Technical analysis - Page 128

January 9, 2024

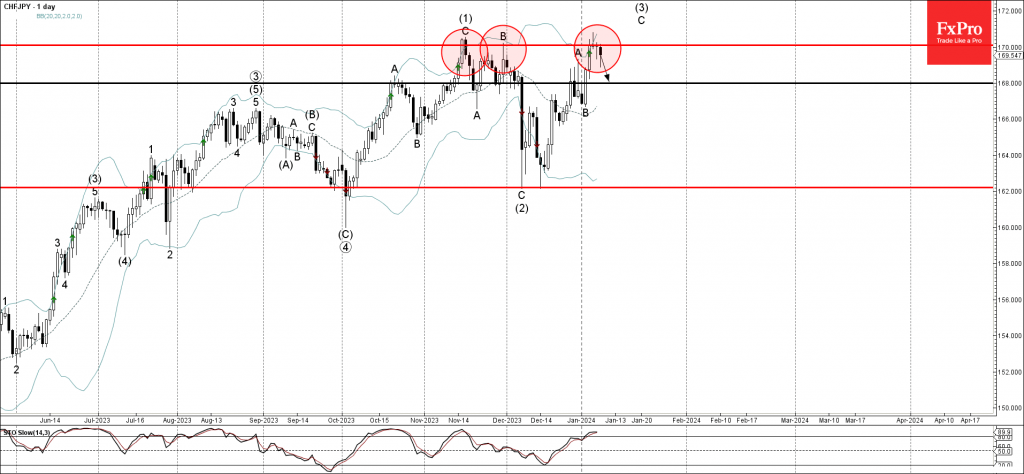

– CHFJPY reversed from resistance level 170.00 – Likely to fall to support level 168.00. CHFJPY currency pair recently reversed down from the pivotal resistance level 170.00 (former Double Top from November) intersecting with the upper daily Bollinger Band. The.

January 9, 2024

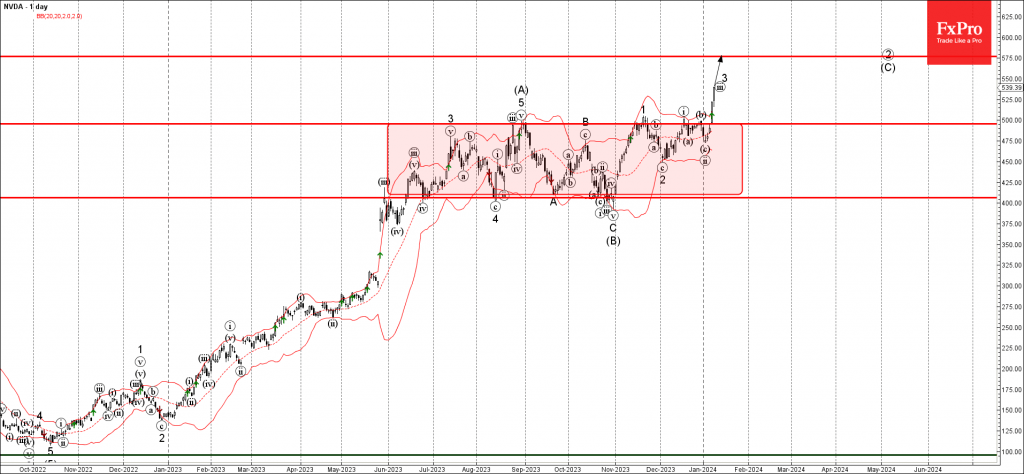

– Nvidia broke round resistance level 500.00 – Likely to rise to resistance level 575.00 Nvidia under the strong bullish pressure after the price broke through the round resistance level 500.00 (upper border of the sideways price range inside which.

