Technical analysis - Page 166

March 9, 2023

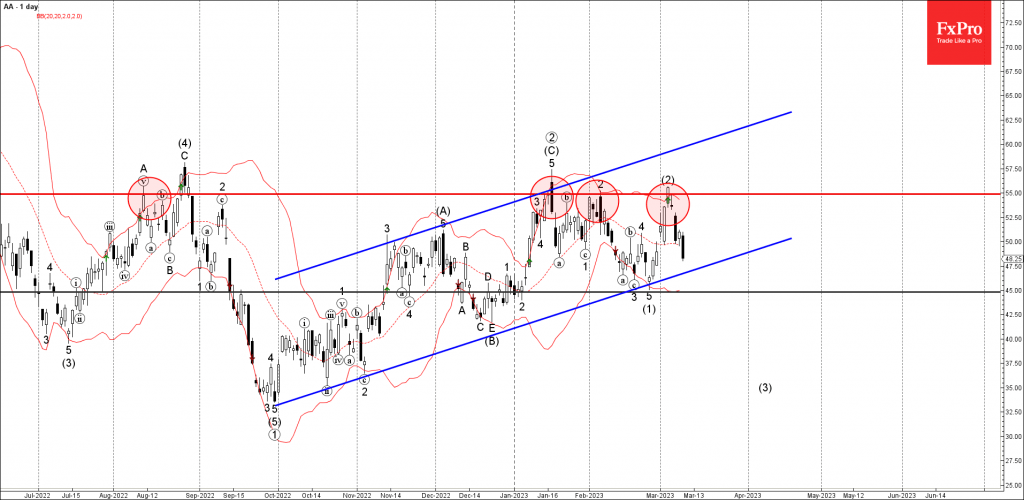

• Alcoa reversed from resistance level 55.00 • Likely to fall to support level 45.00 Alcoa falling sharply today following the earlier reversal from the resistance level 55.00 (which has been reversing the price from last August) – standing near the upper.

March 9, 2023

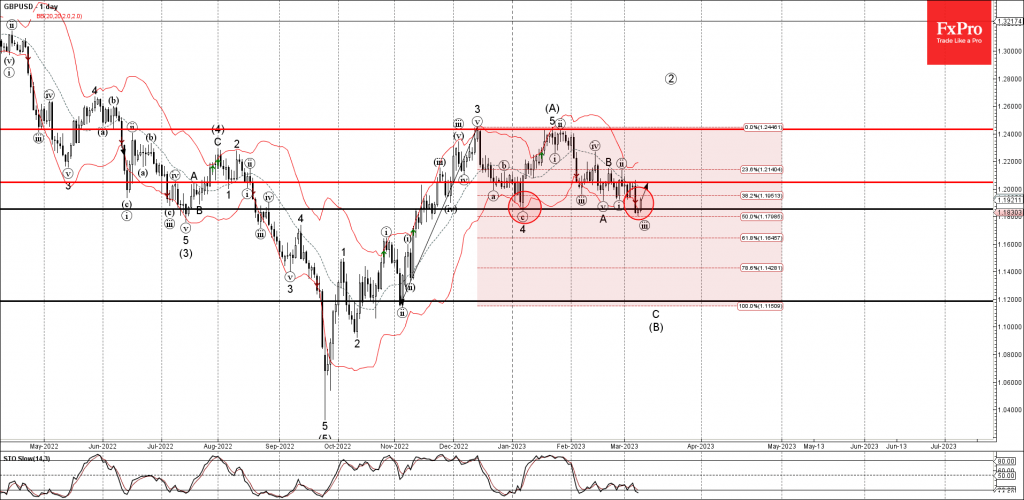

• GBPUSD reversed from support level 1.1855 • Likely to rise to resistance level 1.2050 GBPUSD recently reversed up from the powerful support level 1.1855 (previous monthly low from January) – coinciding with the lower daily Bollinger Band and the.

