Technical analysis - Page 153

June 16, 2023

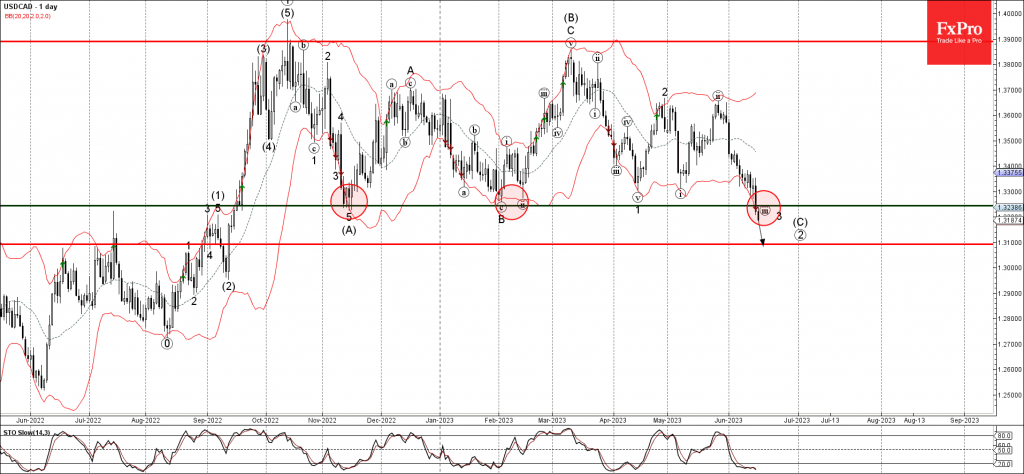

– USDCAD broke support level 1.3245 – Likely to fall to support level 1.3100 USDCAD falling steadily after the pair broke below the key support level 1.3245 (which has been reversing the price from last November). The breakout of.

