Technical analysis - Page 117

April 23, 2024

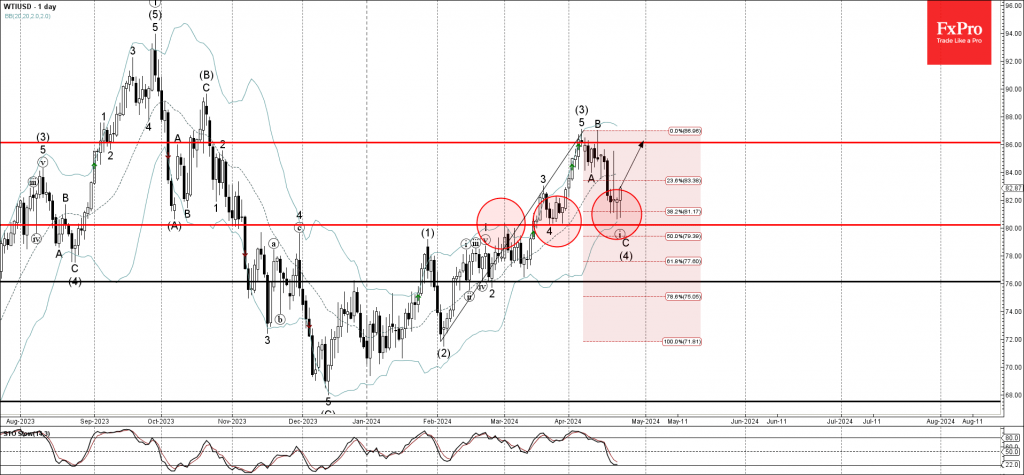

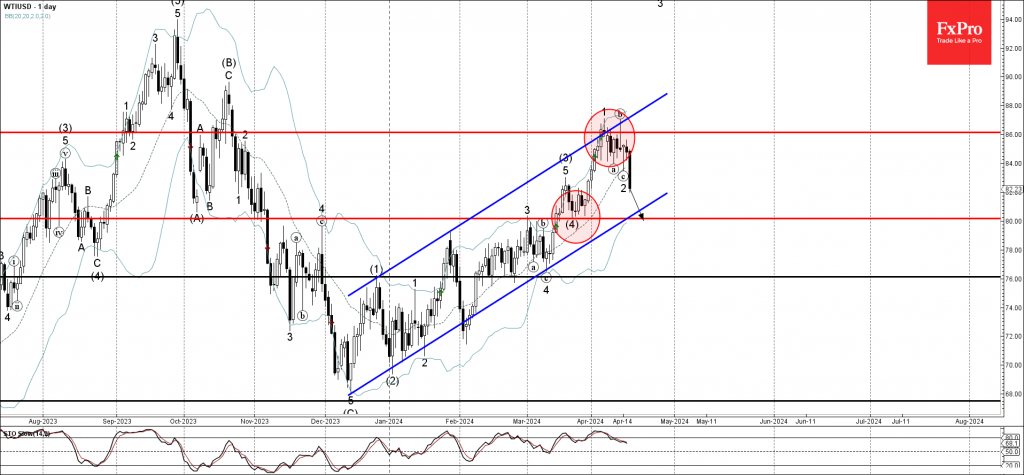

– WTI crude oil reversed from support zone – Likely to rise to resistance level 86.00 WTI crude oil recently reversed up from the support zone lying between the round support level 80.00 (low of wave (iv) from March), lower.

