Technical analysis - Page 131

December 12, 2023

– Nasdaq-100 broke resistance level 16000.00 – Likely to rise to resistance level 16500.00 Nasdaq-100 index recently under the bullish pressure after the price broke above the round resistance level 16000.00, which stopped the weekly uptrend earlier this year, as.

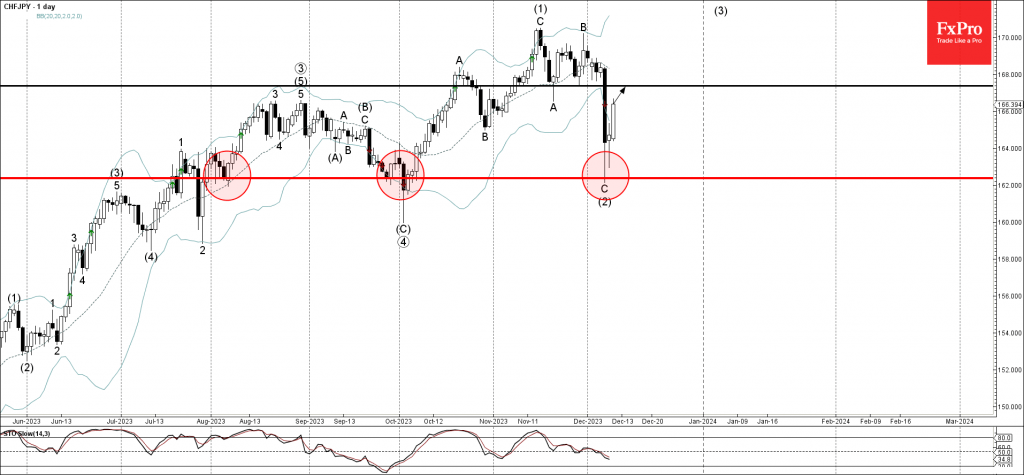

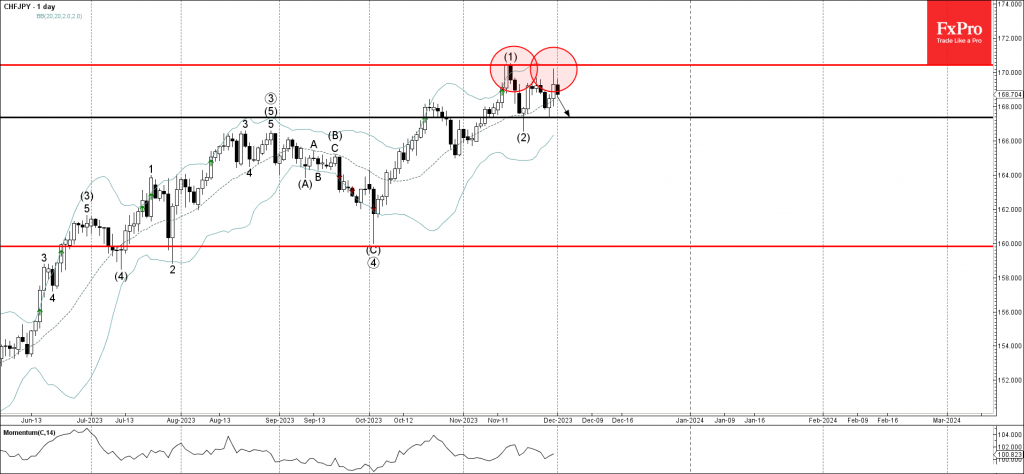

December 12, 2023

– CHFJPY reversed from support level 162.40 – Likely to rise to resistance level 167.35 CHFJPY recently reversed up sharply from the key support level 162.40, which has been reversing the pair from the start of August. The upward reversal.

December 8, 2023

– GBPCHF reversed from support level 1.1000 – Likely to rise to resistance level 1.1125 GBPCHF recently reversed up from the round support level 1.1000, lower boundary of the sideways price range inside which the pair has been trading from.

December 8, 2023

– EURNZD reversed from support level 1.7530 – Likely to rise to resistance level 1.7800 EURNZD recently reversed up from the strong support level 1.7530, which has been steadily reversing the pair from the middle of January. The support level.

December 7, 2023

– EURCHF reversed from support level 0.9420 – Likely to rise to resistance level 0.9500 EURCHF recently reversed from the strong support level 0.9420, which stopped the previous strong downtrend in the middle of October. The upward reversal from the.

December 7, 2023

– CADJPY reversed from support level 104.60 – Likely to rise to resistance level 107.00 CADJPY rising strongly after the price reversed up from the key support level 104.60, which reversed the price twice in July. The support level 104.60.

December 6, 2023

– Silver reversed from resistance level 25.80 – Likely to fall to support level 23.50 Silver falling strongly after the price reversed down from the key resistance level 25.80, which reversed the price multiple times in April and May. The.

December 6, 2023

– S&P 500 reversed from long-term resistance level 4600.00 – Likely to fall to support level 4500.00 S&P 500 index under the bearish pressure after the earlier downward reversal from the long-term resistance level 4600.00, which stopped the sharp weekly.

December 5, 2023

– Gold reversed from multi-year resistance level 2065.00 – Likely to fall to support level 1900.00 Gold recently reversed down from the major multi-year resistance level 2065.00, which has been reversing the price from the middle of 2020, as can.

December 5, 2023

– EURUSD broke daily up channel – Likely to fall to support level 1.7000 EURUSD currency pair under the bearish pressure after the earlier breakout of the support trendline of the daily up channel, which enclosed the previous impulse wave.

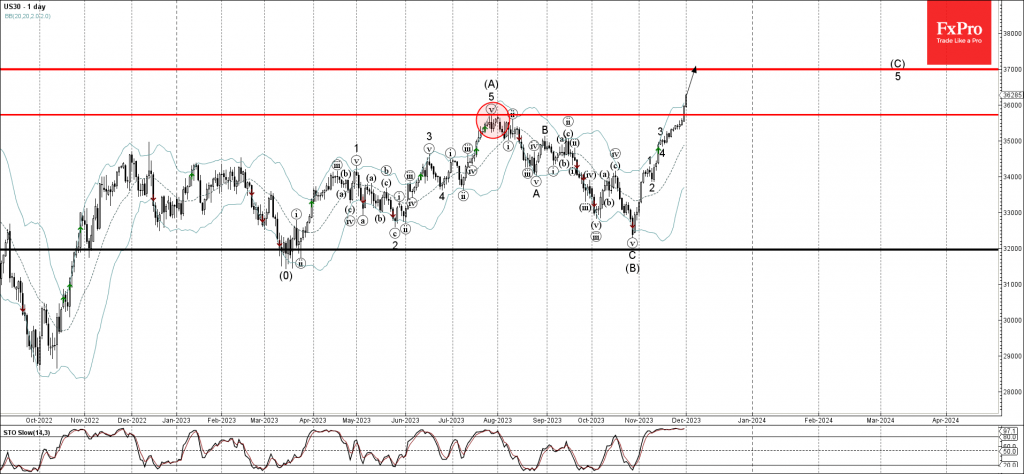

December 1, 2023

– Dow Jones broke multi-month resistance level 35735.00 – Likely to rise to resistance level 37000.00 Dow Jones index under the bullish pressure after the earlier breakout of the multi-month resistance level 35735.00, which stopped the previous impulse wave (A).