Technical analysis - Page 158

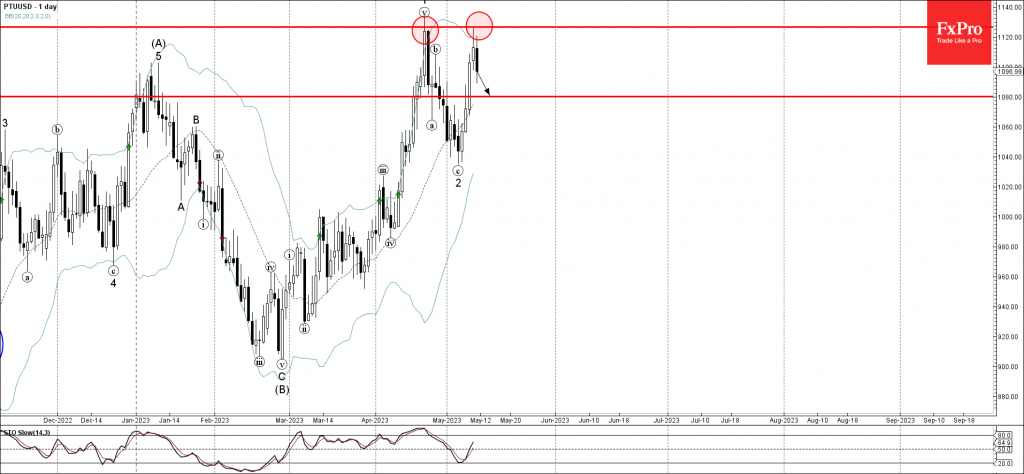

May 11, 2023

• Platinum reversed from resistance level 1125.00 • Likely to fall to support level 1080.00 Platinum recently reversed down from the major resistance level 1125.00 (which stopped the previous sharp upward impulse in April), strengthened by the nearby upper.

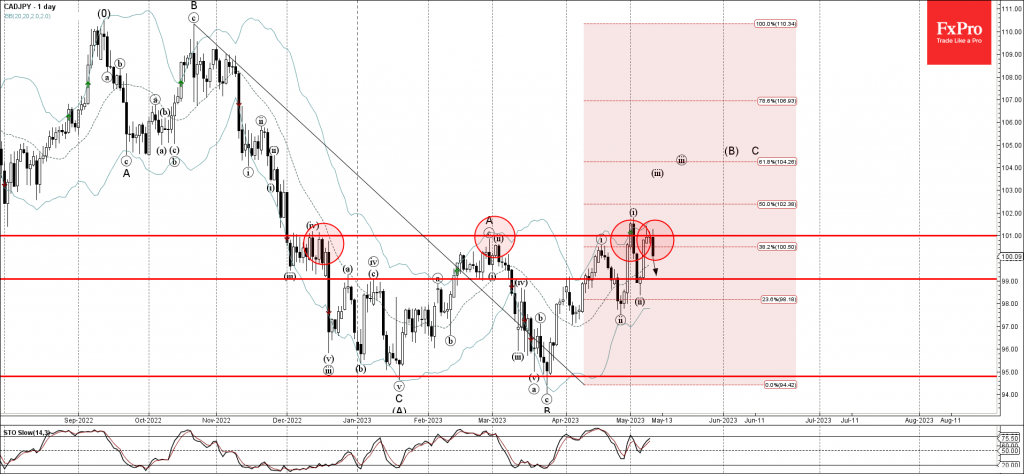

May 10, 2023

• CADJPY reversed from pivotal resistance level 101.00 • Likely to fall to support level 99,00 CADJPY earlier reversed down once again from the pivotal resistance level 101.00 (which has reversed the pair multiple times from December), strengthened by the.

