Technical analysis - Page 118

April 12, 2024

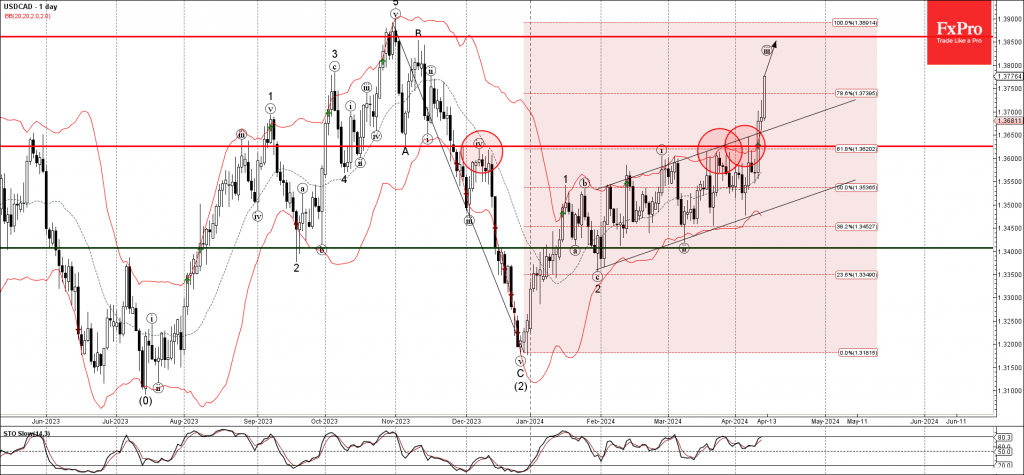

– USDCAD broke key resistance level 1.3625 – Likely to rise to resistance level 1.3860 USDCAD rising strongly after the earlier breakout of the key resistance level 1.3625 (which has been reversing the price from December) intersecting with the 61.8%.

April 12, 2024

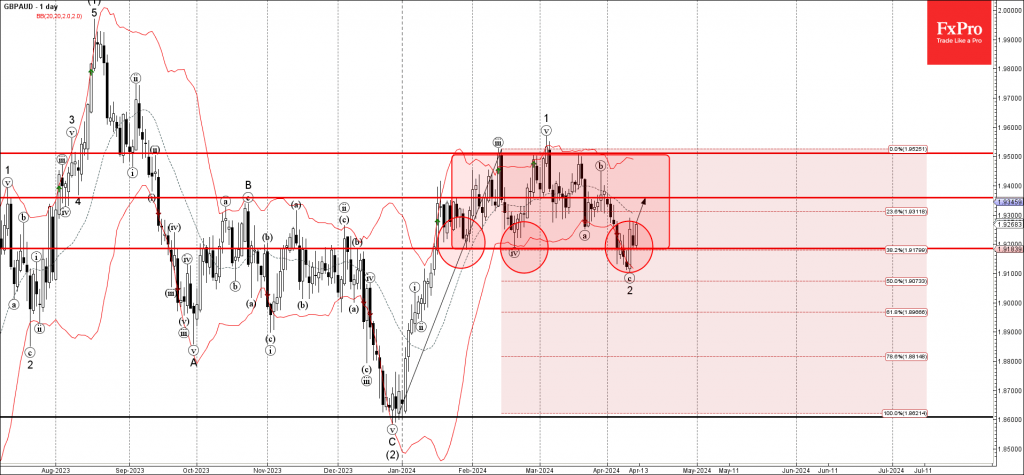

– GBPAUD reversed from support level 1.918 – Likely to rise to resistance level 1.9360 GBPAUD recently reversed up from the key support level 1.918 (which has been reversing the price from January). The support level 1.918 was strengthened by.

