Technical analysis - Page 154

June 9, 2023

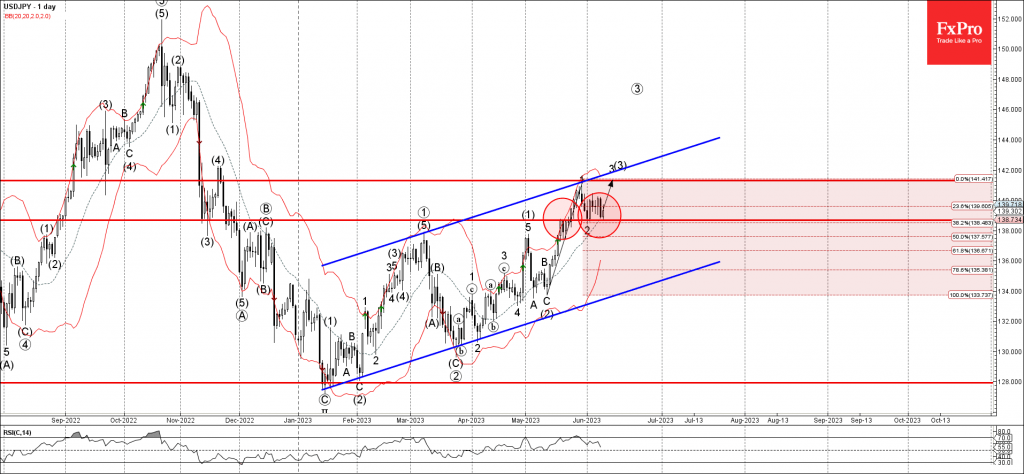

– USDJPY reversed from support level 138.70. – Likely to rise to resistance level 141.30 USDJPY recently reversed up from the 138.70 support (which stopped the previous correction 2 in early June). Support at 138.70 was strengthened by the.

June 8, 2023

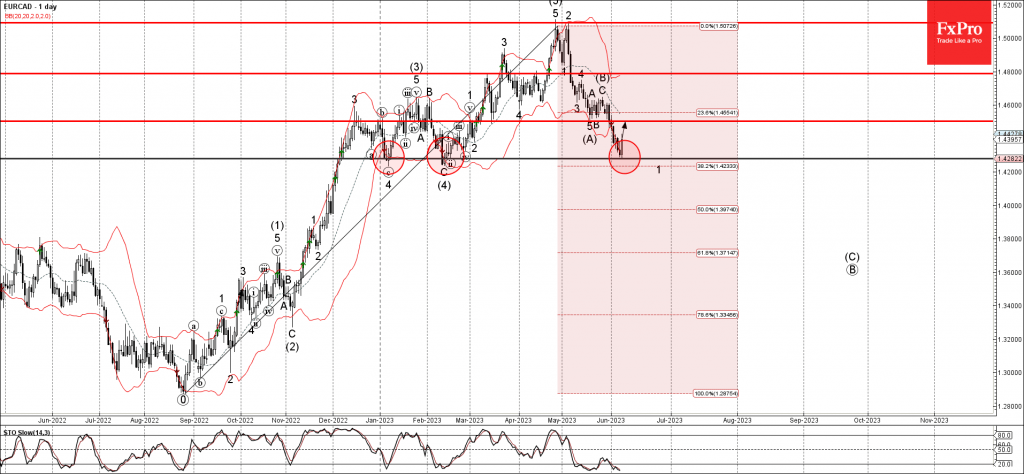

– EURCAD reversed from support level 1.4280 – Likely to rise to resistance level 1.4500 EURCAD recently reversed up from the key support level 1.4280 (which stopped the previous corrections 4 and (4) in January and February respectively). The upward.

