Technical analysis - Page 134

November 9, 2023

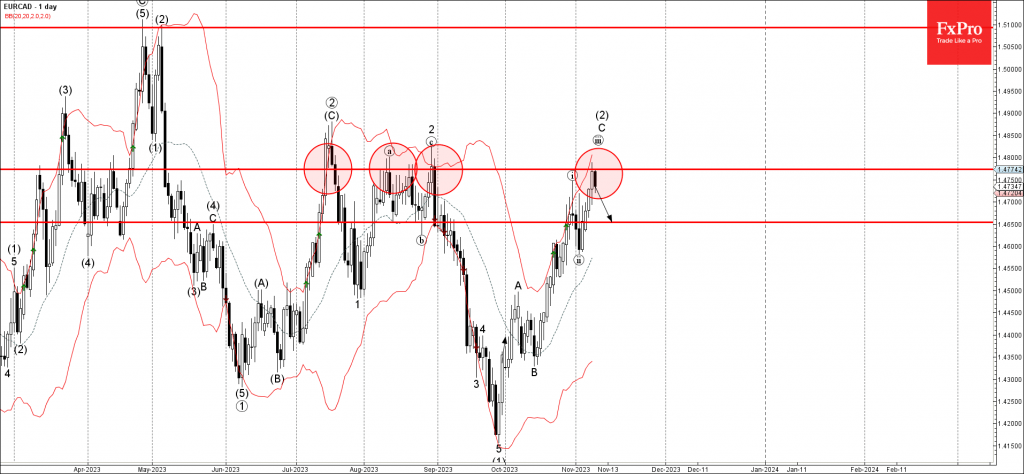

– EURCAD reversed from pivotal resistance level 1.4775 – Likely to fall to support level 1.4650 EURCAD recently reversed down from the pivotal resistance level 1.4775 (which has been reversing the pair from the start of July). The downward reversal.

November 9, 2023

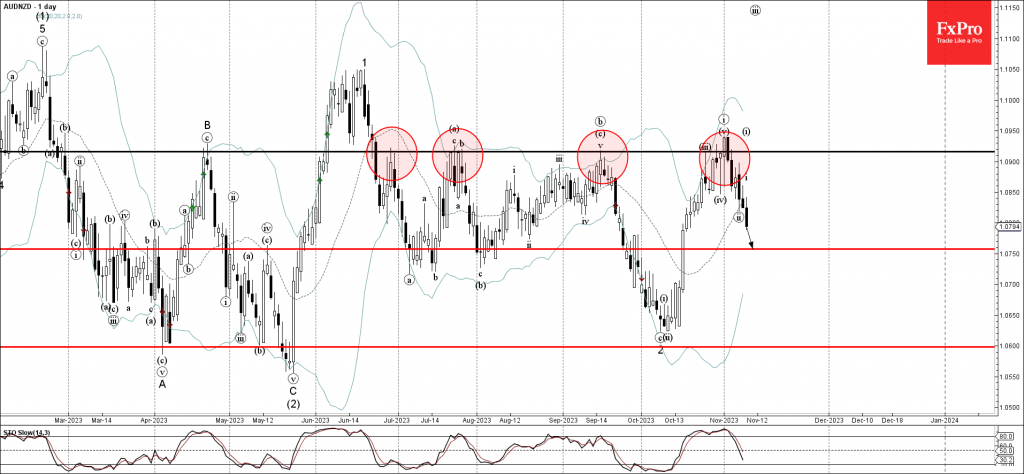

– AUDNZD reversed from powerful resistance level 1.0915 – Likely to fall to support level 1.0750 AUDNZD continues to fall after the earlier downward reversal from the powerful resistance level 1.0915 (which has been reversing the pair from the end.

November 8, 2023

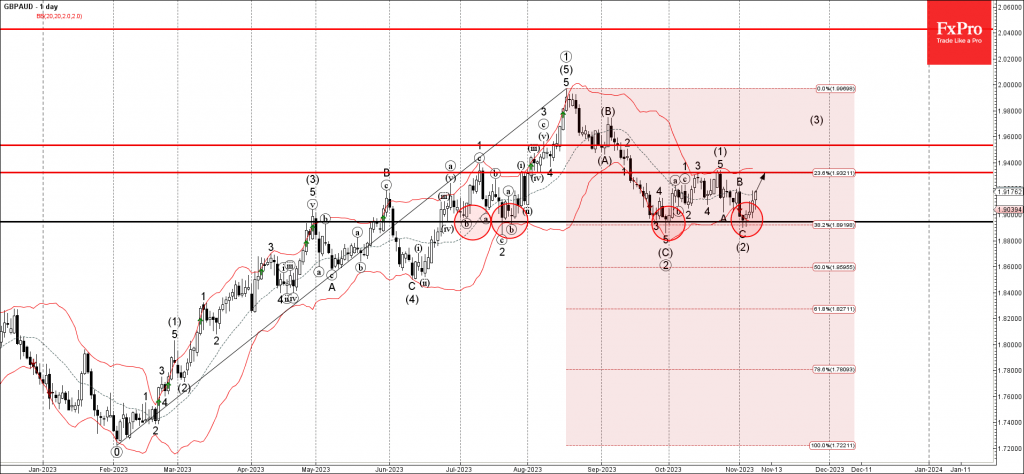

– GBPAUD reversed from support level 1.8945 – Likely to rise to resistance level 1.9325 GBPAUD currency pair recently reversed up from the pivotal support level 1.8945 (which has been reversing the pair from the start of July) coinciding with.

