Technical analysis - Page 140

September 19, 2023

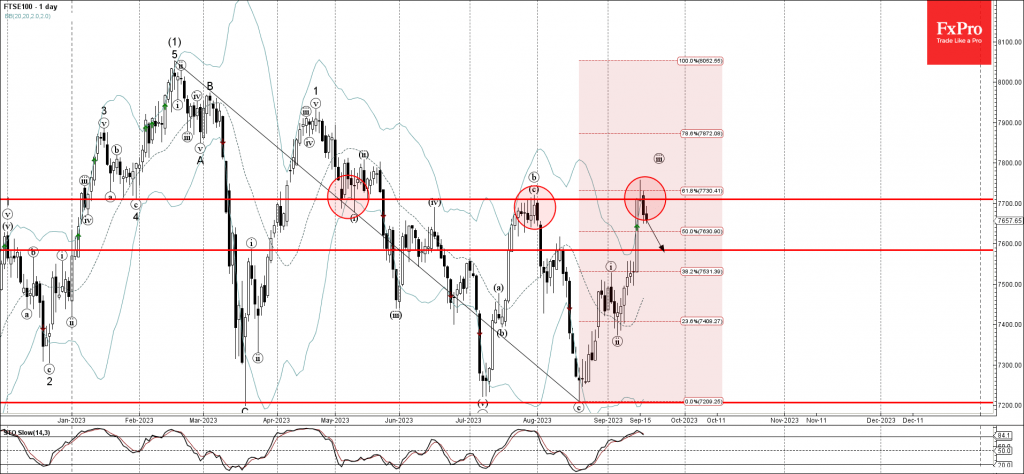

– FTSE 100 reversed from pivotal resistance level 7710,00 – Likely to fall to support level 7585,00 FTSE 100 index previously reversed down from the pivotal resistance level 7710,00 (former yearly high from July, former strong support from May) intersecting.

September 19, 2023

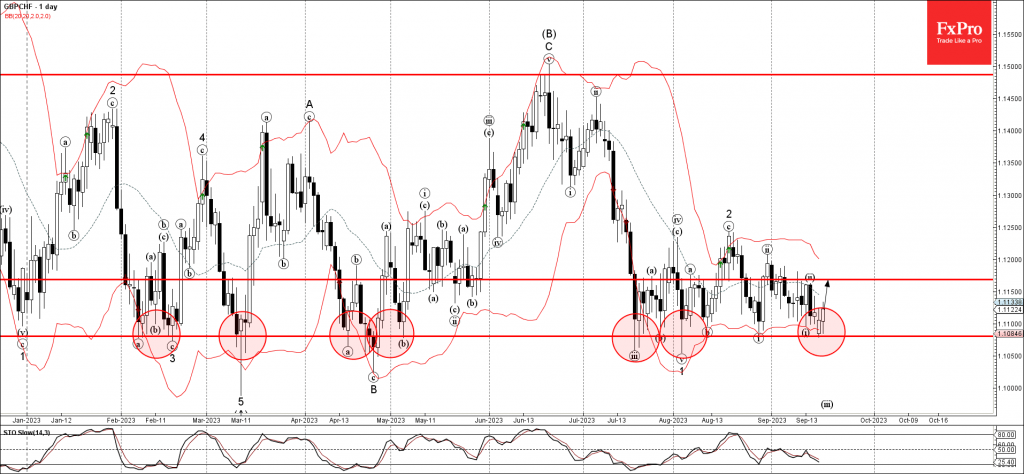

– GBPCHF reversed from multi-month support level 1.1080 – Likely to rise to resistance level 1.1170 GBPCHF currency pair recently reversed up from the major, multi-month support level 1.1080 (which has been reversing the price from February) intersecting with the.

