Technical analysis - Page 160

April 25, 2023

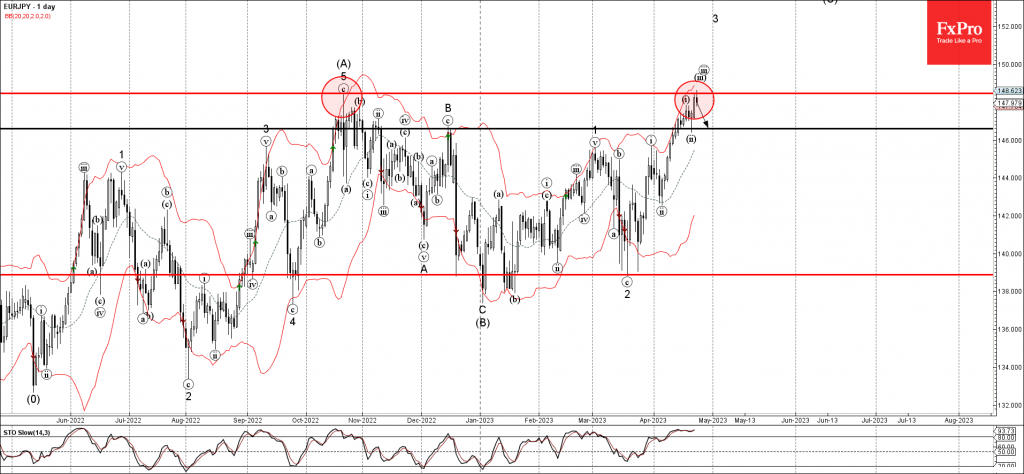

• EURJPY reversed from strong resistance level 148.50 • Likely to fall to support level 146.60 EURJPY currency pair recently reversed down from the multi-month resistance level 148.50 (which stopped the previous impulse wave (A) in October). The resistance level.

April 25, 2023

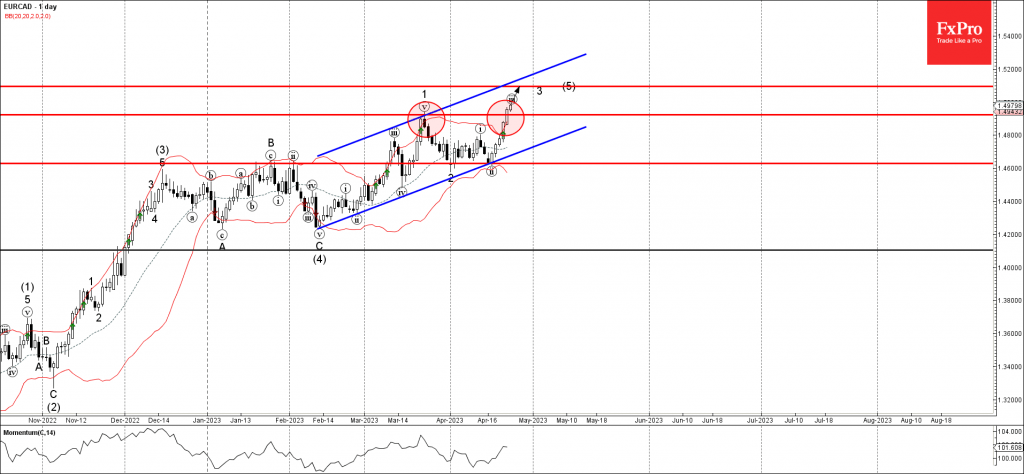

• EURCAD under bullish pressure • Likely to rise to resistance level 1.5090 EURCAD currency pair under the bullish pressure after the price broke the resistance level 1.4923 (which stopped the previous impulse wave 1 in the middle of March)..