January 8, 2024

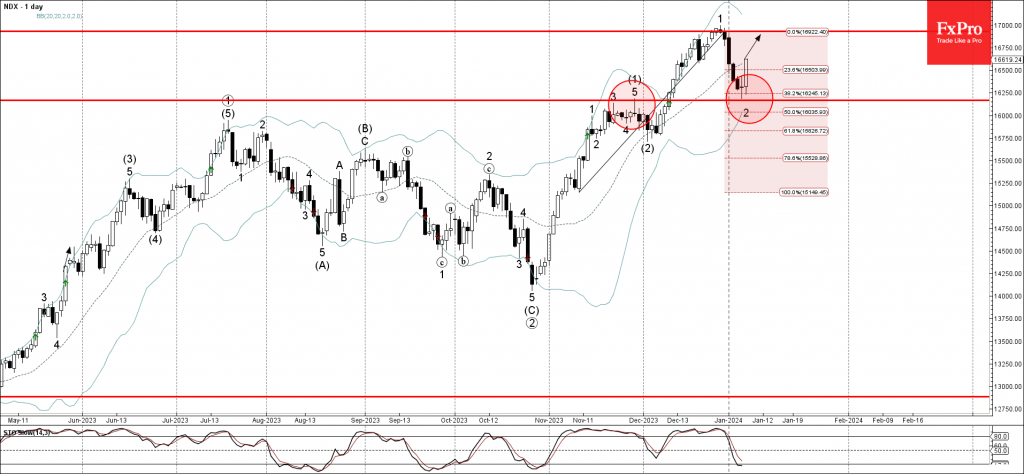

– Nasdaq-100 index reversed from support level 16170.00 – Likely to rise to resistance level 16930.00 Nasdaq-100 index recently reversed up from the pivotal support level 16170.00 (former double top from the end of November) intersecting with the 38.2% Fibonacci.

January 8, 2024

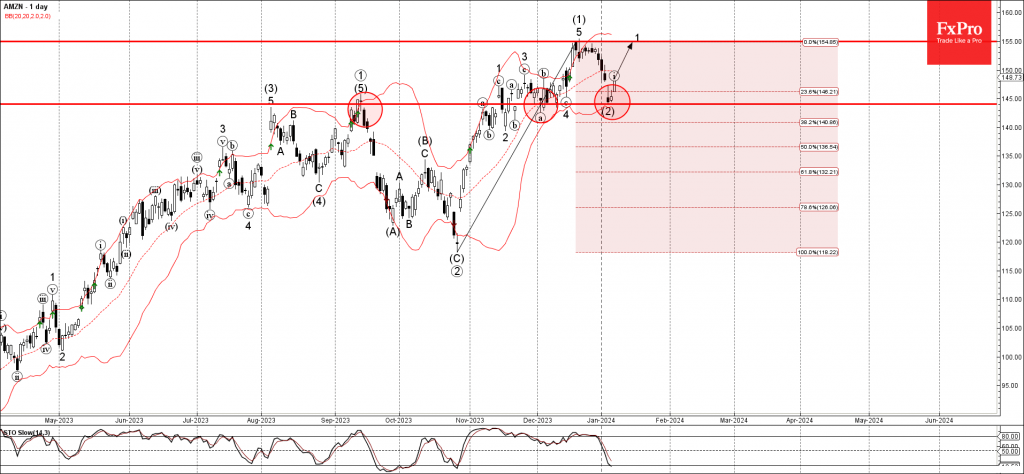

– Amazon reversed from key support level 144.00 – Likely to rise to resistance level 155.00 Amazon recently reversed up from the key support level 144.00 (former multi-month resistance level from September). The support level 144.00 was strengthened by the.

