Technical analysis - Page 148

July 24, 2023

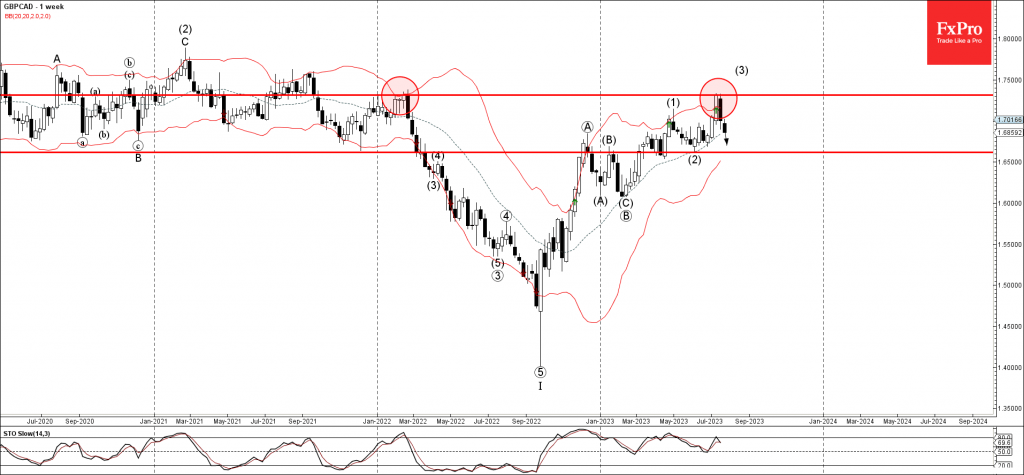

– GBPCAD reversed from major resistance level 1.7310 – Likely to fall to support level 1.6600 GBPCAD currency pair recently reversed down from the major resistance level 1.7310, previous yearly high from last year – standing above the upper weekly Bollinger.

July 24, 2023

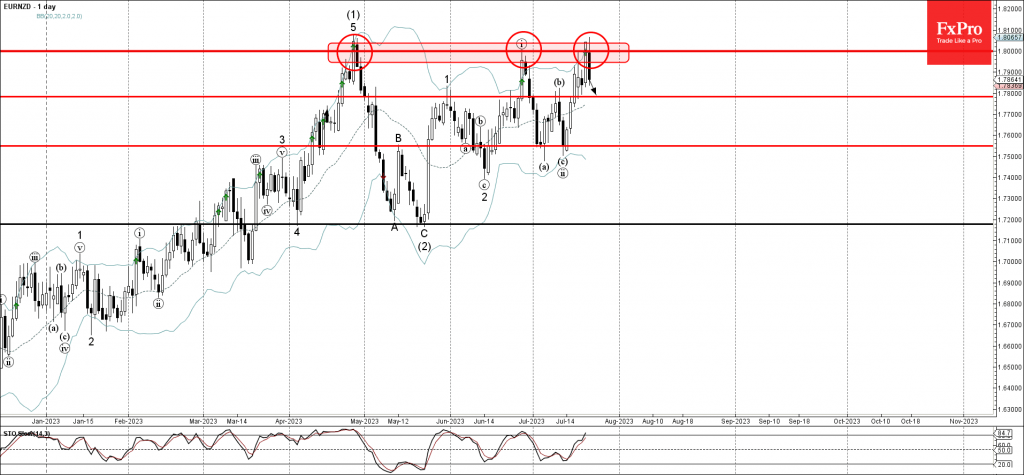

– EURNZD reversed from resistance level 1.8000 – Likely to fall to support level 1.7800 EURNZD recently reversed up from round resistance level 1.8000, which has been reversing the price from the end of April. The downward reversal from the resistance level.