April 24, 2023

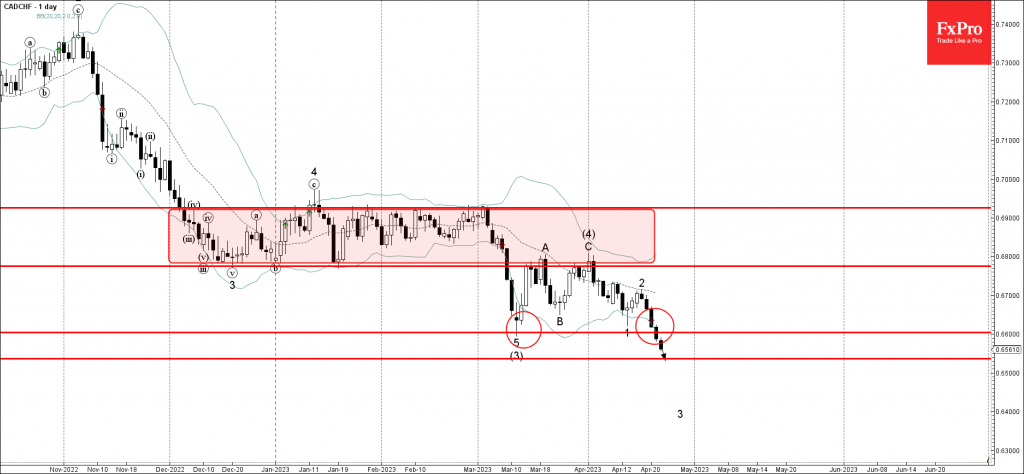

• CADCHF broke key support level 0.6600 • Likely to fall to support level 0.6535 CADCHF currency pair under the bearish pressure after the price broke the key support level 0.6600 (which stopped the previous impulse waves 1 and (3))..

April 24, 2023

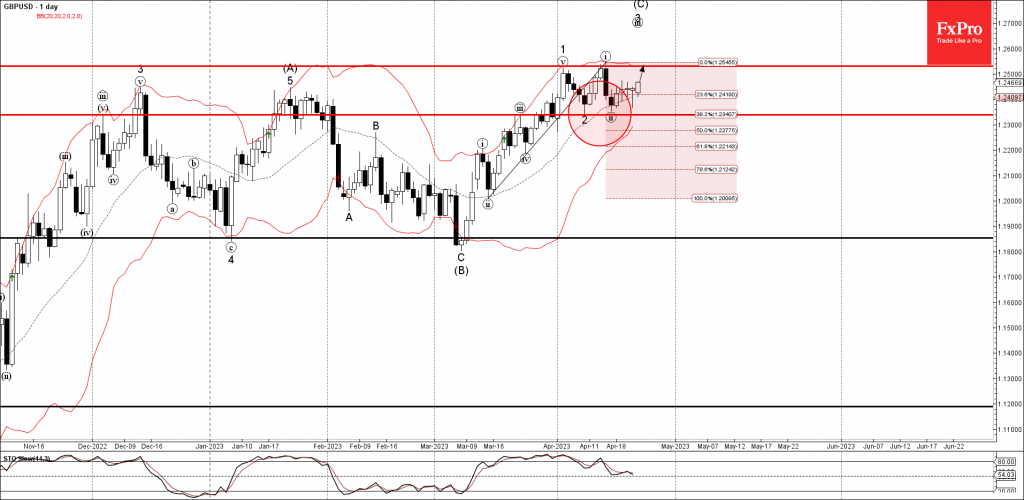

• GBPUSD reversed from key support level 1.2335 • Likely to rise to resistance level 1.2530 GBPUSD currency pair recently reversed up from the key support level 1.2335 (which stopped the previous corrections 2 and (ii)). The support level.

