Technical analysis - Page 119

April 5, 2024

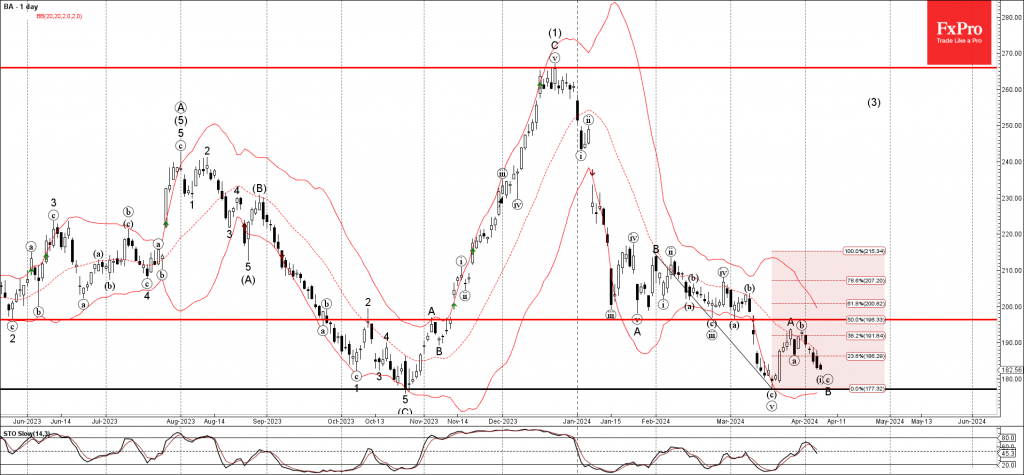

– Boeing reversed from resistance area – Likely to fall to support level 177.20 Boeing recently reversed down from the resistance area set between the key resistance level 196.34 (former support from February and March) standing near the 50% Fibonacci.

April 4, 2024

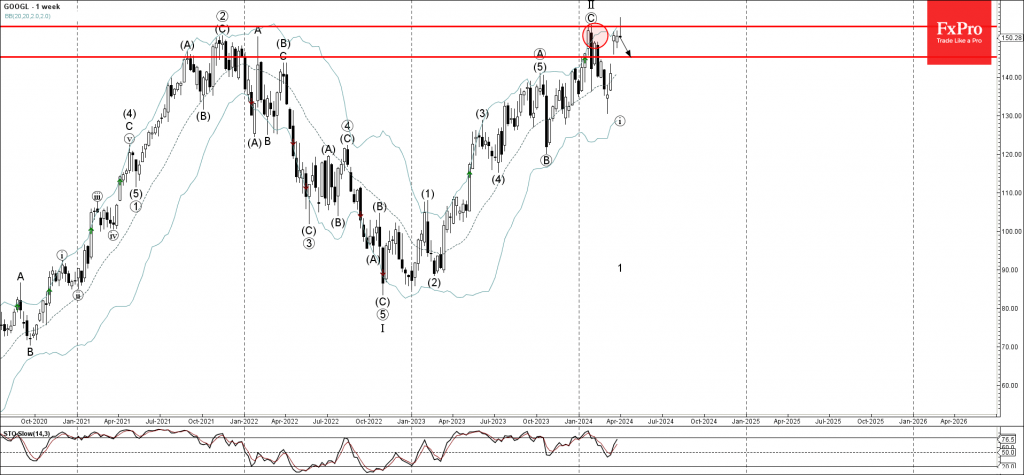

– Google reversed from key resistance level 153.20 – Likely to fall to support level 145.25 Google recently reversed down from the major resistance zone located between the key resistance level 153.20 (which stopped the weekly uptrend at the start.

