Technical analysis - Page 133

November 22, 2023

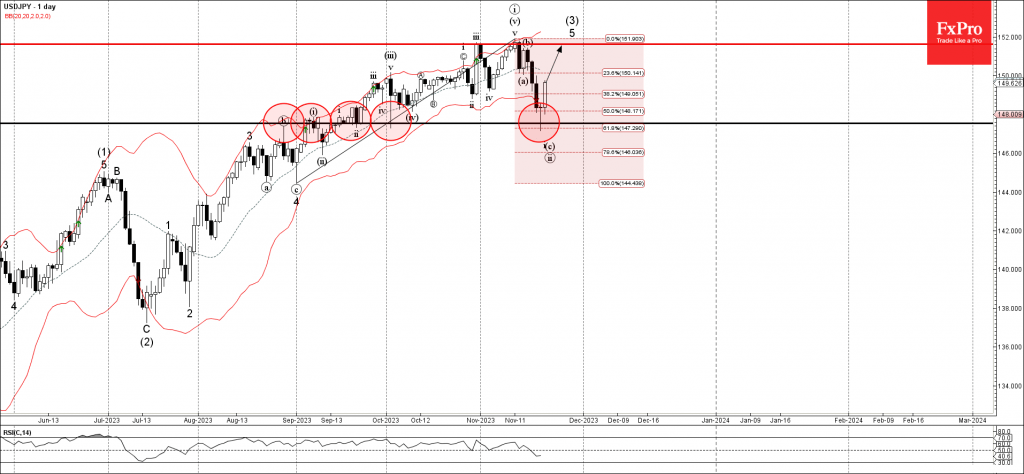

– USDJPY reversed from key support level 147.55 – Likely to rise to resistance level 152.00, USDJPY currency pair recently reversed up from the key support level 147.55 (which has been supporting the price from September) intersecting with the 61.8%.

November 22, 2023

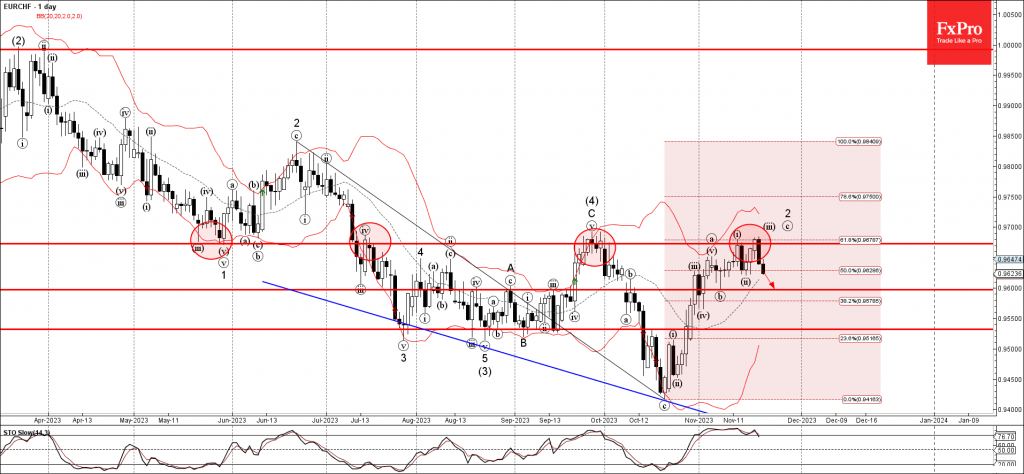

– EURCHF reversed from resistance level 0.9670 – Likely to fall to support level 0.9600 EURCHF currency pair recently reversed down from the strong resistance level 0.9670 (former strong support from May, which has been repeatedly reversing the pair from.