July 24, 2023

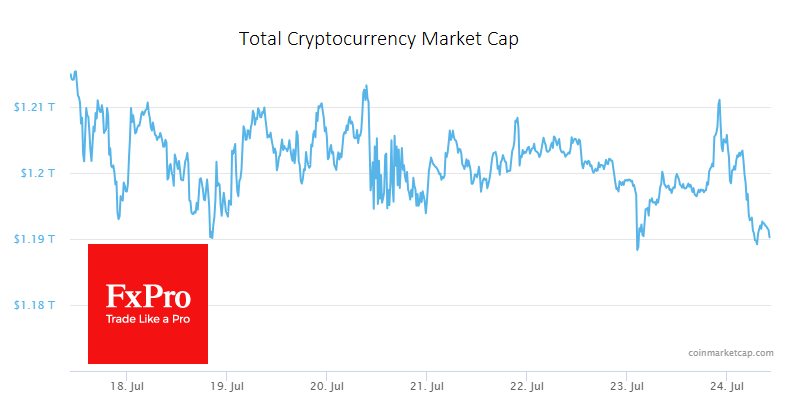

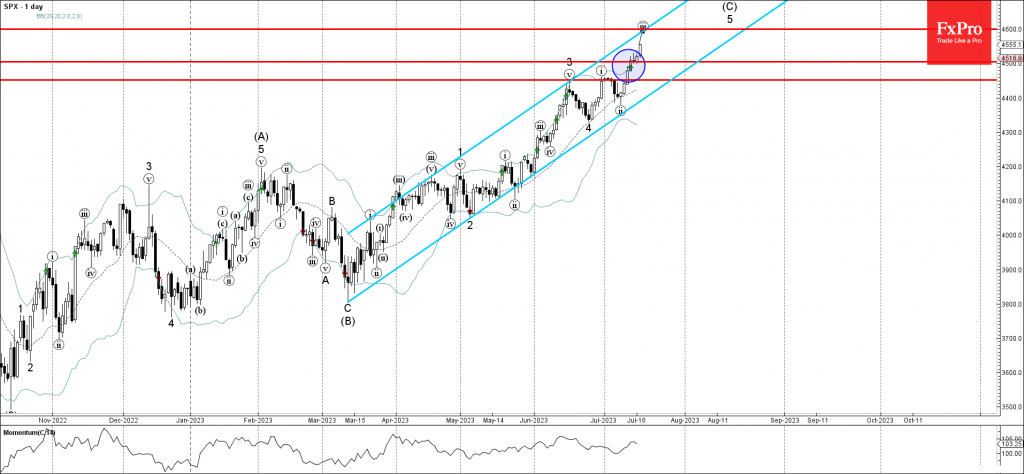

Market picture The crypto market lost 1.8% to last week’s level of $1.192 trillion, spending most of its time within the $1.190-1.210 trillion range and near its lower boundary on Monday morning. The market has found its temporary equilibrium as.