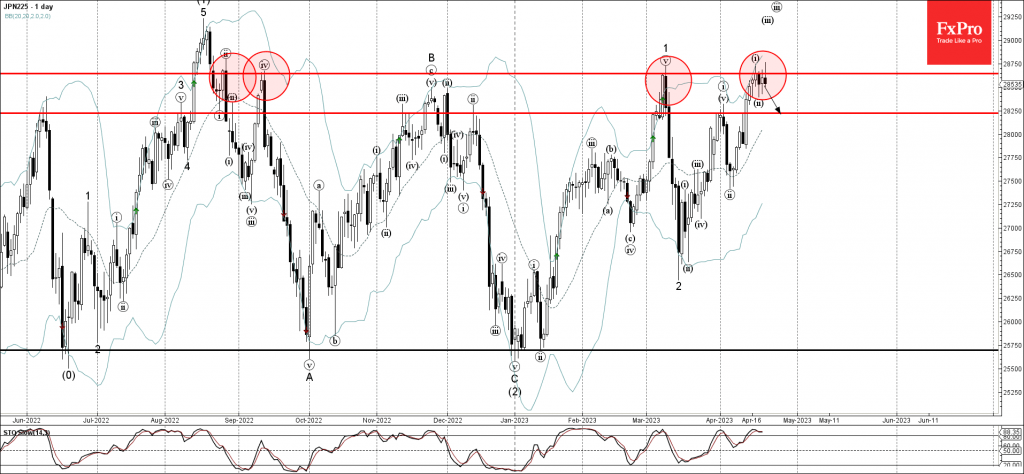

April 21, 2023

• Nikkei 225 reversed from resistance level 28645.00 • Likely to fall to support level 28250.00 Nikkei 225 index recently reversed down from the long-term resistance level 28645.00 (which has been steadily reversing the price from August of 2021). The.

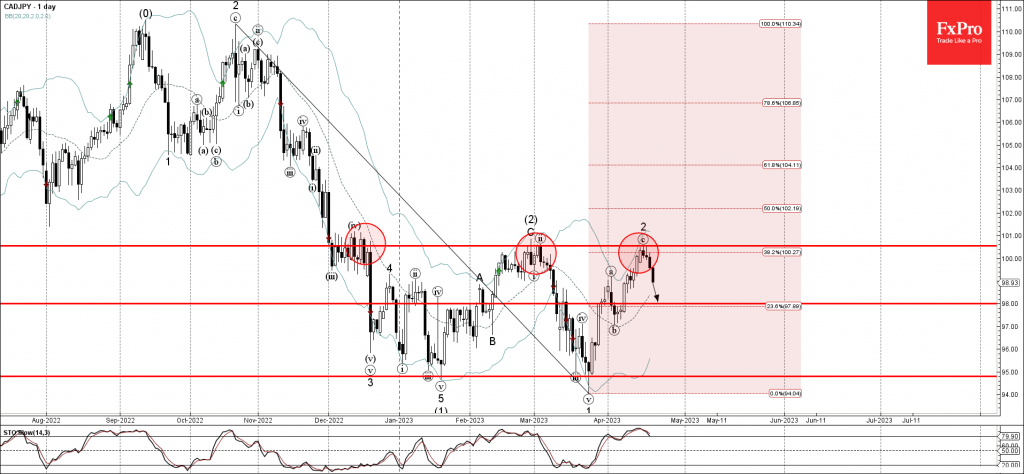

April 21, 2023

• CADJPY reversed from resistance level 100.50 • Likely to fall to support level 98.00 CADJPY currency pair recently reversed down from the pivotal resistance level 100.50 (which has been reversing the price from the middle of December) coinciding.