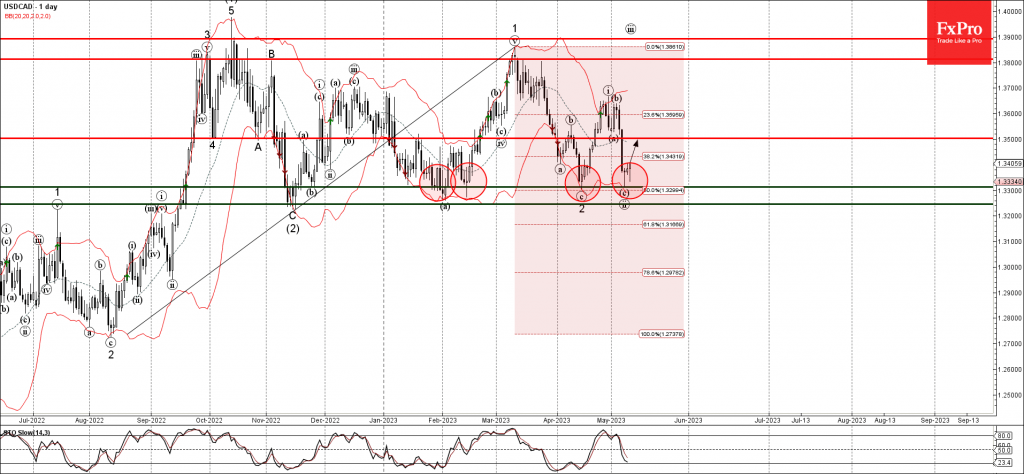

May 10, 2023

• USDCAD reversed from support level 1.3310 • Likely to rise to resistance level 1.3500 USDCAD recently reversed up from the key support level 1.3310 (which has been steadily reversing the price from November). The support level 1.3310 was further.

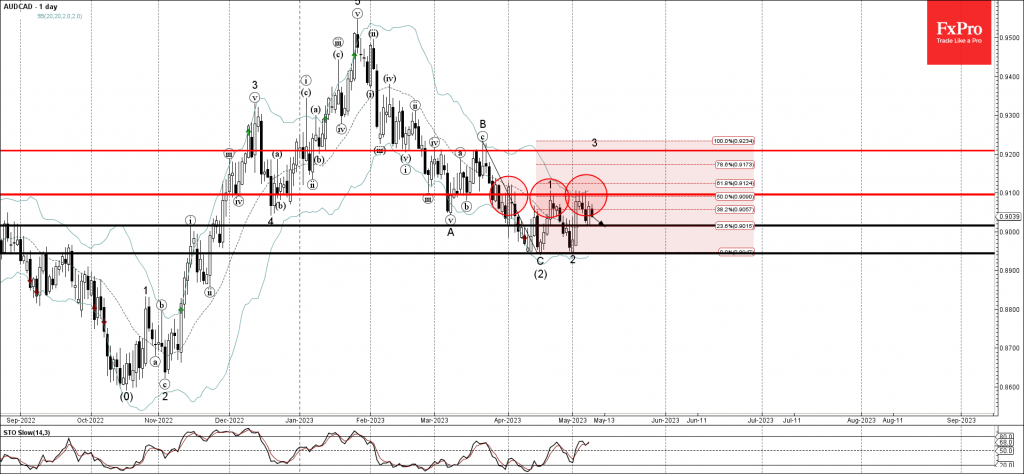

May 9, 2023

• AUDCAD reversed from resistance level 0.9100 • Likely to fall to support level 0.9015 AUDCAD earlier reversed down from the pivotal resistance level 0.9100 (which has been repeatedly reversing the price from the start of April). The downward reversal.

