Technical analysis - Page 156

May 24, 2023

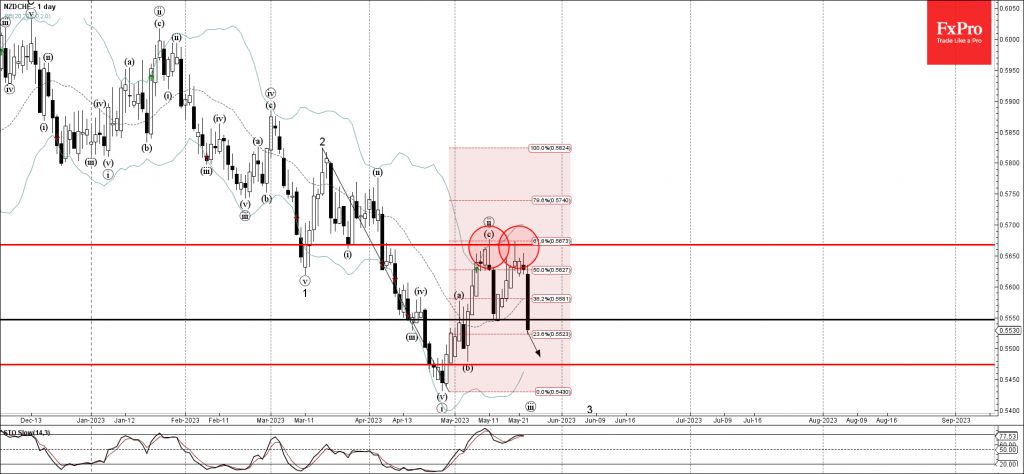

• NZDCHF broke the support level 0,5500 • Likely to fall to support level 0.5475 NZDCHF today broke the support level 0,5500 (which reversed the price earlier this month). The breakout of the support level 0,5500 should accelerate the active.

May 24, 2023

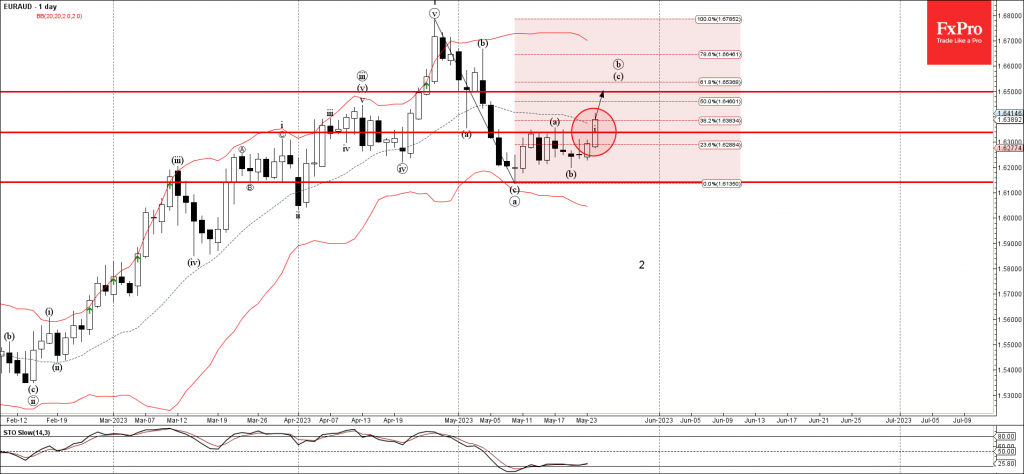

• EURAUD broke resistance level 1.6340 • Likely to rise to resistance level 1.6500. EURAUD currency pair recently broke the resistance level 1.6340 (which has been steadily reversing the pair from the start of May, as can be seen.

