Technical analysis - Page 167

March 2, 2023

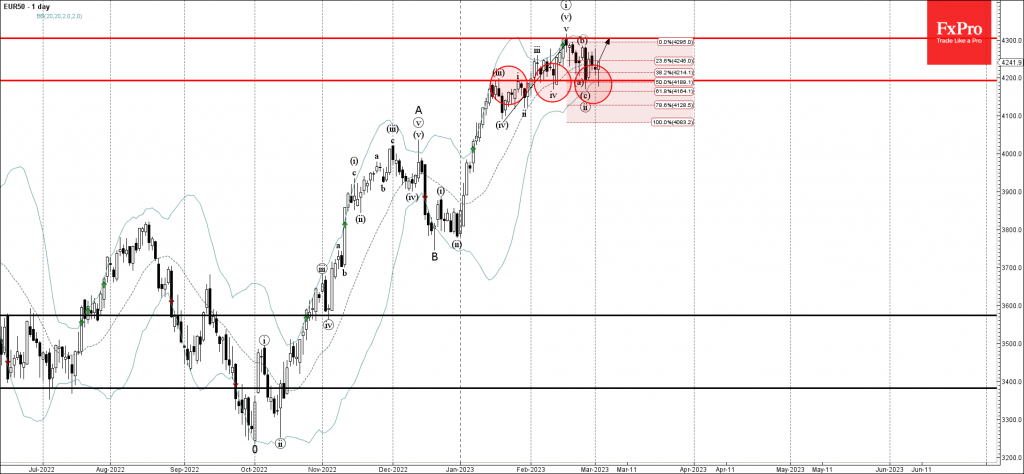

• EUR50 reversed from support level 4200.00 • Likely to rise to resistance levels 4300.00 EUR50 index previously reversed up from the support level 4200.00 (former resistance from January) intersecting with the lower daily Bollinger Band and the 50% Fibonacci correction.

March 2, 2023

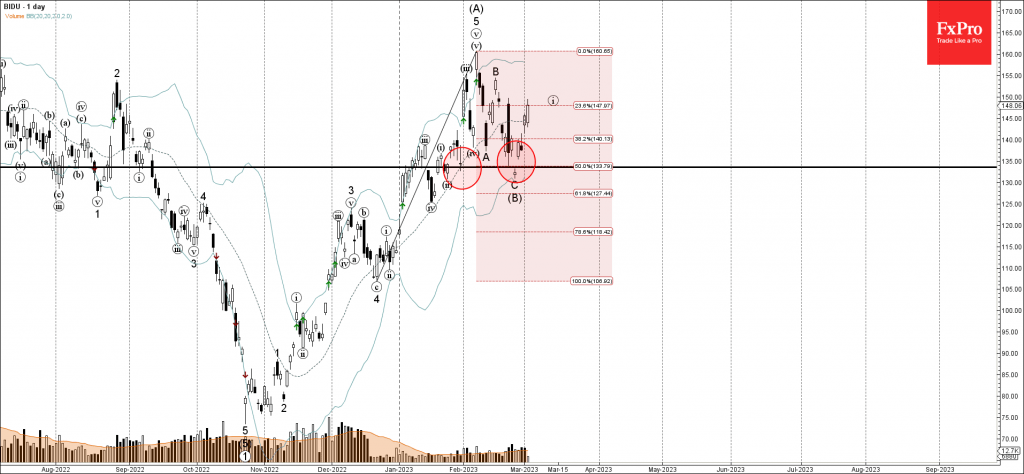

• Baidu reversed from support level 133.50 • Likely to rise to resistance levels 150.00 and 155.00 Baidu recently reversed up from the key support level 133.50 (former support from the end of January) intersecting with the lower daily Bollinger Band and.