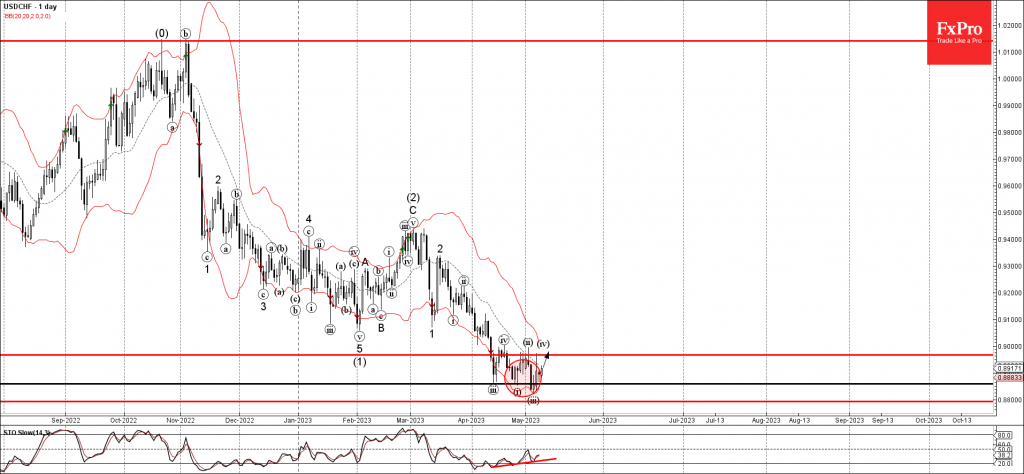

May 9, 2023

• USDCHF reversed from key support level 0.8860 • Likely to rise to resistance level 0.8965 USDCHF currency pair recently reversed up from the key support level 0.8860 (which has been steadily reversing the pair from the middle of April)..

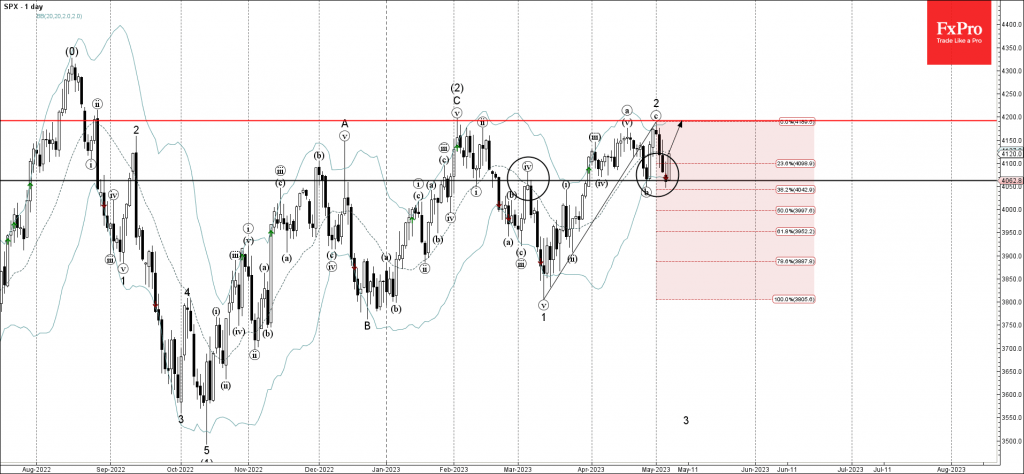

May 5, 2023

• S&P 500 reversed from support level 4060.00 • Likely to rise to resistance level 4190.00 S&P 500 index earlier reversed up from the support level 4060.00 (which stopped the previous minor correction (b) at the end of April)..