September 18, 2023

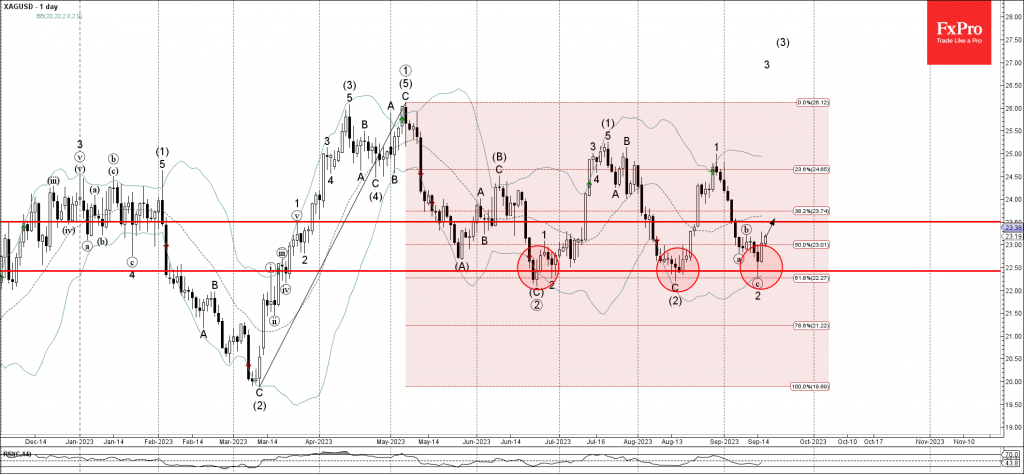

– Silver reversed from support level 22.50 – Likely to rise to resistance level 23.50 Silver recently reversed up from the strong multi-month support level 22.50 (which has been reversing the price from June) intersecting with the lower daily Bollinger.

September 18, 2023

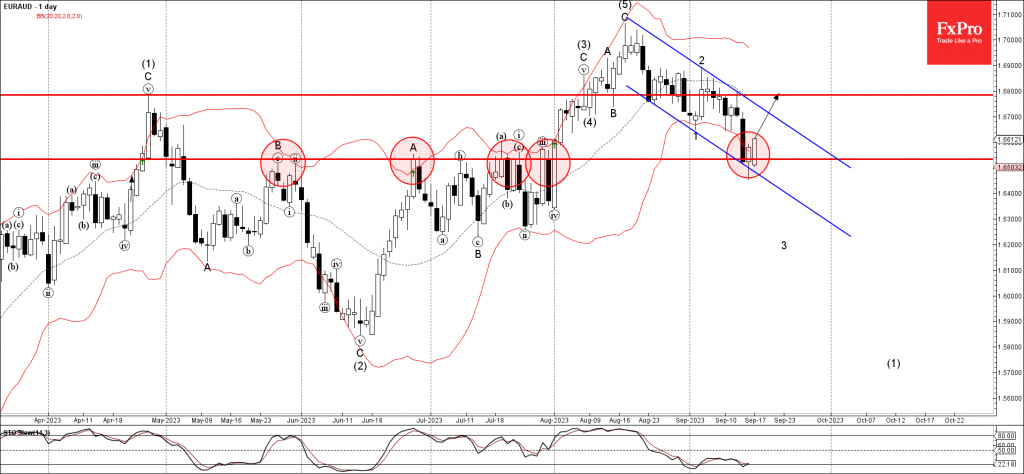

– EURAUD reversed from support level 1.6535 – Likely to rise to resistance level 1.6800 EURAUD currency pair recently reversed up from the support level 1.6535 (former resistance from May, June and July) intersecting with the lower daily Bollinger Band.

