Technical analysis - Page 130

December 20, 2023

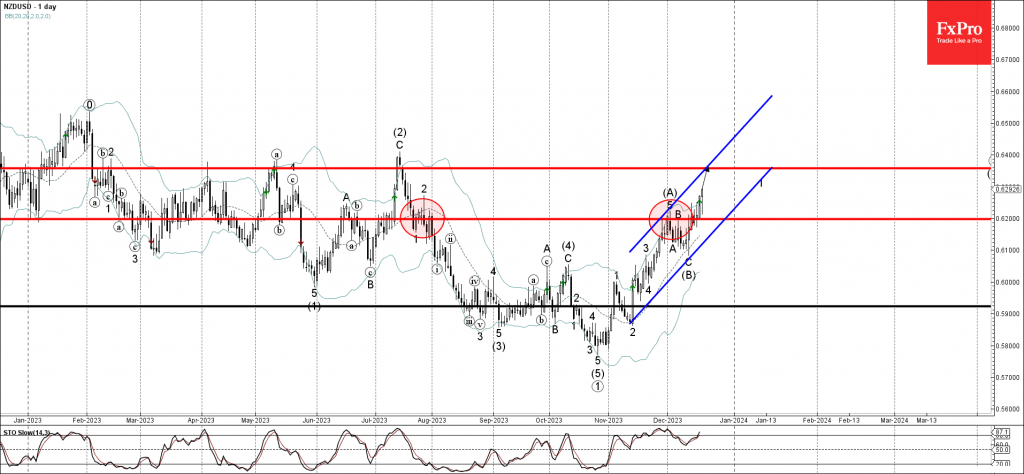

– NZDUSD broke key resistance level 0.6200 – Likely to rise to resistance level 0.6360 NZDUSD currency pair under the bullish pressure after breaking the key resistance level 0.6200 (which has been reversing the price from the end of July)..

December 20, 2023

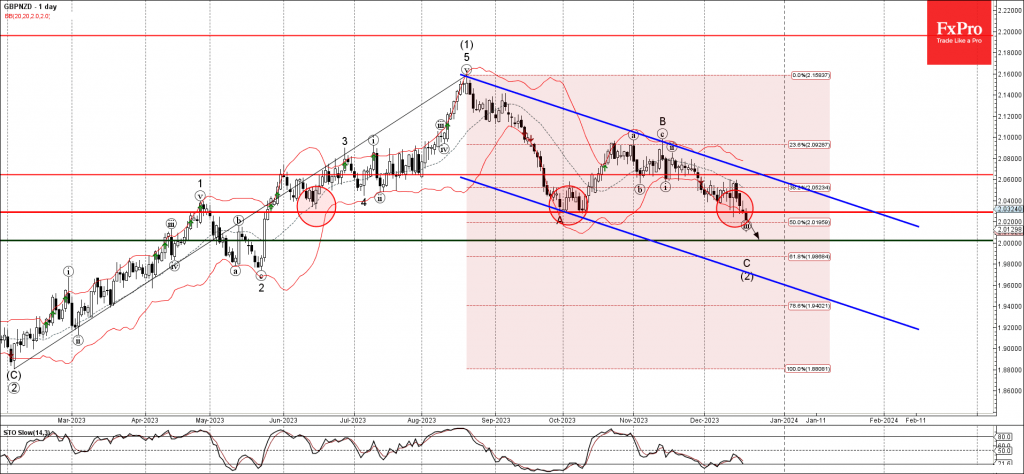

– GBPNZD broke key support level 2.0290 – Likely to fall to support level 2.0000 GBPNZD currency pair recently broke the key support level 2.0290 (which has been reversing the price from the middle of June). The breakout of the.