March 9, 2023

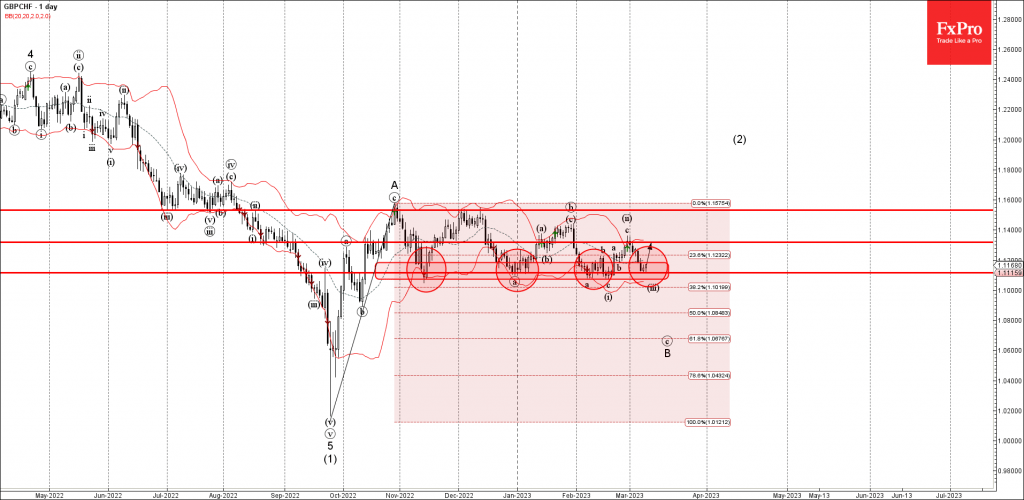

• GBPCHF reversed from support level 1.1115 • Likely to rise to resistance level 1.1320 GBPCHF currency pair recently reversed up from the key support level 1.1115 (which has been reversing the price from the start of November) – coinciding with.

March 8, 2023

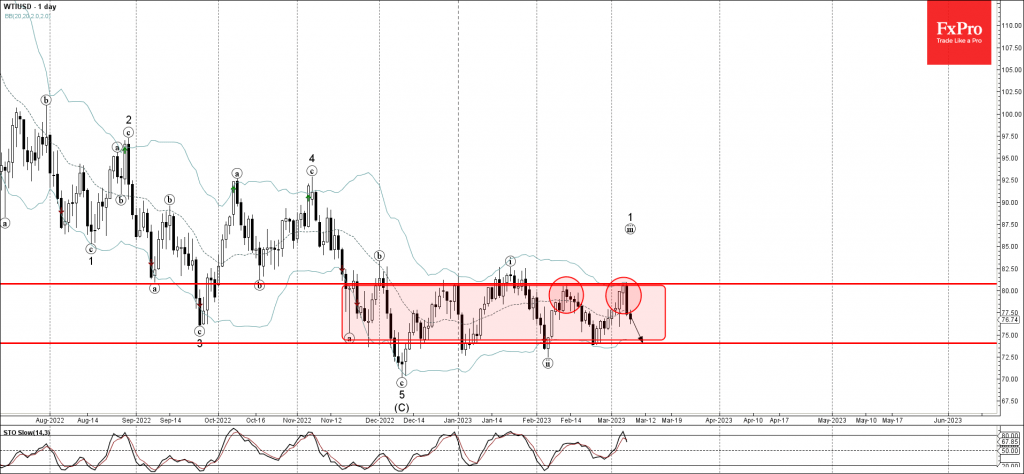

• WTI reversed from resistance level 80.80 • Likely to fall to support level 74.00 WTI crude oil recently reversed down from the resistance level 80.80 (upper border of the sideways price range inside which the price has been moving from.