May 24, 2023

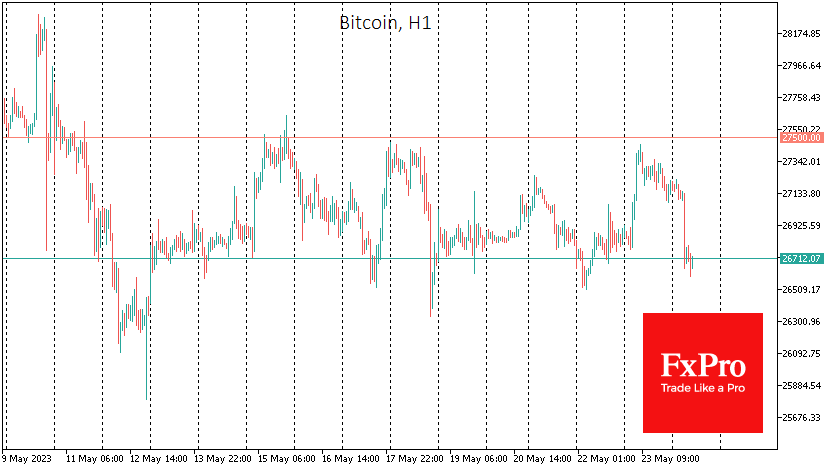

Market picture The crypto market lost 1.8% over the past 24 hours to $1.120 trillion, returning to Monday’s levels. The growth momentum of the previous day was not supported by the new portion of bad news about the debt ceiling,.

May 23, 2023

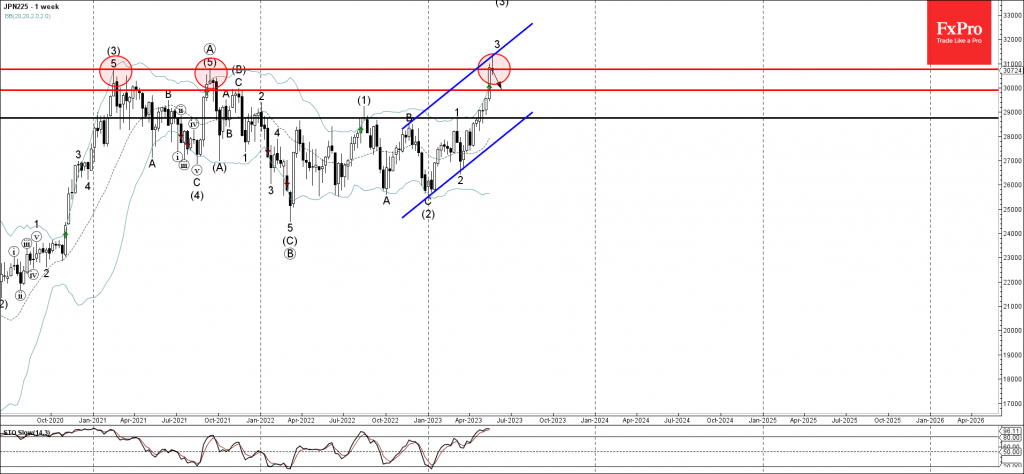

• Nikkei 225 reversed from multiyear resistance level 30750.00 • Likely to test support level 30000.00 Nikkei 225 index recently reversed down from the multiyear resistance level 30750.00 (which reversed the index twice in 2021 as can be seen below)..