July 21, 2023

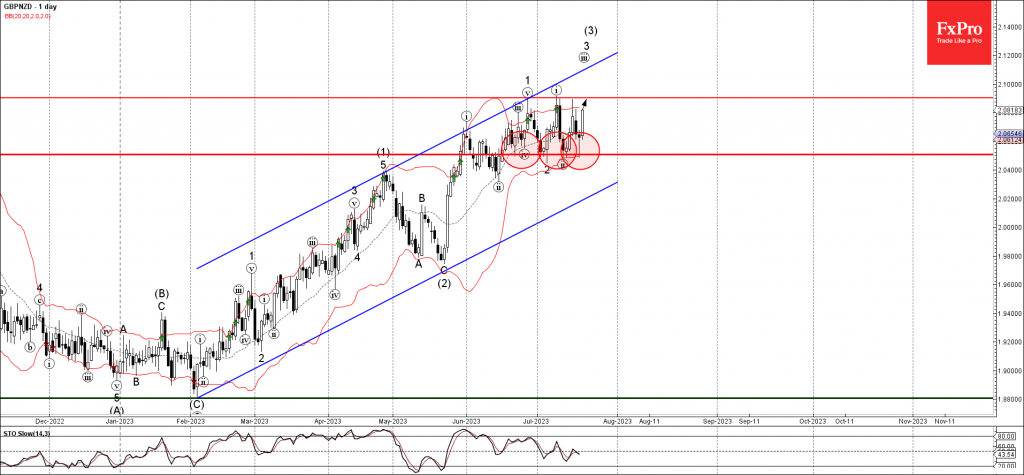

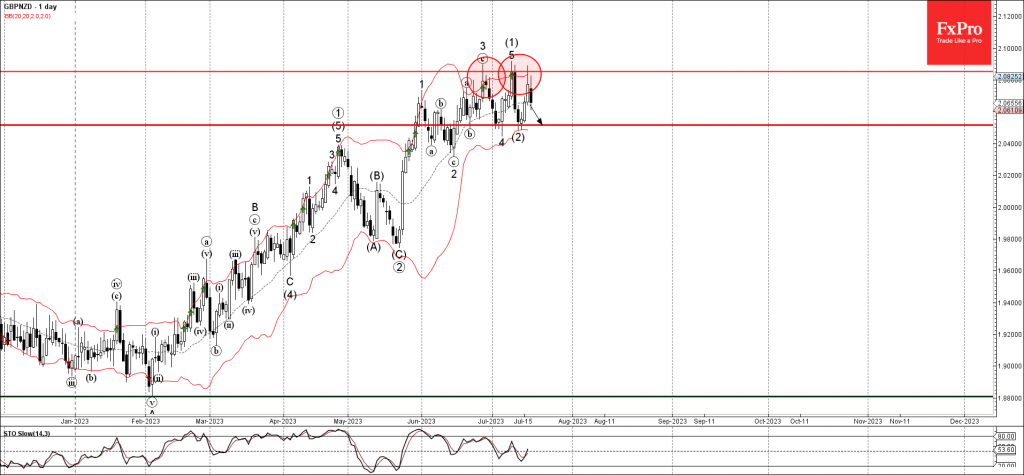

– GBPNZD reversed from key support level 2.0500 – Likely to rise to resistance level 2.090 GBPNZD recently reversed up from key support level 2.0500, which stopped the earlier corrections iv, 2 and ii . The upward reversal from the support level.

July 21, 2023

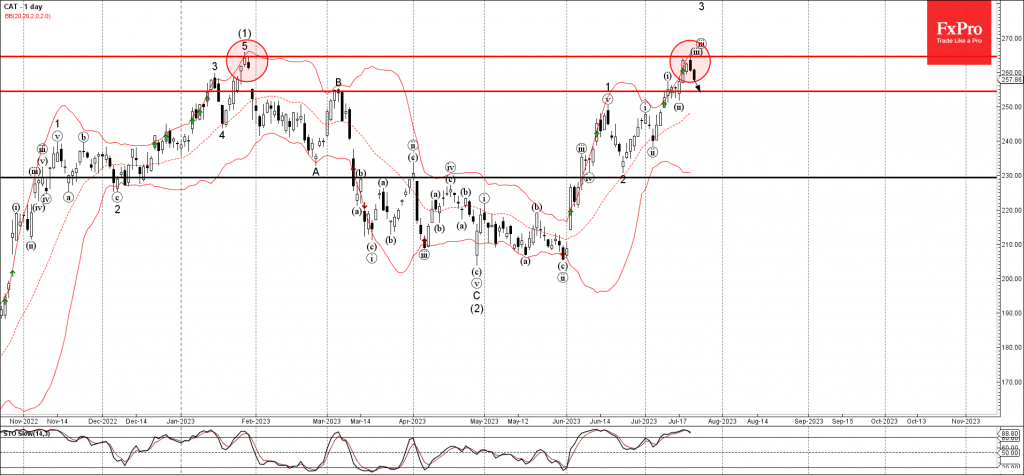

– Caterpillar reversed from resistance level 264.50 – Likely to fall to support level 254.00 Caterpillar recently reversed down from the major long-term resistance level 264.50, which stopped the previous sharp uptrend at the start of this year, as can be seen.

