Technical analysis - Page 164

March 23, 2023

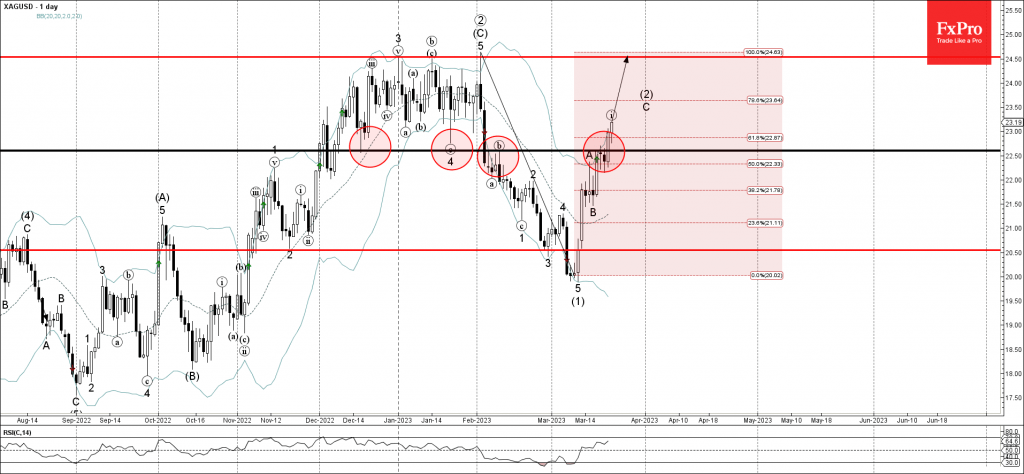

• Silver broke key resistance level 22.60 • Likely to rise to resistance level 24.50 Silver recently broke the key resistance level 22.60 (former support from December, which has been reversing the price from February). The breakout of the resistance.

March 23, 2023

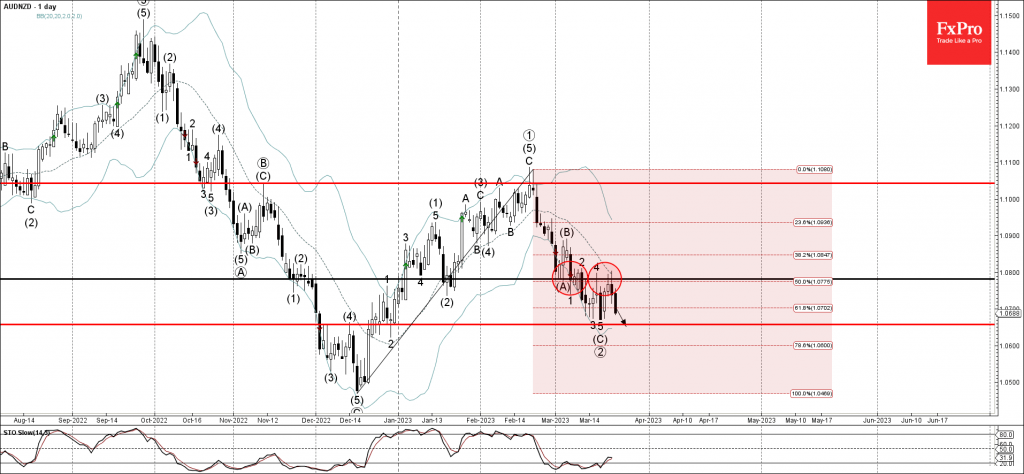

• AUDNZD reversed from resistance level 1.078 • Likely to fall to support level 1.0670 AUDNZD currency pair recently reversed down from the key resistance level 1.078 (former support from the start of March). The resistance level 1.078 was.