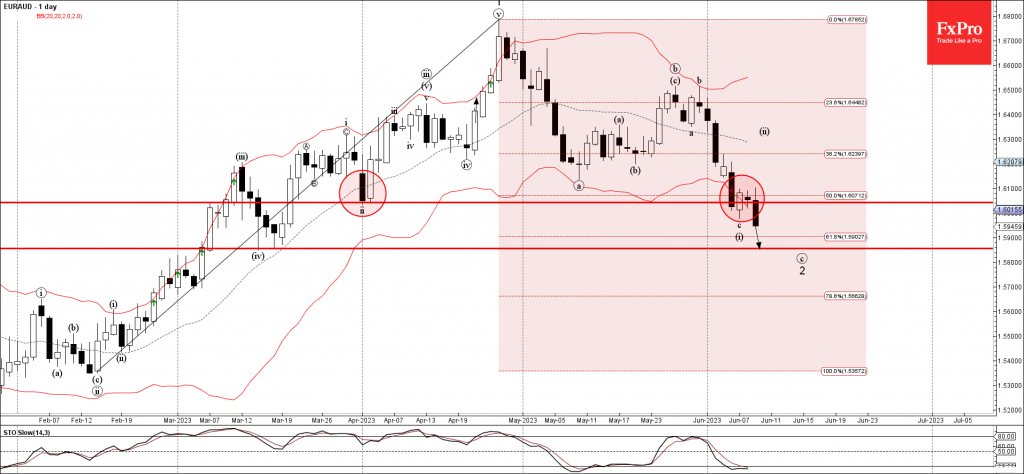

June 16, 2023

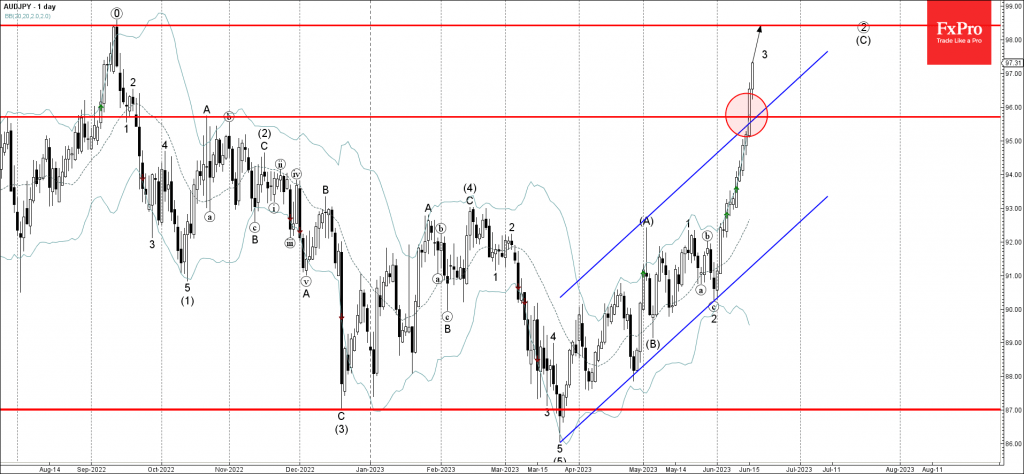

– AUDJPY broke resistance level 95.70 – Likely to rise to resistance level 98.40 AUDJPY rising strongly inside the minor impulse wave 3, which recently broke above the strong resistance level 95.70 (which stopped the two upward corrections in.

June 16, 2023

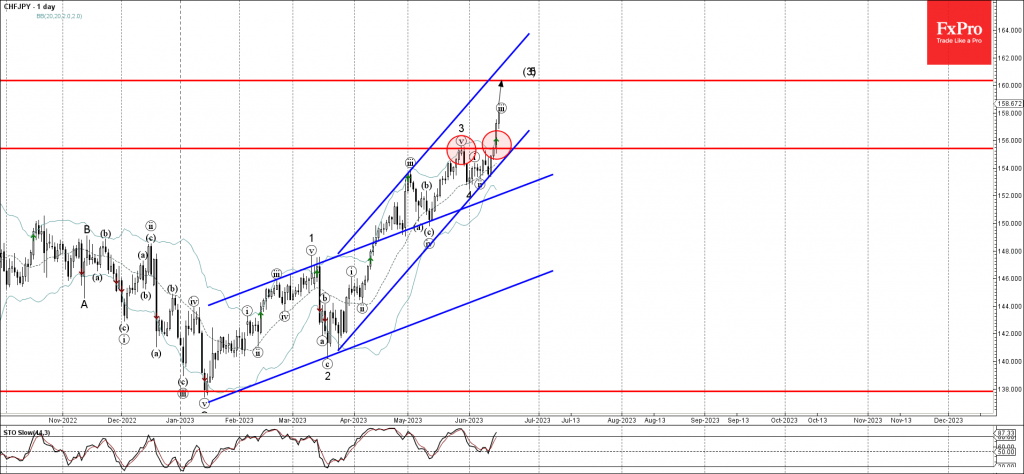

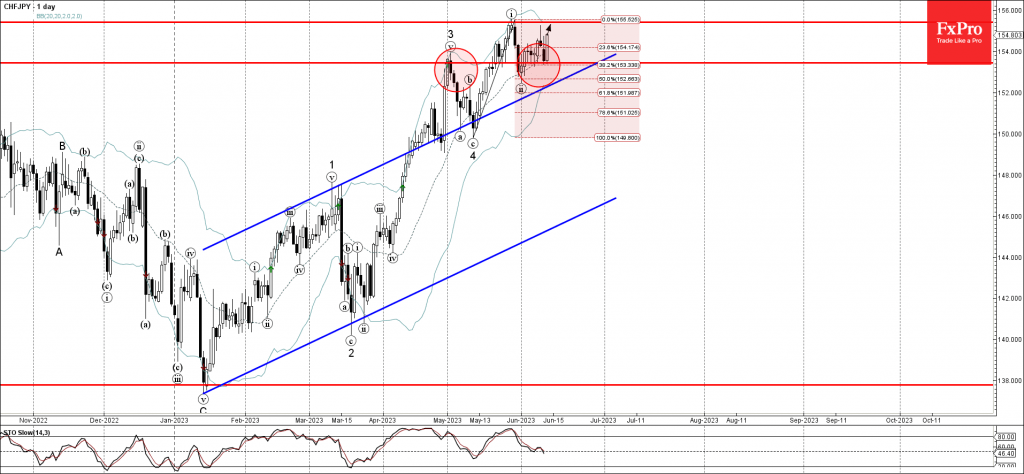

– CHFJPY broke resistance level 155.40 – Likely to rise to resistance level 160.00 CHFJPY recently broke above the strong resistance level 155.40 (which stopped the earlier impulse wave 3 with the daily Evening Star at the end of last.