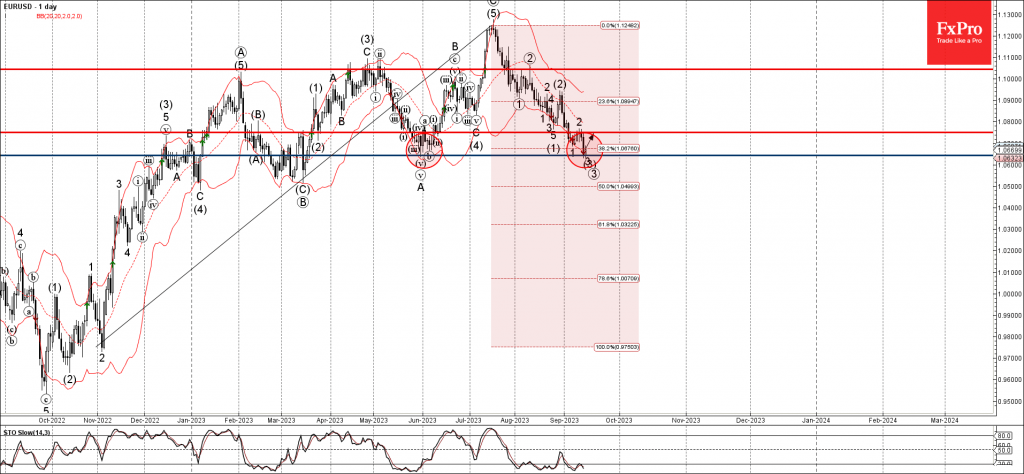

September 15, 2023

– EURUSD reversed from support level 1.0645 – Likely to rise to resistance level 1.0750 EURUSD currency pair recently reversed up from the support level 1.0645 (former multi-month low from May) intersecting with the lower daily Bollinger Band. The support.

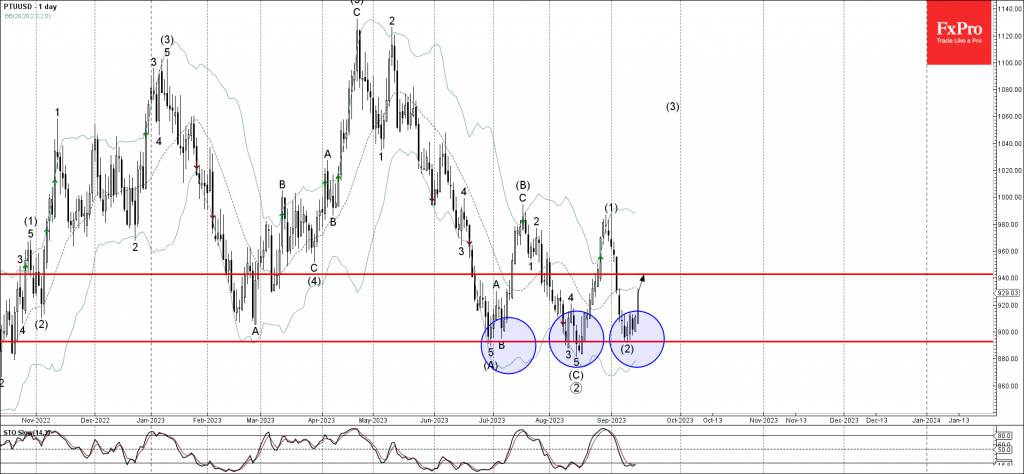

September 15, 2023

– Platinum reversed from support level 890.00 – Likely to rise to resistance level 940.00 Platinum recently reversed up from the major support level 890.00 (which has been reversing the price from June) intersecting with the lower daily Bollinger Band..

