Technical analysis - Page 168

February 23, 2023

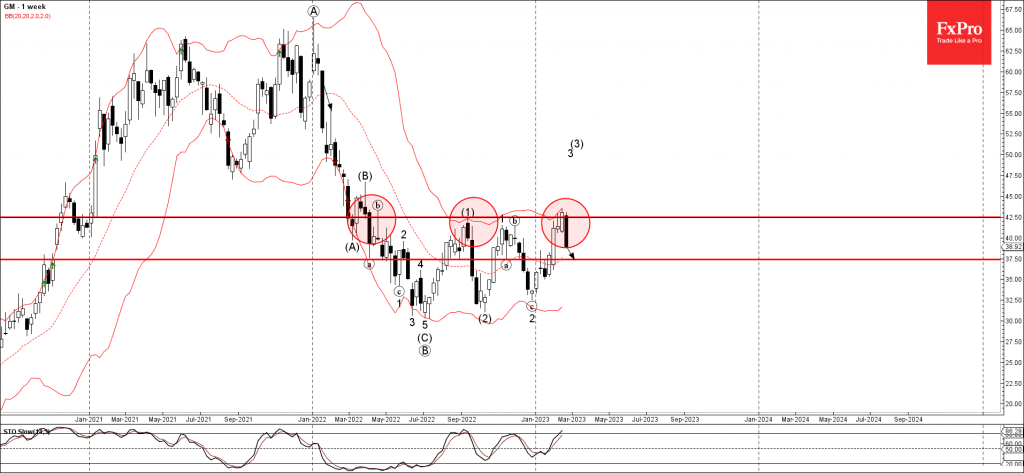

• General Motors reversed from key resistance level 42.500 • Likely to fall to support level 37.50 General Motors recently reversed down from the key resistance level 42.500 (which has been reversing the price from the start of 2022) intersecting.

February 23, 2023

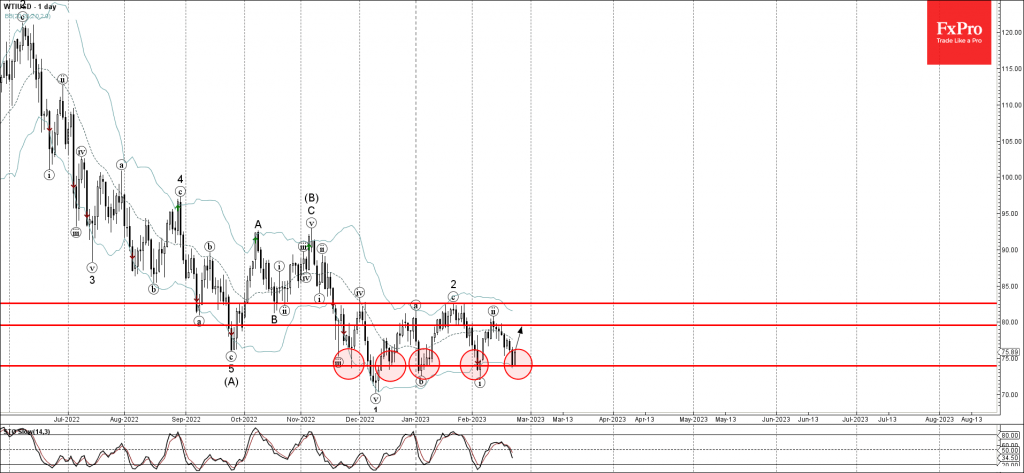

• WTI reversed from support level 74.00 • Likely to rise to resistance level 80.00 WTI crude oil recently reversed up from the pivotal support level 74.00 (which has been reversing the price from the end of November). The support.