June 15, 2023

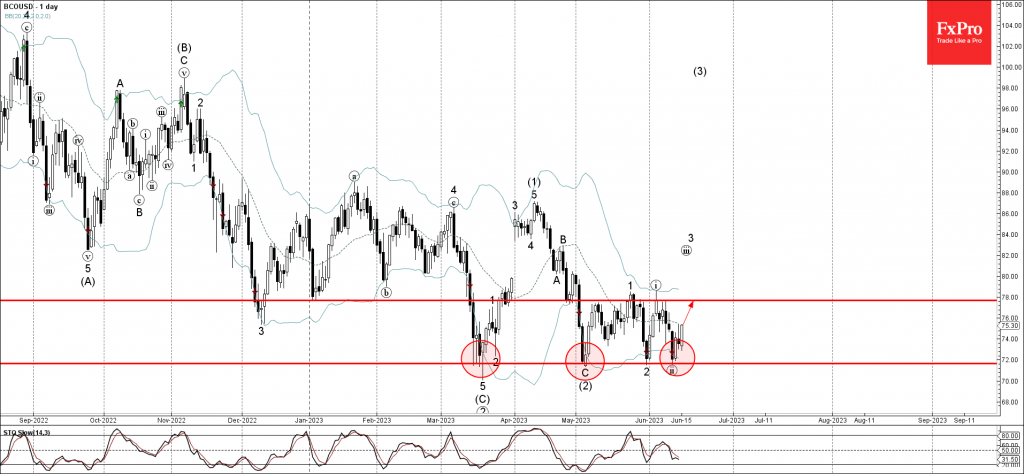

– Brent reversed from key support level 72.00 – Likely to rise to resistance level 78.00 Brent crude oil recently reversed up from the key support level 72.00 (which has been repeatedly reversing the price from the middle of.

June 15, 2023

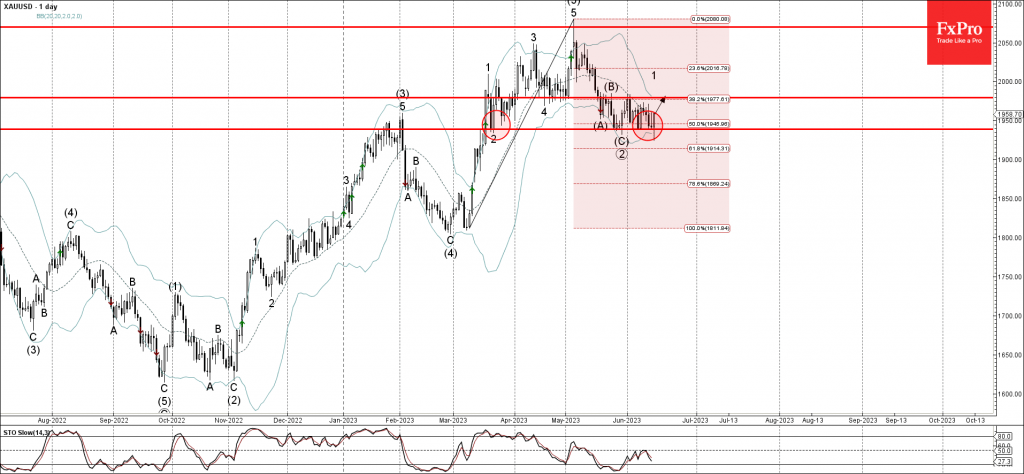

– Gold reversed from support level 1940.00 – Likely to rise to resistance level 1980.00 Gold recently reversed up from the pivotal support level 1940.00 (which has been reversing the price from the middle of March). The support level.