June 8, 2023

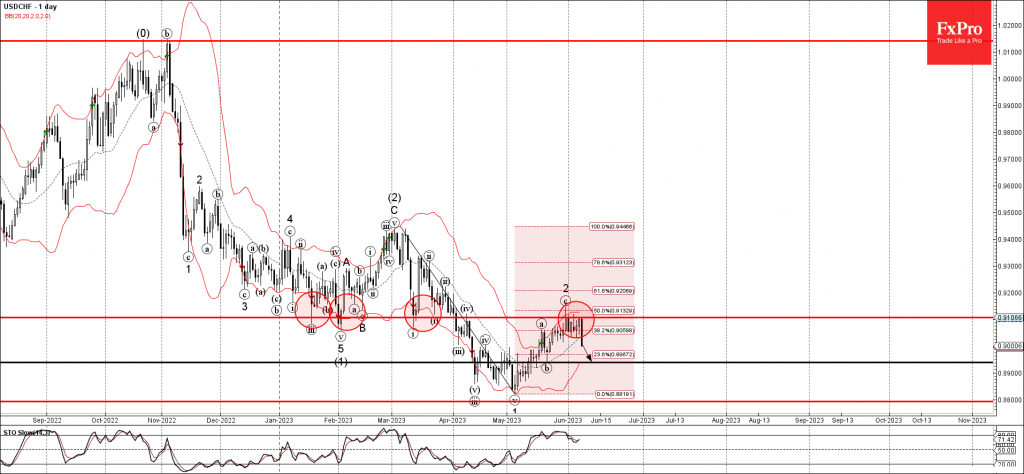

– USDCHF reversed from pivotal resistance level 0.9100 – Likely to fall to support level 0.8940 USDCHF recently reversed down sharply from the pivotal resistance level 0.9100 (former strong support from January to March), coinciding with the upper daily Bollinger.

June 7, 2023

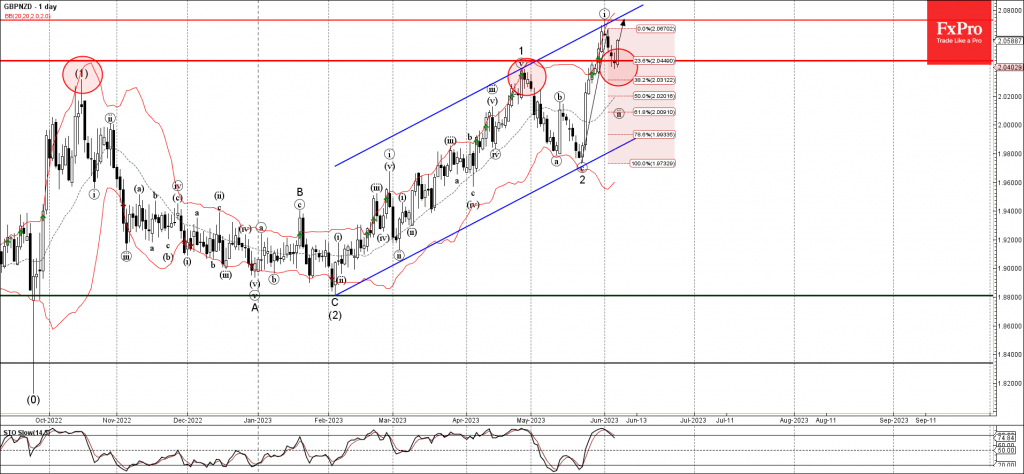

– GBPNZD reversed from support level 2.0390 – Likely to rise to resistance level 2.0730 GBPNZD recently reversed up sharply from the powerful support level 2.0390 (which stopped the two previous sharp upward impulses in October and April). The upward.