April 4, 2024

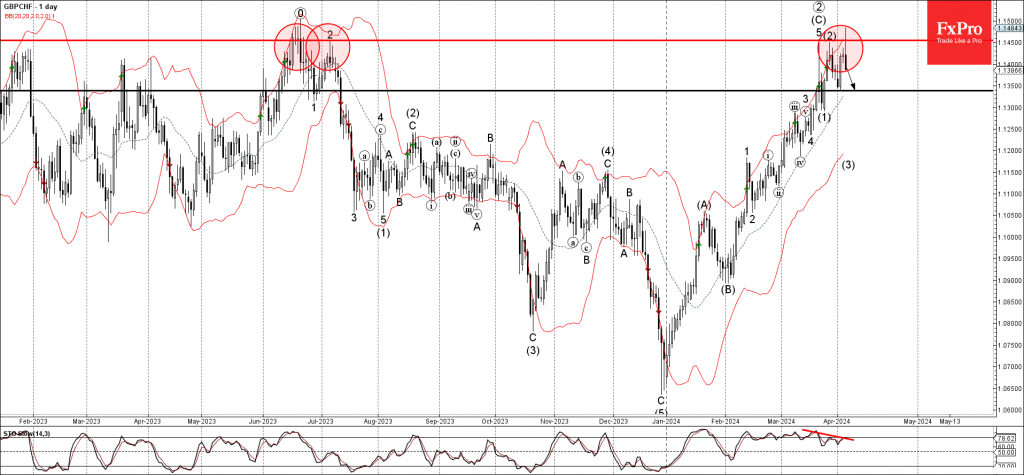

– GBPCHF reversed from resistance zone – Likely to fall to support level 1.1340 GBPCHF recently reversed down from the major resistance zone located between the resistance level 1.1450 (which has been reversing the pair from last June) and the.

April 3, 2024

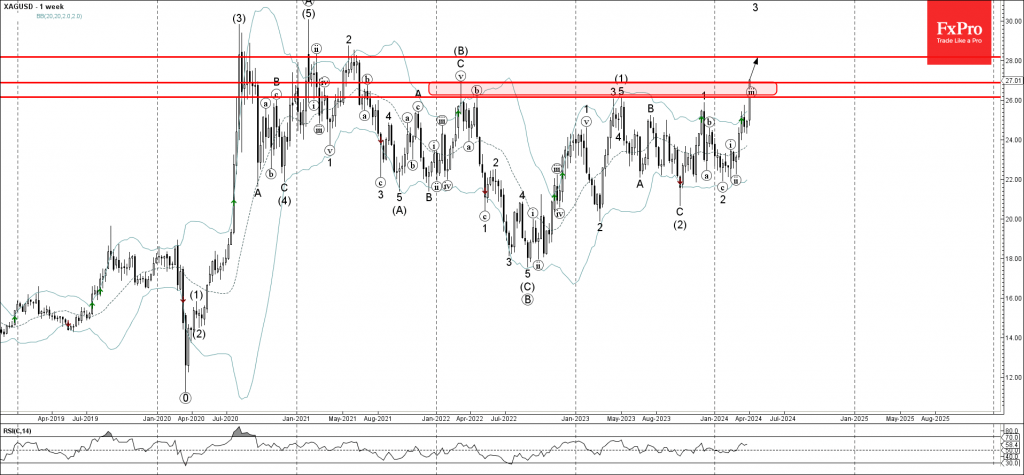

– Silver broke major resistance zone – Likely to rise to resistance level 28.00 Silver under the bullish pressure after the recent breakout of the major resistance zone located between the resistance levels 26.15 and 26.90 (previous yearly highs from.

April 3, 2024

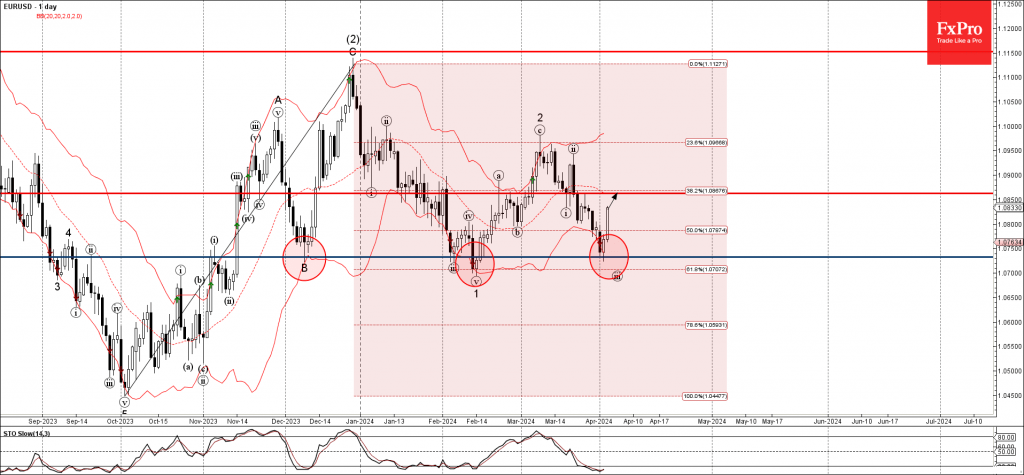

– EURUSD reversed from key support level 1.0730 – Likely to rise to resistance level 1.0860 EURUSD currency pair recently reversed up from the key support level 1.0730, which has been reversing the pair from the start of December, standing.