April 23, 2024

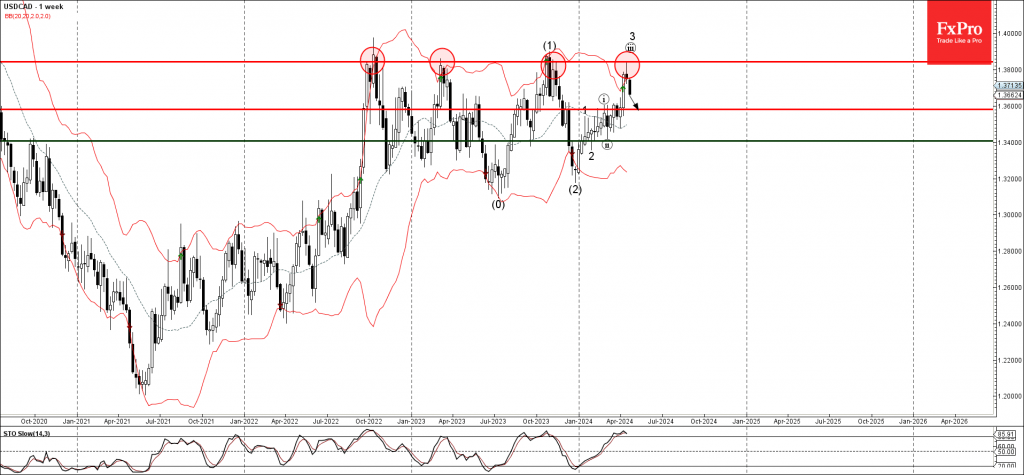

– USDCAD reversed from long-term resistance level 1.3840 – Likely to fall to support level 1.3600 USDCAD currency pair continues to fall after the pair reversed down with the weekly Shooting Star from the major long-term resistance level 1.3840, which.

April 19, 2024

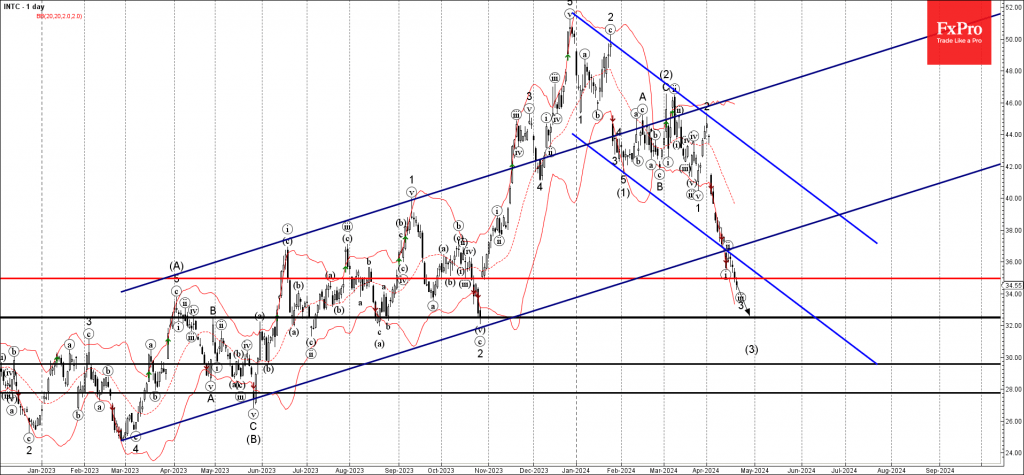

– Intel broke support zone – Likely to fall to support level 32.50 Intel continues to fall inside the sharp minor impulse wave 1, which previously broke the support zone lying at the intersection of the two daily channels from.