March 23, 2023

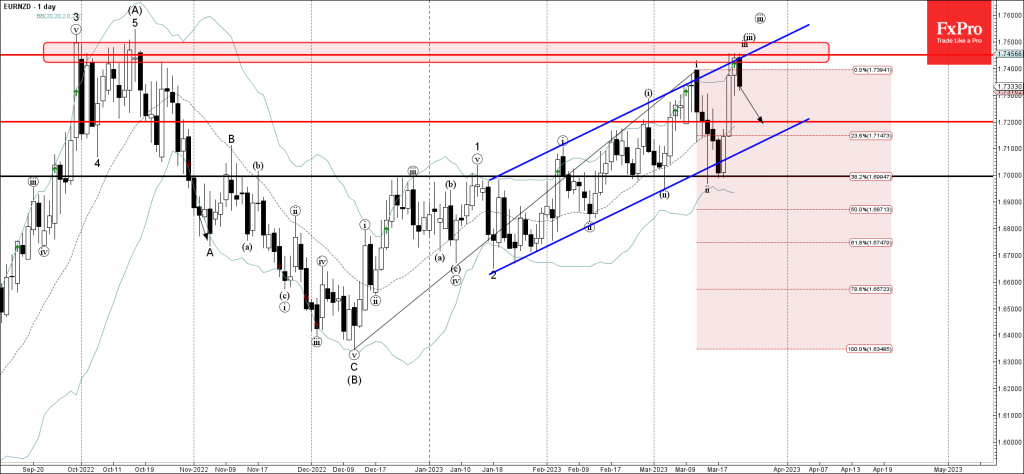

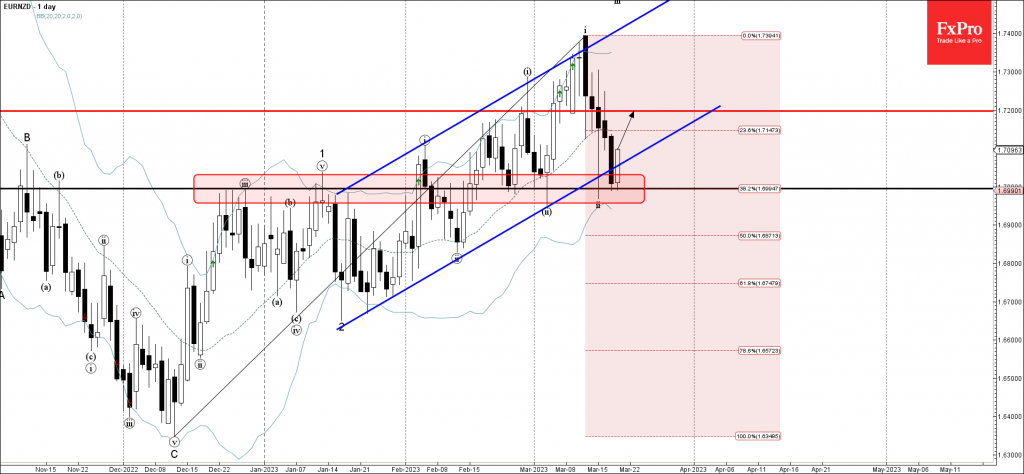

• EURNZD reversed from key resistance level 1.7450 • Likely to fall to support level 1.7200 EURNZD currency pair recently reversed down from the key resistance level 1.7450 (which reversed the pair multiple times in last October). The resistance level.

March 22, 2023

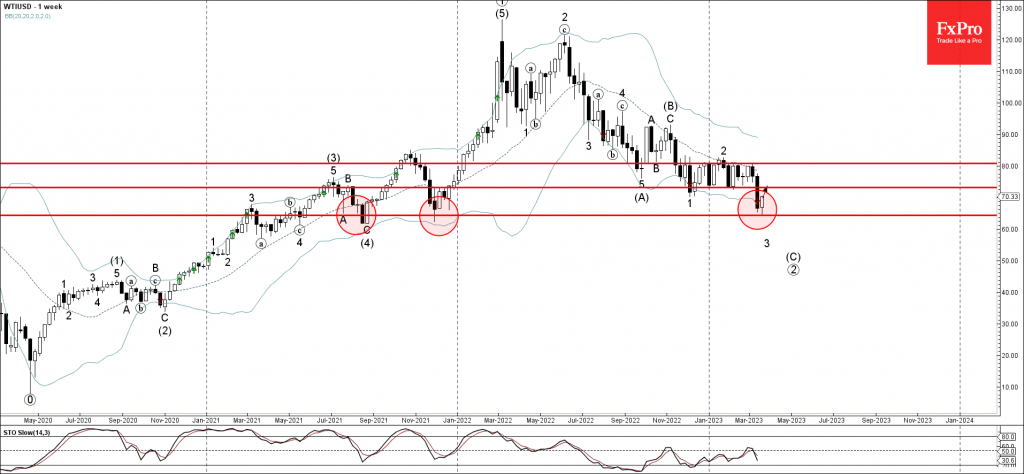

• WTI crude oil reversed from support level 64.40 • Likely to rise to resistance level 73.20 WTI crude oil recently reversed up from the powerful support level 64.40 (which has been reversing the price from the middle of May)..