May 23, 2023

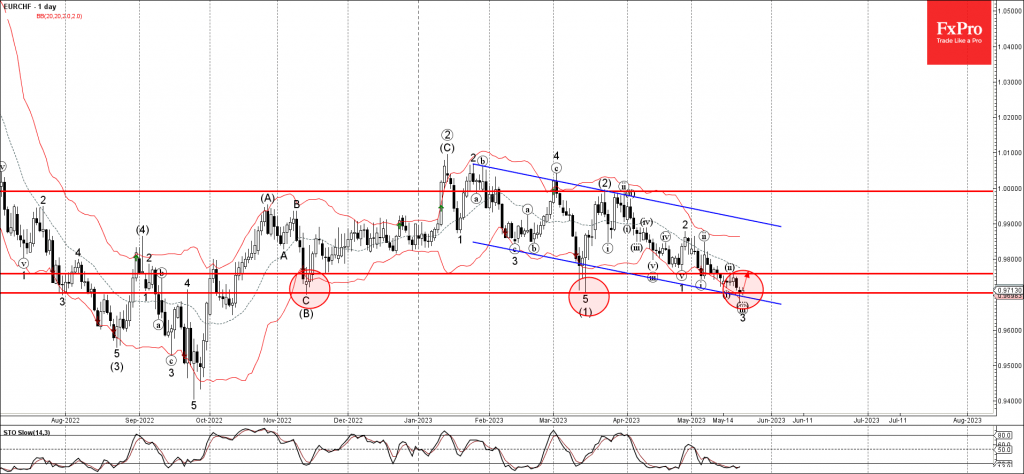

• EURCHF reversed from support level 0.9705 • Likely to rise to resistance level 0.9760 EURCHF recently reversed up from the major long-term key support level 0.9705 (low of the previous waves (B) and (1) from November and March.

May 22, 2023

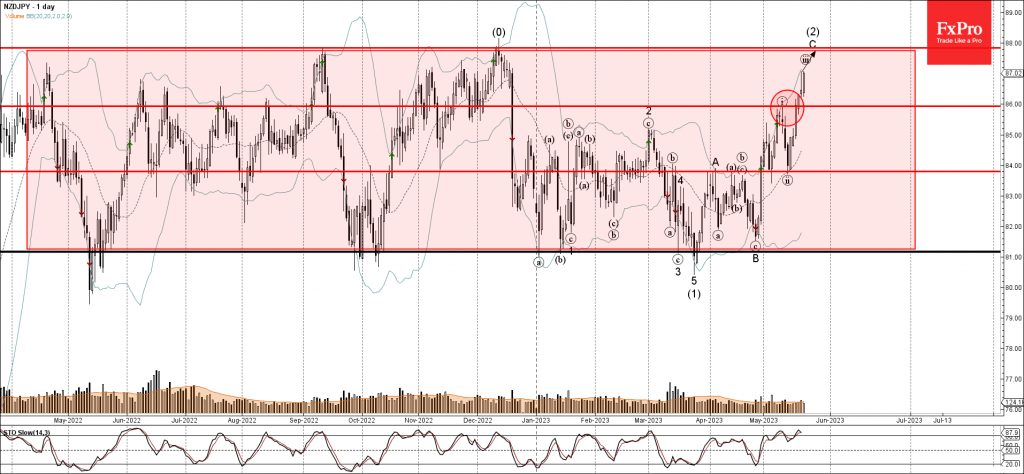

• NZDJPY broke key resistance level 86.00 • Likely to rise to resistance level 87.85 NZDJPY rising strongly after the price broke the key resistance level 86.00 (which stopped the previous short-term impulse wave (i) at the start of May)..