April 19, 2024

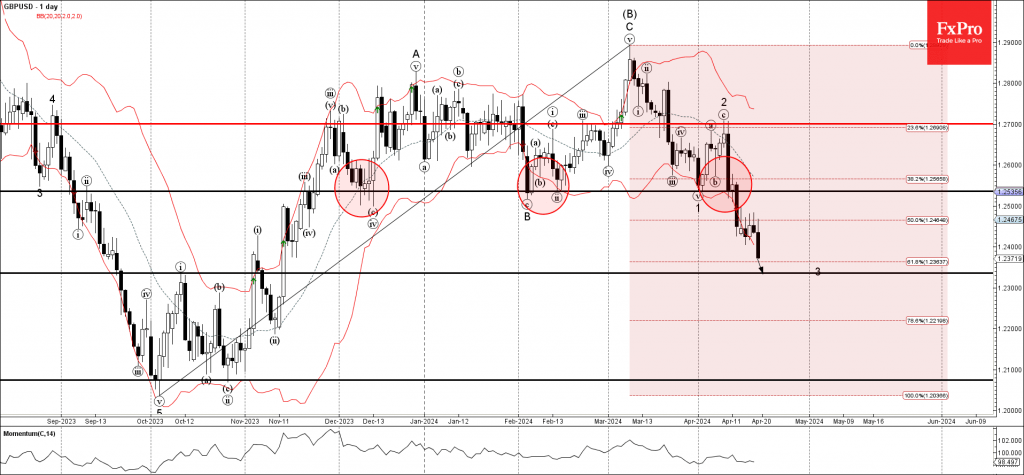

– GBPUSD broke key support level 1.2535 – Likely to fall to support level 1.2335 GBPUSD currency pair continues to fall strongly after breaking the key support level 1.2535, which has been steadily reversing the price from December. The breakout.

April 18, 2024

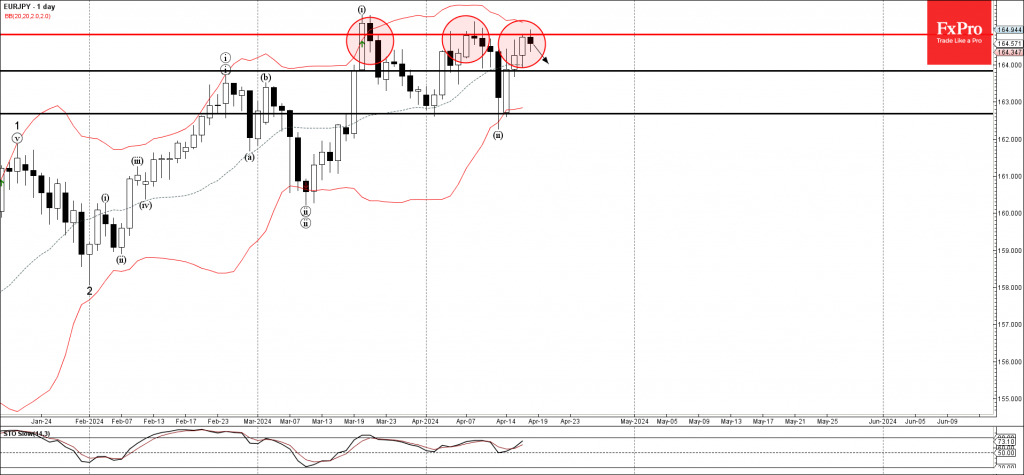

– EURJPY reversed from resistance level 164.00 – Likely to fall to support level 163.85 EURJPY currency pair recently reversed down from the pivotal resistance level 164.00, which has been reversing the price from last month. The resistance level 164.00.