April 11, 2024

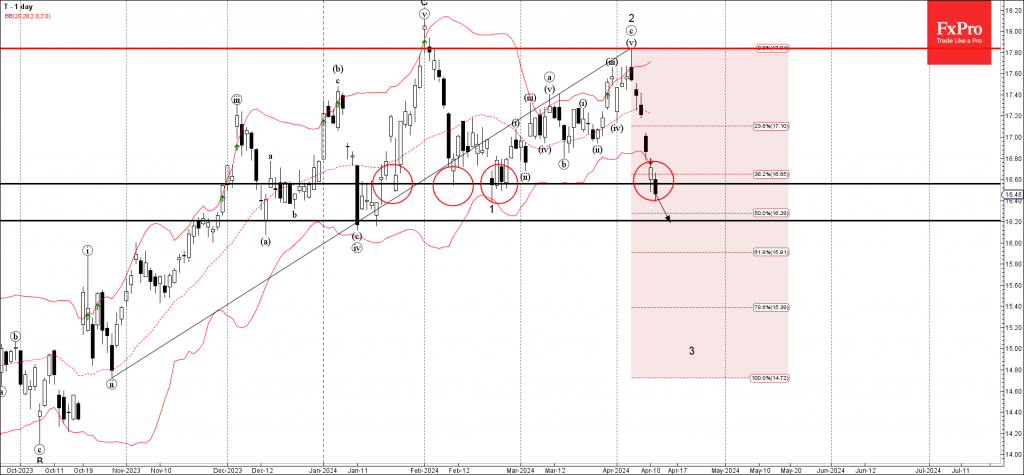

– AT&T broke key support level 16.60 – Likely to fall to support level 16.20 AT&T under the bearish pressure after the price broke the key support level 16.60 (which has been reversing the price from January). The breakout of.