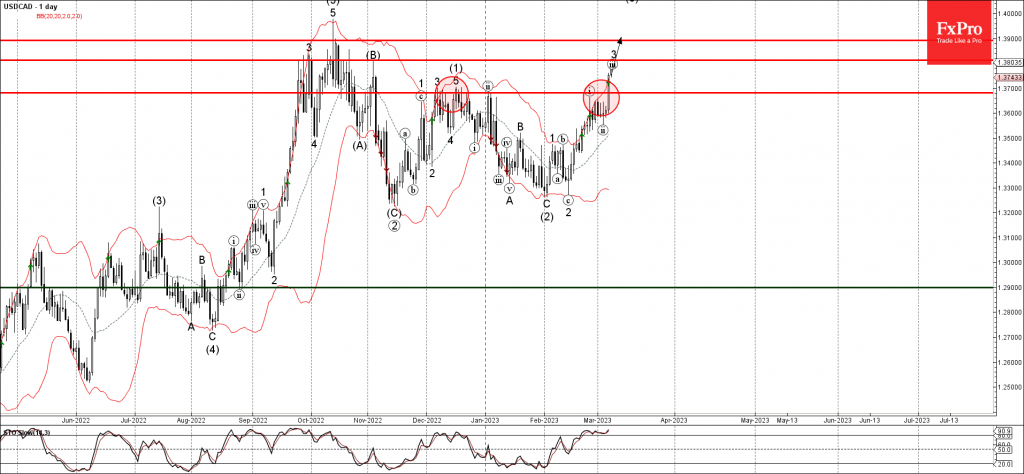

March 8, 2023

• USDCAD broke resistance level 1.3680 • Likely to rise to resistance level 1.3815 USDCAD currency pair recently broke above the resistance level 1.3680 (which has been reversing the price from the start of December). The breakout of the resistance level.

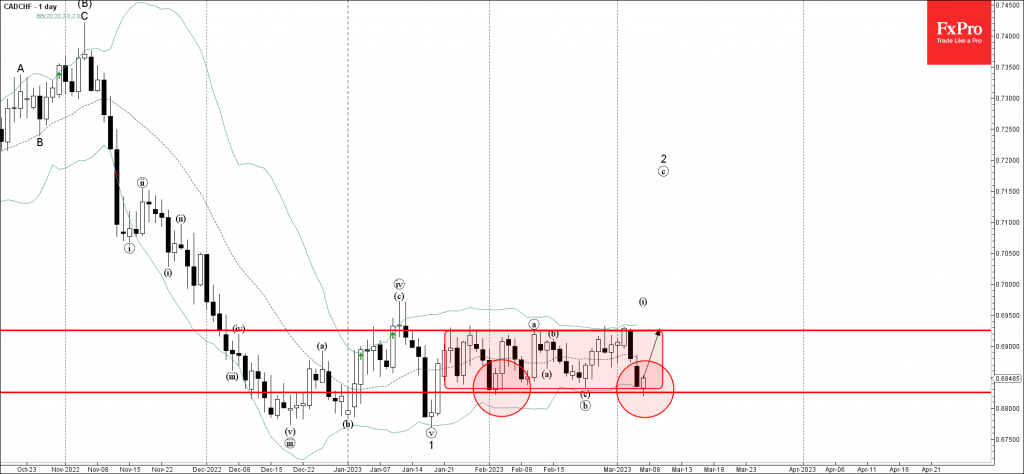

March 7, 2023

• CADCHF reversed from strong support level 0.6825 • Likely to rise to resistance level 0.6925 CADCHF currency pair recently reversed up from the strong support level 0.6825 (which is the lower boundary of the narrow sideways price range inside which the.

