Technical analysis - Page 123

February 21, 2024

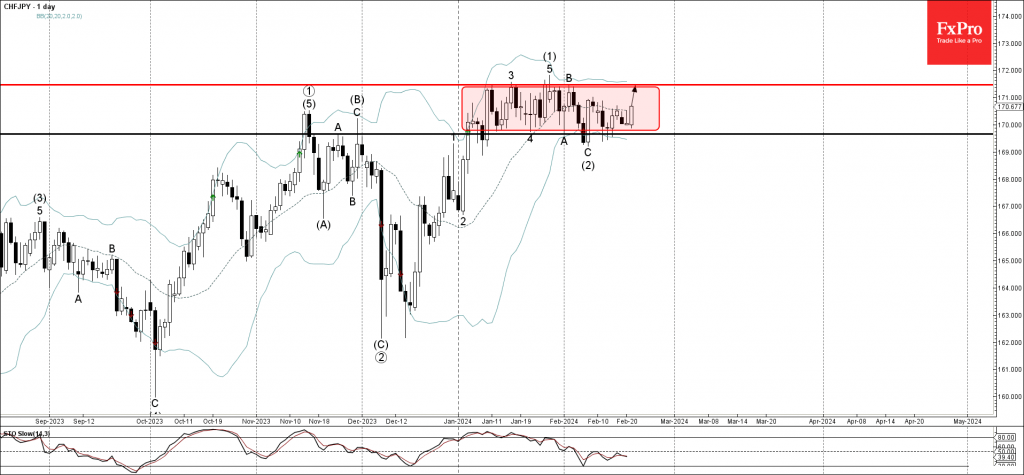

– CHFJPY reversed from support level 169.65 – Likely to rise to resistance level 171.45 CHFJPY currency pair recently reversed up from the key support level 169.65 (lower boundary of the narrow sideways price range inside which the pair has.