March 22, 2023

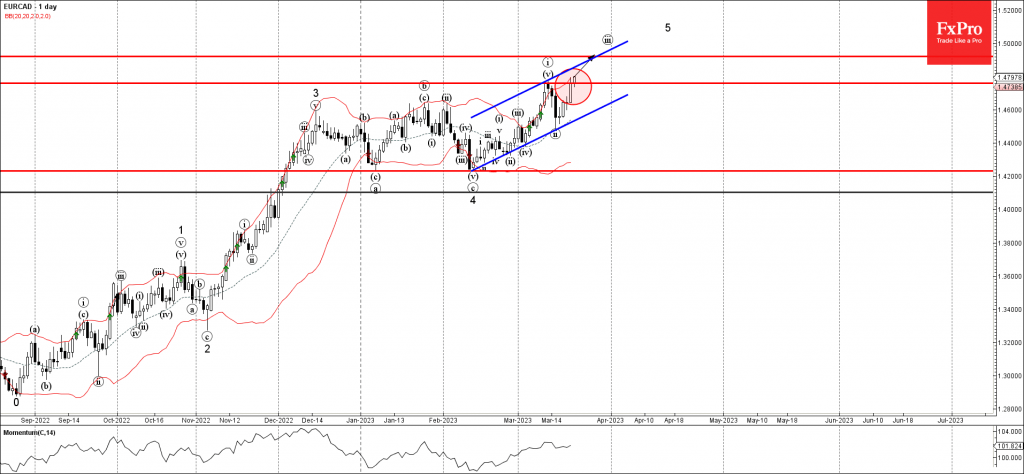

• EURCAD broke resistance level 1.4760 • Likely to rise to resistance level 1.4925 EURCAD currency pair recently broke above the resistance level 1.4760 (top of the previous minor impulse wave (i) from the start of March). The breakout of.