December 19, 2023

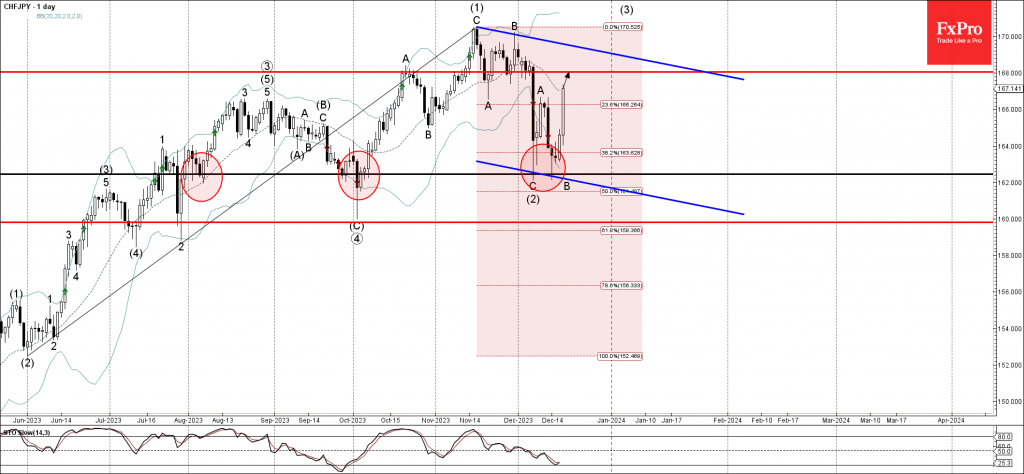

– CHFJPY reversed from support level 162.45 – Likely to rise to resistance level 168.00 CHFJPY currency pair recently reversed up from the key support level 162.45 (which has been reversing the price from August). The support level 162.45 was.

December 19, 2023

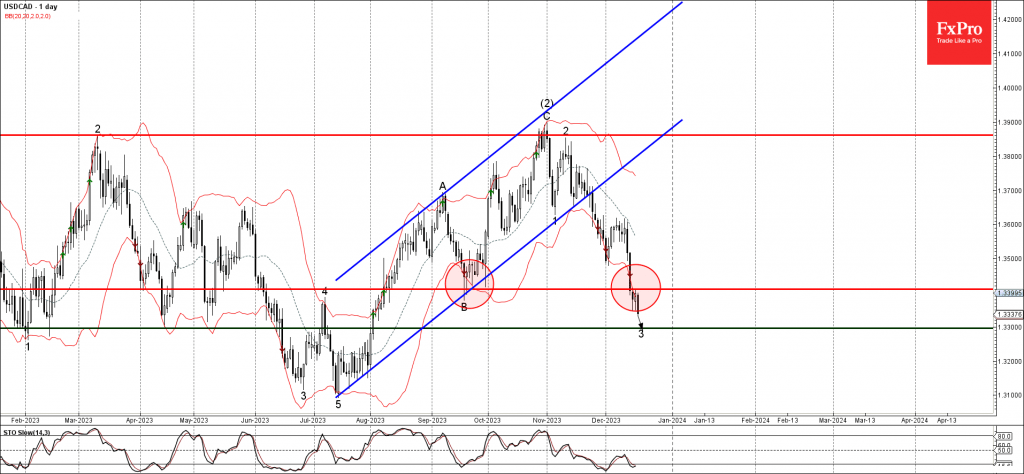

– USDCAD broke support level 1.3410 – Likely to fall to support level 1.3300 USDCAD currency pair under the bearish pressure after the pair broke the support level 1.3410 (low of wave B of the previous ABC correction (2) from.

