Technical analysis - Page 145

August 14, 2023

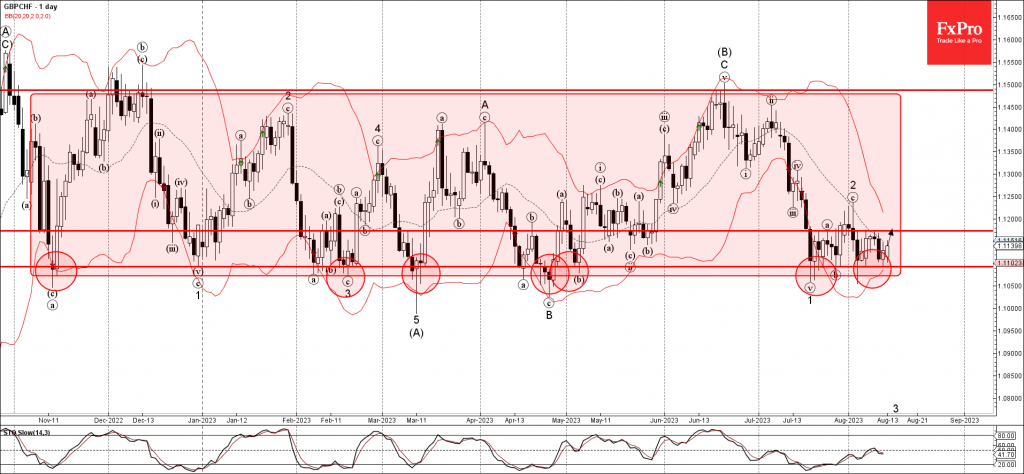

– GBPCHF reversed from support level 1.1100 – Likely to rise to resistance level 1.1175 GBPCHF currency pair recently reversed up from the key support level 1.1100 (which is the lower boundary of the wide sideways price range from November)..