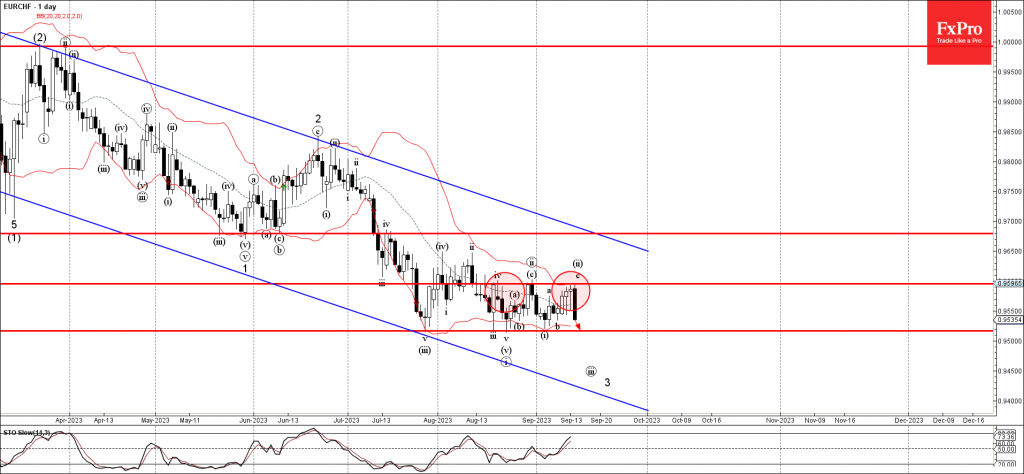

September 14, 2023

– EURCHF reversed from resistance level 0.9595 – Likely to fall to support level 0.9515 EURCHF currency pair recently reversed down from the resistance level 0.9595 (which has been reversing the pair from last month) intersecting with the upper daily.

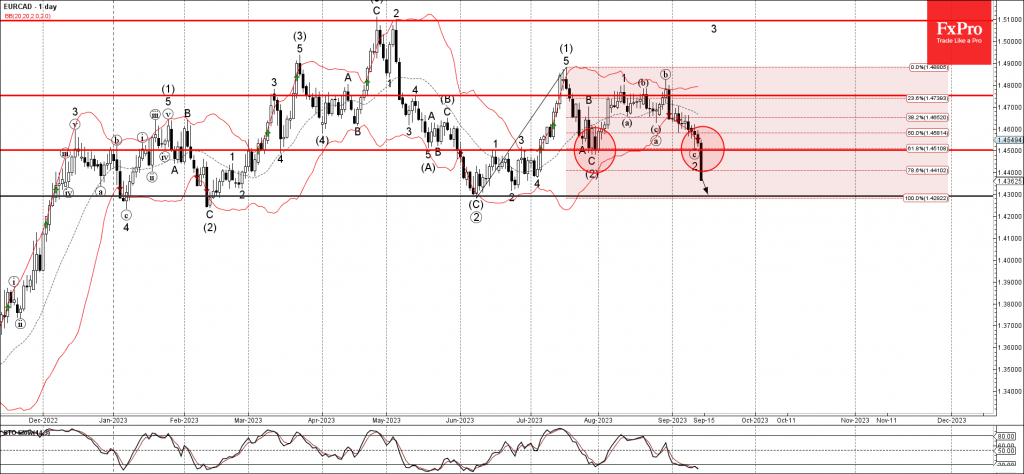

September 14, 2023

– EURCAD broke the support level 1.4500 – Likely to fall to support level 1.4300 EURCAD currency pair recently broke the support level 1.4500 (low of the previous ABC correction (2)) intersecting with the 61.8% Fibonacci correction of the upward.

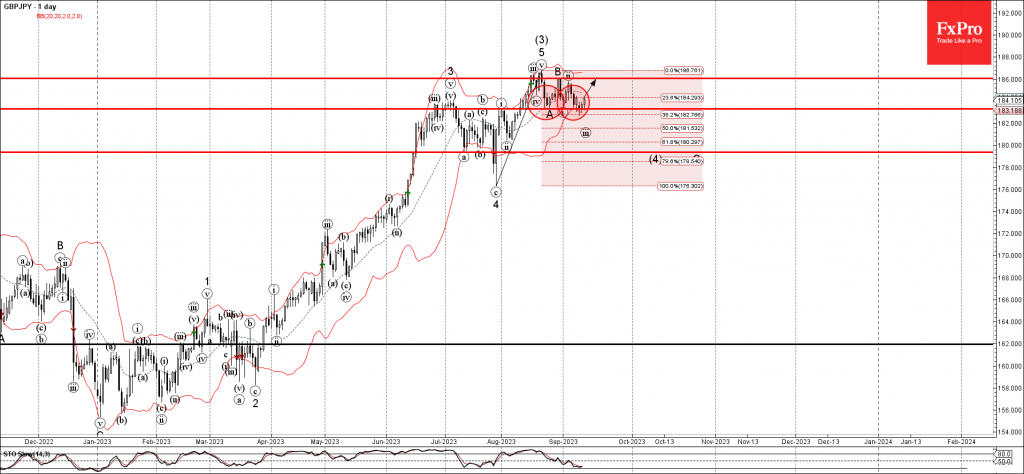

September 13, 2023

– GBPJPY reversed up from support level 183.30 – Likely to rise to resistance level 186.00 GBPJPY recently reversed up from the support level 183.30 (former top of wave i from the end of July) intersecting with the lower daily.

