Technical analysis - Page 165

March 16, 2023

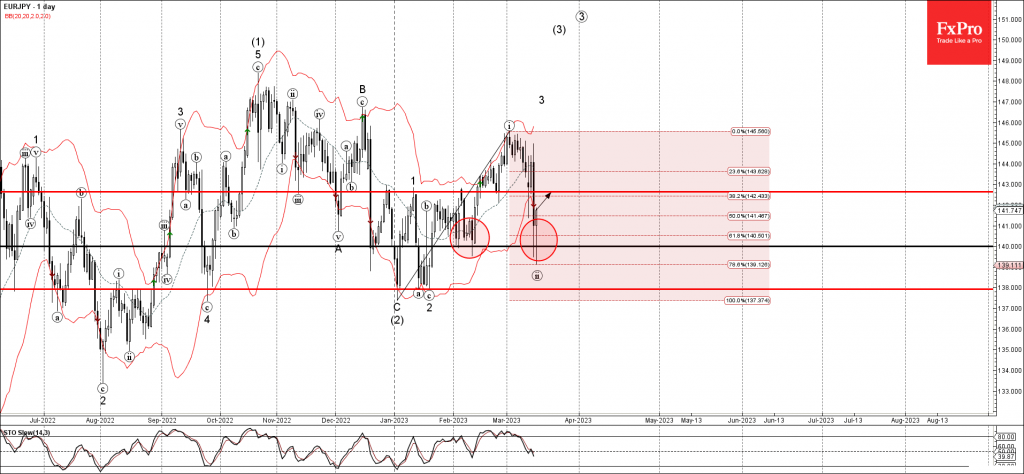

• EURJPY reversed from round support level 140.00 • Likely to rise to resistance level 142.65 EURJPY currency pair recently reversed up from the round support level 140.00 (previous Double Bottom from the start of February). The support level 140.00.

March 16, 2023

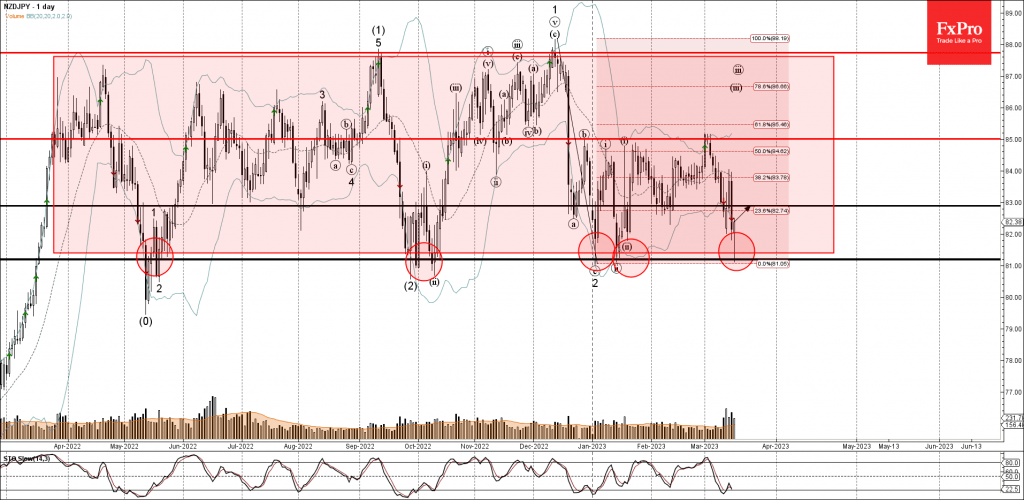

• NZDJPY reversed from support level 81.20 • Likely to rise to resistance level 83.00 NZDJPY currency pair recently reversed up from the key support level 81.20 (lower boundary of the wide sideways price range inside which the price has.