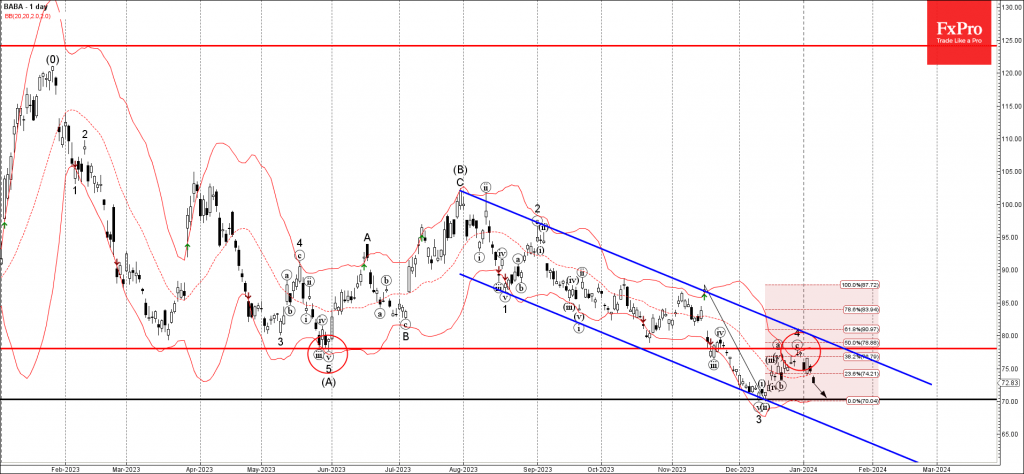

January 5, 2024

– Alibaba reversed from resistance level 78.00 – Likely to fall to support level 70.30 Alibaba recently reversed down from the pivotal resistance level 78.00 (former multi-month support from May of 2023). The resistance level 78.00 was strengthened by the.

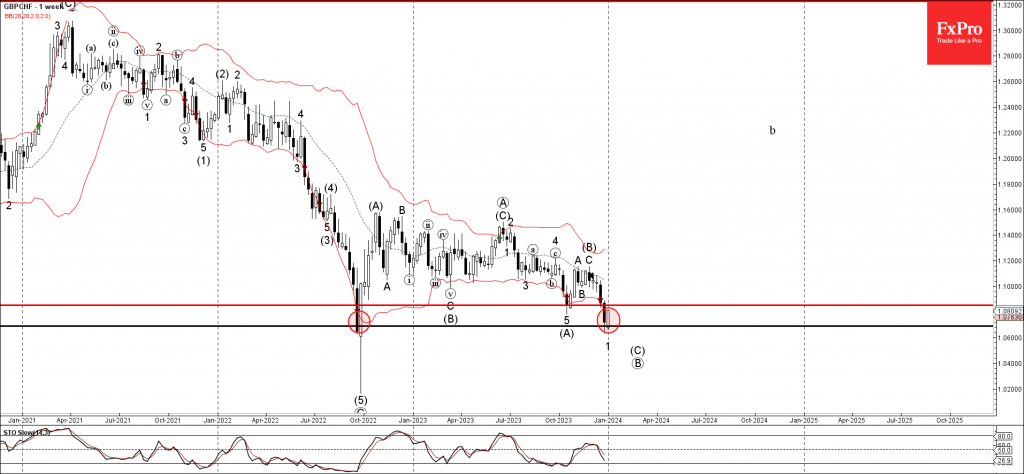

January 5, 2024

– GBPCHF reversed from support level 1.0690 – Likely to rise to resistance level 1.0855 GBPCHF currency pair recently reversed up from the major support level 1.0690 (which stopped the sharp weekly downtrend at the end of 2022). The support.