February 23, 2023

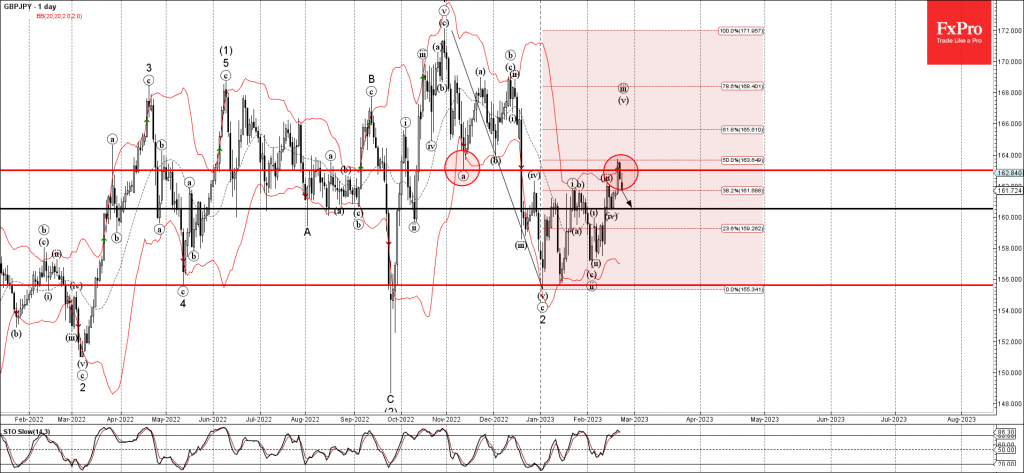

• GBPJPY reversed from key resistance level 163.00 • Likely to fall to support level 160.50 GBPJPY currency pair recently reversed down from the key resistance level 163.00 (former monthly low from November) coinciding with the upper daily Bollinger Band.

February 22, 2023

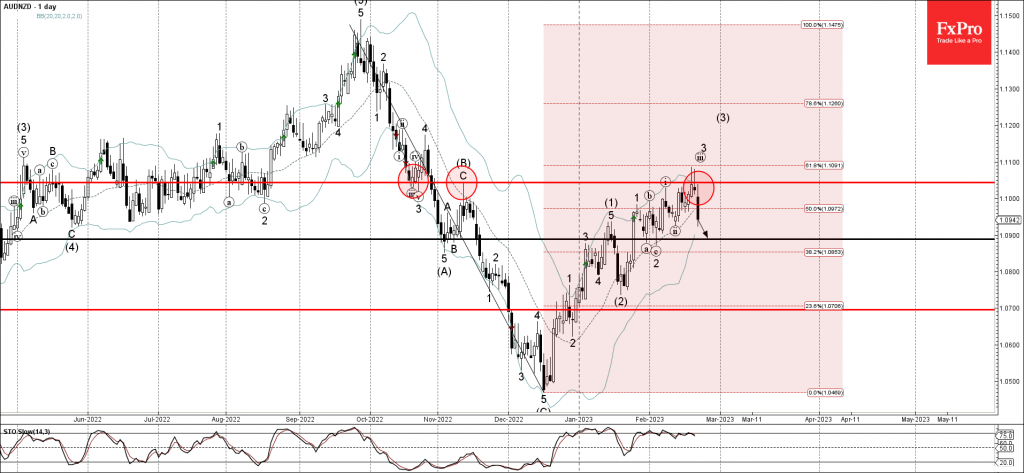

• AUDNZD reversed from resistance level 1.1045 • Likely to fall to support level 1.0900 AUDNZD currency pair recently reversed down with the two daily Shooting Stars from the resistance level 1.1045 (former monthly high from November). The downward reversal.