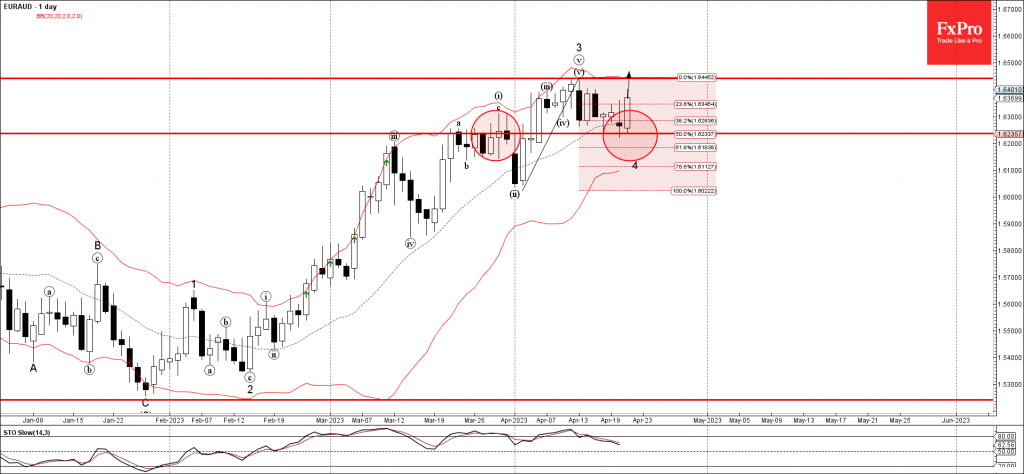

April 21, 2023

• EURAUD reversed from support level 1.6235 • Likely to rise to resistance level 1.6440 EURAUD currency pair recently reversed up from the support level 1.6235 (former resistance from March) coinciding with the 20-day moving average and the 50% Fibonacci.

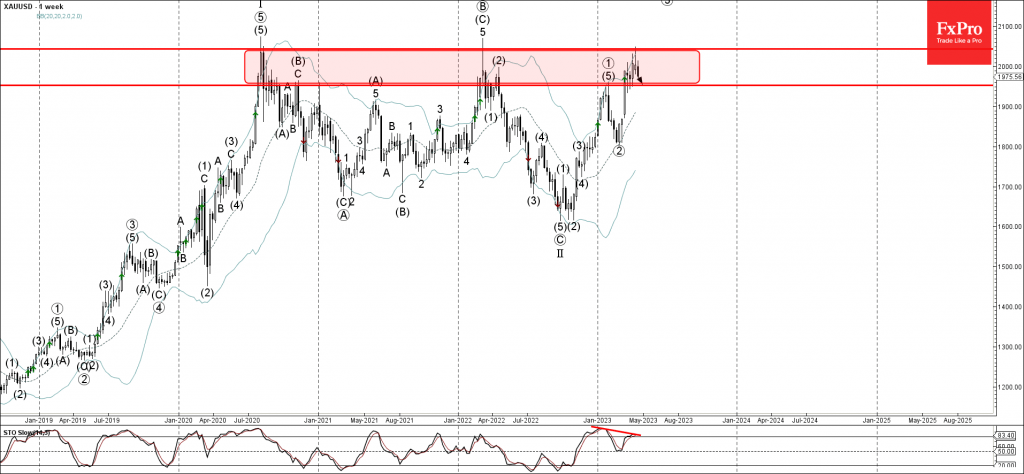

April 19, 2023

• Gold reversed from major resistance level 2050.00 • Likely to fall to support level 1953.00 Gold continues to fall after the price reversed down from the major resistance level 2050.00 (which is the upper boundary of the powerful resistance.

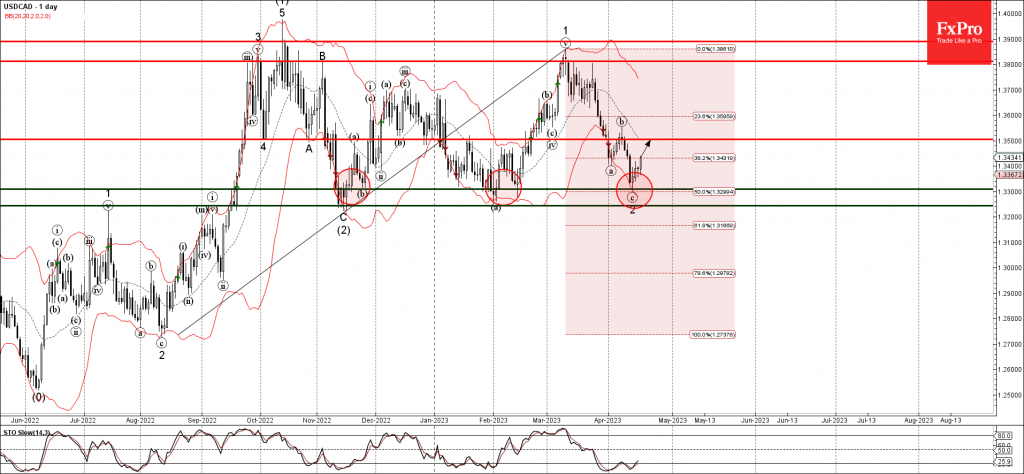

April 19, 2023

• USDCAD reversed from powerful support level 1.3300 • Likely to rise to resistance level 1.3500 USDCAD recently reversed up from the powerful support level 1.3300 (which has been reversing the price from the middle of November) coinciding with the.