August 14, 2023

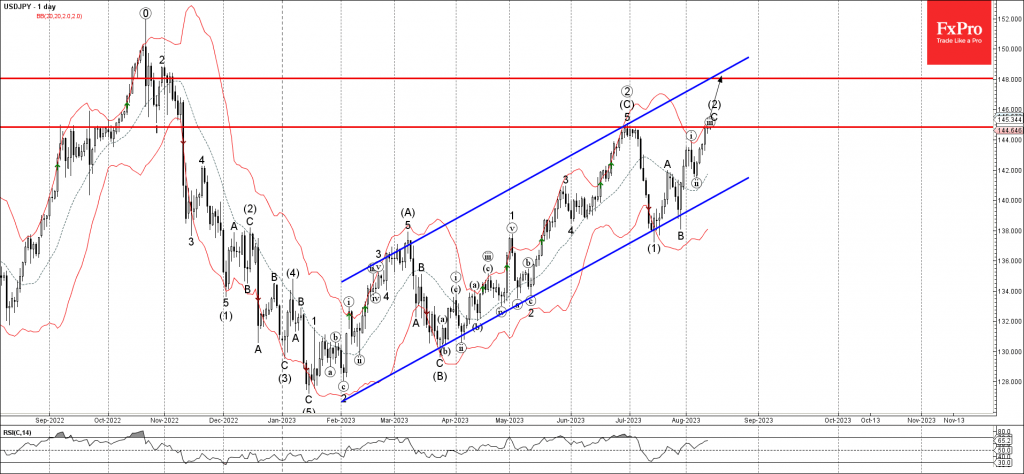

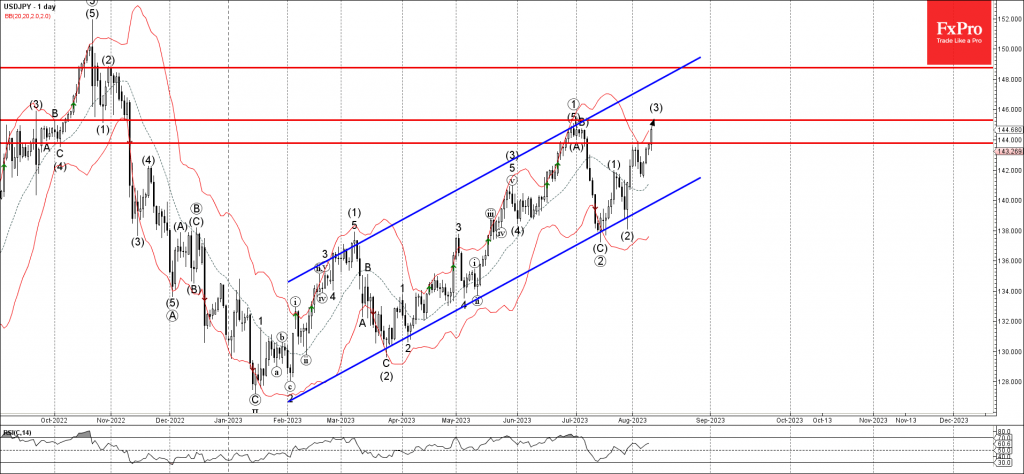

– USDJPY broke resistance level 144.85 – Likely to rise to resistance level 148.00 USDJPY currency pair recently broke the resistance level 144.85 (previous multi-month high from July, which stopped the previous wave C). The breakout of the resistance level.

August 14, 2023

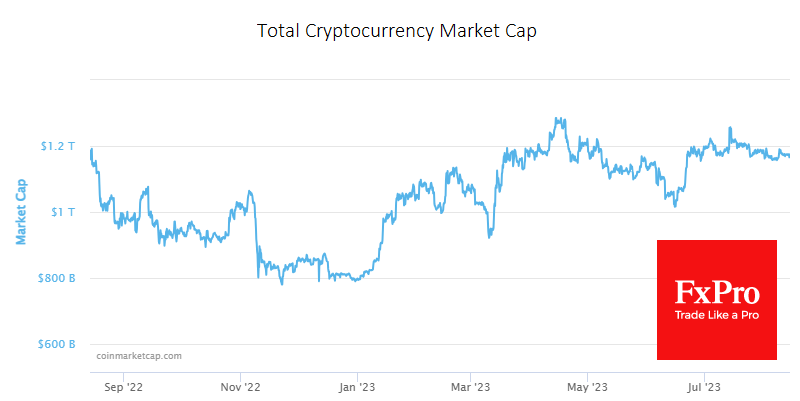

Market Picture During the week, the crypto market gained 0.7% and showed very low volatility over the last four days, with movements around the $1.17 trillion level. The Cryptocurrency Fear and Greed Index moved into neutral territory and is now.