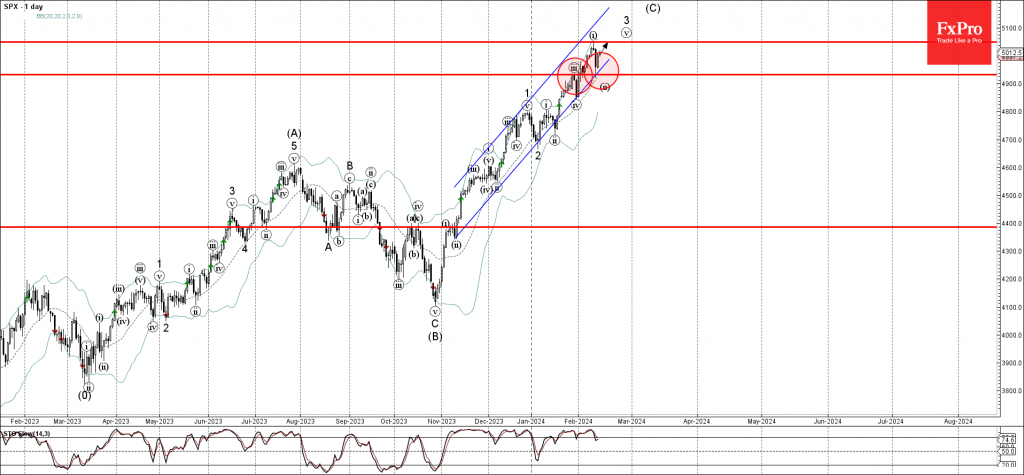

February 21, 2024

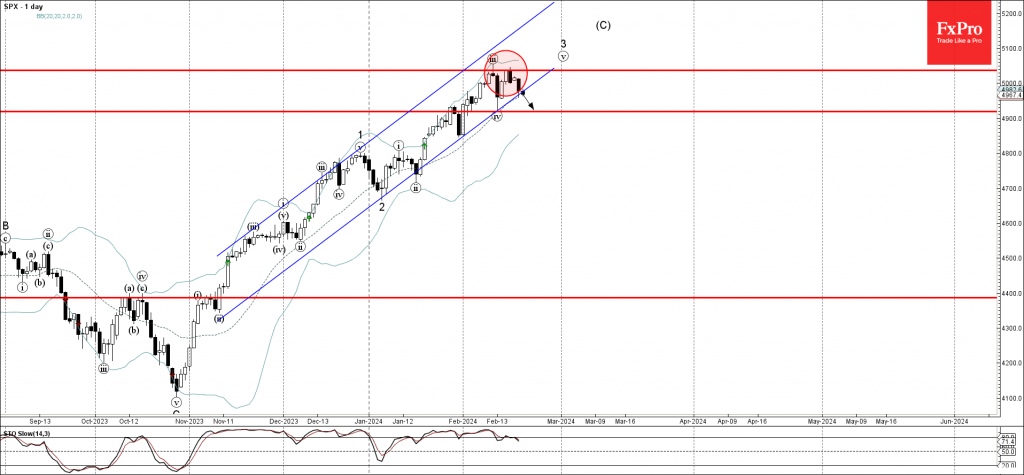

– S&P 500 reversed from resistance level 5035.00 – Likely to fall to support level 4920.00 S&P 500 index recently reversed down from the pivotal resistance level 5035.00 (which stopped the previous minor impulse wave iii at the start of.