June 7, 2023

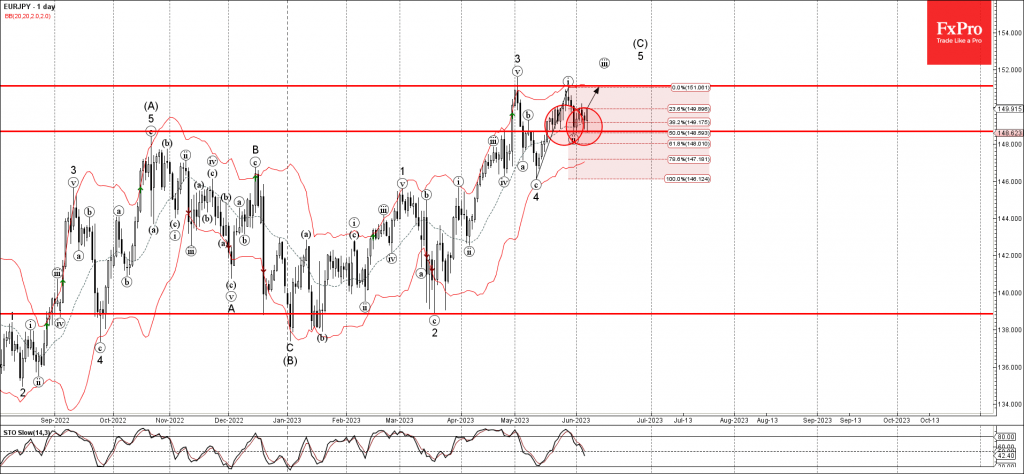

– EURJPY under bullish pressure – Likely to rise to resistance level 151.15 EURJPY under the bullish pressure after the price reversed up from the key support level 148.70 (which has been reversing the price from the middle of May)..

June 6, 2023

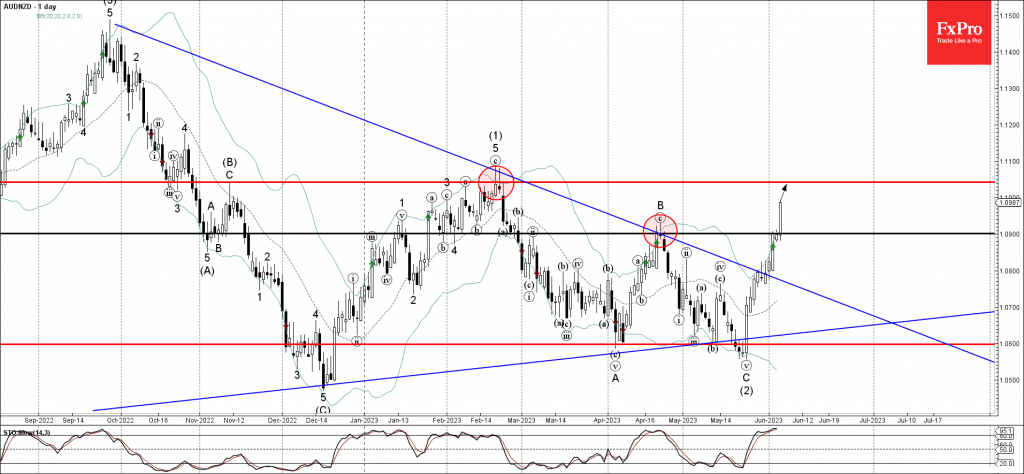

– AUDNZD broke resistance level 1,0900 – Likely to rise to resistance level 1.1045 AUDNZD under the bullish pressure after the price broke above the pivotal resistance level 1,0900 (which has been reversing the price from the start of March)..