April 11, 2024

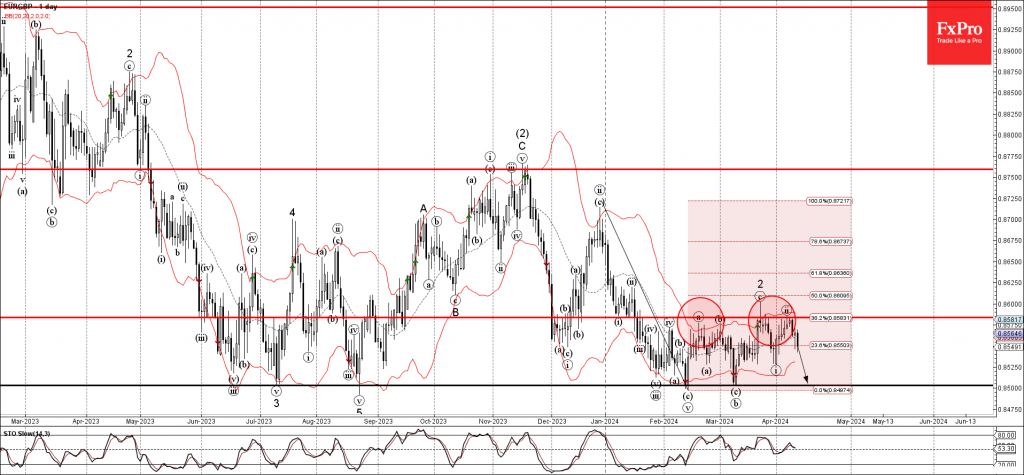

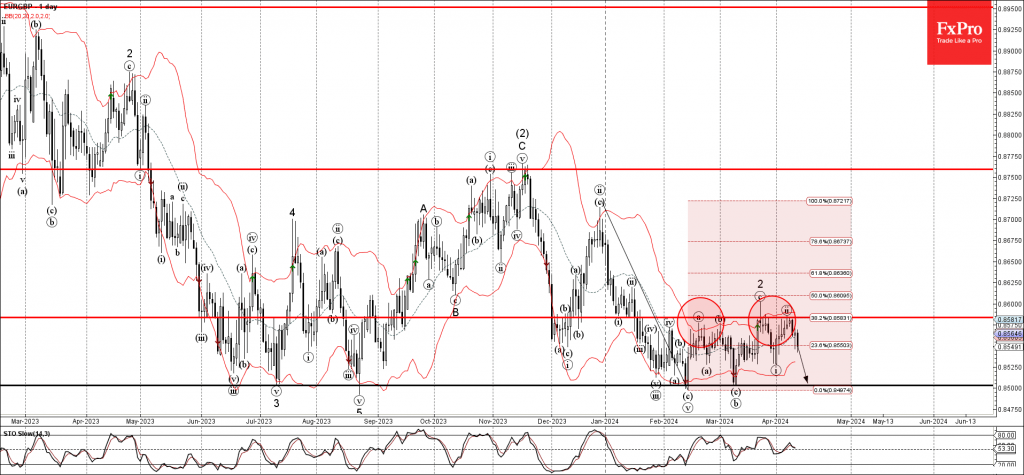

– EURGBP reversed from resistance level 0.8585 – Likely to fall to support level 0.8500 EURGBP currency pair recently reversed down from the pivotal resistance level 0.8585 (which has been reversing the price from February). The resistance level 0.8585 was.

April 11, 2024

– EURGBP reversed from resistance level 0.8585 – Likely to fall to support level 0.8500 EURGBP currency pair recently reversed down from the pivotal resistance level 0.8585 (which has been reversing the price from February). The resistance level 0.8585 was.

April 11, 2024

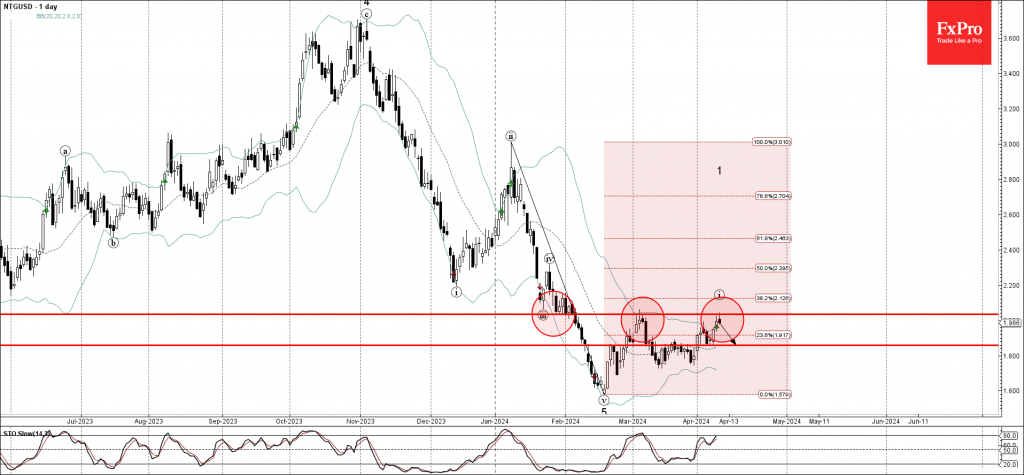

– Natural gas reversed from key resistance level 2.035 – Likely to fall to support level 1.860 Natural gas recently reversed down from the key resistance level 2.035 (former strong support from the end of January and the monthly high.