May 22, 2023

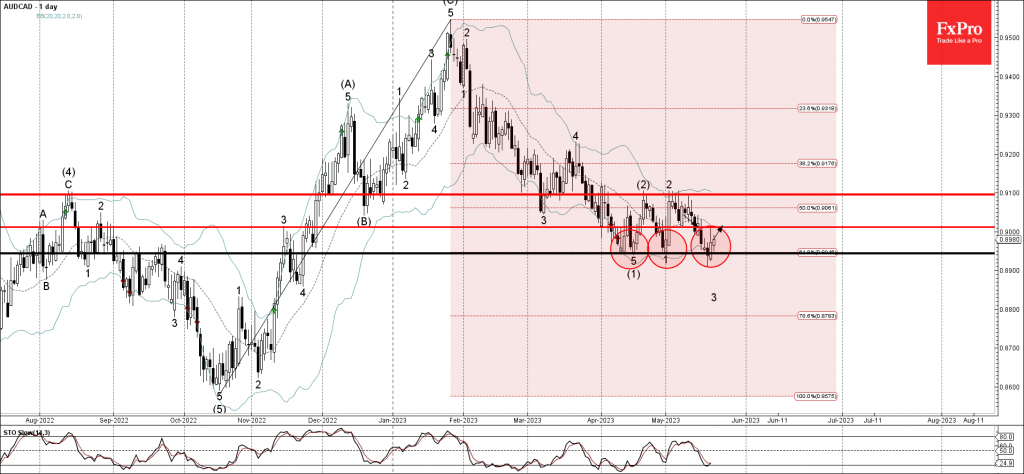

• AUDCAD reversed from support level 0.8945 • Likely to rise to resistance level 0.9010 AUDCAD recently reversed up from the key support level 0.8945 (which stopped the previous impulse wave (1) and 1), standing near the lower daily Bollinger.

May 19, 2023

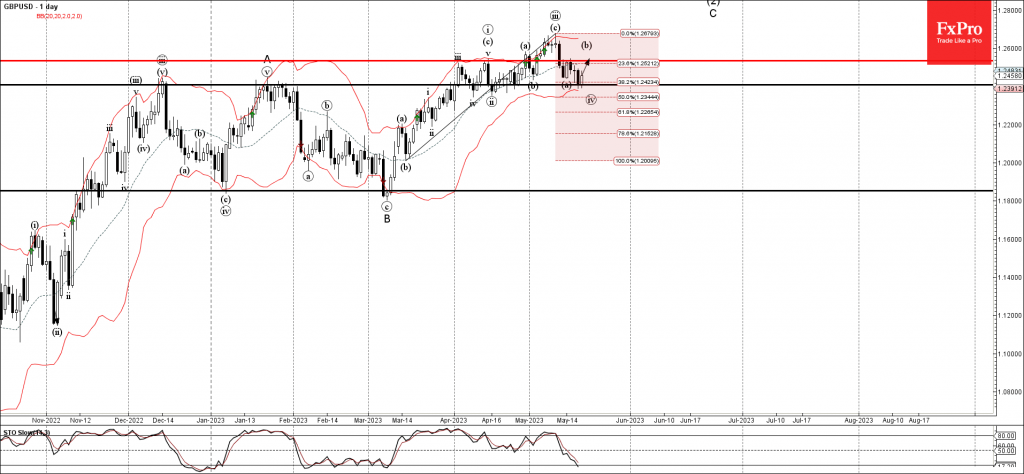

• GBPUSD reversed from support level 1.2410 • Likely to rise to resistance level 1.2535 GBPUSD recently reversed up from the strong support level 1.2410 (former strong resistance from December and January), standing near the lower daily Bollinger Band. The.

May 19, 2023

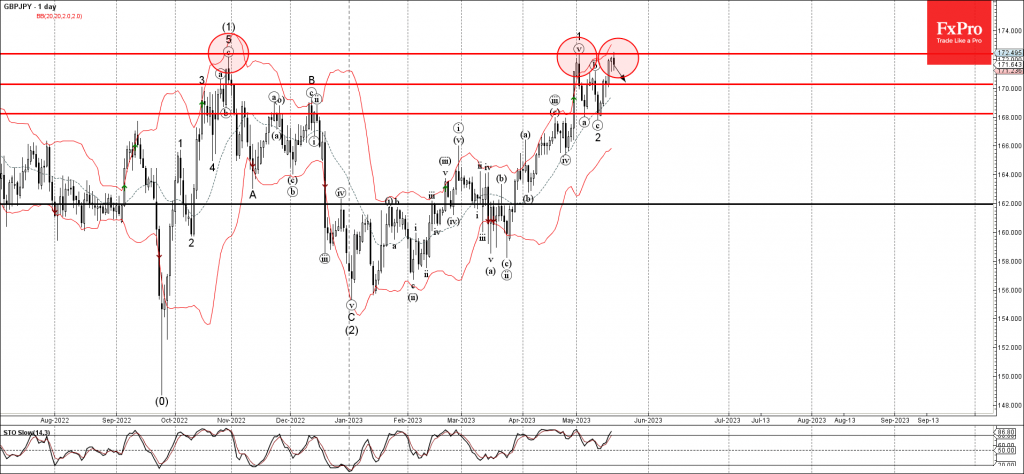

• GBPJPY reversed from resistance level 172.40 • Likely to rise to resistance level 170.00 GBPJPY recently reversed down from the long-term resistance level 172.40 (which has been reversing the price from last October). The downward reversal from the resistance.