June 6, 2023

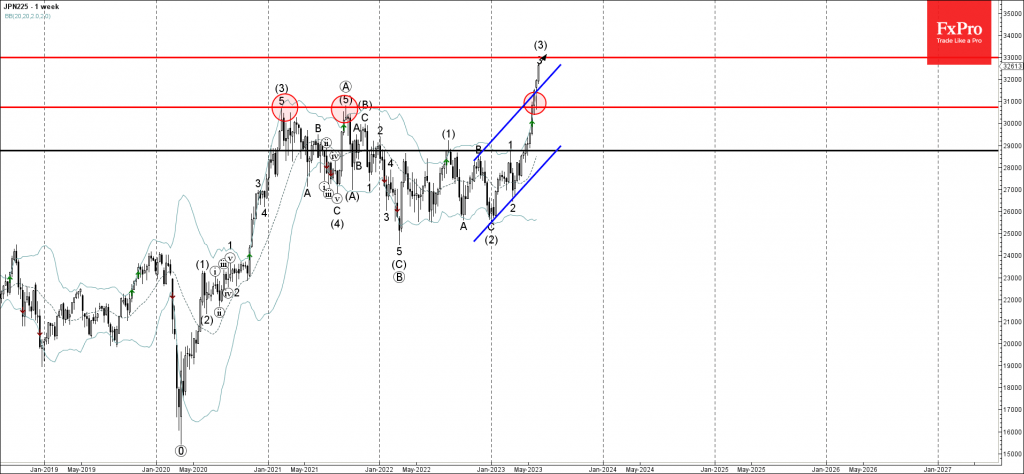

– Nikkei 225 broke long-term resistance level 30735.00 – Likely to rise to resistance level 33000.00 Nikkei 225 index continues to rise sharply after the price broke through the major long-term resistance level 30735.00 (former Double Top from 2021). The.

June 5, 2023

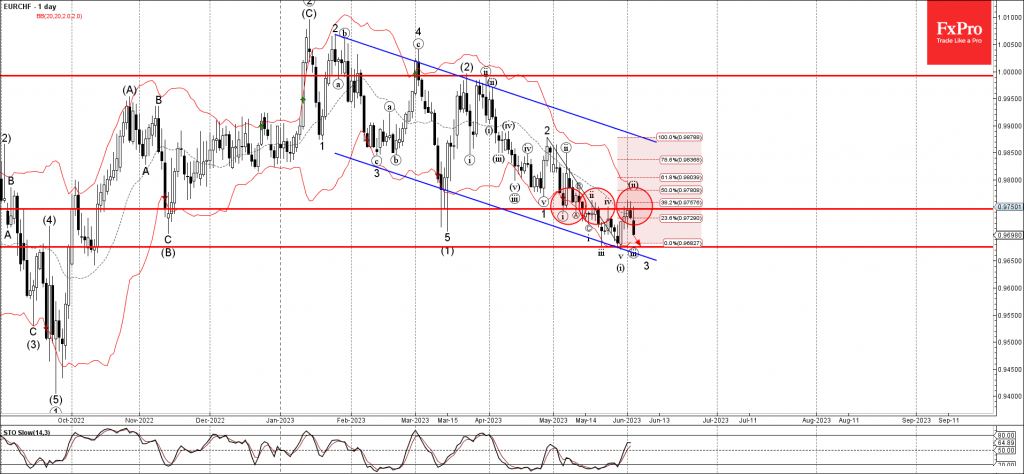

– EURCHF reversed from resistance level 0.9745 – Likely to fall to support level 0.9675 EURCHF recently reversed down from the pivotal resistance level 0.9745 (former support from March and the start of May) strengthened by the 20-day moving.

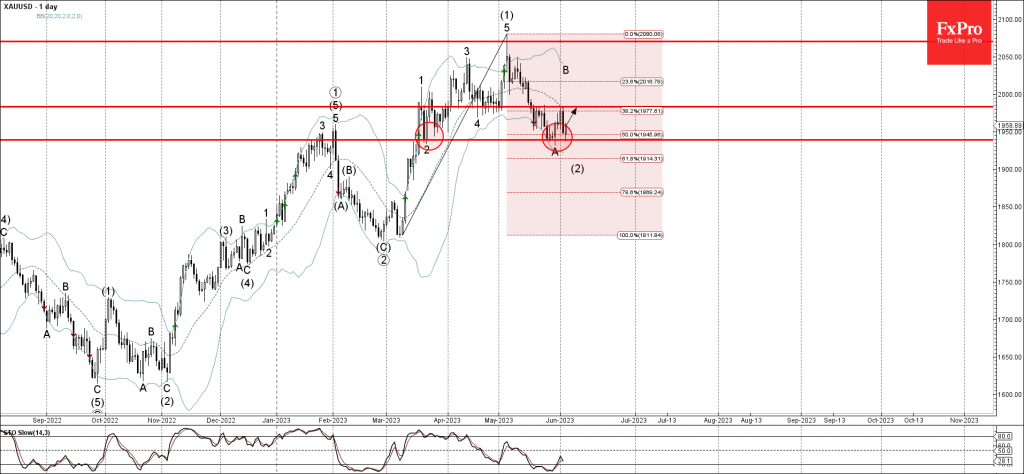

June 5, 2023

– Gold reversed from support level 1940.00 – Likely to rise to resistance level 1985.00 Gold recently reversed up from the key support level 1940.00 (which also stopped the previous wave 2 in the middle of March) standing near the.