November 8, 2023

– EURJPY broke key resistance level 160.00 – Likely to rise to resistance level 164.00 EURJPY currency pair earlier broke above the key resistance level 160.00 (which has been reversing the pair from the middle of August). The breakout of.

November 7, 2023

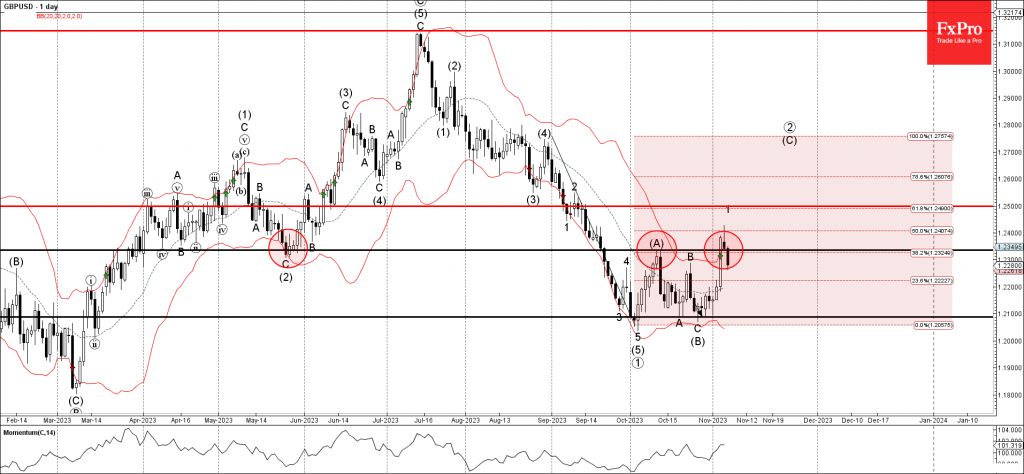

– GBPUSD reversed from key resistance level 1.2335 – Likely to fall to support level 1.2200 GBPUSD currency pair recently reversed down with the daily Shooting Star from the key resistance level 1.2335 (former strong support from May). The resistance.

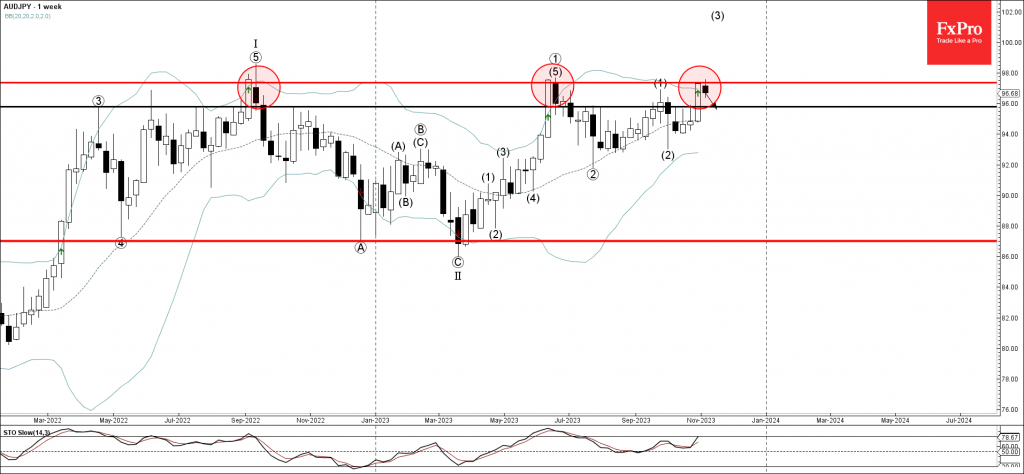

November 7, 2023

– AUDJPY reversed from resistance level 97.35 – Likely to fall to support level 96.00 AUDJPY currency pair recently reversed down from the major resistance level 97.35 (which has been reversing the pair from September of 2022). The resistance level.

November 6, 2023

– AUDUSD reversed from resistance level 0.6500 – Likely to fall to support level 0.6450 AUDUSD currency pair recently reversed down from the pivotal resistance level 0.6500 (former strong support from May, which has been reversing the pair from the.

November 6, 2023

– USDJPY reversed from support level 149.30 – Likely to rise to resistance level 152.00 USDJPY currency pair recently reversed up from the key support level 149.30 (which has been reversing the pair from the middle of October as can.