March 2, 2023

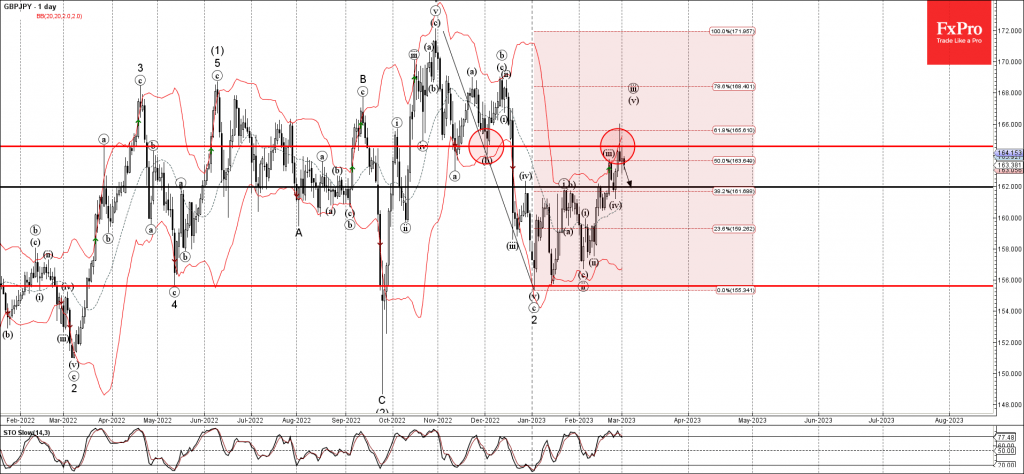

• GBPJPY reversed from resistance level 164.55 • Likely to fall to support level 162.00 GBPJPY currency pair recently reversed down from the key resistance level 164.55 (former support from December) standing close to the 61.8% Fibonacci correction of the.

March 1, 2023

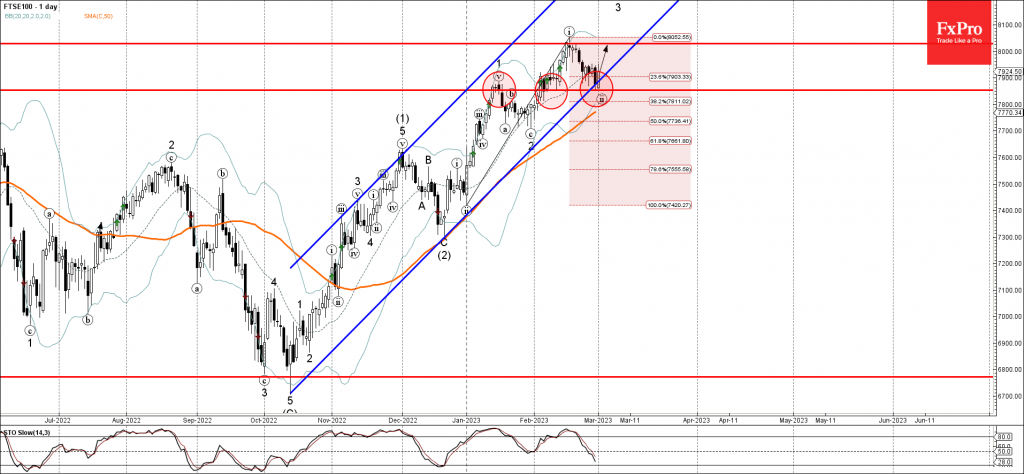

• FTSE 100 reversed from key support level 7850.00 • Likely to rise to resistance level 8000.00 FTSE 100 index recently reversed up from the key support level 7850.00 (former resistance from January, which has been supporting the price from.