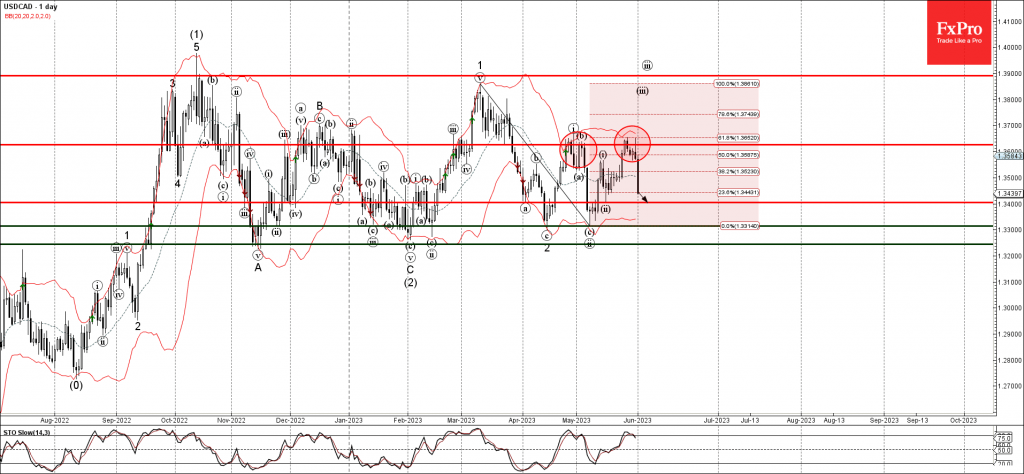

June 1, 2023

– USDCAD reversed from resistance level 1.3625 – Likely to fall to support level 1.3400 USDCAD currency pair recently reversed down from the key resistance level 1.3625 (which stopped the previous waves (i) and (b)). The downward reversal from the.

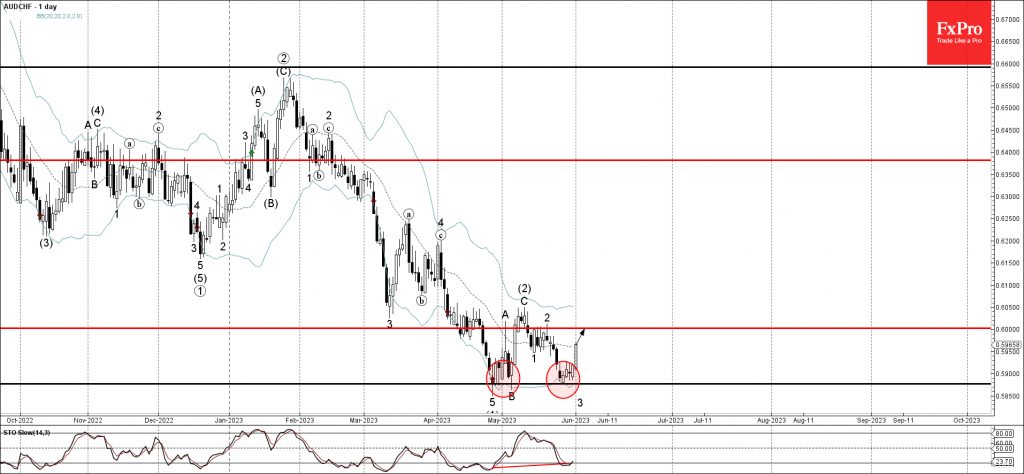

June 1, 2023

– AUDCHF reversed from key support level 0.5875 – Likely to rise to resistance level 0.6000 AUDCHF currency pair recently reversed up from the key support level 0.5875 (which has been steadily reversing the pair from the end of.