Technical analysis - Page 171

January 31, 2023

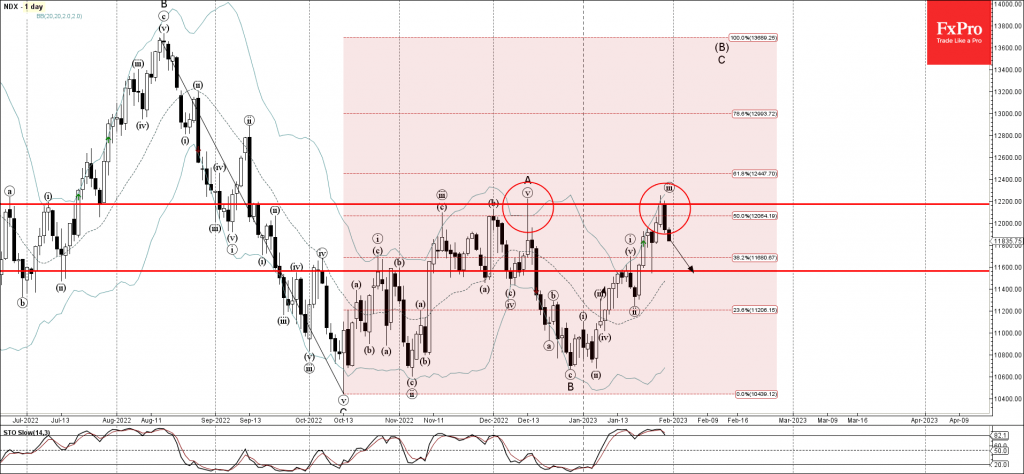

• Nasdaq 100 reversed from pivotal resistance level 12200.00 • Likely to fall to support level 11600.00 Nasdaq 100 index recently reversed from the pivotal resistance level 12200.00 (previous monthly high from December), intersecting with the upper daily Bollinger Band.

January 31, 2023

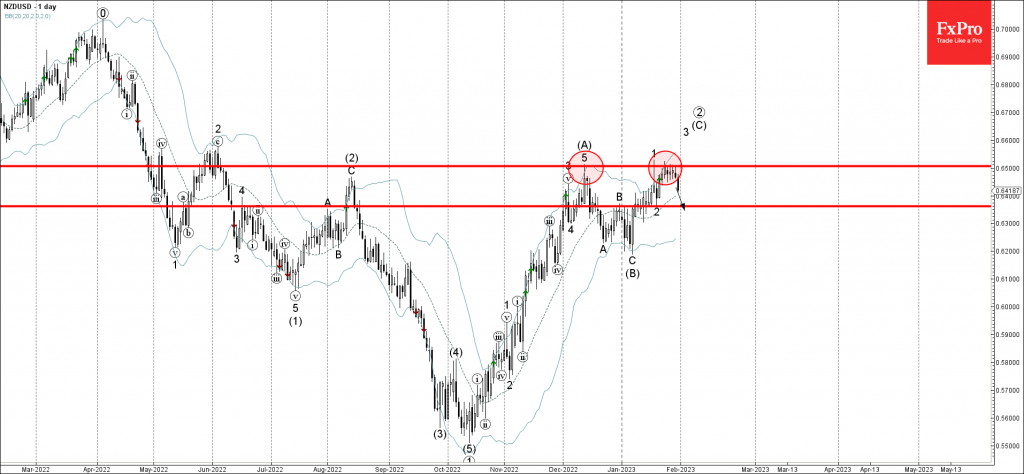

• NZDUSD reversed from resistance level 0.6500 • Likely to fall to support level 0.6360 NZDUSD currency pair recently reversed down from the resistance level 0.6500 (the previous monthly high from last month, which stopped the previous wave (A)). The.

January 30, 2023

• USDCHF reversed from long-term support level 0.9150 • Likely to rise to resistance level 0.9300 USDCHF currency pair previously reversed up from the long-term support level 0.9150 (which has been reversing the price from February of 2022, as can.

January 30, 2023

• GBPUSD reversed from resistance level 1.2430 • Likely to fall to support level 1.2260 GBPUSD currency pair earlier reversed down from the key resistance level 1.2430 (which stopped the previous intermediate impulse wave (A) at the start of December)..

January 27, 2023

• General Electric broke key resistance level 80.62 • Likely to rise to resistance level 87.500 General Electric earlier broke above the key resistance level 80.62 (which stopped the previous short-term upward impulse wave 3). The breakout of the resistance.

January 27, 2023

• Tesla broke resistance level 160.00 • Likely to rise to resistance level 200.00 Tesla rising sharply after the price broke the resistance level 160.00 intersecting with the 61.8% Fibonacci correction of the downward impulse from December. The breakout of.

January 27, 2023

• AUDUSD reversed from long-term resistance level 0.7110 • Likely to fall to support level 0.7000 AUDUSD currency pair recently reversed down from the long-term resistance level 0.7110 (former top of wave (2) from the start of August). The downward.

January 26, 2023

• ExxonMobil broke key resistance level 114.00 • Likely to rise to resistance level 120.00. ExxonMobil recently broke above the key resistance level 114.00 (which reversed the price multiple times during the last November). The breakout of the resistance level 114.00.

January 26, 2023

• EURCAD reversed from pivotal resistance level 1.4595 • Likely to fall to support level 1.4400 EURCAD currency pair recently reversed down from the pivotal resistance level 1.4595 (which stopped the sharp uptrend in the middle of December). The resistance.

January 26, 2023

• Natural gas broke support zone • Likely to fall to support level 2.5000 Natural gas recently broke the support zone lying between the round support level 3.000 and the support level 3.500, which started the sharp uptrend at the.

January 25, 2023

• GBPNZD reversed from support level 1.9000 • Likely to rise to resistance level 1.9330 GBPNZD currency pair recently reversed up from the round support level 1.9000 (which has been reversing the price from December) intersecting with the lower daily.