July 21, 2023

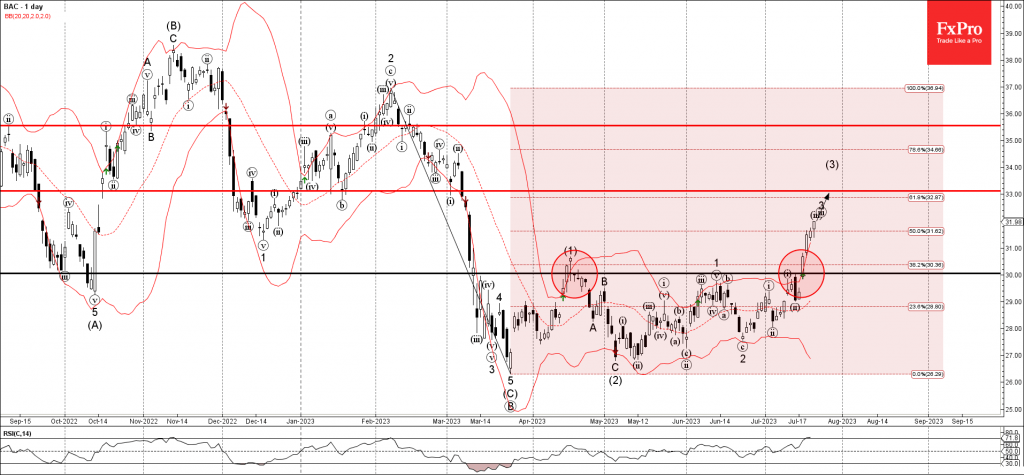

– Bank of America rising inside impulse wave 3 – Likely to reach resistance level 33.00 Bank of America continues to rise inside the short-term upward impulse wave 3, which belongs to the intermediate impulse wave (3) from the start.

July 20, 2023

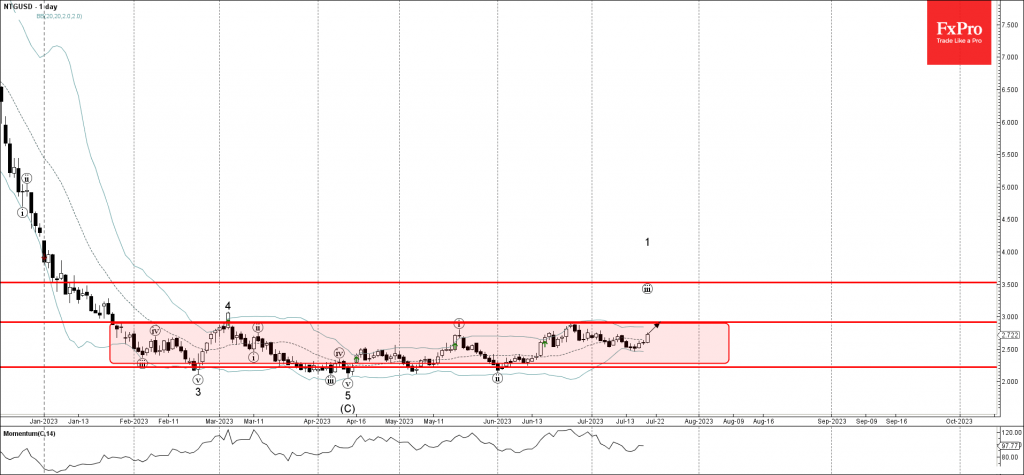

– Natural gas rising inside sideways price range – Likely to rise to resistance level 2.915 Natural gas continues to rise inside the narrow extended sideways price range from the start of this year (enclosed by the price levels 2.224.

July 20, 2023

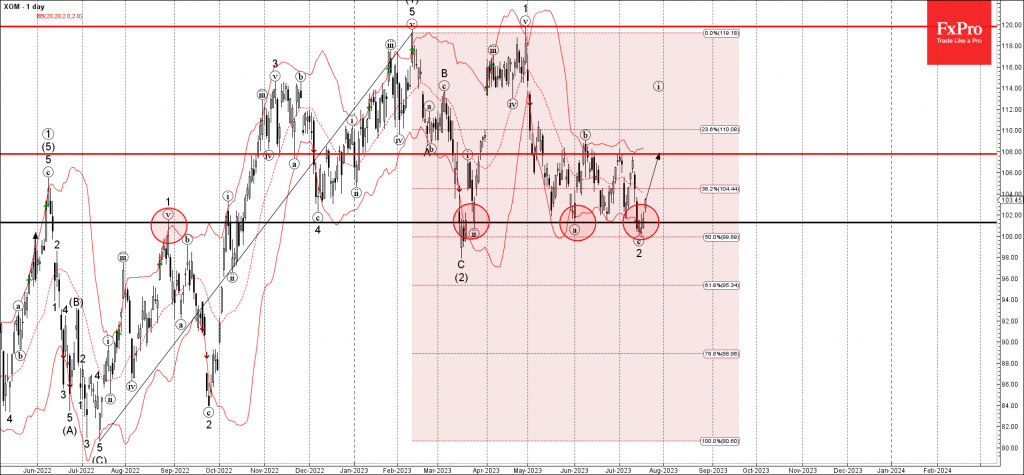

– Exxon reversed from support level 100.00 – Likely to rise to resistance level 108.00 Exxon earlier reversed up from the round support level 100.00, intersecting with the lower daily Bollinger Band and the 50% Fibonacci correction of the upward.

