Technical analysis - Page 176

December 27, 2022

• Brent Crude oil rising inside impulse wave C • Likely to test resistance level 88.95 Brent Crude oil continues to rise inside the C-wave of the intermediate ABC correction (2) which previously broke the resistance level 83.30 intersecting with.

December 27, 2022

• GBPCAD reversed from resistance level 1.6655 • Likely to fall to support level 1.6000 GBPCAD continues to fall inside the weekly downward retracement which started earlier from the key resistance level 1.6655 (former multi-year support level which has been.

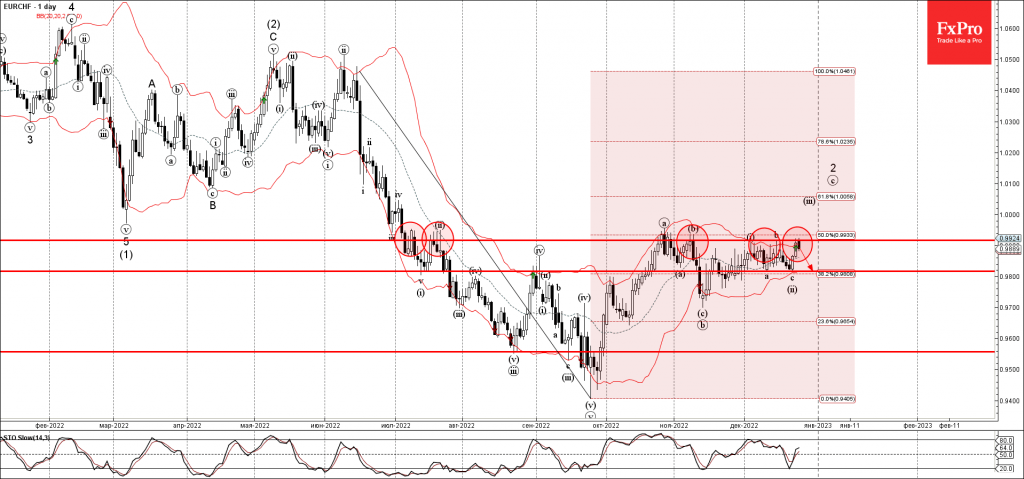

December 26, 2022

• EURCHF reversed from resistance level 0.9920 • Likely to fall to support level 0.9815 EURCHF today reversed down once again from the powerful resistance level 0.9920 (which has been reversing the price from the start of July), intersecting with.

December 26, 2022

• USDJPY reversed from key support level 131.60 • Likely to rise to resistance level 135.00 USDJPY recently reversed up from the key support level 131.60 (former monthly high from May), intersecting with the lower daily Bollinger Band and the.

December 23, 2022

• Costco reversed from support level 450.00 • Likely to rise to resistance level 474.00 Costco earlier reversed up from the pivotal support level 450.00 (which has been reversing the price from June), intersecting with the lower daily Bollinger Band..

December 23, 2022

• USDCHF reversed from key support level 0.9220 • Likely to rise to resistance level 0.9380 USDCHF previously reversed up with the daily Morning Star from the key support level 0.9220 (which also started the intermediate impulse wave (3) with.

December 23, 2022

• Platinum reversed from support level 975.65 • Likely to rise to resistance level 1040.00 Platinum recently reversed up from the key support level 975.65 (former monthly high from August), intersecting with the lower daily Bollinger Band and the 38.2%.

December 22, 2022

• GBPUSD falling inside minor correction 2 • Likely to fall to support level 1.1900 GBPUSD continues to fall inside the minor retracement 2, which started earlier from the key resistance level 1.2355 intersecting with the 61.8% Fibonacci correction of.

December 22, 2022

• Gold reversed from resistance level 1820.00 • Likely to fall to support level 1775.00 Gold today once again reversed down strongly from the resistance zone located between the resistance level 1820.00 (top of the previous impulse wave (1)) and.

December 22, 2022

• Caterpillar reversed from major resistance zone • Likely to fall to support level 230.00 Caterpillar earlier reversed down from the major resistance zone located between the resistance levels 240.00 (top of the previous impulse wave (1)) and the 245.00.

December 21, 2022

• GBPAUD reversed from resistance level 1.8200 • Likely to fall to support level 1.8000 GBPAUD earlier reversed down once again from the long-term resistance level 1.8200 (which has been reversing the pair from middle March, as can be seen.