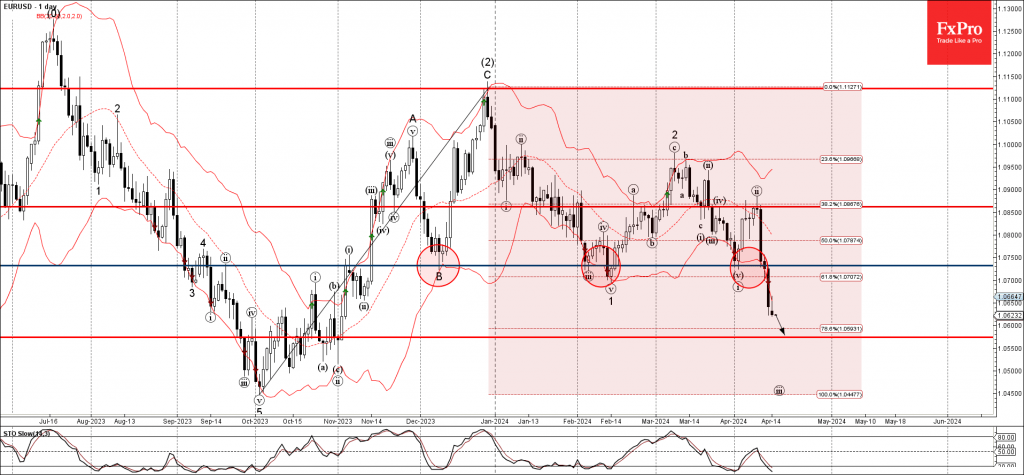

April 18, 2024

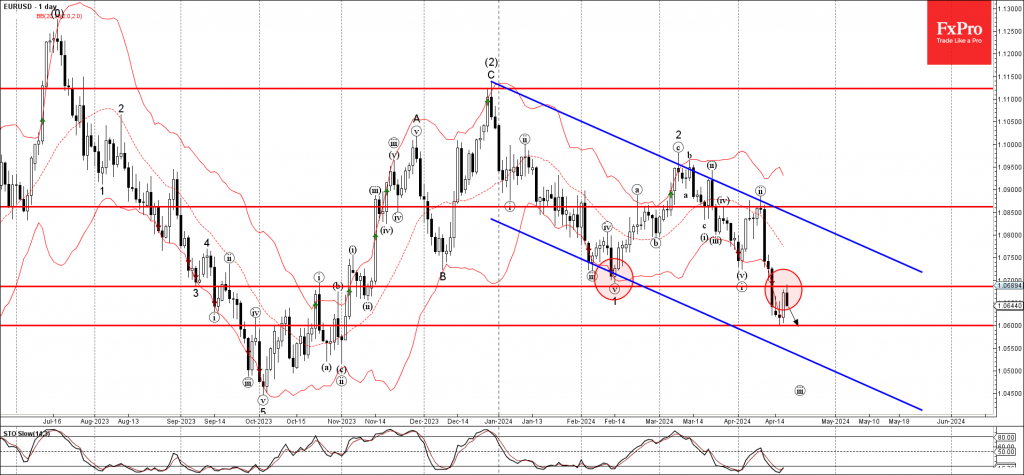

– EURUSD reversed from resistance level 1.0685 – Likely to fall to support level 1.0600 EURUSD currency pair recently reversed down from the resistance level 1.0685, former multi-month support from February, acting as the support after it was broken. The.

April 17, 2024

– WTI reversed from resistance zone – Likely to fall to support level 80.00 WTI crude oil recently reversed down from the resistance zone lying between the resistance level 86.00, upper daily Bollinger Band and the resistance trendline of the.

April 17, 2024

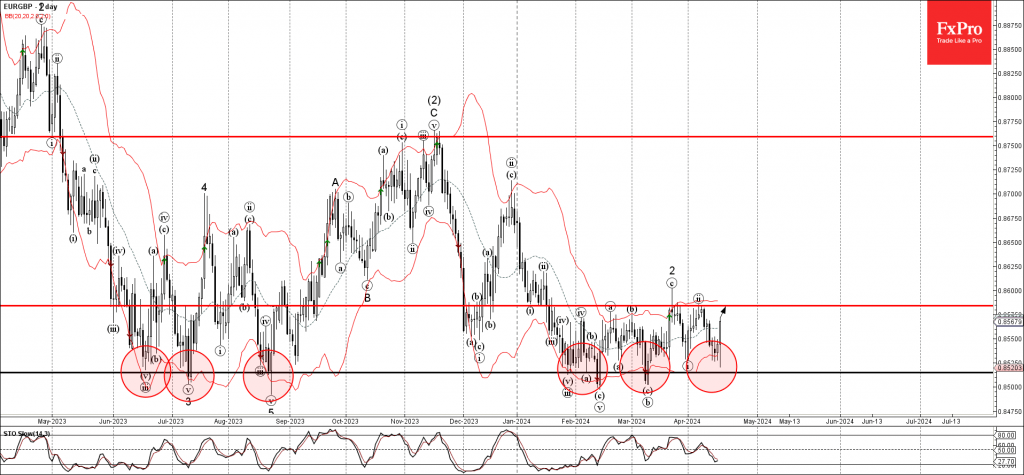

– EURGBP reversed from strong support zone – Likely to rise to resistance level 0.8585 EURGBP currency pair recently reversed up from the strong support zone surrounding the powerful support level 0.8515, which has been reversing the price from last.