June 15, 2023

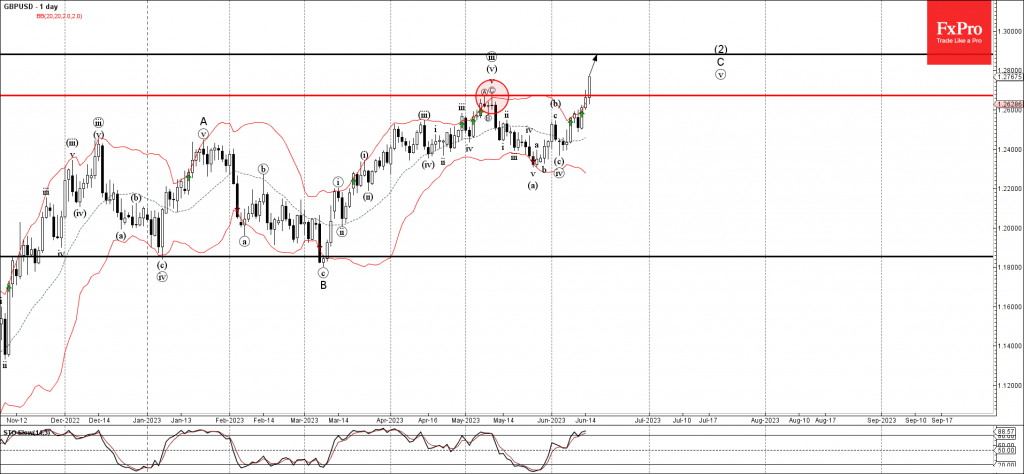

– GBPUSD broke key resistance level 1.2675 – Likely to rise to resistance level 1.2880 GBPUSD currency pair recently broke above the key resistance level 1.2675 (which stopped the previous sharp upward impulse wave (iii) at the start of May)..

June 13, 2023

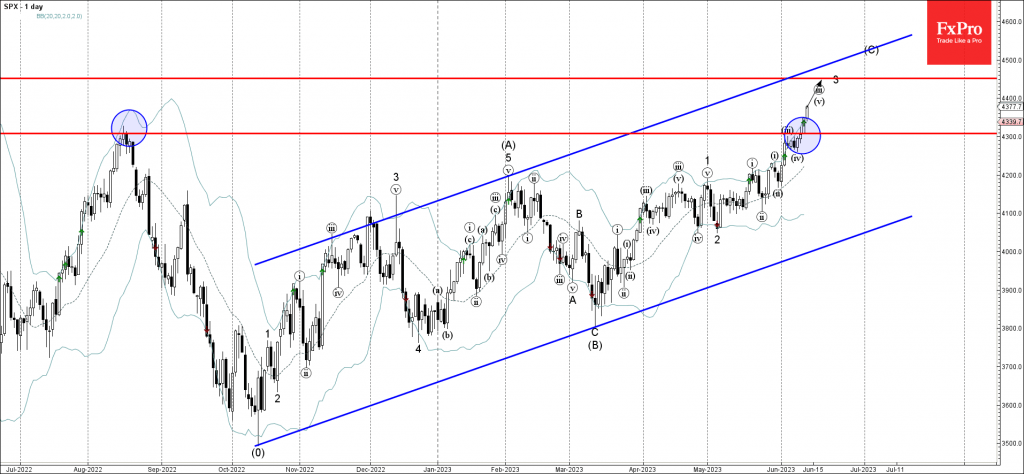

– S&P 500 broke key resistance level 4310.00 – Likely to rise to resistance level 4450.00 S&P 500 index recently broke sharply above the key resistance level 4310.00 (former multi-month high from August). The breakout of the resistance level 4310.00.

June 13, 2023

– CHFJPY reversed from support level 153.45 – Likely to rise to resistance level 155.400 CHFJPY currency pair recently reversed up from the pivotal support level 153.45 (former strong resistance from the start of May). The support level 153.45.