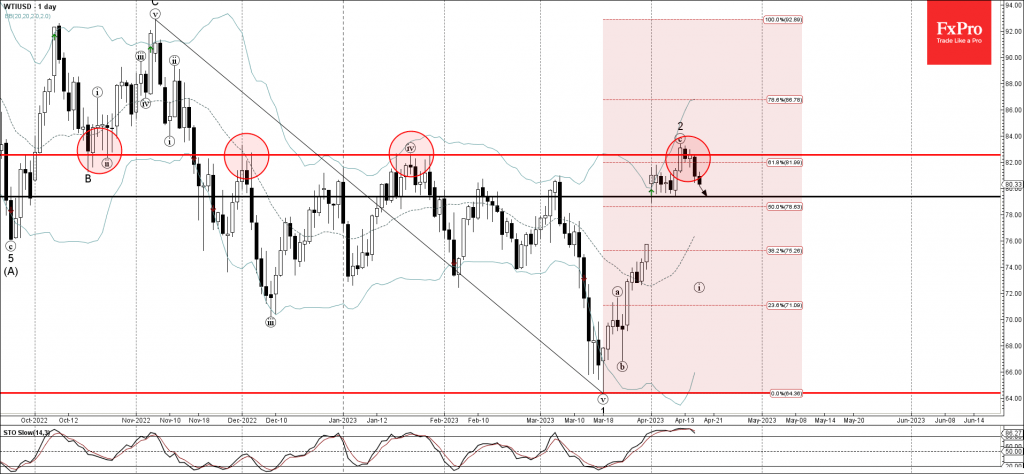

April 18, 2023

• WTI reversed from resistance level 82.55 • Likely to fall support level 79.40 WTI crude oil previously reversed down from the resistance level 82.55 (former strong support from October, which has been reversing all upward corrections after it.

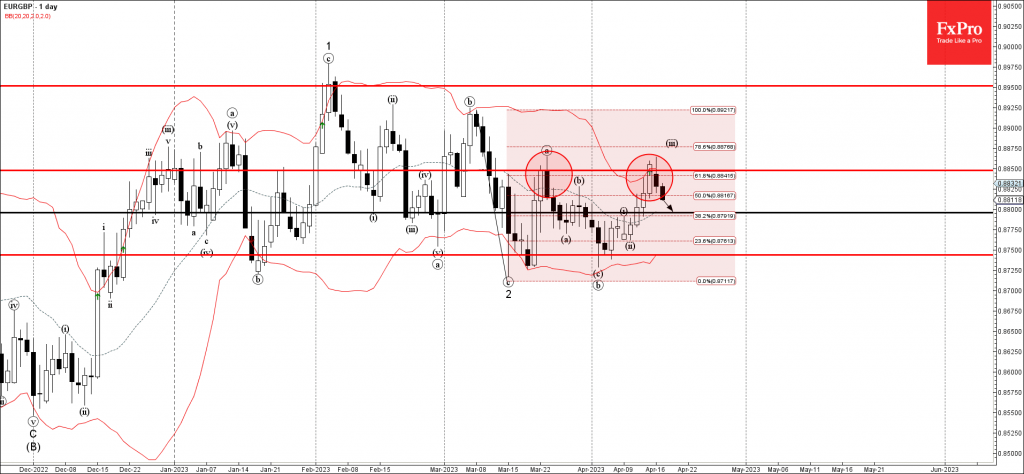

April 18, 2023

• EURGBP reversed from resistance level 0.8850 • Likely to fall support level 0.8800 EURGBP currency pair recently reversed down from the resistance level 0.8850 (which also stopped the previous wave (a) in the middle of March). The resistance level.