February 22, 2023

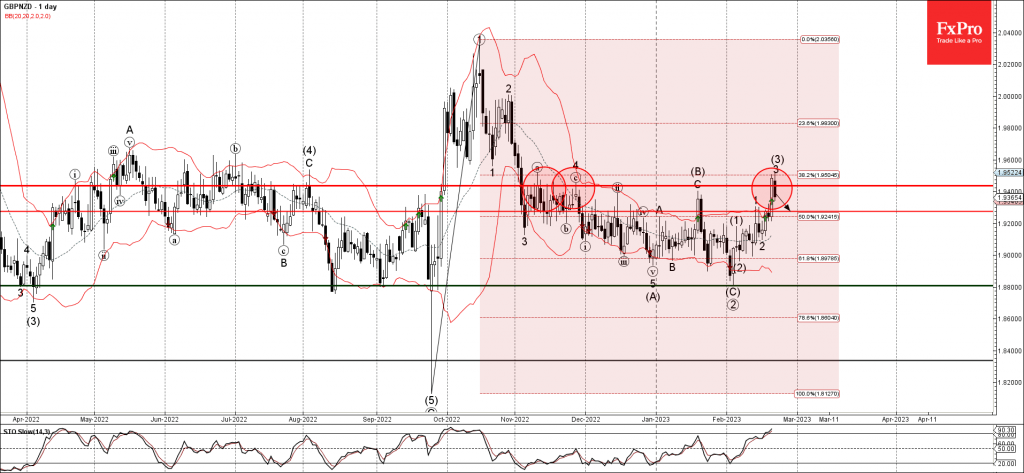

• GBPNZD reversed from resistance level 1.9436 • Likely to fall to level 1.9275 GBPNZD currency pair recently reversed down from the resistance level 1.9436 (which has been reversing the price from the start of November) standing above the upper.

February 21, 2023

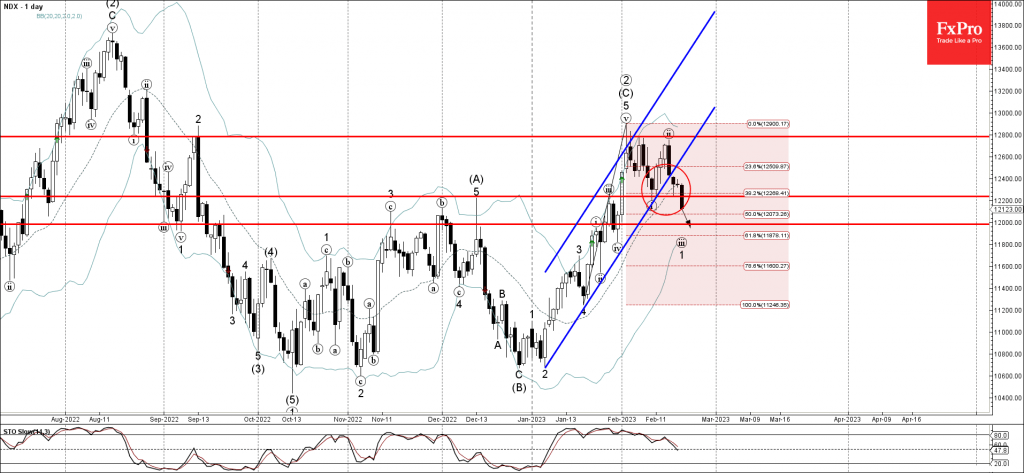

• Nasdaq-100 broke pivotal support level 12235.00 • Likely to fall to support level 12000.00 Nasdaq-100 recently broke the pivotal support level 12235.00 (former strong resistance from December) intersecting with the 38.2% Fibonacci correction of the previous sharp upward impulse.