March 1, 2023

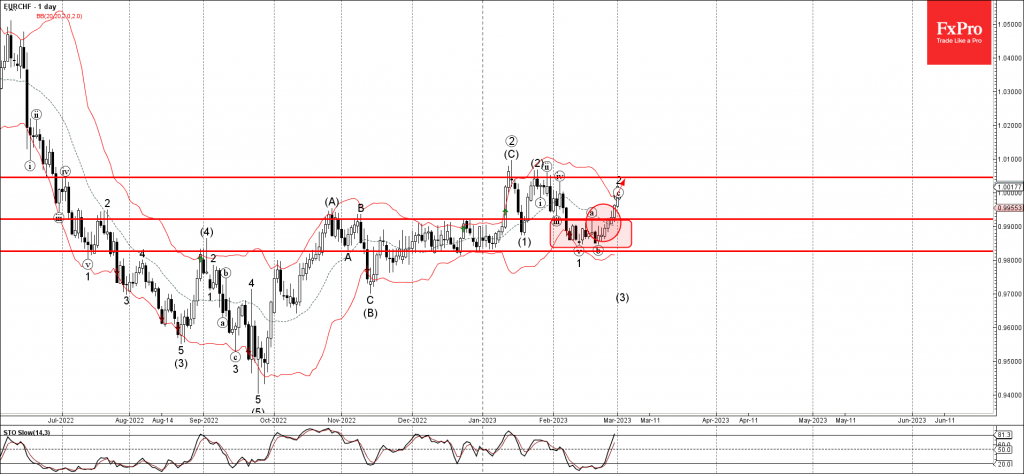

• EURCHF broke key resistance level 0.9920 • Likely to rise to resistance level 1.0045 EURCHF recently broke the key resistance level 0.9920 (upper border of the narrow sideways price range inside which the pair has been moving from the.

February 28, 2023

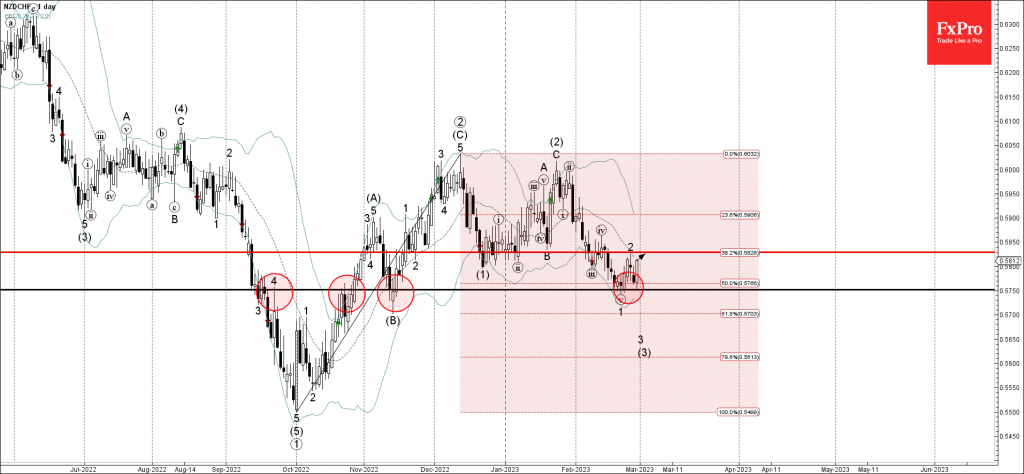

• NZDCHF reversed from support level 0.5750 • Likely to rise to resistance level 0.5830 NZDCHF recently reversed up from the key support level 0.5750 (former resistance from September, which also stopped the previous minor impulse wave 1). The support.