May 19, 2023

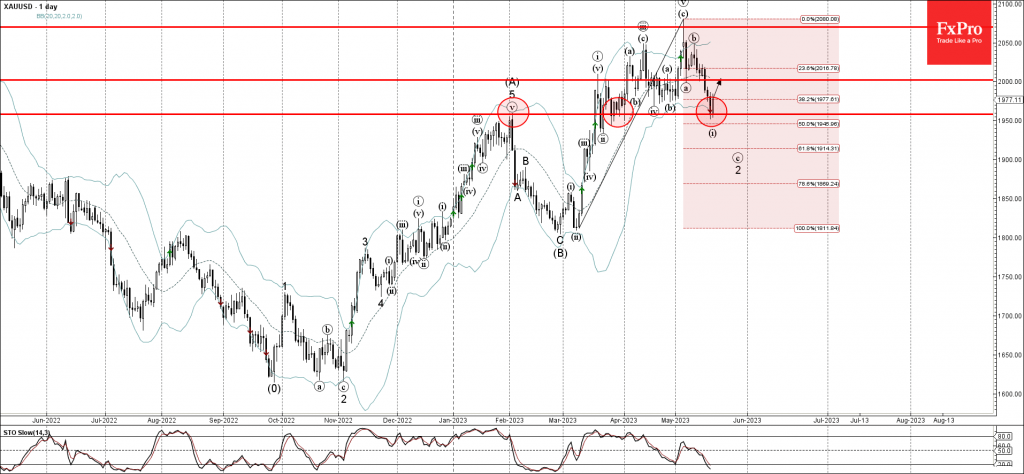

• Gold reversed from support level 1960.00 • Likely to rise to resistance level 2000.00 Gold recently reversed up from the key support level 1960.00 (former monthly high from February which has been reversing the price from March). The upward.

May 18, 2023

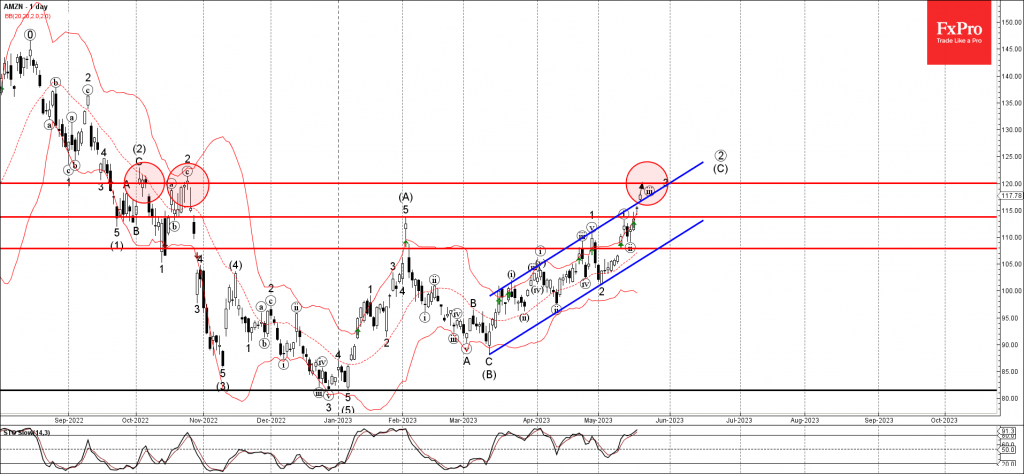

• Amazon broke resistance level 113.75 • Likely to rise to resistance level 120.00 Amazon rising sharply after the price broke the key resistance level 113.75 (former multi-month high from February). The breakout of the resistance level 113.75 accelerated the.