November 21, 2023

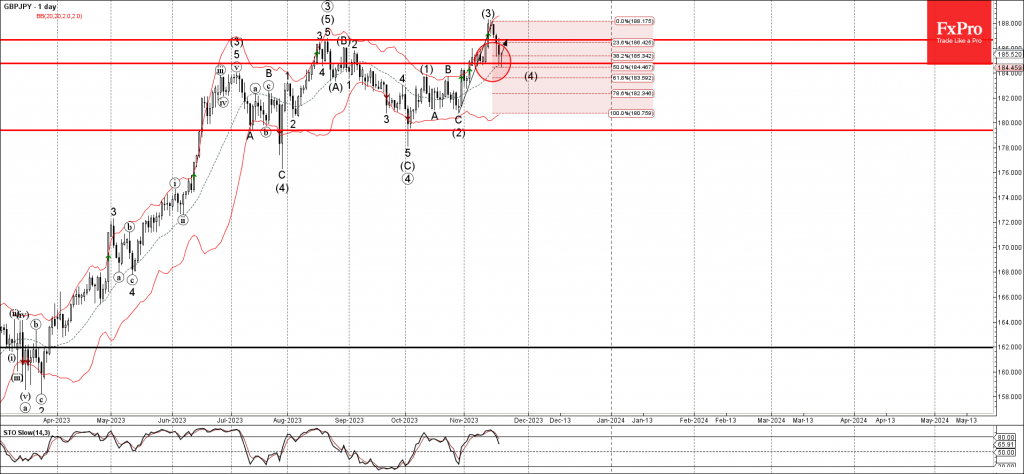

– GBPJPY reversed from support level 184.75 – Likely to rise to resistance level 186.65 GBPJPY currency pair recently reversed up from the key support level 184.75 (which has been repeatedly reversing the pair from the start of this month,.