February 28, 2023

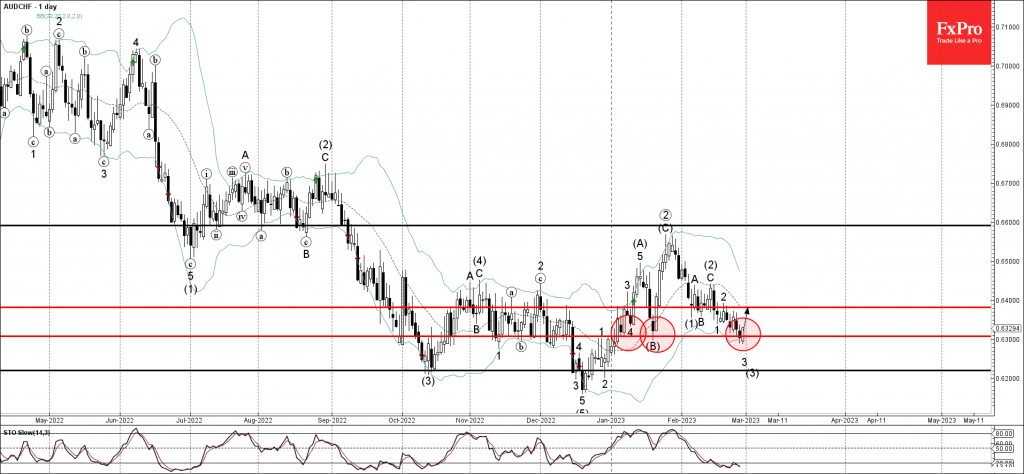

• AUDCHF reversed from support level 0.6300 • Likely to rise to resistance level 0.6380 AUDCHF recently reversed up from the key support level 0.6300 (which has been reversing the price from the end of December). The upward reversal from.

February 27, 2023

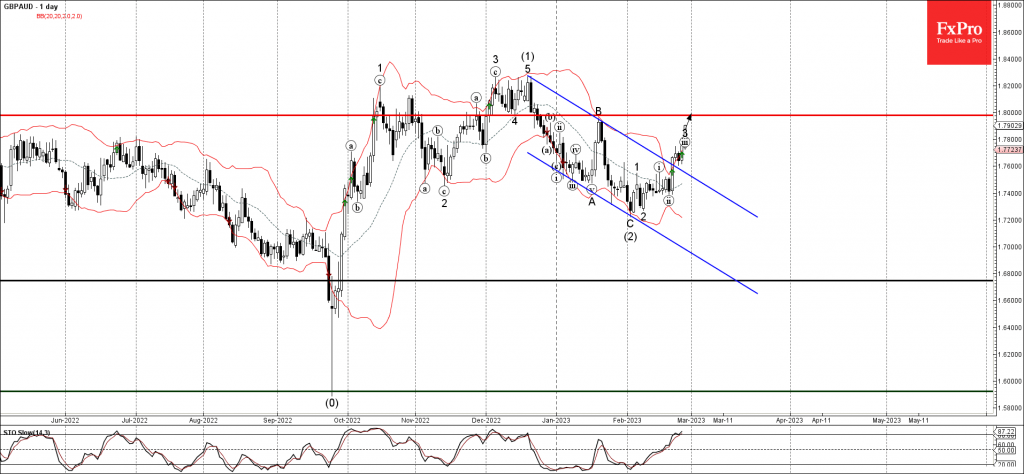

• GBPAUD broke daily down channel • Likely to rise to resistance level 1.8000 GBPAUD previously broke the resistance trendline of the daily down channel from December (which enclosed the previous ABC correction (2)). The breakout of this daily down.

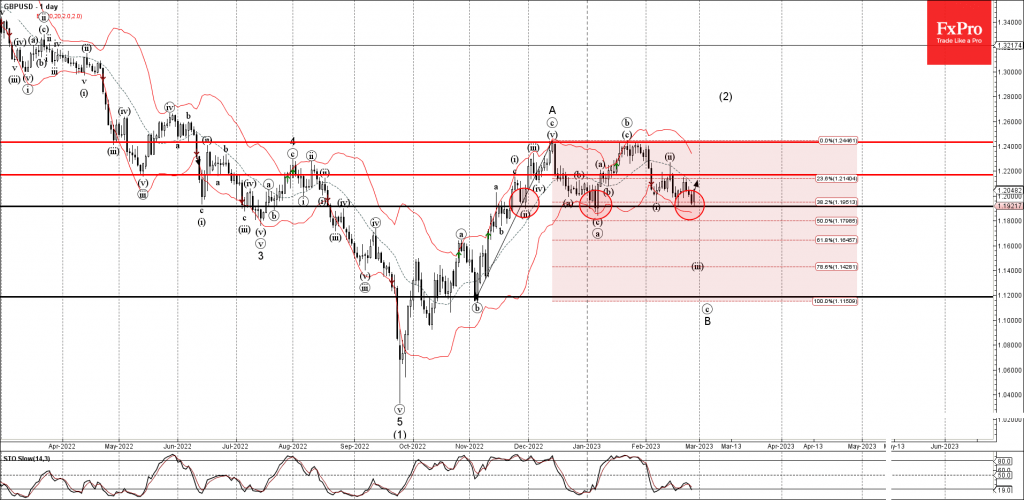

February 27, 2023

• GBPUSD reversed from key support level 1.1915 • Likely to rise to resistance level 1.2200 GBPUSD recently reversed up from the key support level 1.1915 (which has been reversing the pair from the end of November) intersecting with the.