March 16, 2023

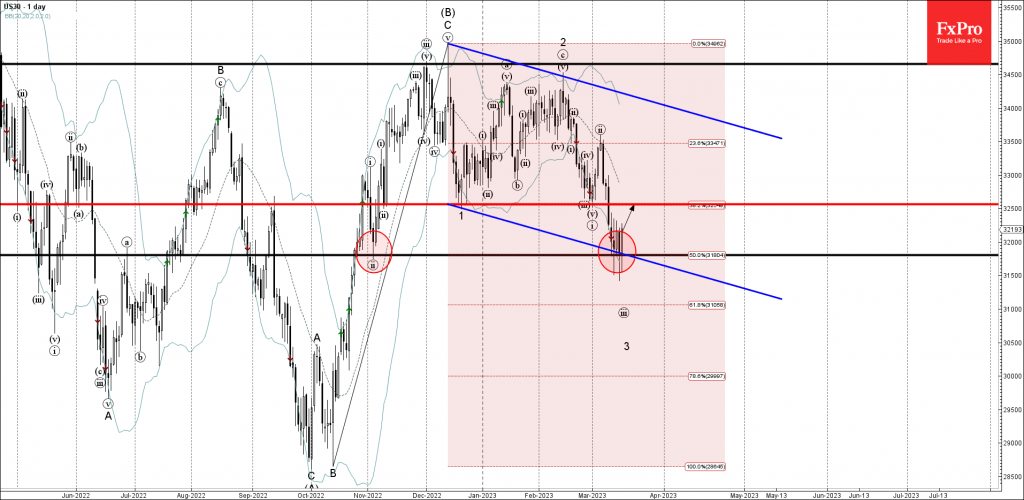

• Dow Jones reversed from support level 31800.00 • Likely to rise to resistance level 32500.00 Dow Jones recently reversed up from the key support level 31800.00 (previous monthly low from November) intersecting with the lower daily Bollinger Band. The.