November 21, 2023

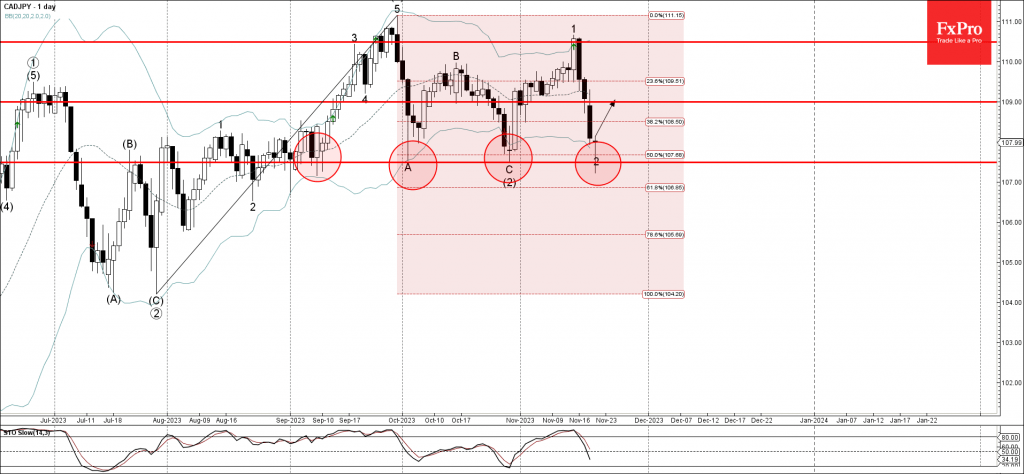

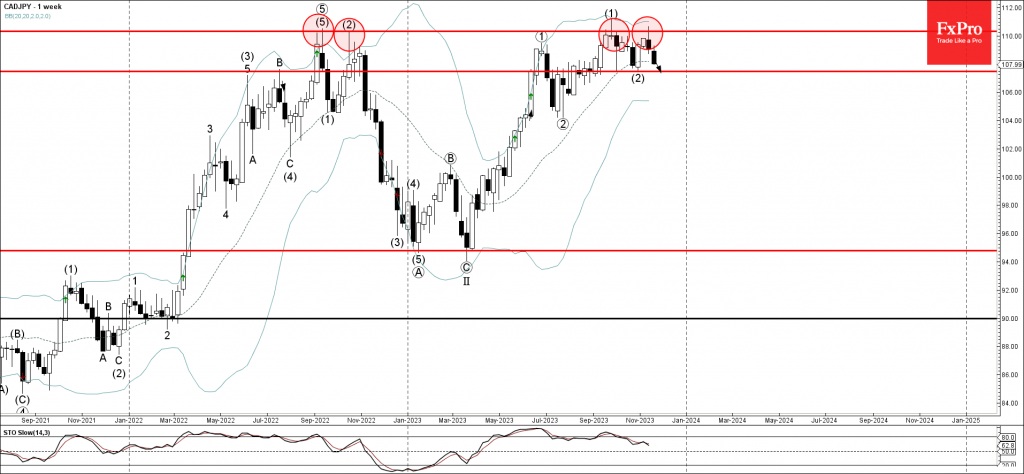

– CADJPY reversed from support level 107.50 – Likely to rise to resistance level 109.00 CADJPY currency pair recently reversed up from the key support level 107.50 (which has been repeatedly reversing the pair from the start of September) strengthened.

November 20, 2023

– CADJPY reversed from the long-term resistance level 110.30 – Likely to fall to support level 107.50 CADJPY currency pair recently reversed down from the long-term resistance level 110.30 (former yearly high, Double Top from last year) strengthened by the.

November 20, 2023

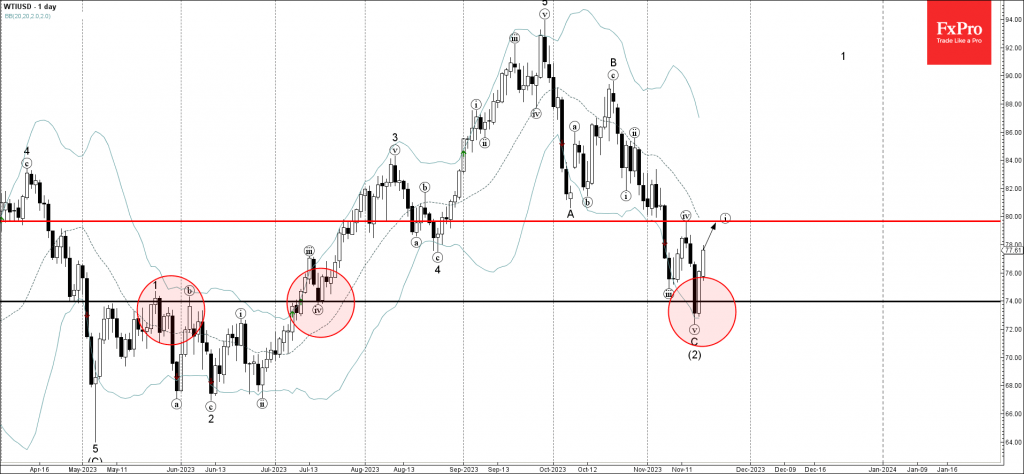

– WTI reversed from pivotal support level 74.00 – Likely to rise to resistance level 80.00 WTI crude oil recently reversed up from pivotal support level 74.00 (former resistance from May and June) intersecting with the lower daily Bollinger Band..