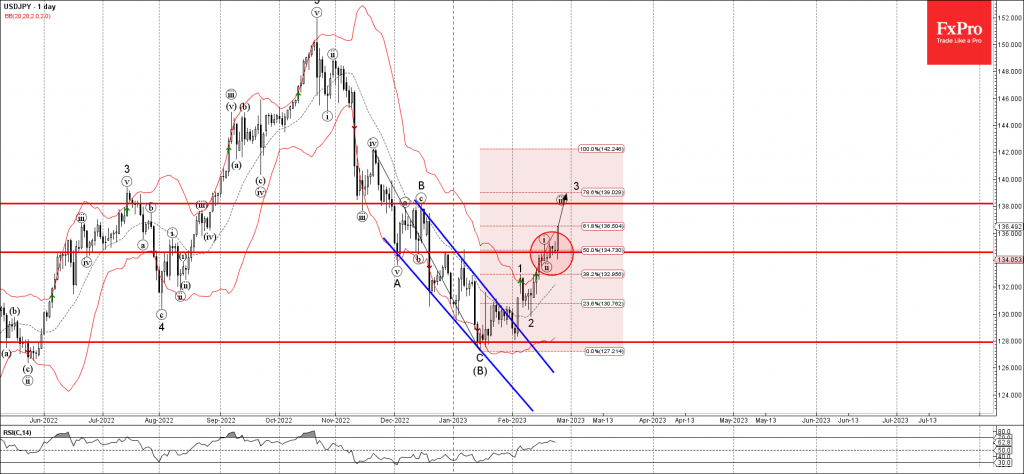

February 24, 2023

• USDJPY under the bullish pressure • Likely to rise resistance level 138.00 USDJPY under the bullish pressure after the earlier breakout of the resistance level 134.60 (which has been reversing the price from December) coinciding with the 50% Fibonacci.

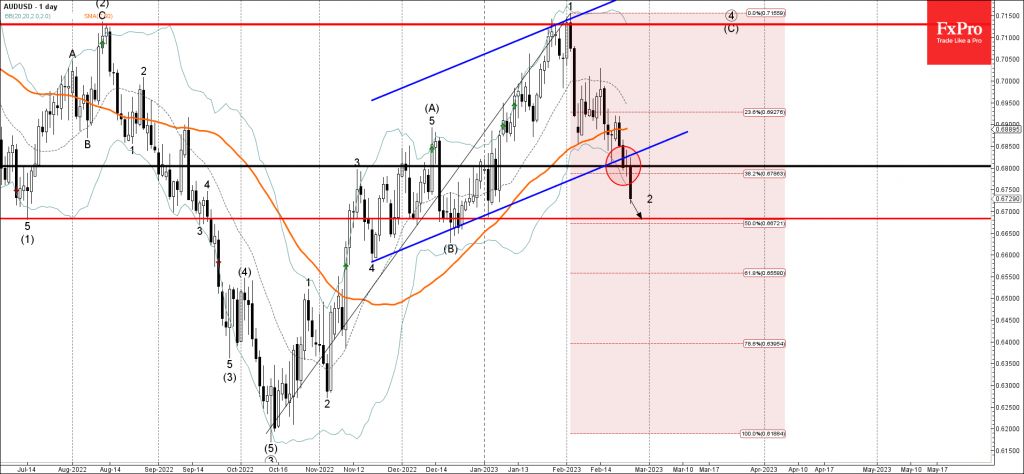

February 24, 2023

• AUDUSD broke key support level 0.6800 • Likely to fall to support level 0.6700 AUDUSD currency pair recently broke the key support level 0.6800 (which formed the daily Hammer earlier this month) intersecting with the daily up channel from.