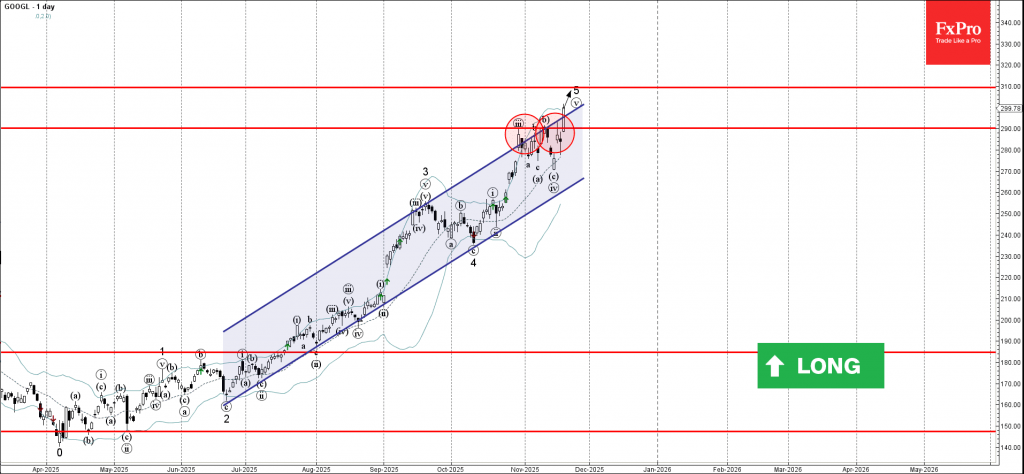

Google: ⬆️ Buy Google recently broke through the resistance zone between the resistance level 290.00 (which stopped the previous waves iii and b) and the resistance trendline of the daily up channel from June. The breakout of this resistance zone.

November 19, 2025

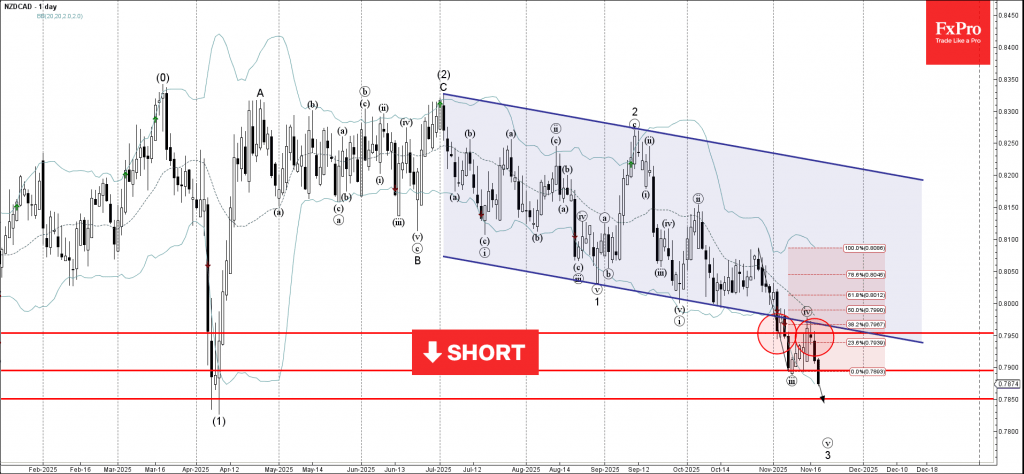

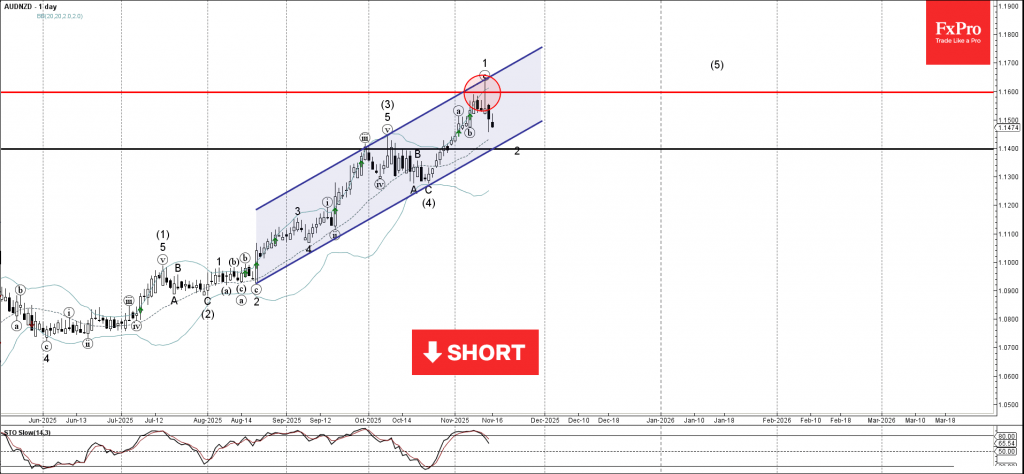

NZDCAD: ⬇️ Sell – NZDCAD reversed from resistance zone – Likely to fall to support level 0.7850 NZDCAD currency pair recently reversed down from the resistance zone between the resistance level 0.7950, 20-day moving average and the lower trendline of.