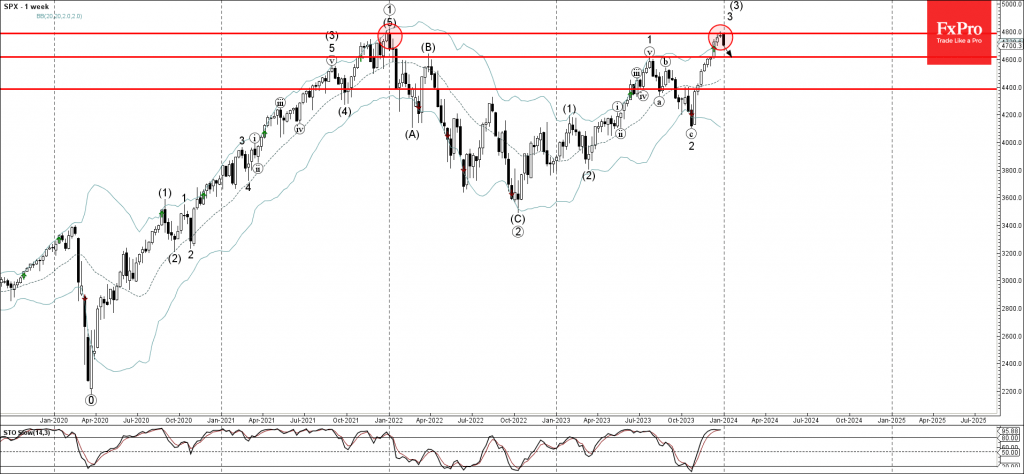

January 4, 2024

– S&P 500 index reversed from resistance level 4800 – Likely to fall to support level 4600.00 S&P 500 index recently reversed down from the major long-term resistance level 4800.00 (which stopped the sharp weekly uptrend at the end of.

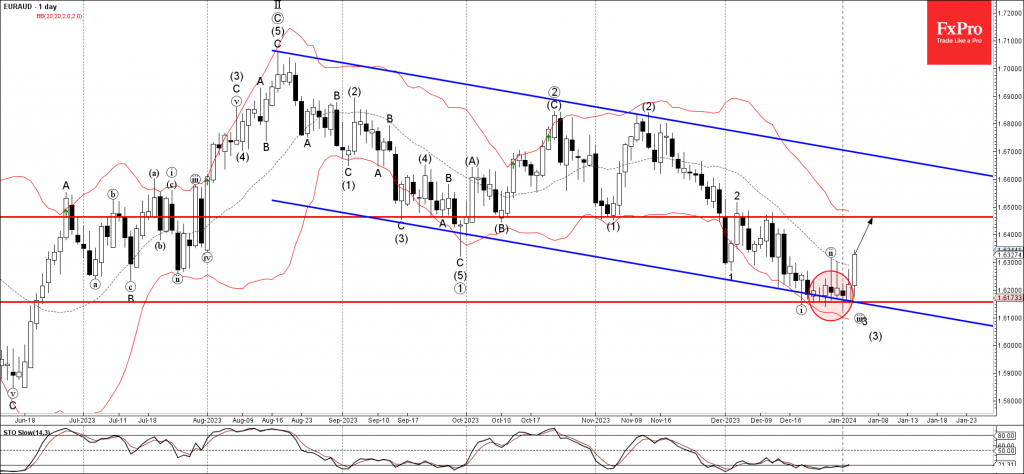

January 4, 2024

– EURAUD reversed from support level 1.6155 – Likely to rise to resistance level 1.6465 EURAUD recently reversed up from the key support level 1.6155 (which reversed the price multiple times from the middle of December). The support level 1.6155.

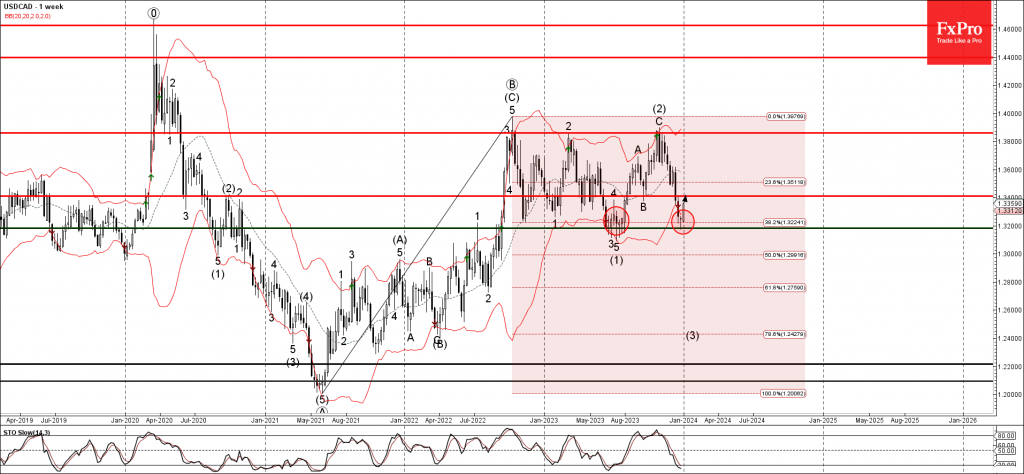

January 3, 2024

– USDCAD reversed from key support level 1.3200 – Likely to rise to resistance level 1.3400 USDCAD currency pair recently reversed up from the key support level 1.3200 (which reversed the price multiples times in the middle of 2023, as.