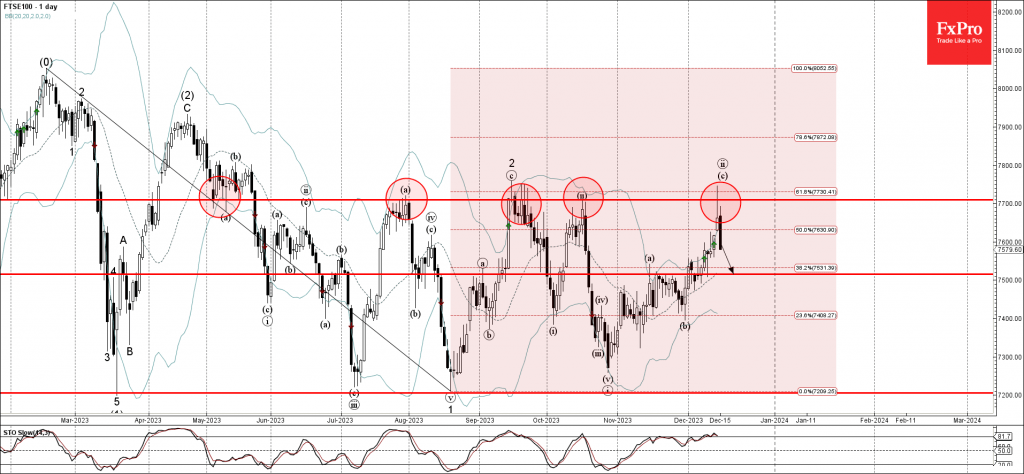

December 15, 2023

– FTSE 100 reversed from resistance level 7700.00 – Likely to fall to support level 7500.00 FTSE 100 index under the bearish pressure after the index reversed down from the resistance level 7700.00 (which has been reversing the index from.

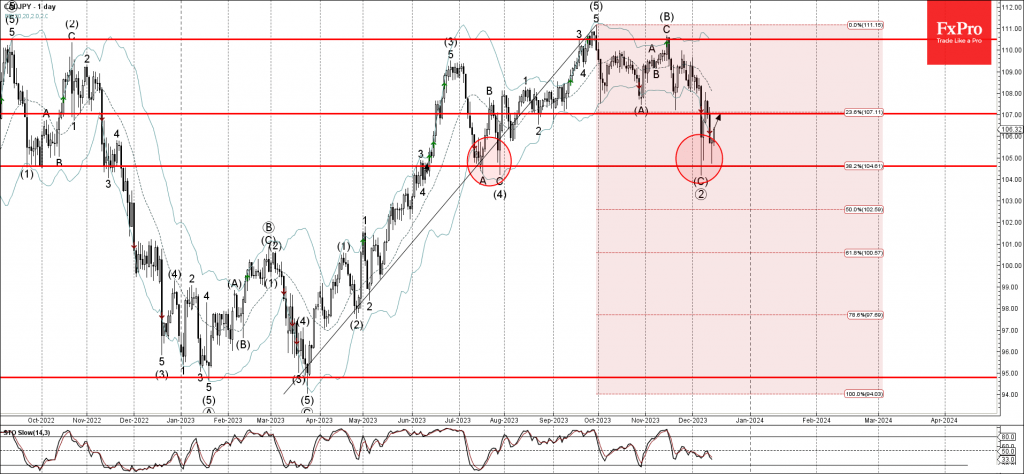

December 15, 2023

– CADJPY reversed from support level 104.60 – Likely to rise to resistance level 107.00 CADJPY today reversed up from the key support 104.60 (which has been repeatedly reversing the price from July) standing below the lower daily Bollinger Band..