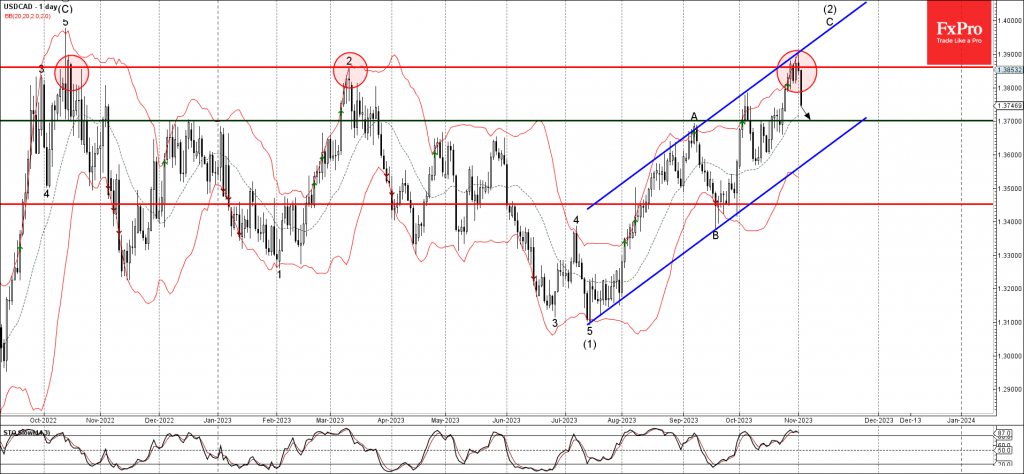

November 2, 2023

– USDCAD reversed from major resistance level 1.3860 – Likely to fall to support level 1.3700 USDCAD currency pair recently reversed down from the major resistance level 1.3860 (which has been reversing the pair from October of 2022, as can.

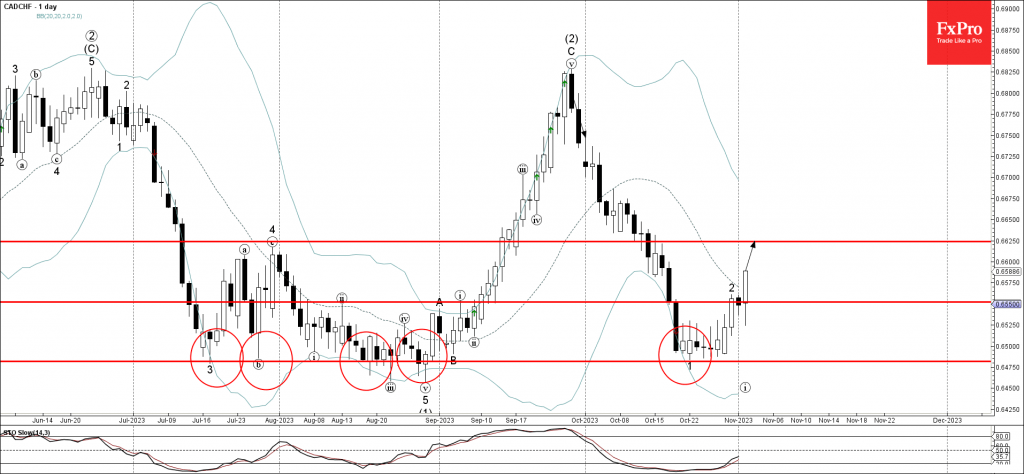

November 2, 2023

– CADCHF broke resistance level 0.6550 – Likely to rise to resistance level 0,6625 CADCHF recently broke through the resistance level 0.6550 (which stopped the pervious minor correction 2 at the end of October, as can be seen below). The.

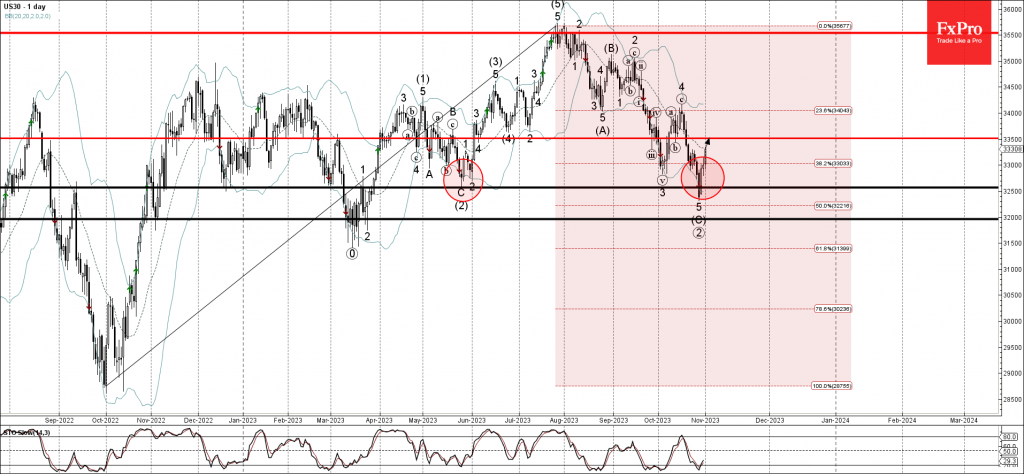

November 1, 2023

– Dow Jones reversed from support level 32565.00 – Likely to rise to resistance level 33500.00 Dow Jones index recently reversed up from the strong support level 32565.00 (former multi-month low from May) coinciding with the lower daily Bollinger Band..