April 11, 2024

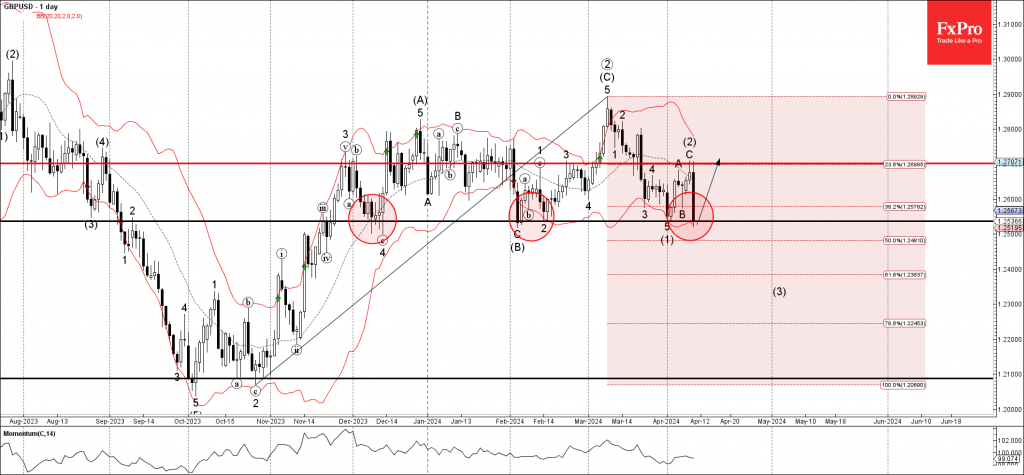

– GBPUSD reversed from support level 1.2535 – Likely to rise to resistance level 1.2700 GBPUSD currency pair recently reversed up from the key support level 1.2535, which has been steadily reversing the price from the start of December. The.

April 9, 2024

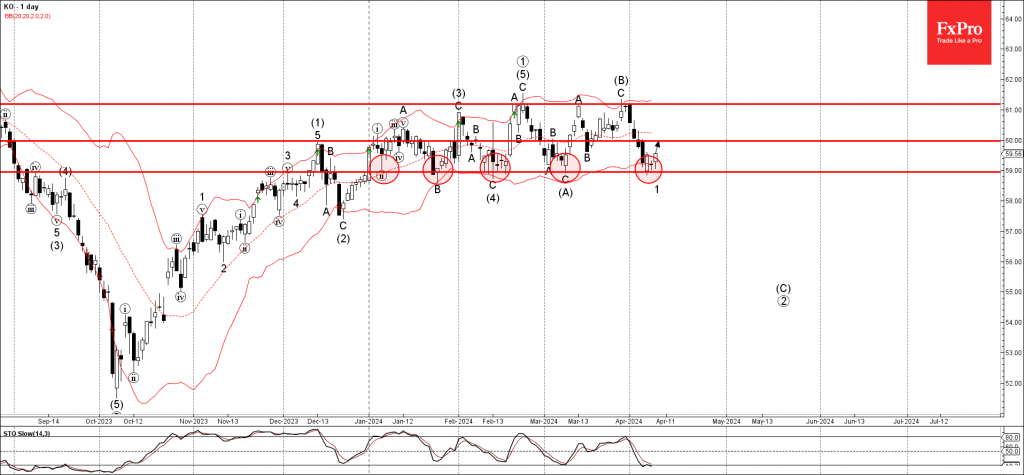

– Coca-Cola reversed from pivotal support level 59.00 – Likely to rise to resistance level 60.00 Coca-Cola today reversed from the pivotal support level 59.00, which has been steadily reversing the price from last April. The support level 59.00was strengthened.

April 9, 2024

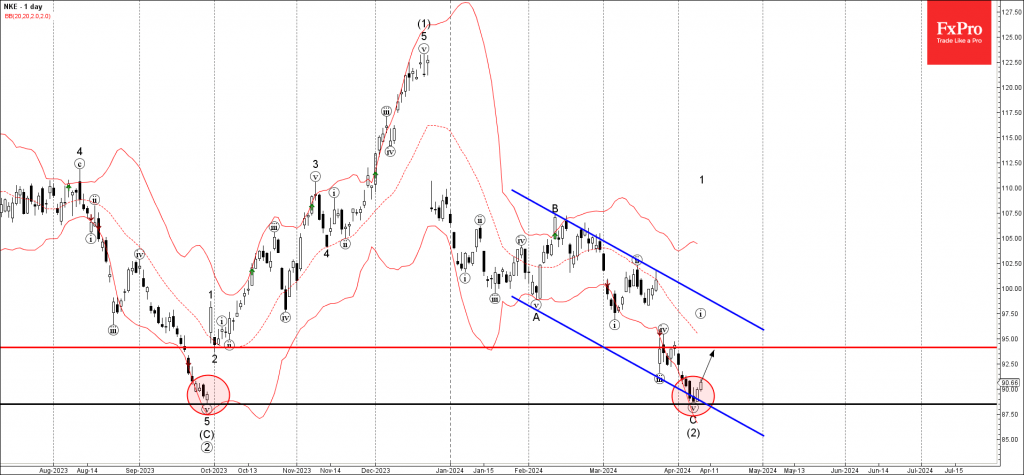

– Nike reversed from powerful support level 88.50 – Likely to rise to resistance level 95.00 Nike recently reversed up with the daily Morning Star from the powerful support level 88.50, which also stopped the extended downtrend in September of.