March 15, 2023

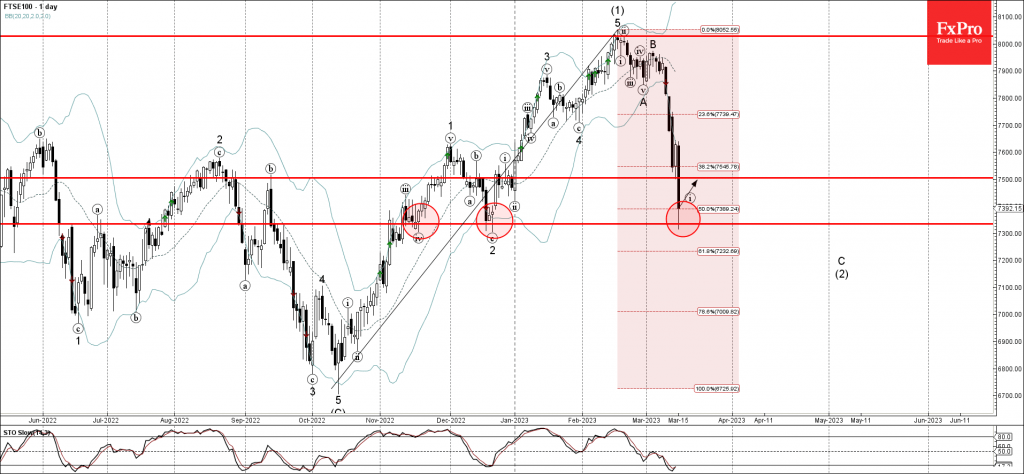

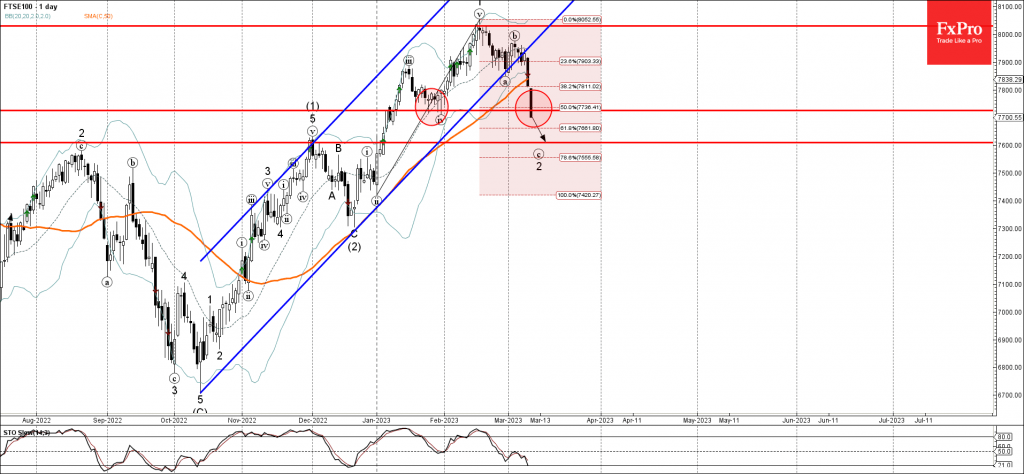

• FTSE 100 index reversed from support level 7335,00 • Likely to rise to resistance level 7500.00 FTSE 100 index today reversed up from the powerful support level 7335,00 (which has been reversing the price from the middle of November).

March 15, 2023

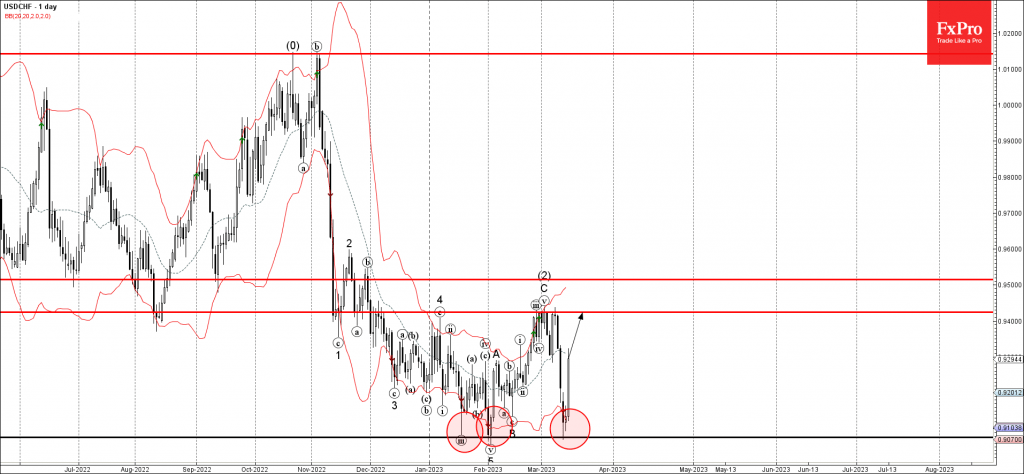

• USDCHF reversed from support level 0.9075 • Likely to rise to resistance level 0.9425 USDCHF currency pair recently reversed up from the strong support level 0.9075 (which has been repeatedly reversing the price from the middle of January). The.

March 14, 2023

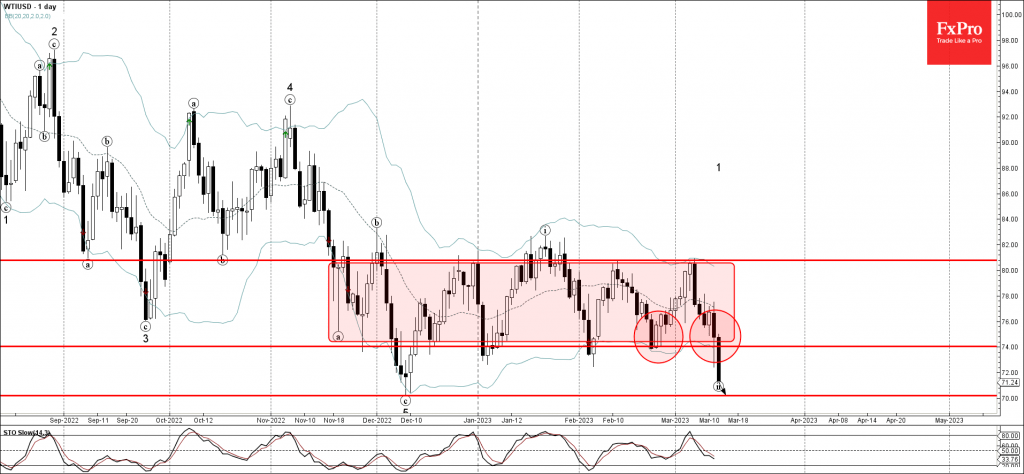

• WTI broke key support level 74.00 • Likely to fall to support level 70.20 WTI crude oil under the bearish pressure after the earlier breakout of the key support level 74.00 (which is the lower boundary of the sideways.