November 18, 2025

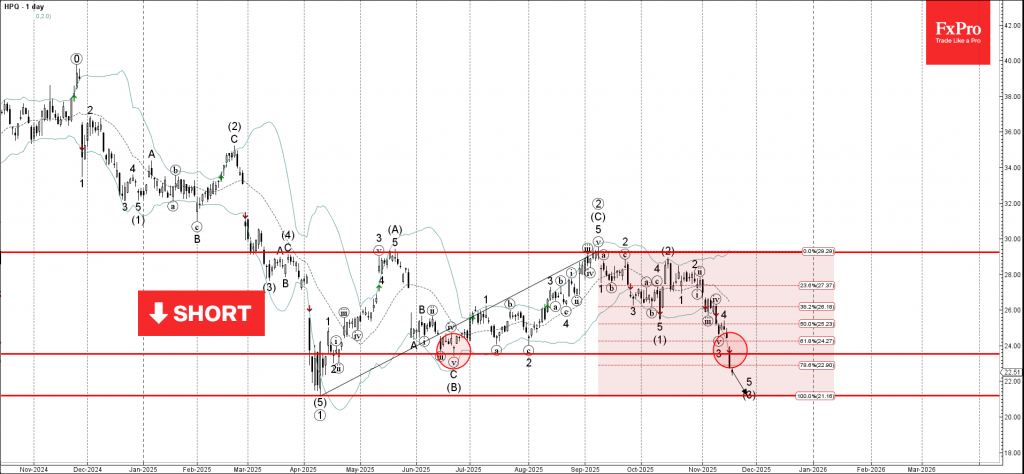

HPQ: ⬇️ Sell – HPQ broke support level 23.50 – Likely to fall to support level 21.20 HPQ recently broke the support level 23.50 (former monthly low from June, which stopped wave (B) of the previous long-term ABC correction 2.

November 18, 2025

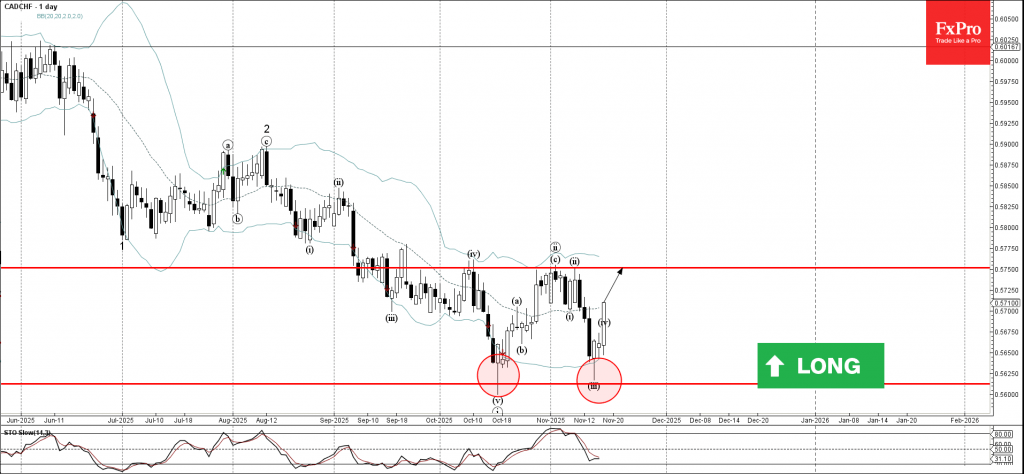

CADCHF: ⬆️ Buy – CADCHF reversed from key support level 0.5600 – Likely to rise to resistance level 0.5750 CADCHF currency pair recently reversed from key support level 0.5600 (which stopped the previous impulse wave i in the middle of October,.