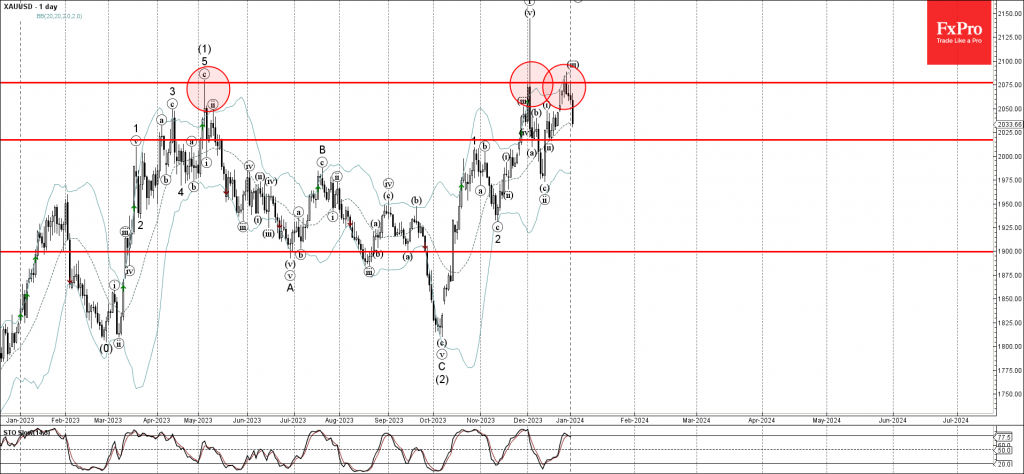

January 3, 2024

– Gold reversed from resistance level 2075.00 – Likely to fall to support level 2016.00 Gold recently reversed down from the strong multi-month resistance level 2075.00 (which also stopped the earlier uptrend in March of 2023, as can be seen.

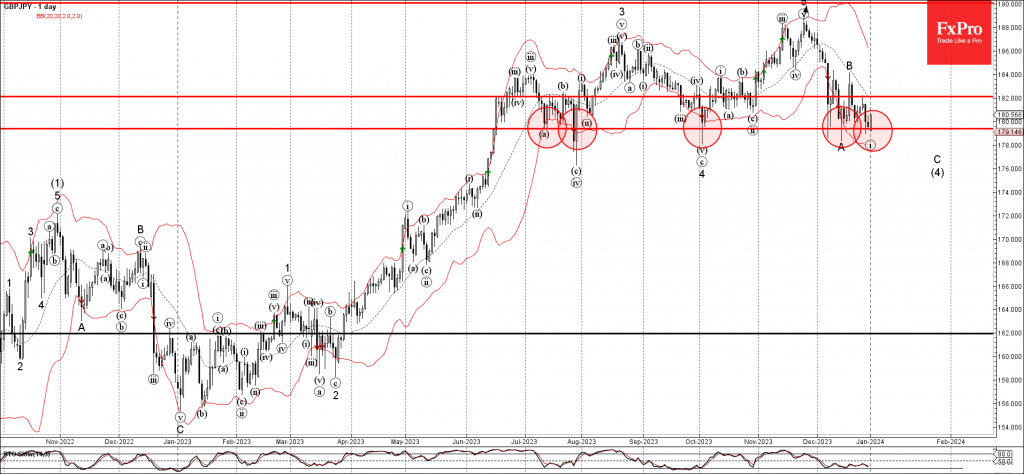

January 2, 2024

– GBPJPY reversed from support level 179.40 – Likely to rise to resistance level 182.00 GBPJPY currency pair recently reversed up from the multi-month support level 179.40 (which has steadily reversed the pair from the start of July). The support.