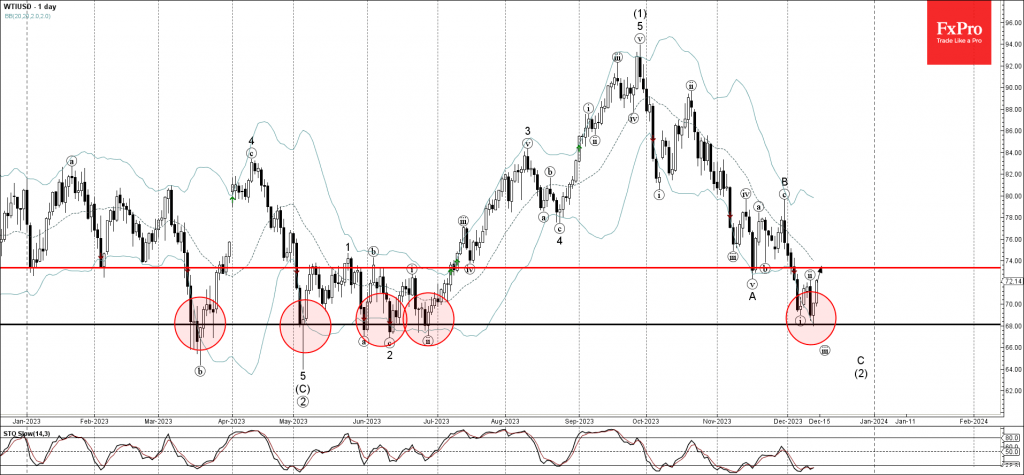

December 14, 2023

– WTI reversed from support level 68.00 – Likely to rise to resistance level 73.35 WTI crude oil recently reversed up from the major long-term support 68.00 (which has been repeatedly reversing the price from March) coinciding with the lower.

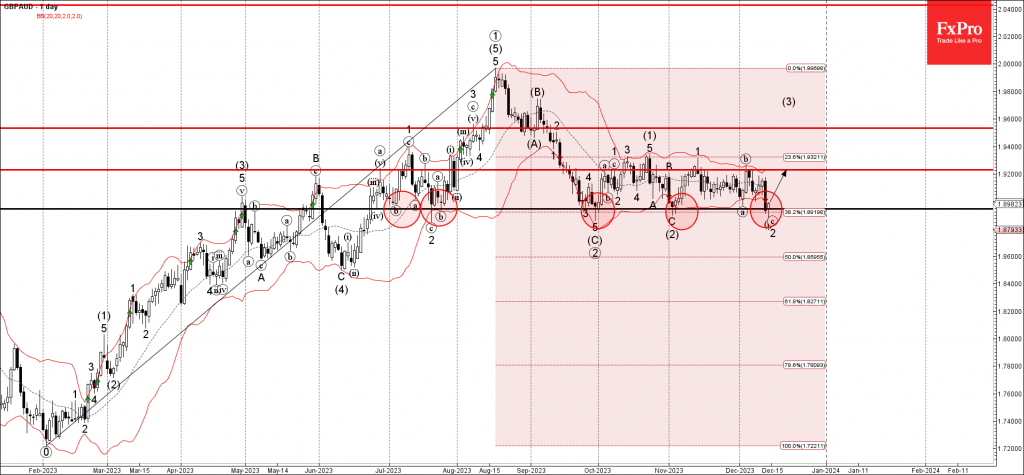

December 14, 2023

– GBPAUD reversed from support level 1.8945 – Likely to rise to resistance level 1.9200 GBPAUD currency pair recently reversed up from the strong support level 1.8945 (which has been repeatedly reversing the pair from the start of July) intersecting.

December 13, 2023

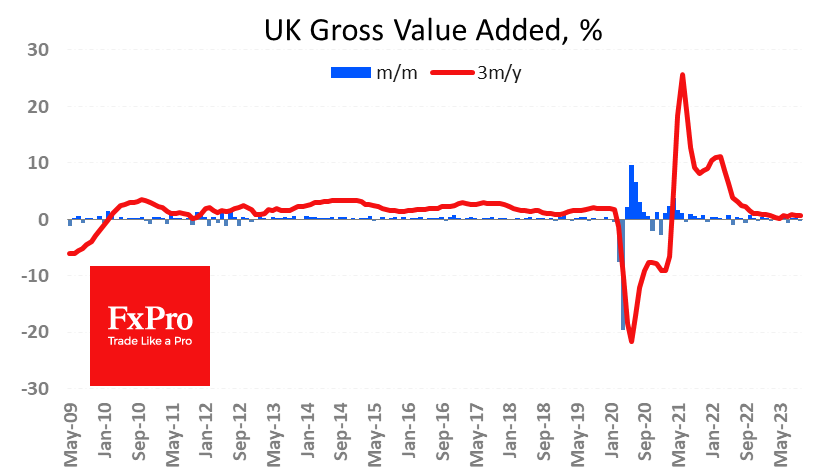

A series of macro statistics continue to be published to help build a picture of the economy ahead of the Bank of England’s final decision on Thursday. The economy is reported to have lost 0.3% for October, pulling back in.