November 17, 2023

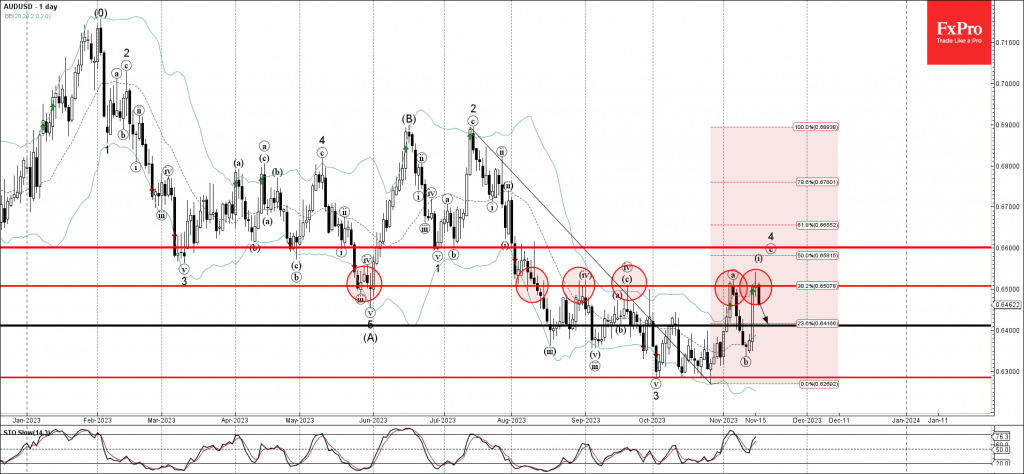

– AUDUSD reversed from resistance level 0.6500 – Likely to fall to support level 0,6400AUDUSD currency pair recently reversed down from pivotal resistance level 0.6500 (former strong support from May, which has been reversing the price from August) intersecting with.

November 17, 2023

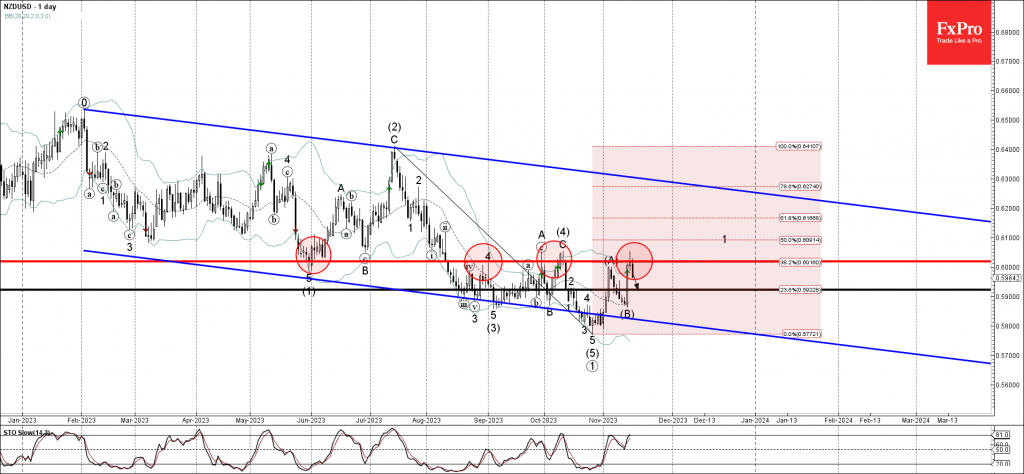

– NZDUSD reversed from resistance level 0.6020 – Likely to fall to support level 0.5925NZDUSD currency pair recently reversed down from key resistance level 0.6020 (which has been reversing the price from August) coinciding with the upper daily Bollinger Band..

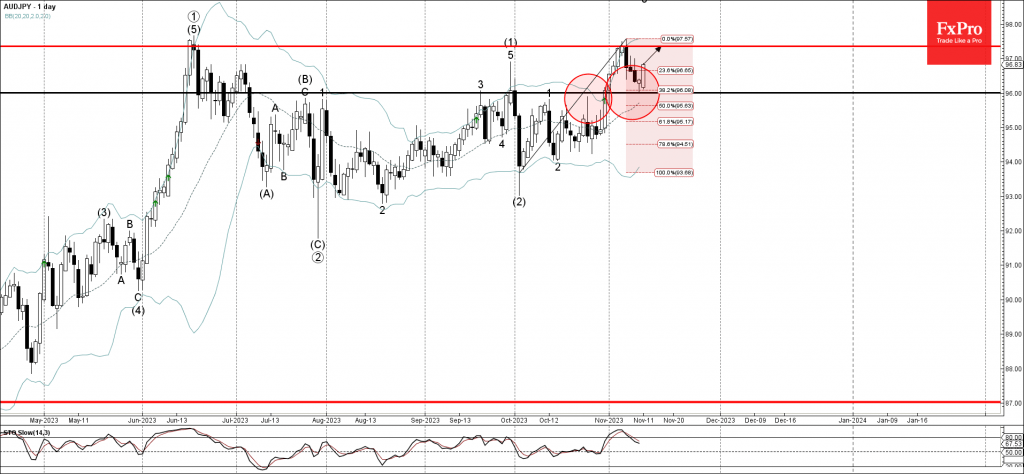

November 13, 2023

– AUDJPY reversed up from key support level 96.00 – Likely to rise to resistance level 35000.00 AUDJPY currency pair recently reversed up from key support level 96.00 (former strong resistance from September) coinciding with the 38.2% Fibonacci correction of.