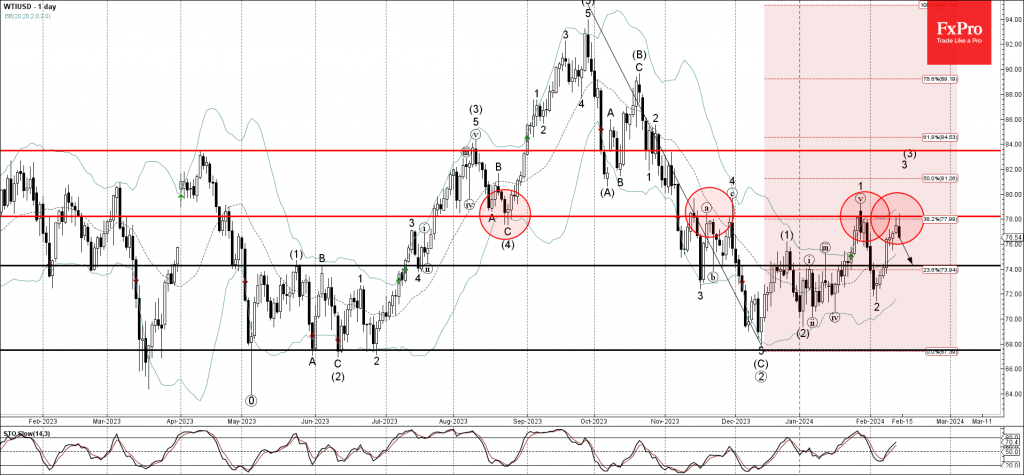

February 20, 2024

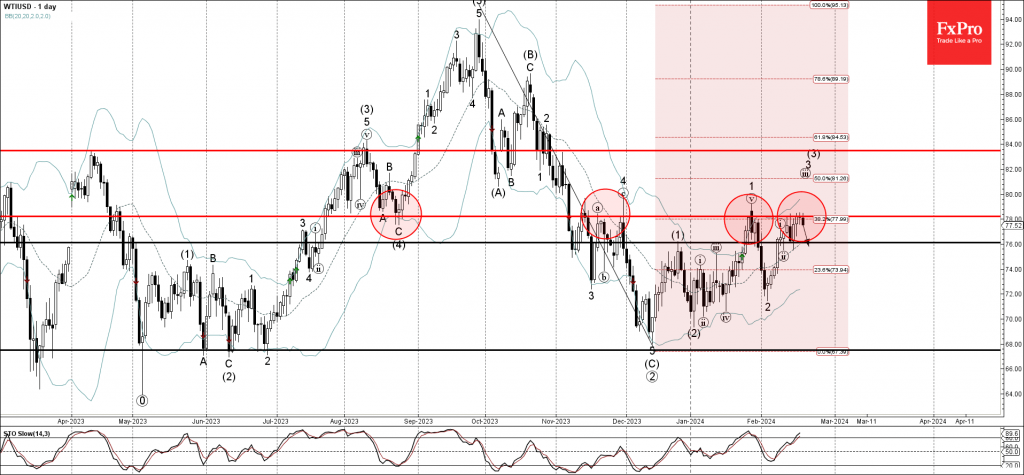

– WTI crude oil reversed from resistance level 78.20 – Likely to fall to support level 76.00 WTI crude oil recently reversed down from the key resistance level 78.20 (former support from August, which has been reversing the price from.

February 20, 2024

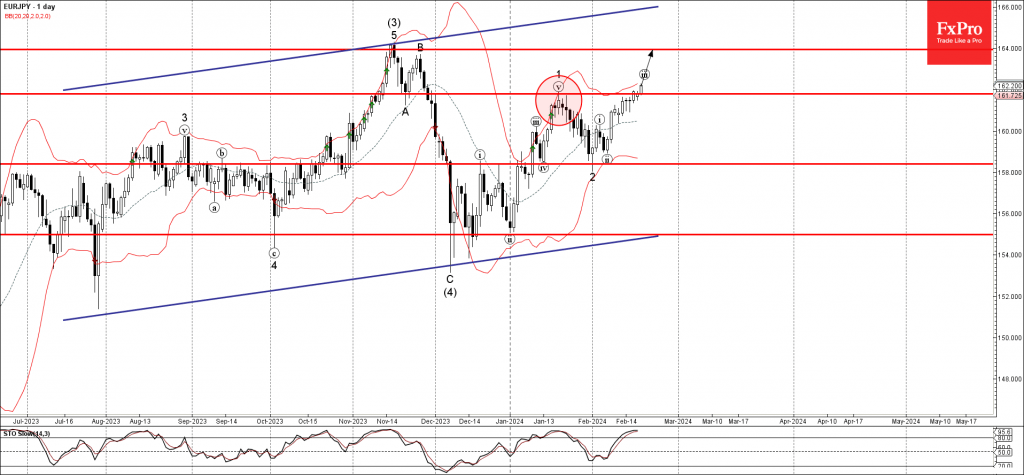

– EURJPY broke resistance level 161.80 – Likely to rise to resistance level 164.00 EURJPY currency pair continues to rise steadily after the price broke the resistance level 161.80 (which stopped the previous minor impulse wave 1 in the middle.

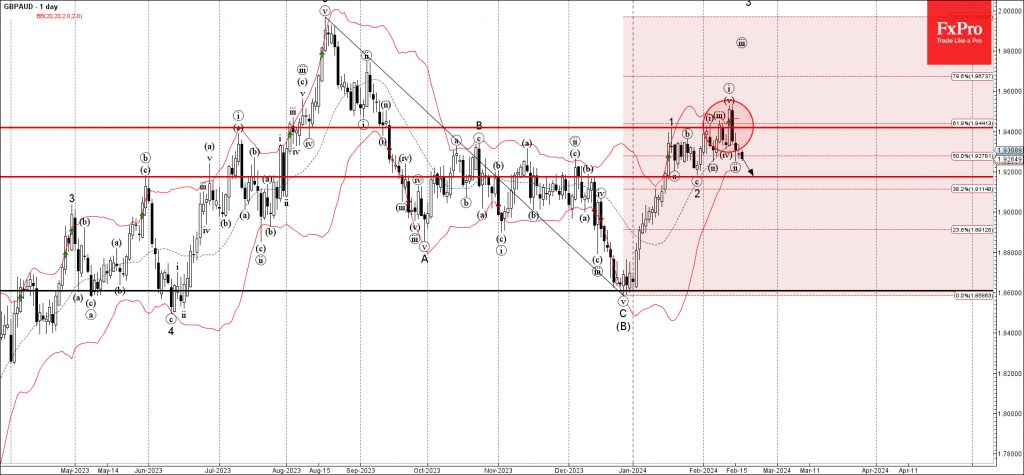

February 19, 2024

GBPAUD currency pair recently reversed down from the resistance level 1.9400 (which has been repeatedly reversing the pair from the middle of January). The downward reversal from the resistance level 1.9400 created the 3rd consecutive candlesticks reversal pattern Bearish Engulfing..