February 21, 2023

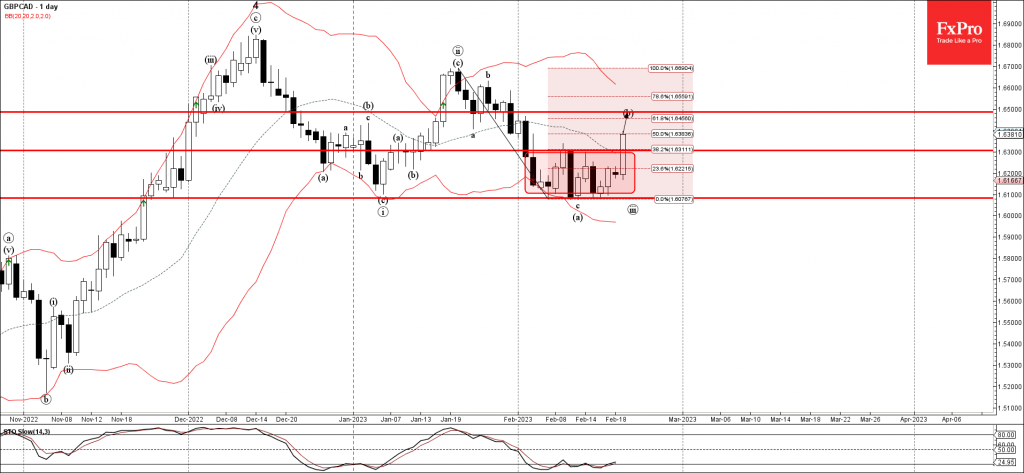

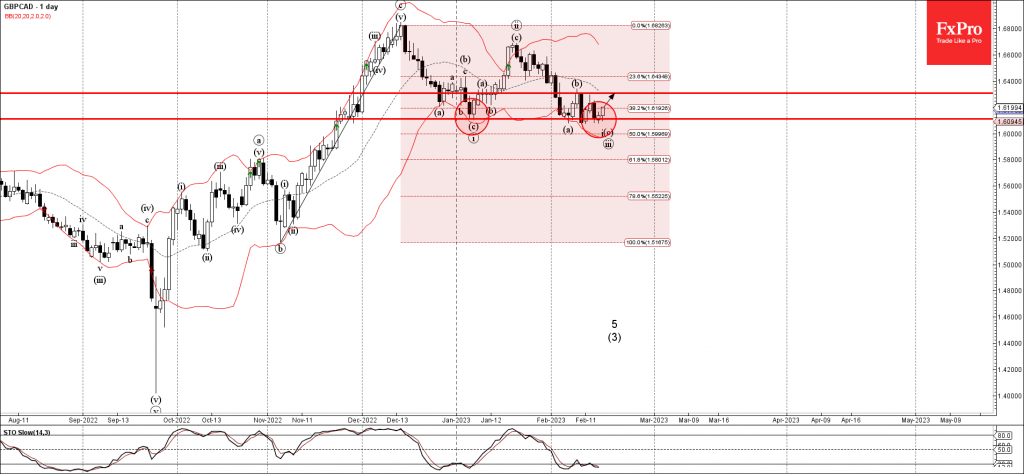

• GBPCAD broke key resistance level 1.6300 • Likely to rise to resistance level 1.6500 GBPCAD currency pair recently broke the key resistance level 1.6300, which is the top border of the narrow price range inside which the pair has.

February 20, 2023

• NZDUSD reversed from key support level 0.6220 • Likely to rise to resistance level 0.6400 NZDUSD currency pair recently reversed up from the key support level 0.6220, intersecting with the lower daily Bollinger Band and the 38.2% Fibonacci correction.