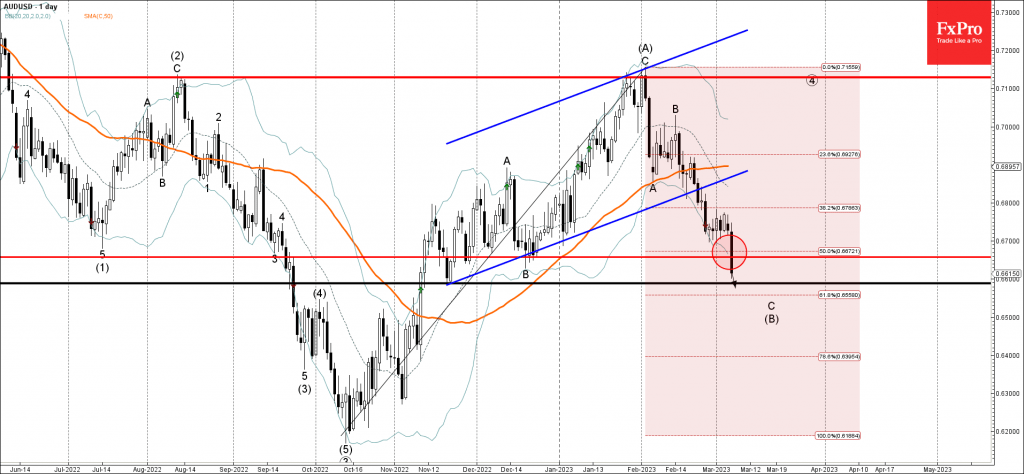

March 7, 2023

• AUDUSD broke support level 0.6660 • Likely to fall to support level 0.6600 AUDUSD recently broke the key support level 0.6660 (which stopped the earlier B-wave in December) intersecting with the 50% Fibonacci correction of the upward impulse from October. The.

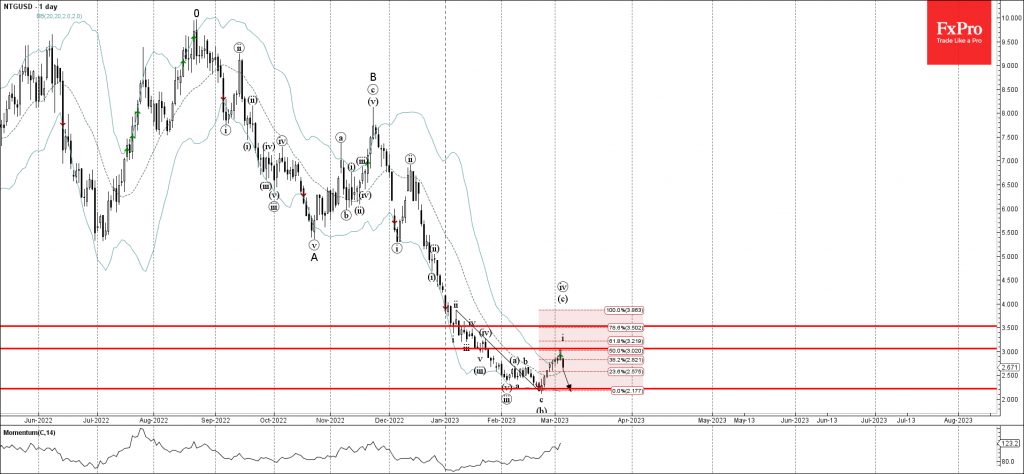

March 6, 2023

• Natural Gas reversed from round resistance level 3.0000 • Likely to fall to support level 2.224 Natural Gas recently reversed down from the round resistance level 3.0000 (former support from the start of January). The resistance level 3.0000 was further strengthened.

March 6, 2023

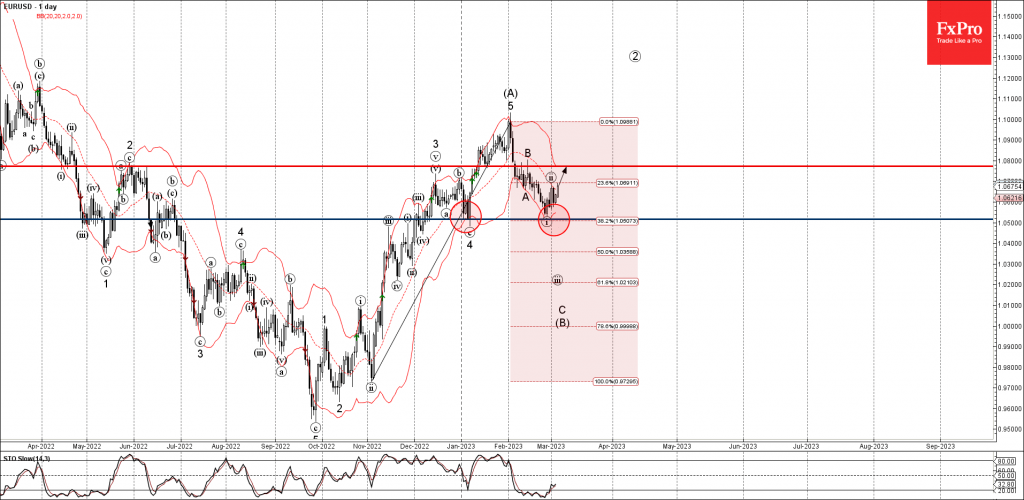

• EURUSD reversed from round support level 1.0500 • Likely to rise to resistance level 1.0775 EURUSD currency pair recently reversed up from the round support level 1.05000 (which has been reversing the price from the start of December) coinciding with.