April 9, 2024

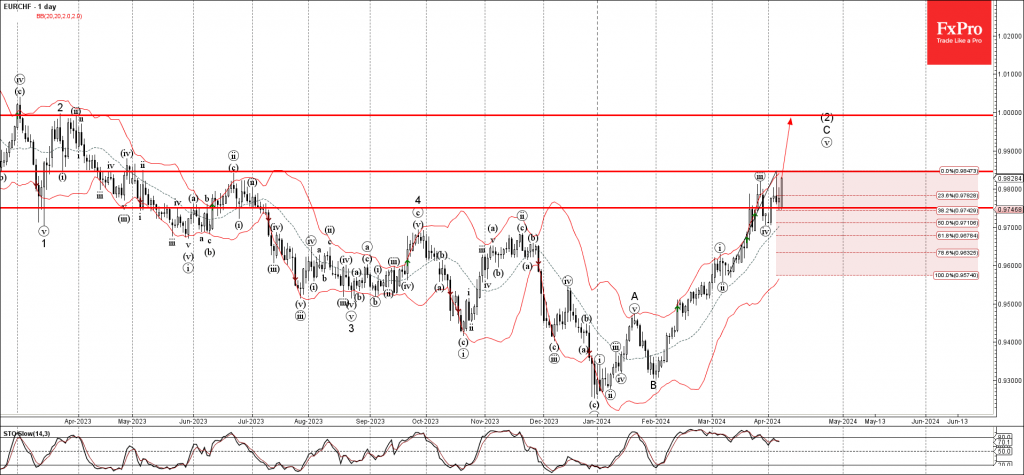

– EURCHF reversed from support level 0.9750 – Likely to rise to resistance level 0.9845 and 1 EURCHF rising after the recent upward reversal from the support level 0.9750 intersecting with the 38.2% Fibonacci correction of the upward impulse from.

April 9, 2024

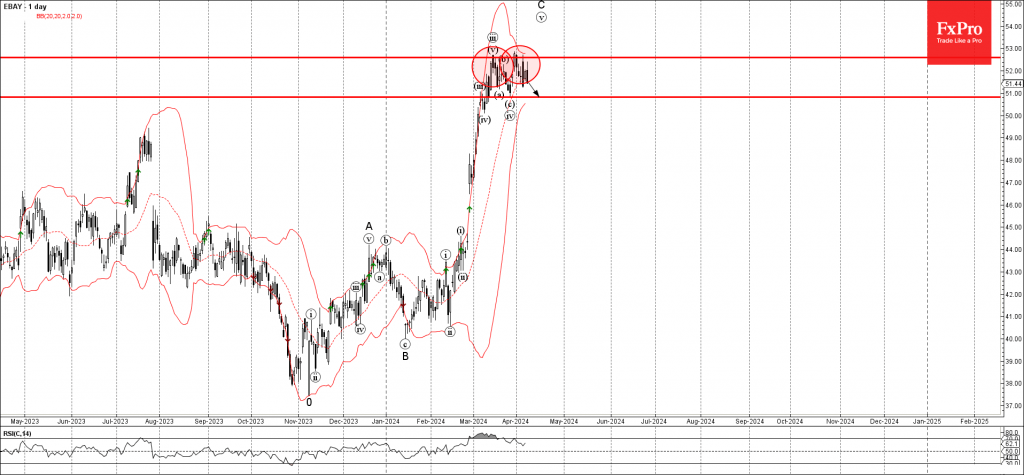

– Ebay reversed from key resistance level 52.60 – Likely to rise to support level 50.95 Ebay recently reversed down from the key resistance level 52.60 (which has been steadily reversing the price from the start of March) standing near.