November 18, 2025

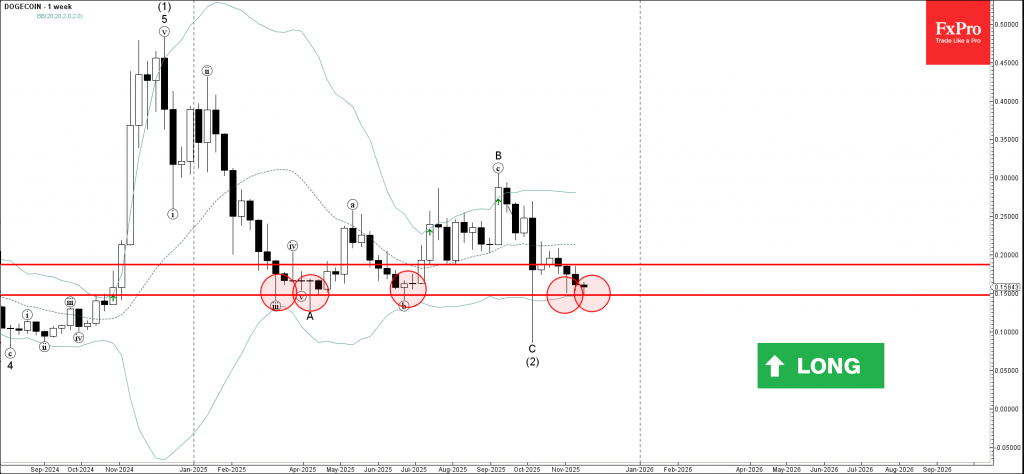

Dogecoin: ⬆️ Buy – Dogecoin reversed from strong support level 0.1500 – Likely to rise to resistance level 0.2000 Dogecoin cryptocurrency recently reversed from strong support level 0.1500 (which has been steadily reversing the price from the start of 2025, as.

November 18, 2025

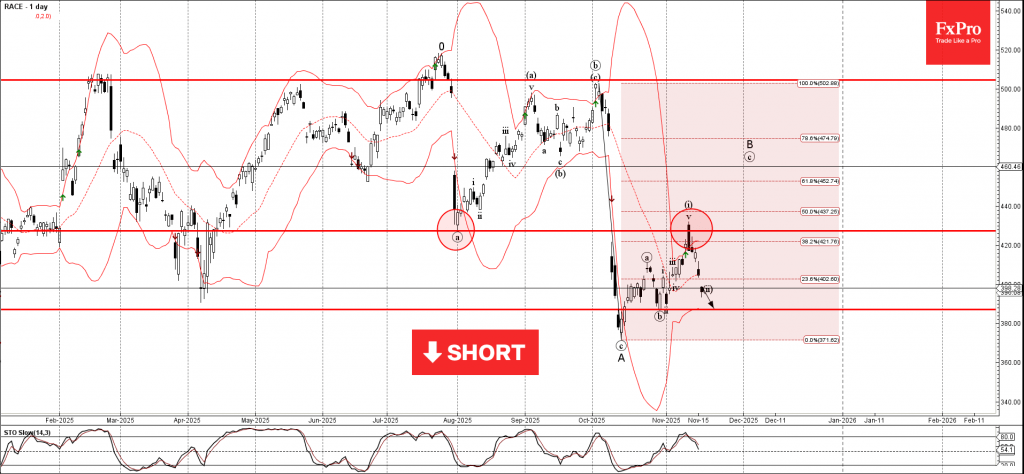

Ferrari: ⬇️ Sell – Ferrari reversed from resistance zone – Likely to fall to support level 387.00 Ferrari recently reversed down from the resistance zone between the resistance level 427.00 (former monthly low from August), upper daily Bollinger Band and.

November 17, 2025

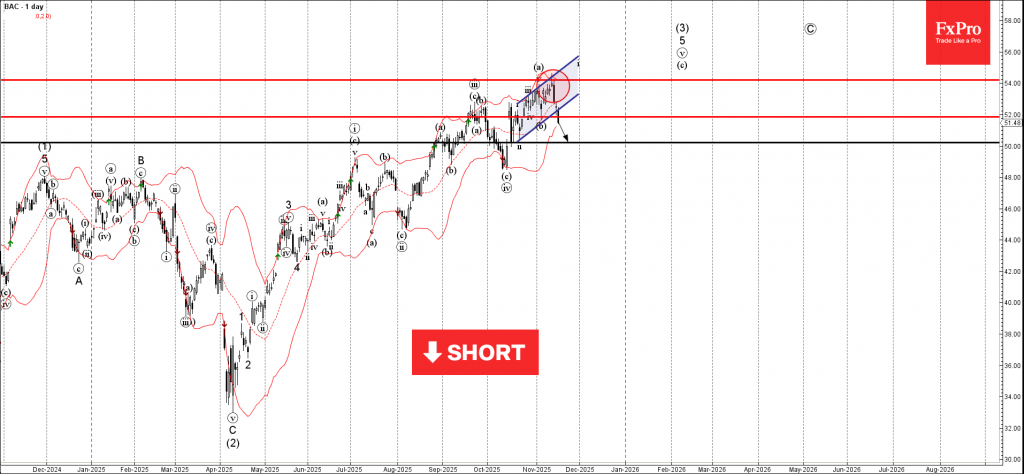

Bank of America: ⬇️ Sell – Bank of America broke support zone – Likely to fall to support level 50.00 Bank of America recently broke the support zone between the key support level 52.00 (which stopped earlier wave (b)) and.