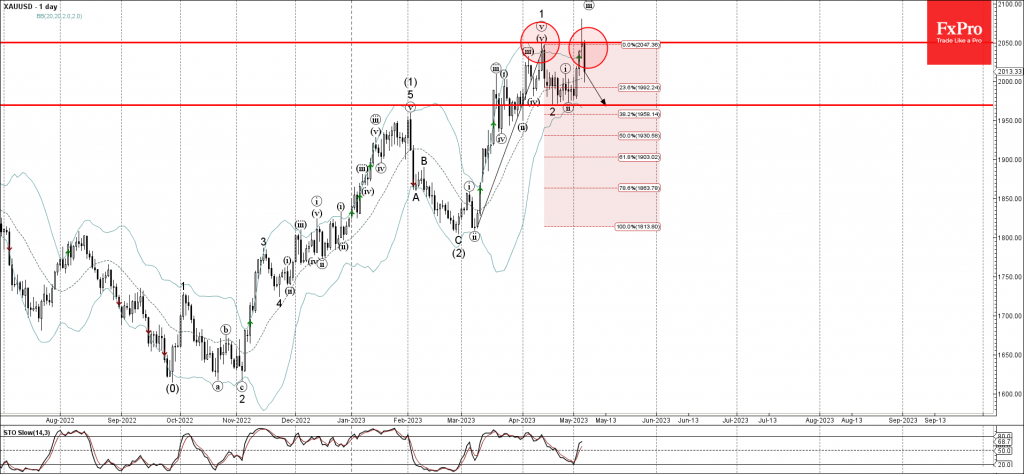

May 5, 2023

• Gold reversed from resistance level 2050.00 • Likely to fall to support level 1970.00 Gold recently reversed down strongly from the resistance level 2050.00 (which stopped the previous impulse wave 1 in April, upward target set in our earlier.

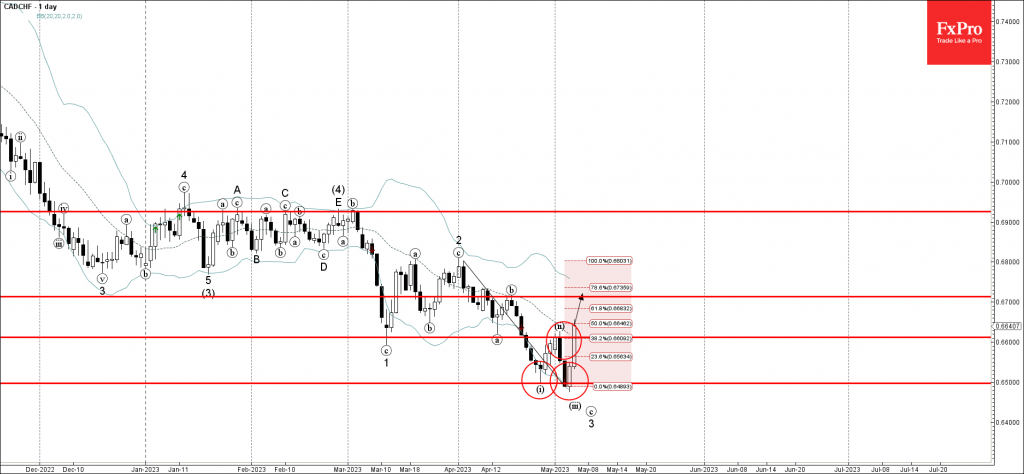

May 5, 2023

• CADCHF broke resistance level 0.6600 • Likely to rise to resistance level 0.6715 CADCHF currency pair recently broke the resistance level 0.6600 (which stopped the previous short-term correction (ii)). The breakout of the resistance level 0.6600 coincided with.

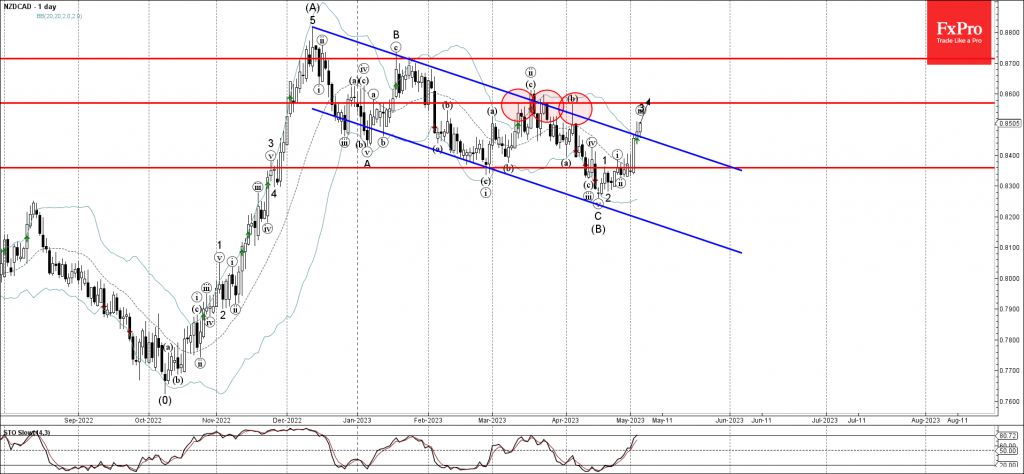

May 4, 2023

• NZDCAD broke daily down channel • Likely to rise to resistance level 0.8570 NZDCAD currency pair recently broke the resistance trendline of the daily down channel from December (which encloses the previous intermediate ABC correction (B)). The breakout.