March 3, 2023

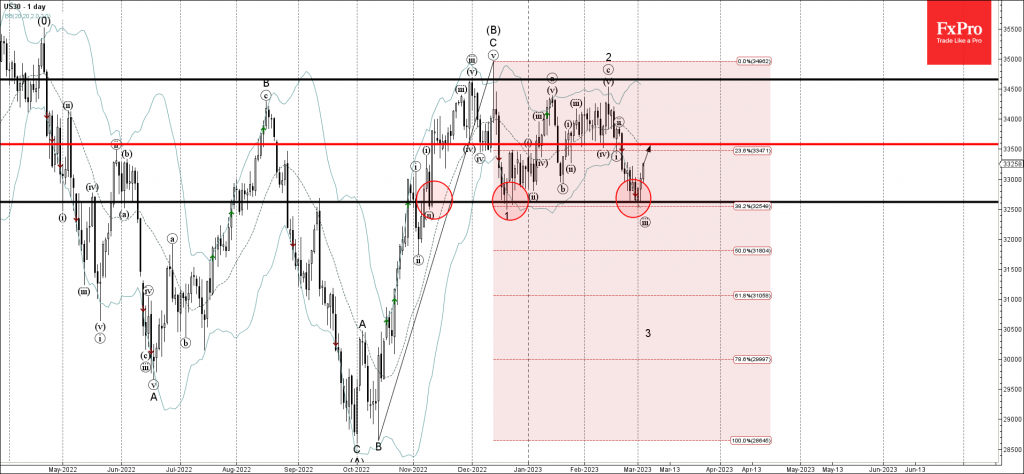

• Dow Jones index reversed from key support level 32620.00 • Likely to rise to resistance level 33585.00 Dow Jones index recently reversed up from the key support level 32620.00 (which has been reversing the price from the start of November) strengthened.

March 3, 2023

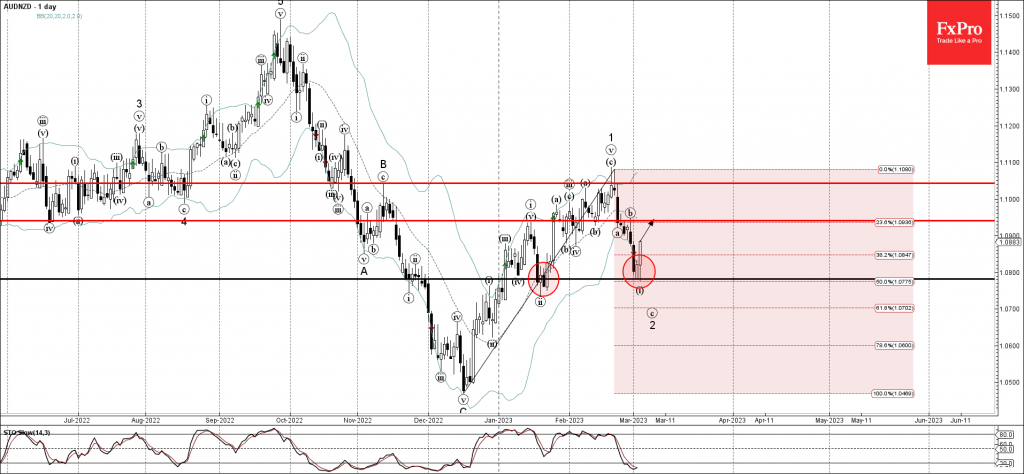

• AUDNZD reversed from support level 1.078 • Likely to rise to resistance level 1.0950 AUDNZD recently reversed up from the support level 1.078 (which reversed the pair multiple times in January) strengthened by the lower daily Bollinger Band and by the.