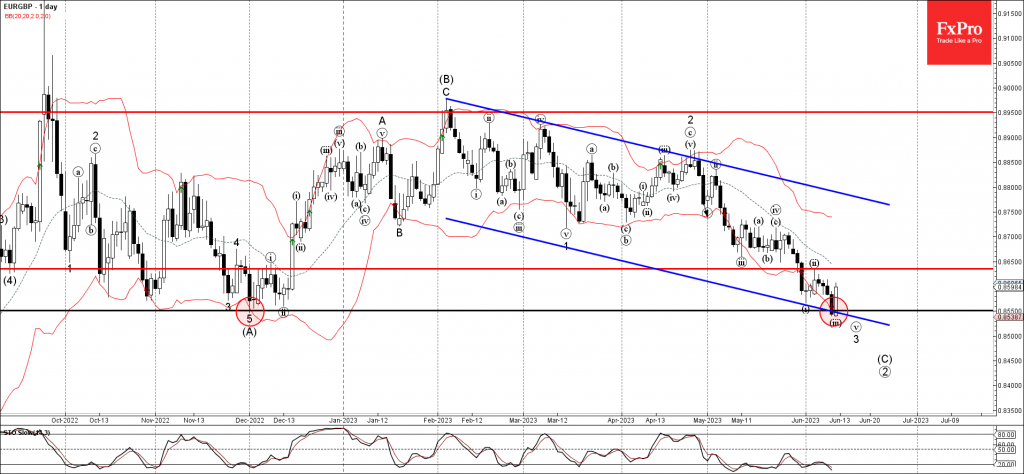

June 13, 2023

– EURGBP reversed from support level 0.8550 – Likely to rise to resistance level 0.8650 EURGBP currency pair recently reversed up from the key support level 0.8550 (former multi-month low from December). The support level 0.8550 was strengthened by the.

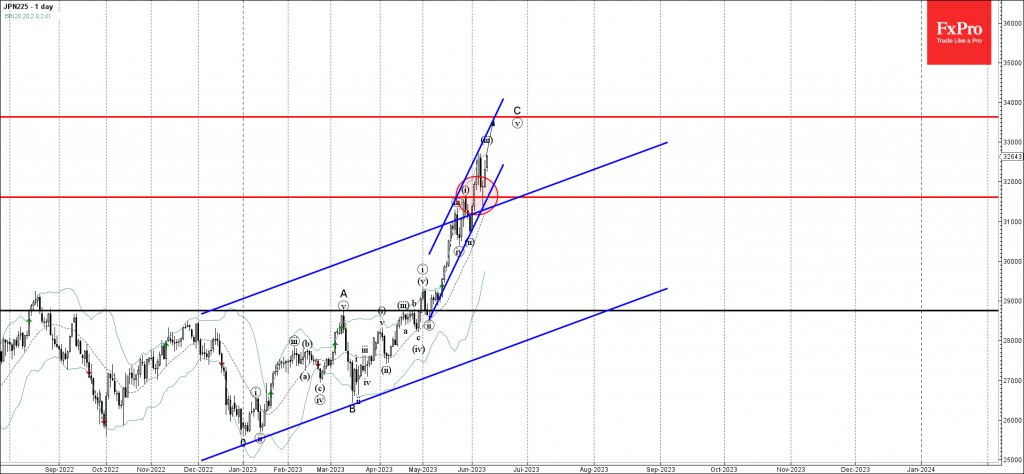

June 12, 2023

– Nikkei 225 reversed from support level 31600.00 – Likely to rise to resistance level 33635.00 Nikkei 225 index recently reversed up from the pivotal support level 31600.00 (which stopped the previous sharp impulse wave (i) at the end.

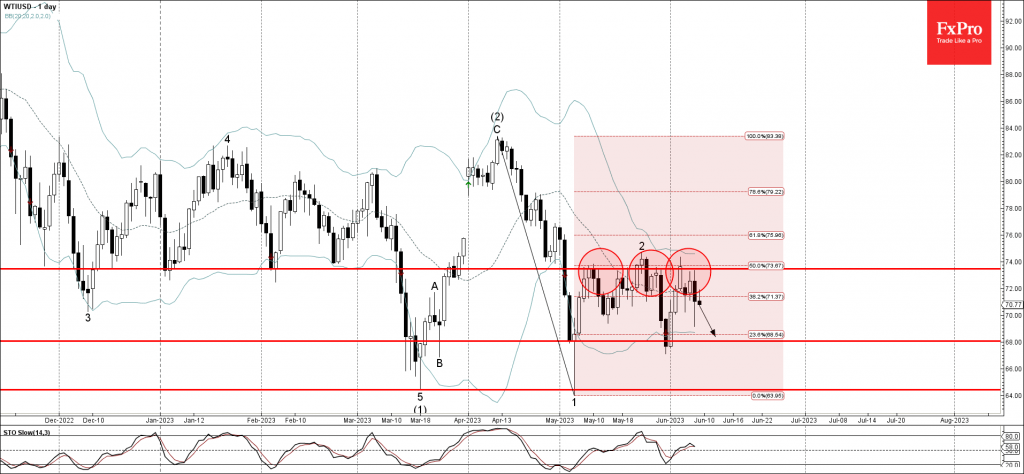

June 9, 2023

– WTI reversed from resistance level 73.45 – Likely to fall to support level 68.00 WTI crude oil recently reversed down from the resistance level 73.45 (which has been steadily reversing the price from the start of May). The resistance.