August 11, 2023

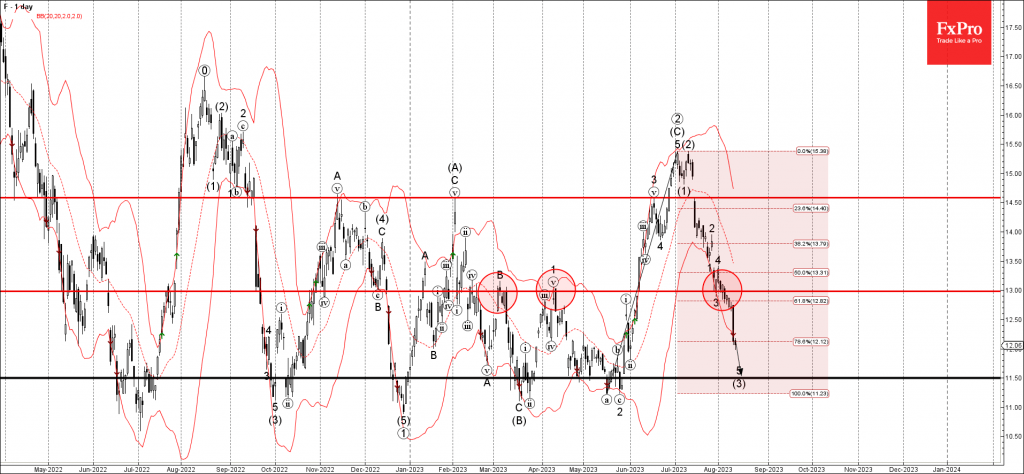

– Ford broke support level 13.00 – Likely to fall to support level 11.50 Ford recently broke the support level 13.00 (former monthly high from March and April, which also reversed the previous impulse wave 3 from the end of.

August 11, 2023

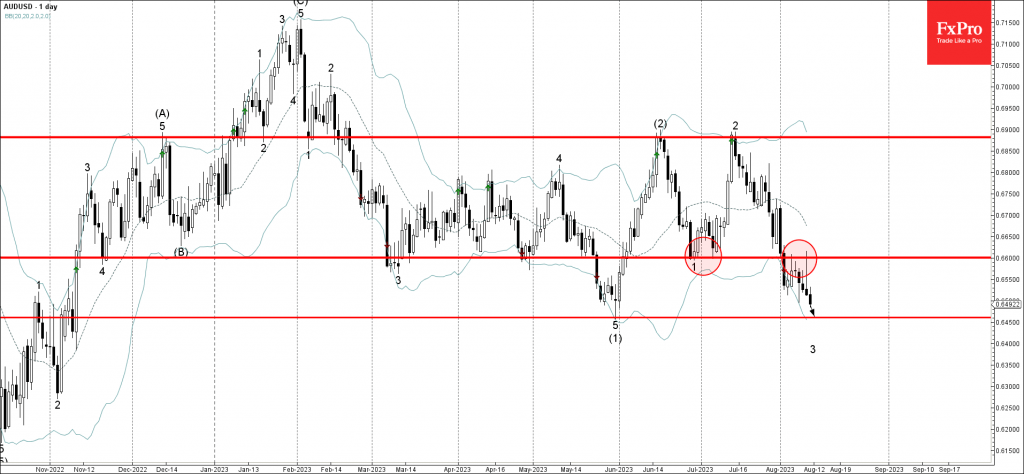

– AUDUSD reversed from resistance level 0.6600 – Likely to fall to support level 0.6460 AUDUSD currency pair recently reversed down twice from the pivotal resistance level 0.6600 (former strong support from June and July). The downward reversal from.

August 11, 2023

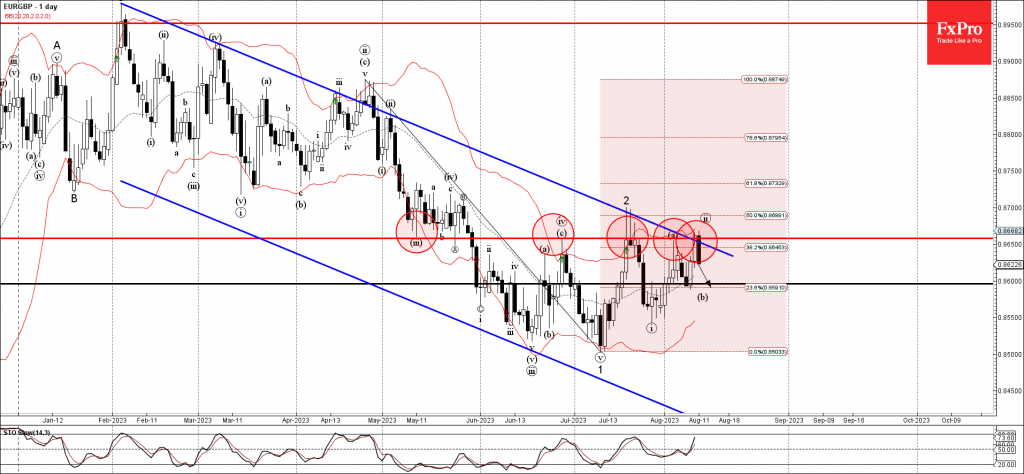

– EURGBP reversed from resistance level 0.8660 – Likely to fall to support level 0.8600 EURGBP currency pair recently reversed down from the key resistance level 0.8660 (former monthly low from May, which has been reversing the price from.