March 21, 2023

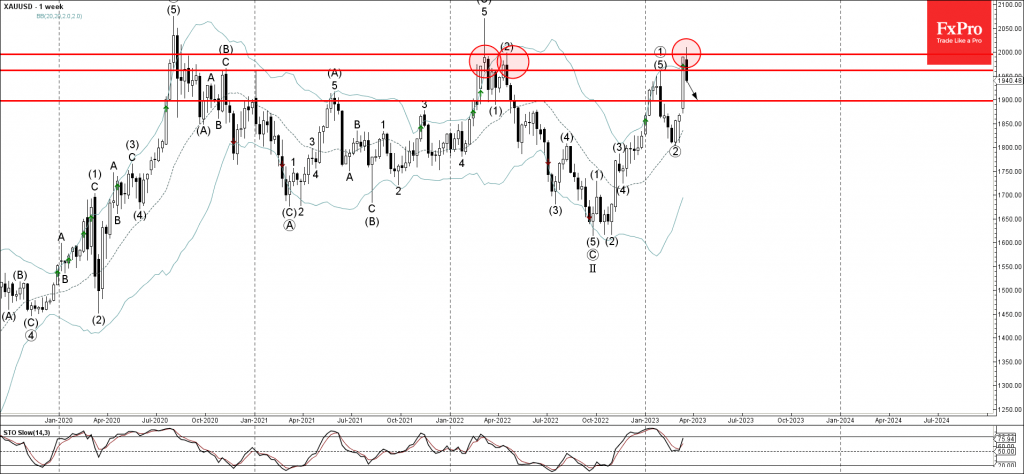

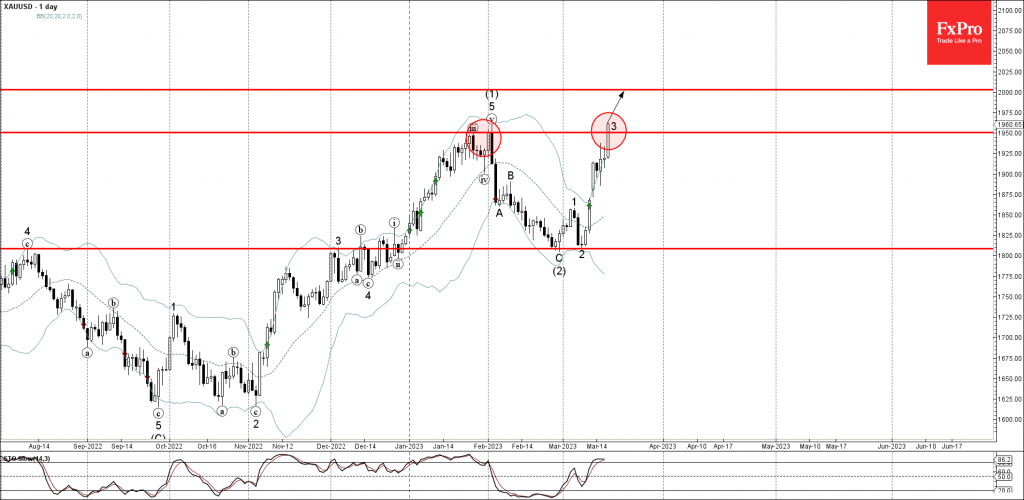

• Gold under bearish pressure • Likely to fall to support level 1900.00 Gold under the bearish pressure after the earlier downward reversal from the round resistance level 2000.00 (likely upward target set in our previous forecast for this precious.

March 21, 2023

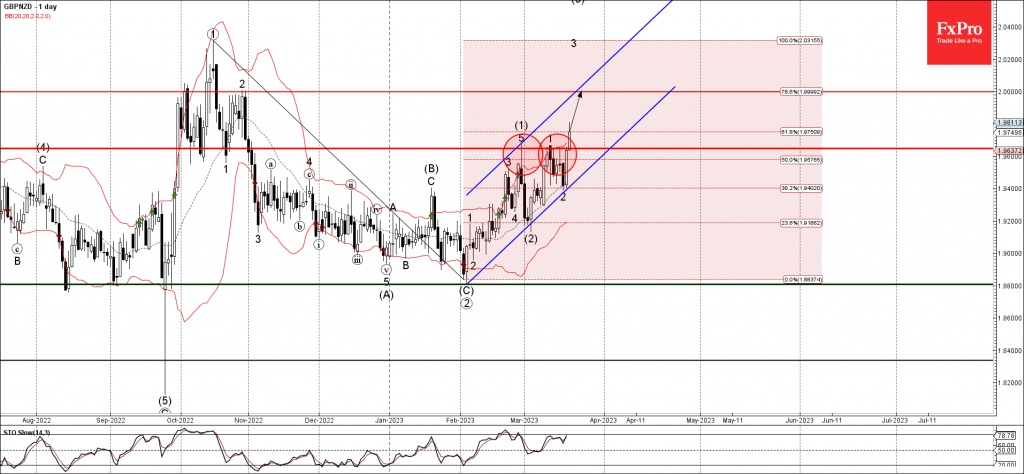

• GBPNZD broke resistance level 1.9650 • Likely to rise to resistance level 2.0000 GBPNZD recently broke the resistance level 1.9650 (earlier strong resistance from February) standing close to the 50% Fibonacci correction of the downward ABC correction from the.

March 20, 2023

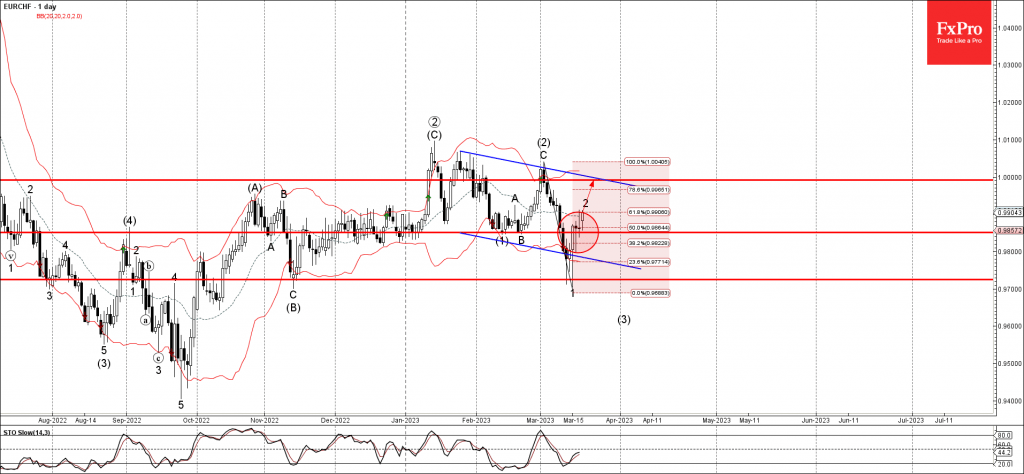

• EURCHF broke resistance level 0.9850 • Likely to rise to resistance level 1.0000 EURCHF recently broke the resistance level 0.9850 (former support from February) intersecting with the 50% Fibonacci correction of the downward impulse 1 from the start of.