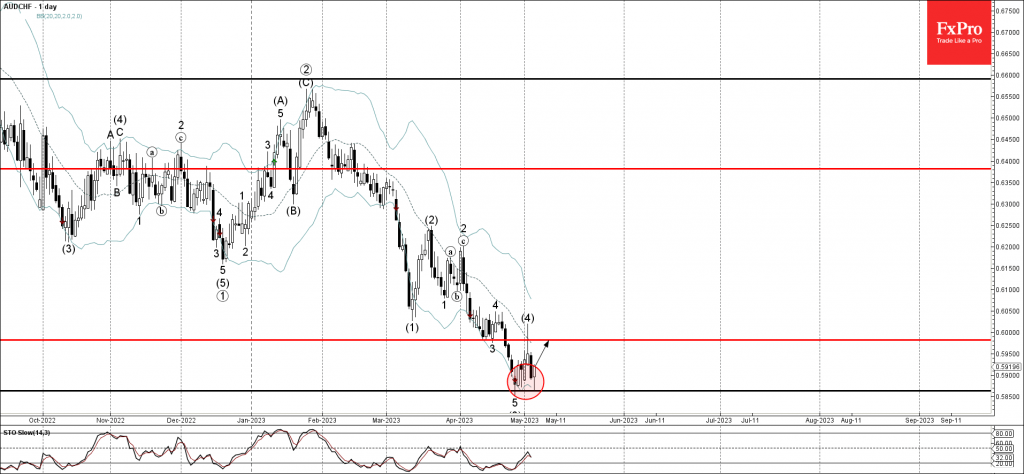

May 4, 2023

• AUDCHF reversed from support level 0.5865 • Likely to rise to round resistance level 0.6000 AUDCHF currency pair recently reversed up from the key support level 0.5865 (which stopped the previous short term impulse wave 5) intersecting with the.

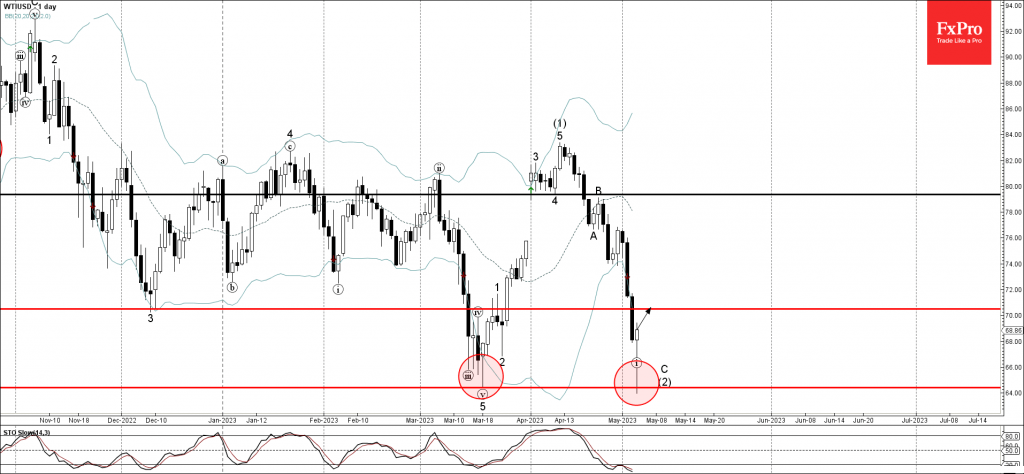

May 4, 2023

• WTI reversed from key support level 64.40 • Likely to rise to resistance level 70.00. WTI crude oil recently reversed up from the key support level 64.40 (previous monthly low from March) standing well below the lower daily Bollinger.