August 10, 2023

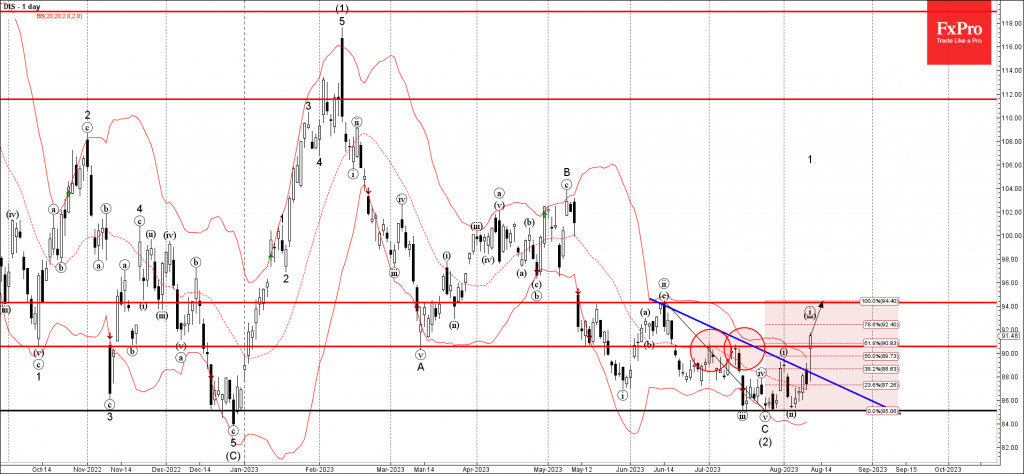

– Disney broke resistance level 90.50 – Likely to rise to resistance level 94.10 Disney recently broke the resistance level 90.50 (which has been reversing the price from the end of June) after the price broke the resistance trendline.

August 10, 2023

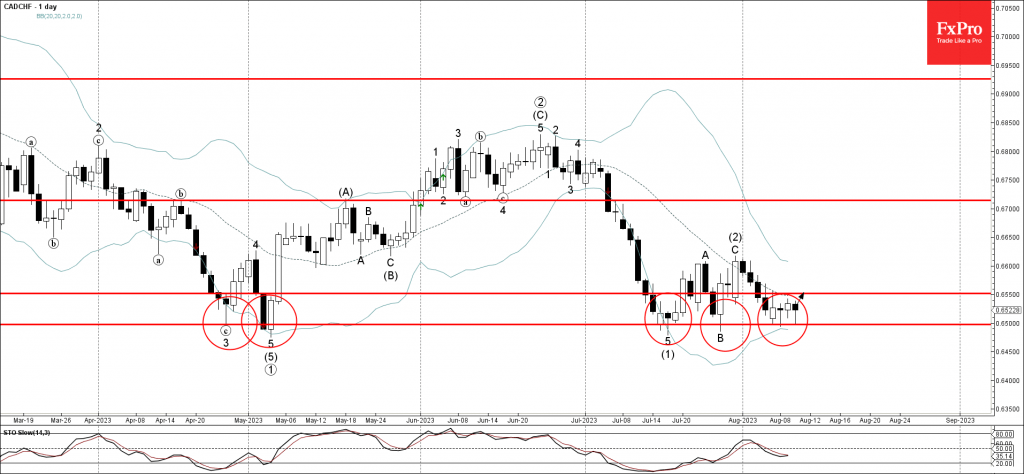

– CADCHF reversed from support level 0.6500 – Likely to rise to resistance level 0.6550 CADCHF currency pair today reversed up from the key support level 0.6500, which has been steadily reversing the price from the end of April. The.