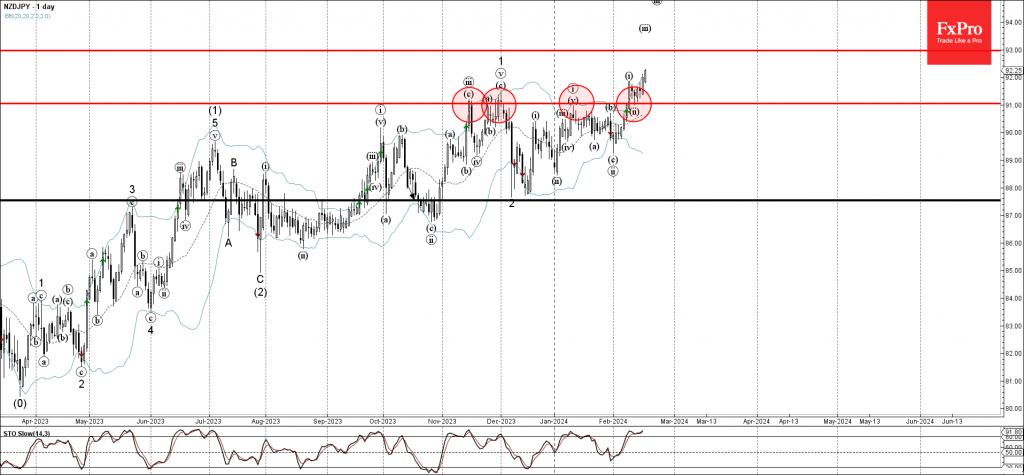

February 19, 2024

– NZDJPY reversed from support level 91.00 – Likely to rise to resistance level 93.00 NZDJPY currency pair recently reversed up from the support level 91.00 (former resistance which has been reversing the price from November). The upward reversal from.

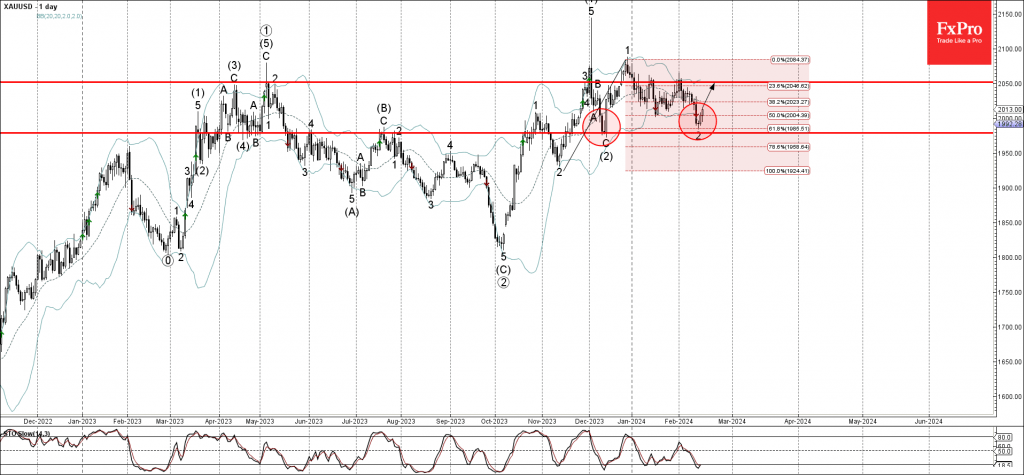

February 16, 2024

– Gold reversed from support level 1980.00 – Likely to rise to resistance level 2050.00 Gold recently reversed up from the support level 1980.00 (which formed the daily Morning Star in December), intersecting with the lower daily Bollinger Band and.