April 2, 2024

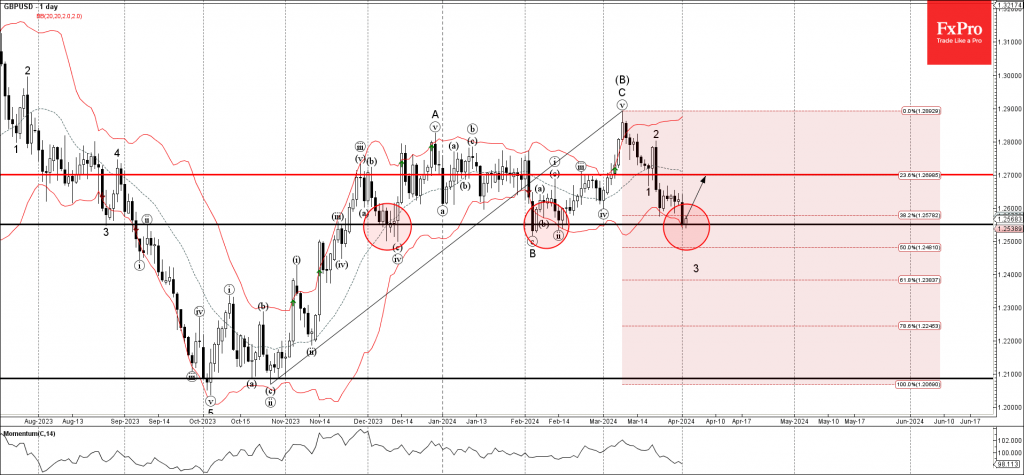

– Sterling reversed from pivotal support level 1.2550 – Likely to rise to resistance level 1.2700 Sterling recently reversed up from the pivotal support level 1.2550, which has been reversing the pair from the start of December, as can be.

April 2, 2024

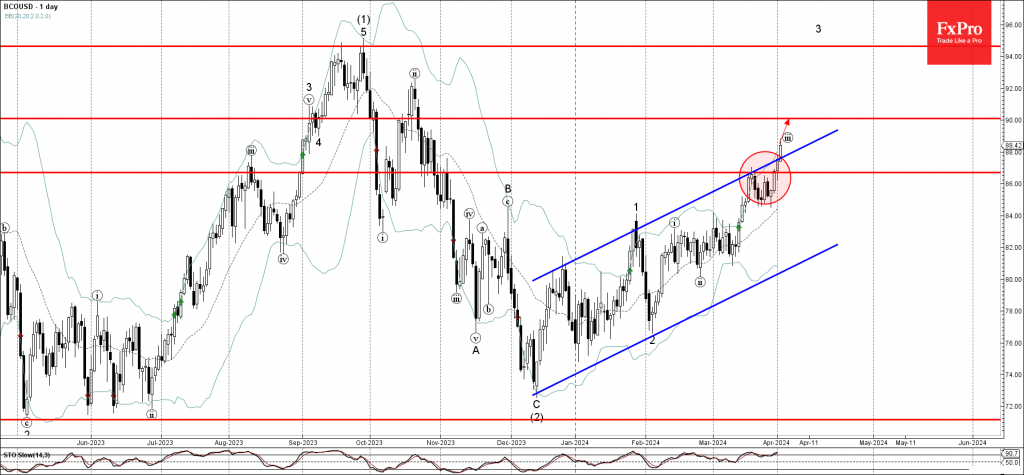

– Brent crude oil broke resistance level 86.70 – Likely to rise to resistance level 90.00 Brent crude oil recently broke the resistance level 86.70, which reversed the price with the daily Evening Star in March. The breakout of the.