August 10, 2023

– USDJPY broke resistance level 143.80 – Likely to rise to resistance level 145.30 USDJPY currency pair recently broke the resistance level 143.80, which reversed the price strongly with the daily Evening Star at the start of this month. The.

August 9, 2023

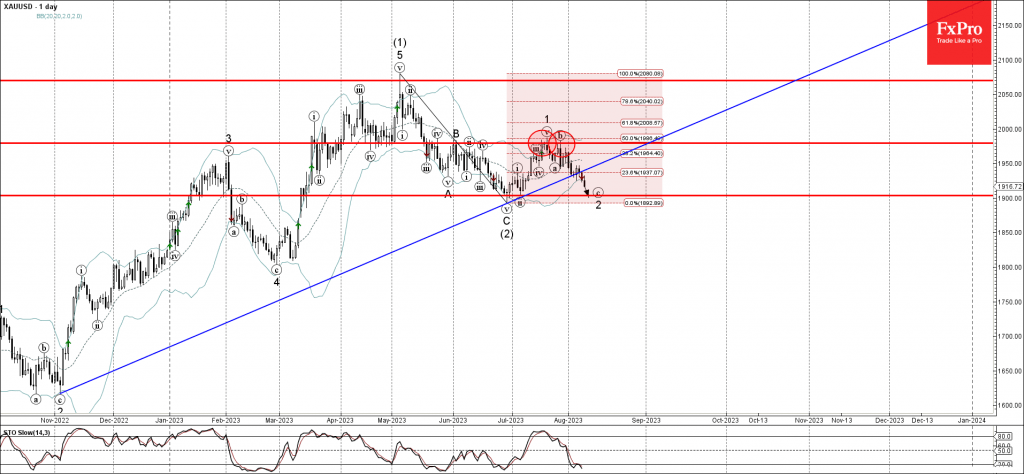

– Gold broke support trendline from November – Likely to fall to support level 1900.00 Gold previously broke the support trendline from last November, which accelerated the c-wave of the active ABC correction 2. The active c-wave started earlier from.

August 9, 2023

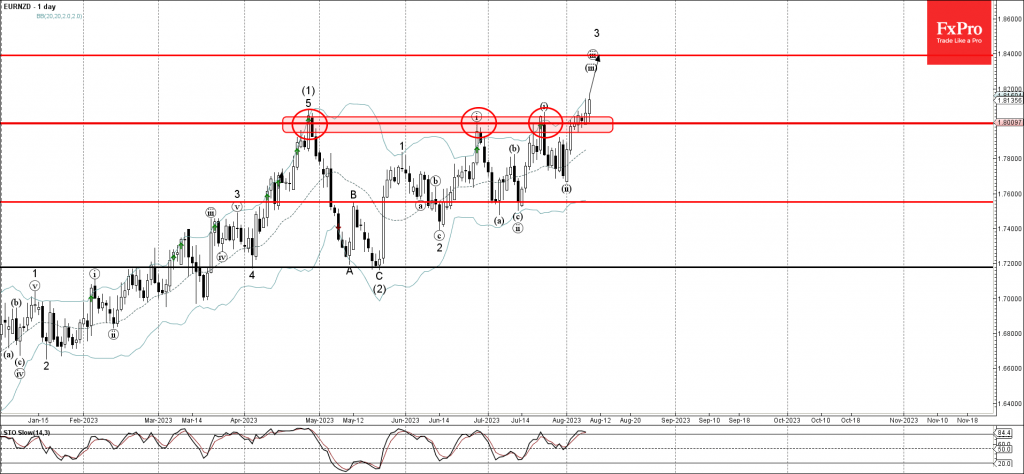

– EURNZD broke round resistance level 1.8000 – Likely to rise to resistance level 1.8400 EURNZD recently broke above the round resistance level 1.8000, which has been steadily reversing the price from April, as can be seen below. The breakout.