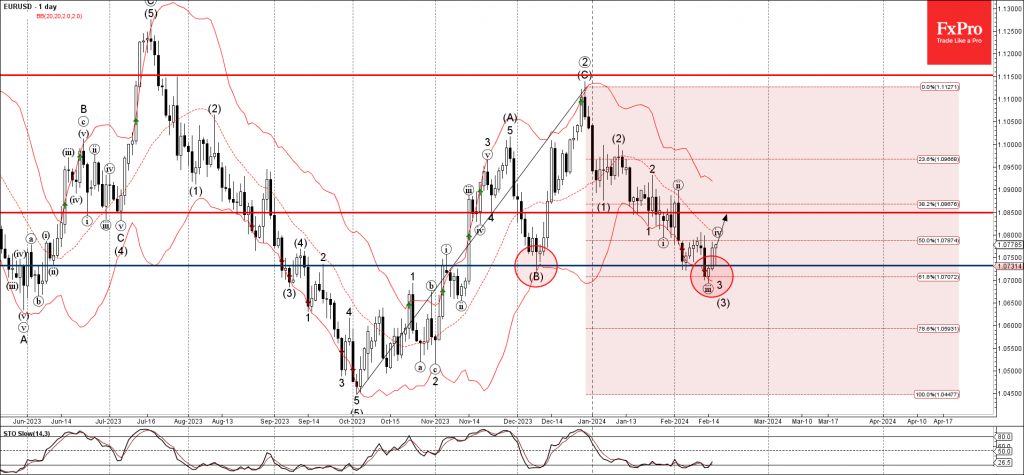

February 16, 2024

– EURUSD reversed from support level 1.0730 – Likely to rise to resistance level 1.0850 EURUSD currency pair recently reversed up from the support level 1.0730 (previous monthly low from December), intersecting with the lower daily Bollinger Band and the.

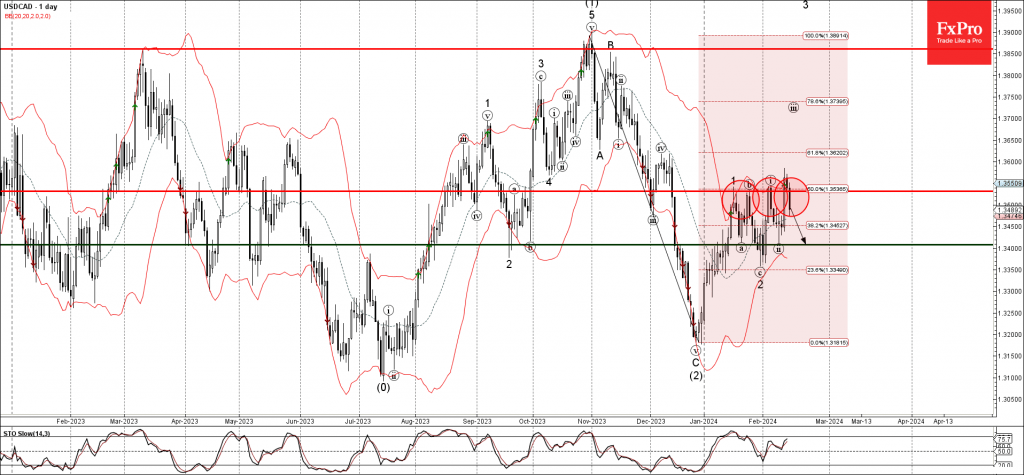

February 15, 2024

– USDCAD reversed from resistance level 1.3530 – Likely to fall to support level 1.3400 USDCAD currency pair recently reversed down from the key resistance level 1.3530 (which has been reversing the price from the middle of January), intersecting with.

February 15, 2024

– S&P 500 reversed from support level 4930.00 – Likely to rise to resistance level 5050.00 S&P 500 index recently reversed up from the support level 4930.00 (former support from the end of January), intersecting with the 20-day moving average.

February 14, 2024

– WTI crude oil reversed from resistance level 78.00 – Likely to fall to support level 74.00 WTI crude oil recently reversed down from the pivotal resistance level 78.00 (former support from August, which has been reversing the price from.