July 20, 2023

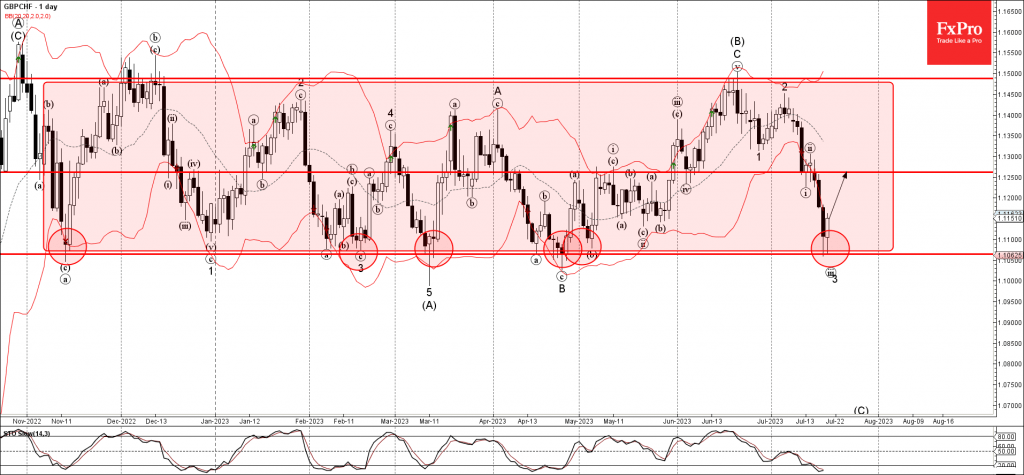

– GBPCHF reversed from support level 1.1065 – Likely to rise to resistance level 1.1250 GBPCHF currency pair previously reversed up from the major support level 1.1065, lower boundary of the sideways price range from November, strengthened by the lower.

July 19, 2023

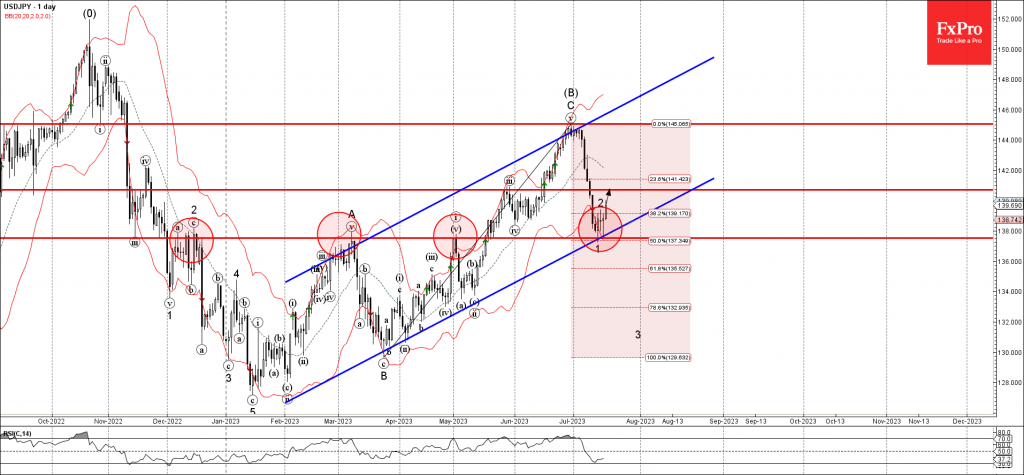

– USDJPY reversed from support level 137.50 – Likely to rise to resistance level 140.70 USDJPY currency pair previously reversed up from the key support level 137.50, former monthly high from March and May, strengthened by the lower daily Bollinger.

July 19, 2023

– GBPNZD reversed from key resistance level 2.0855 – Likely to fall to support level 2.0500 GBPNZD currency pair recently reversed down from the key resistance level 2.0855, intersecting with the upper daily Bollinger Band. The downward reversal from the.