February 20, 2023

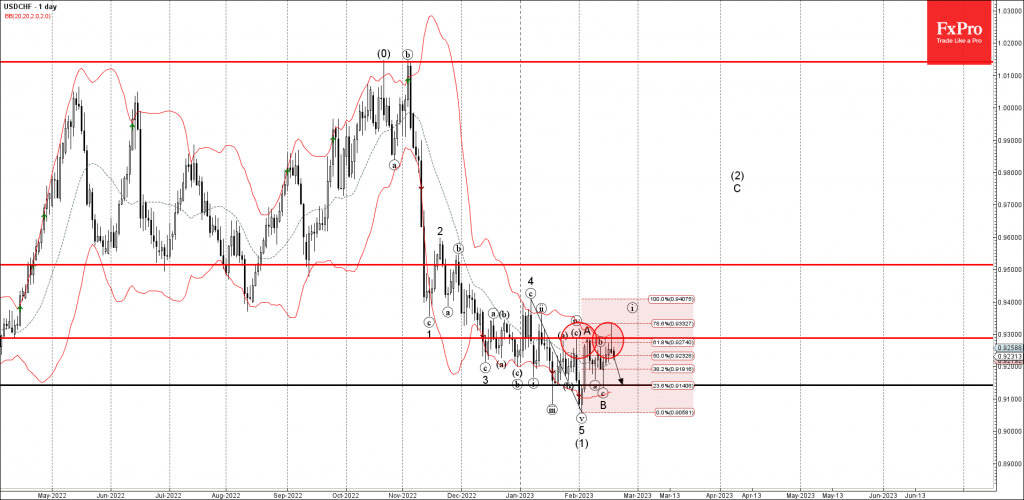

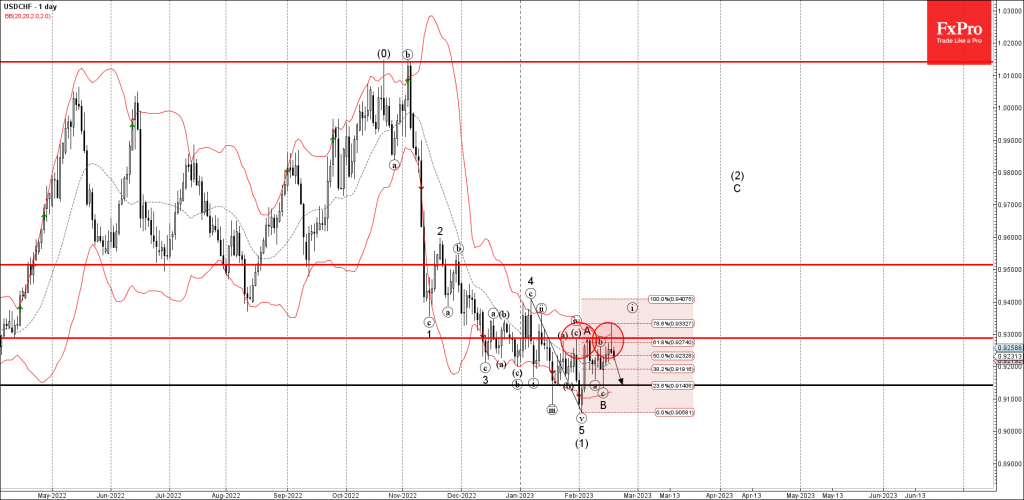

• USDCHF reversed from resistance level 0.9300 • Likely to fall to support level 0.9145 USDCHF currency pair recently reversed down from the resistance level 0.9300, intersecting with the upper daily Bollinger Band and the 61.8% Fibonacci correction of the.

February 17, 2023

• GBPCAD reversed from key support level 1.6110 • Likely to rise to resistance level 1.63000 GBPCAD previously reversed once again from the key support level 1.6110 (previous monthly low from January) standing near the lower daily Bollinger Band. The.

February 17, 2023

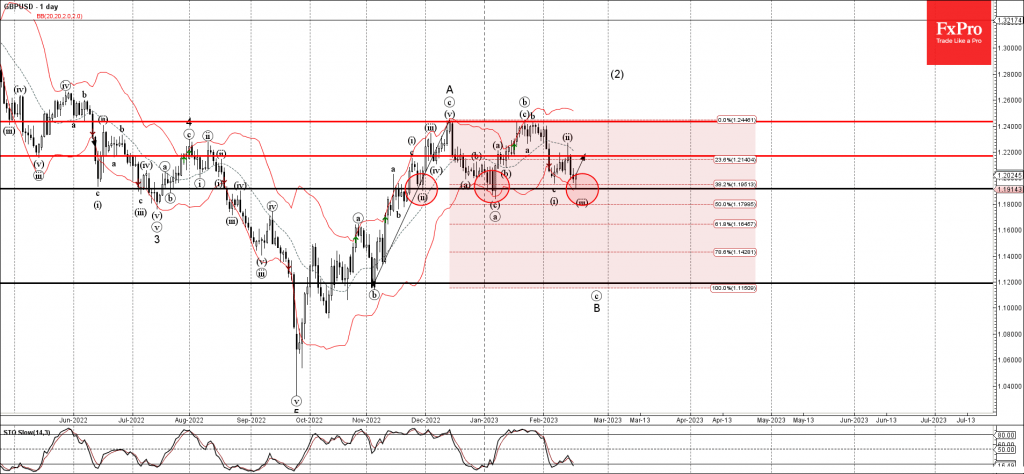

• GBPUSD reversed from support level 1.1915 • Likely to rise to resistance level 1.2200 GBPUSD currency pair recently reversed up from the strong support level 1.1915 (which has been reversing the price from the end of November) intersecting with.