March 14, 2023

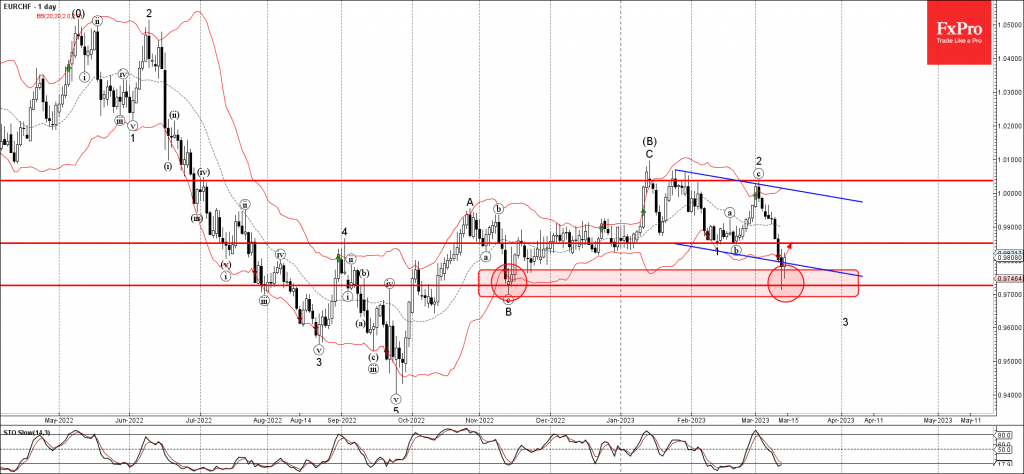

• EURCHF reversed from support level 0.9725 • Likely to rise to resistance level 0.9850 EURCHF recently reversed up from the support area located between the support level 0.9725 (which reversed the price in November) standing well below the lower.

March 13, 2023

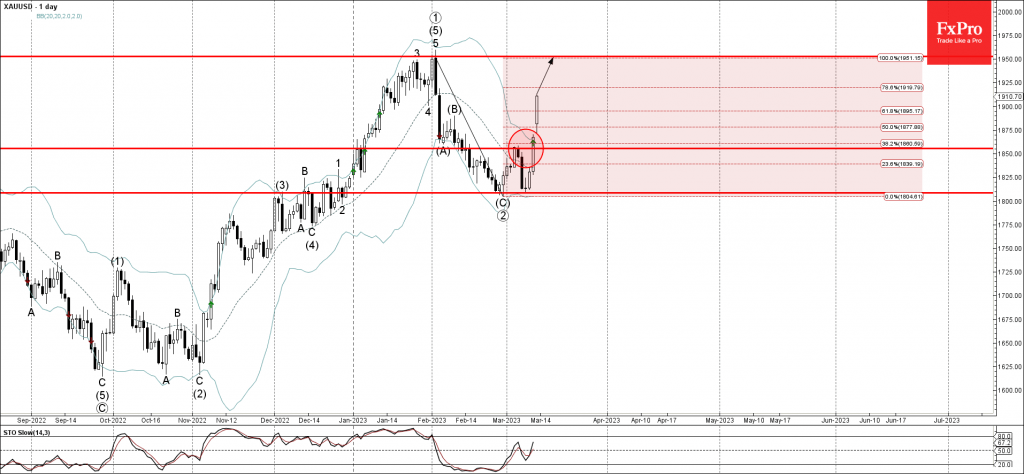

• Gold broke resistance area • Likely to rise to resistance level 1950.00 Gold recently broke the resistance area located between the resistance level 1855.00 and the 38.2% Fibonacci correction of the downward correction from the start of February. The.