April 1, 2024

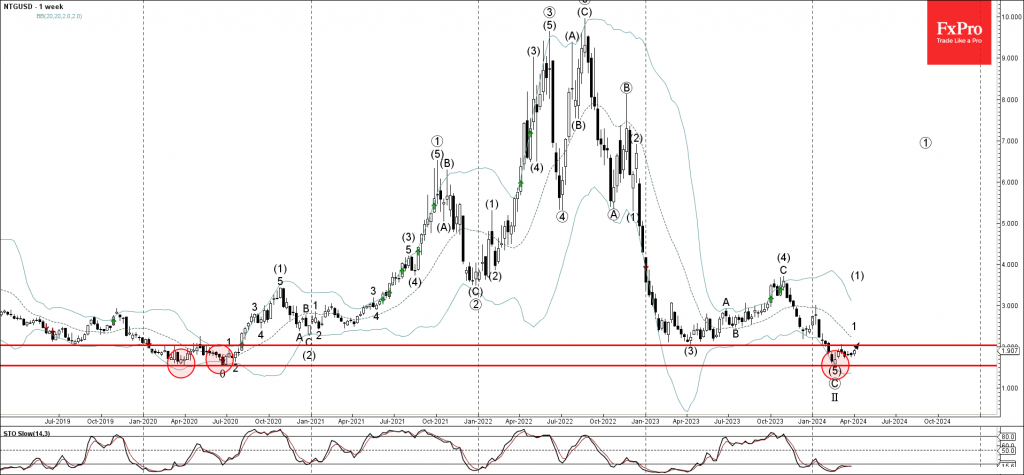

– Natural gas reversed from multi-month support level 1.541 – Likely to rise to resistance level 2.030 Natural gas recently reversed up from the multi-month support level 1.541, which reversed the price twice in the middle of 2020. The support.

April 1, 2024

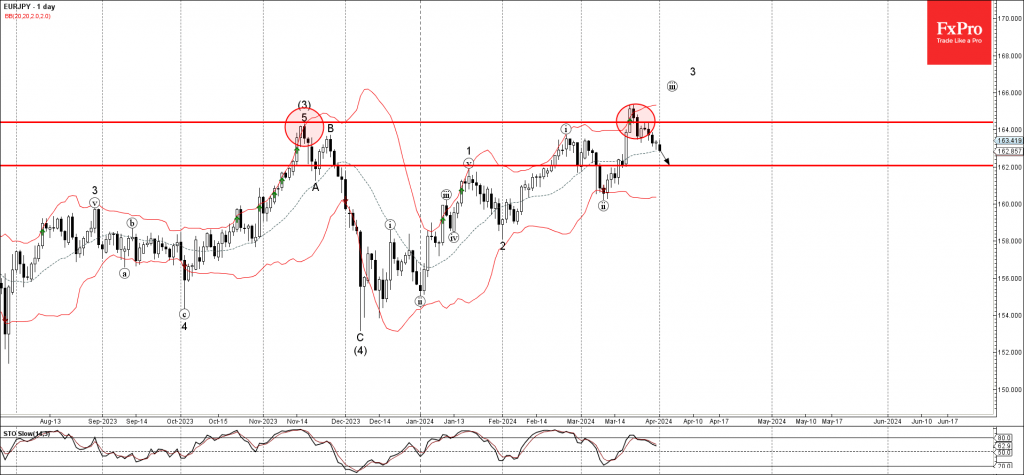

– EURJPY reversed from resistance level 164.30 – Likely to fall to support level 162.00 EURJPY currency pair recently reversed down from the resistance level 164.30, former multi month high from the middle of November. The resistance level 164.30 was strengthened by.

March 29, 2024

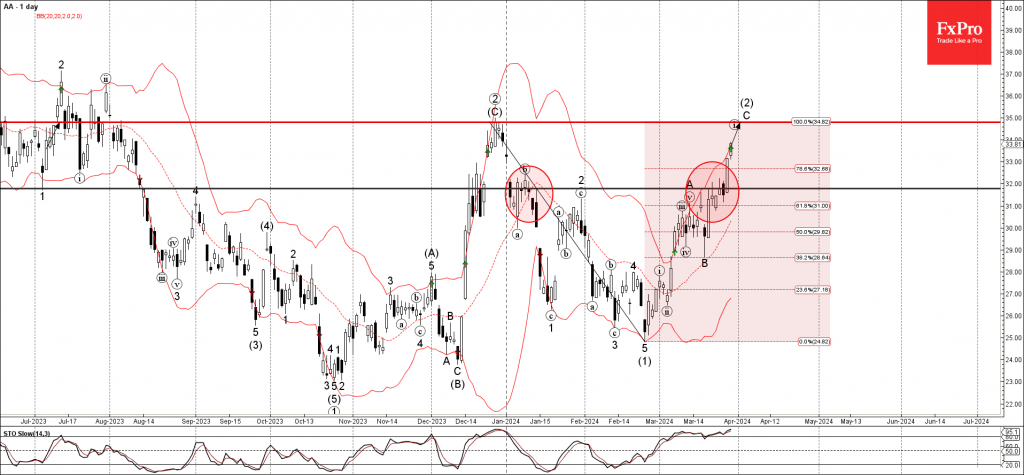

– Alcoa broke resistance level 32.00 – Likely to rise to resistance level 35.00 Alcoa recently broke the resistance level 32.00, which has been reversing the price from the start of January – which accelerated the active impulse wave C. The.

March 29, 2024

– Gold rising inside weekly impulse wave 3 – Likely to rise to resistance level 2300.00 Gold rising inside the sharp weekly impulse wave 3, which recently broke the resistance trendline of the daily up channel from November. The breakout.