December 13, 2023

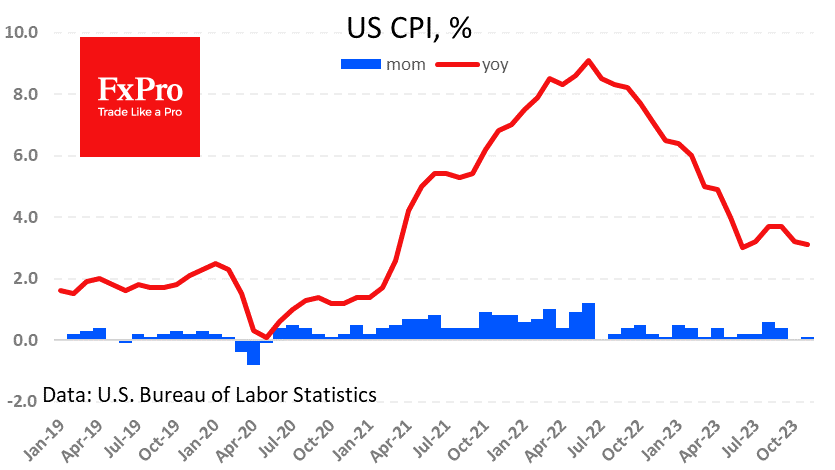

US consumer prices rose by 0.1% m/m (stronger than expected 0.0%). Annual inflation slowed from 3.2% to 3.1%. Core (excluding food and energy) rose 0.3% m/m, maintaining its annual growth rate of 4.0%. Overall inflation has stabilised at levels above.

December 12, 2023

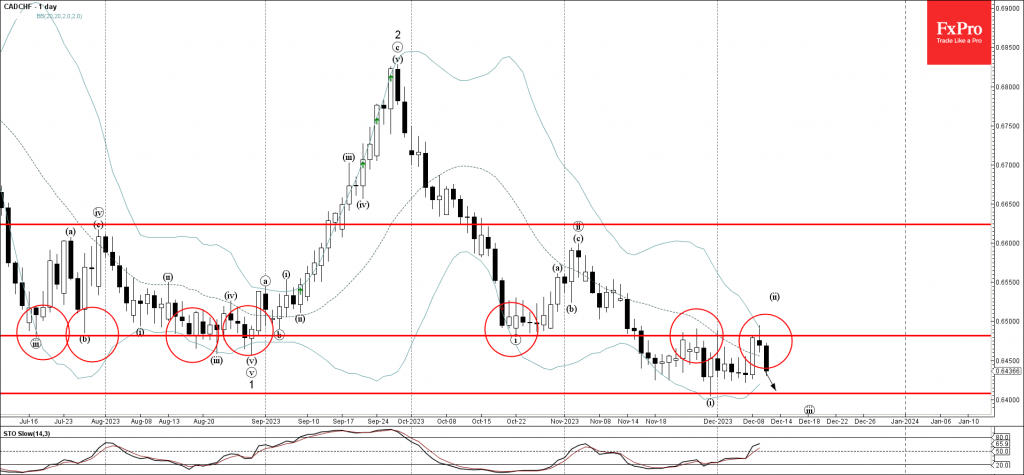

– CADCHF reversed from resistance level 0.6490 – Likely to support level 0.6410 CADCHF currency pair recently reversed down from the strong resistance level 0.6490 (former strong support from October) intersecting with the upper daily Bollinger Band. The downward reversal.