March 13, 2023

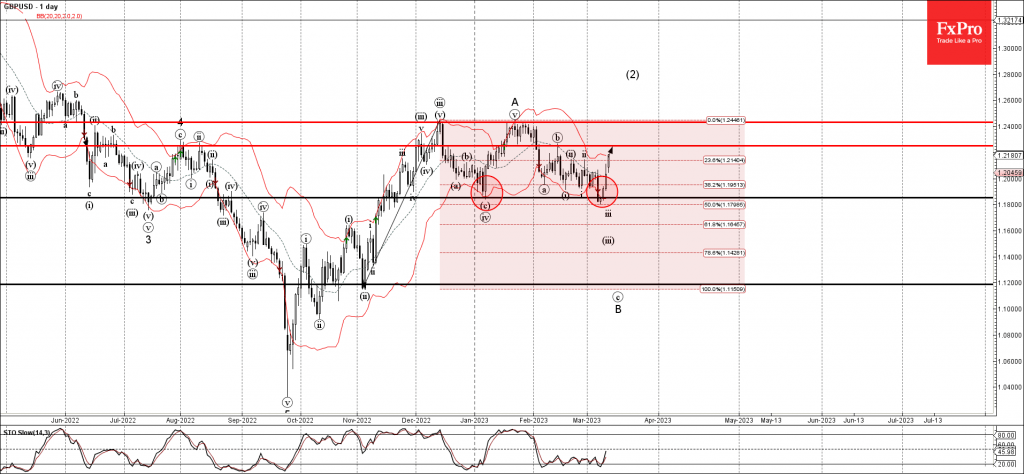

• GBPUSD reversed from support level 1.1855 • Likely to rise to resistance level 1.2250 GBPUSD currency pair recently reversed up from the key support level 1.1855 (previous monthly low from January) standing near the lower daily Bollinger Band and.

March 10, 2023

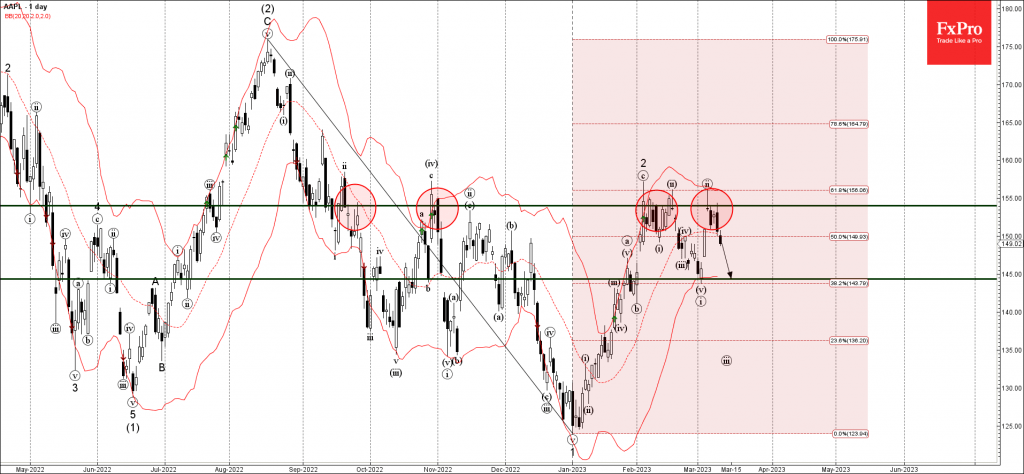

• Apple reversed from resistance level 154.00 • Likely to fall to support level 145.00 Apple recently reversed down from the key resistance level 154.00, which has been repeatedly reversing the price from September. The resistance level 154.00 was further.

March 10, 2023

• FTSE 100 falling inside (c)-wave • Likely to reach support level 7600.00 FTSE 100 index falling sharply inside the (c)-wave of the sharp ABC correction 2 from the middle of February. The price earlier broke the daily up channel.