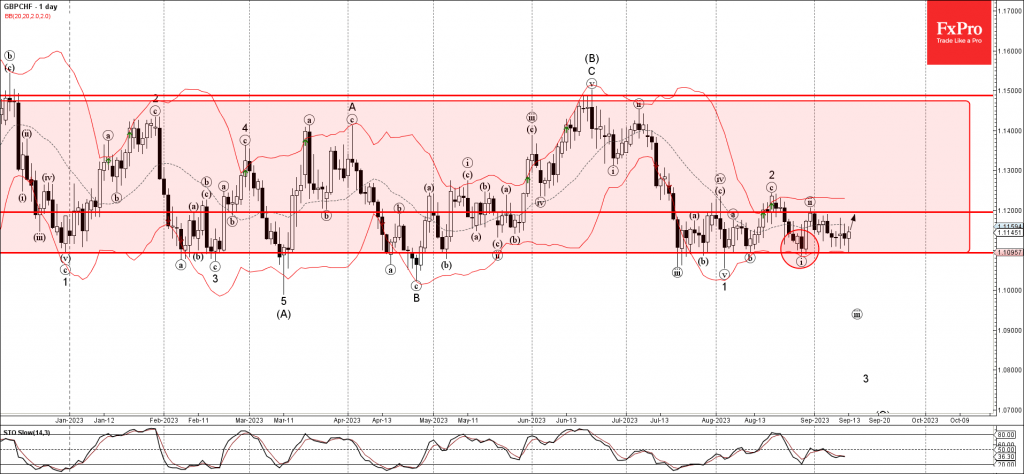

September 13, 2023

– GBPCHF currency pair reversed from support level 1.1095 – Likely to rise to resistance level 1.1200 GBPCHF currency pair recently reversed up from the key support level 1.1095 (lower boundary of the sideways price range inside which the pair.

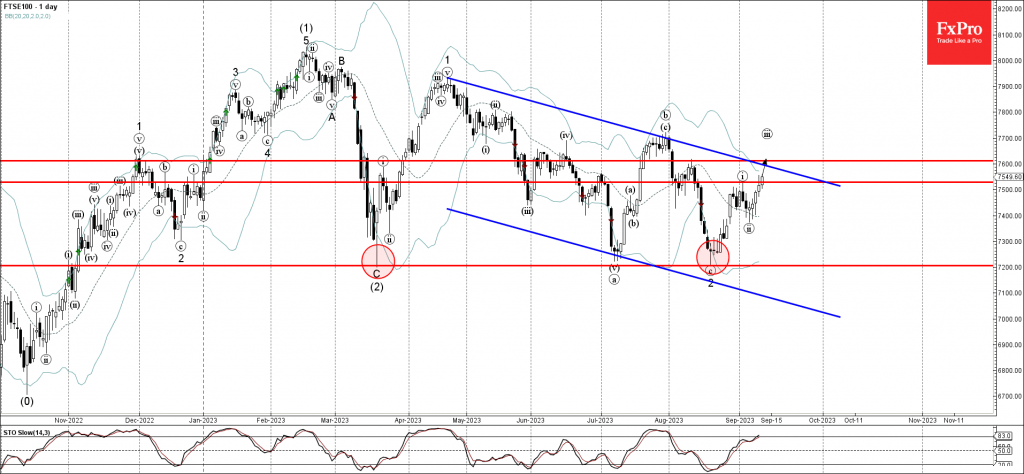

September 12, 2023

– FTSE 100 reversed from resistance level 7528.00 – Likely to rise to resistance level 7600.00 FTSE 100 index recently broke the resistance level 7528.00 (top of the pervious impulse wave i), intersecting with the resistance trendline of the daily.