March 20, 2023

• EURNZD reversed from round support level 1.7000 • Likely to rise to resistance level 1.7200 EURNZD recently reversed up from the round support level 1.7000 (former resistance from December and January, acting as the support after it was broken.

March 17, 2023

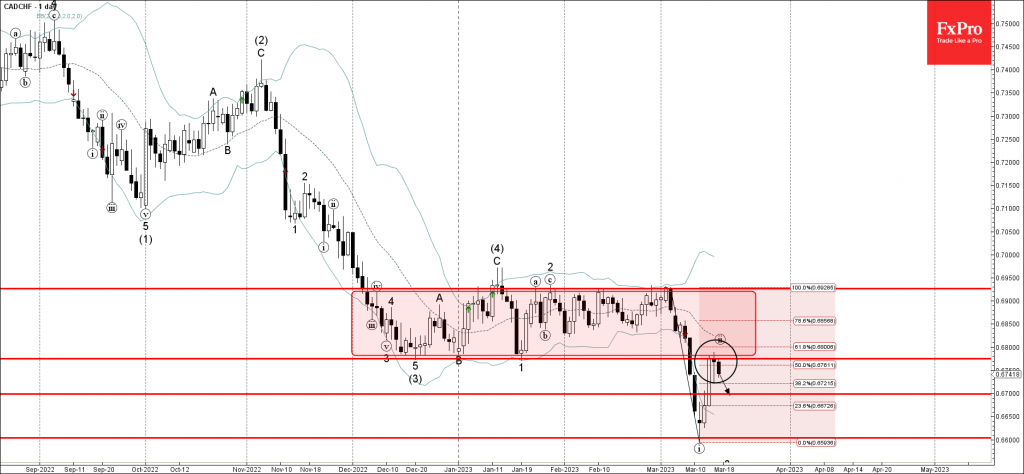

• CADCHF reversed from key resistance level 0.6775 • Likely to fall to support level 0.6700 CADCHF recently reversed down from the key resistance level 0.6775 (former lower boundary of the sideways price range from December, acting as the resistance.

March 17, 2023

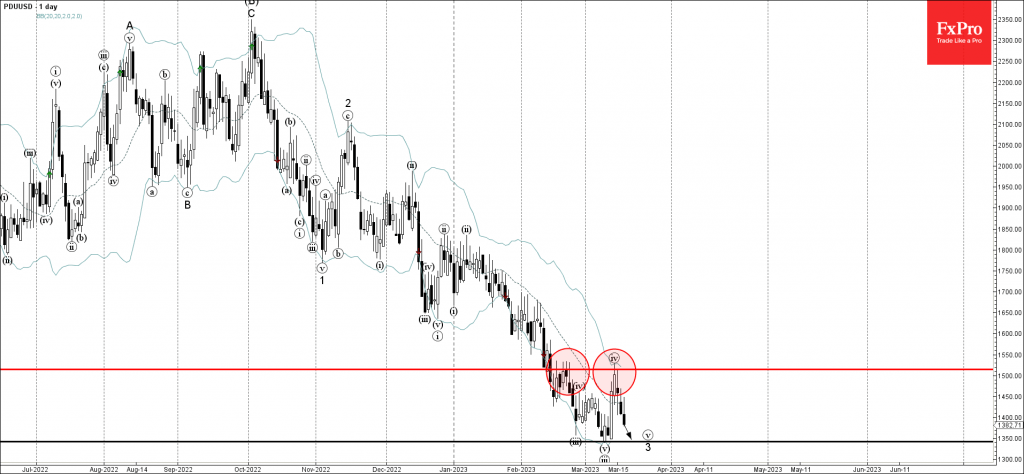

• Palladium reversed from resistance level 1515.40 • Likely to fall to support level 1350.00 Palladium recently reversed down from the pivotal resistance level 1515.40 (which has reversed the price multiple times from the middle of February). The downward reversal.