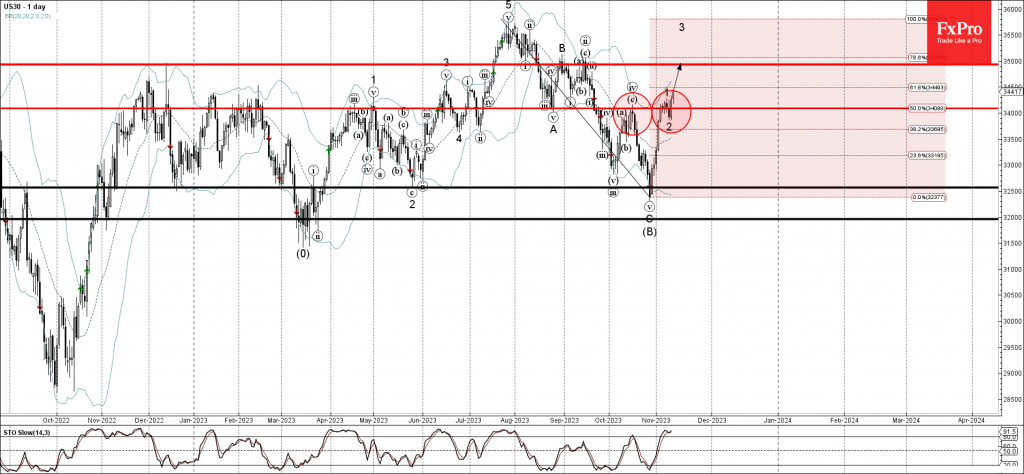

November 13, 2023

– Dow Jones index broke resistance level 34085.00 – Likely to rise to resistance level 35000.00. Dow Jones index recently broke the key resistance level 34085.00 (top of the previous minor correction iv from the middle of October). The breakout.

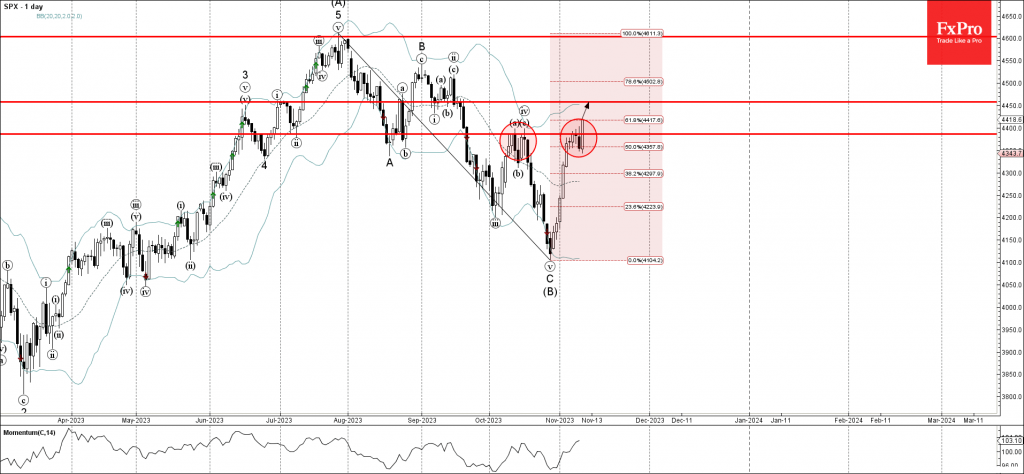

November 11, 2023

– S&P 500 broke key resistance level 4385.00 – Likely to rise to resistance level 4450.00. S&P 500 index recently broke the key resistance level 4385.00 (previous double top from October) standing near the 50% Fibonacci correction of the downward.