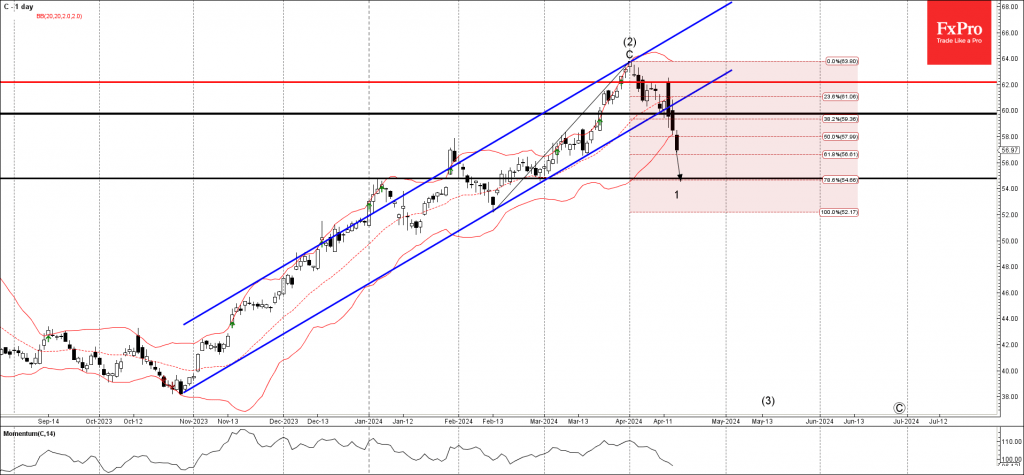

April 16, 2024

– Citigroup falling inside minor impulse wave 1 – Likely to fall to support level 54.80 Citigroup falling inside the sharp minor impulse wave 1 of the intermediate impulse wave (3) from the end of March. The price earlier broke the round.

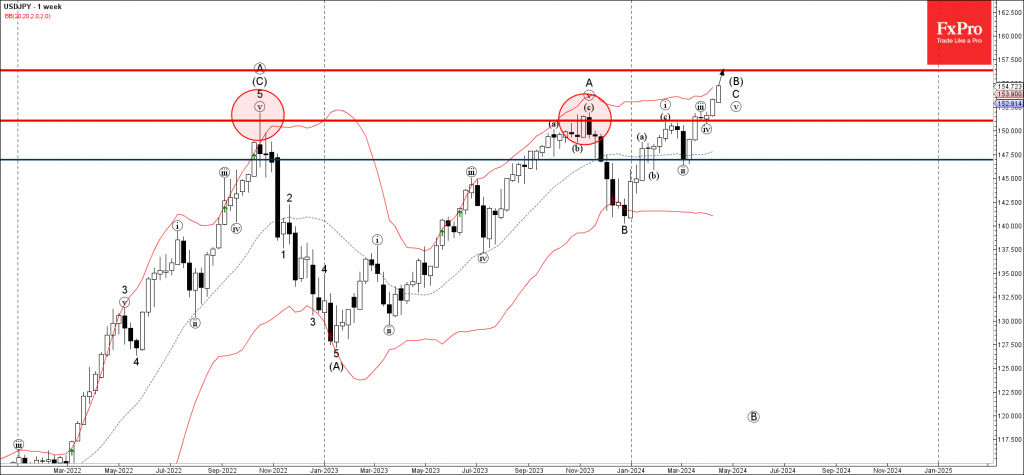

April 16, 2024

– USDJPY under the bullish pressure – Likely to rise to resistance level 156.35 USDJPY currency pair under the bullish pressure after the earlier breakout of the major resistance level 151.80, former yearly high from 2022 and 2023. The breakout.

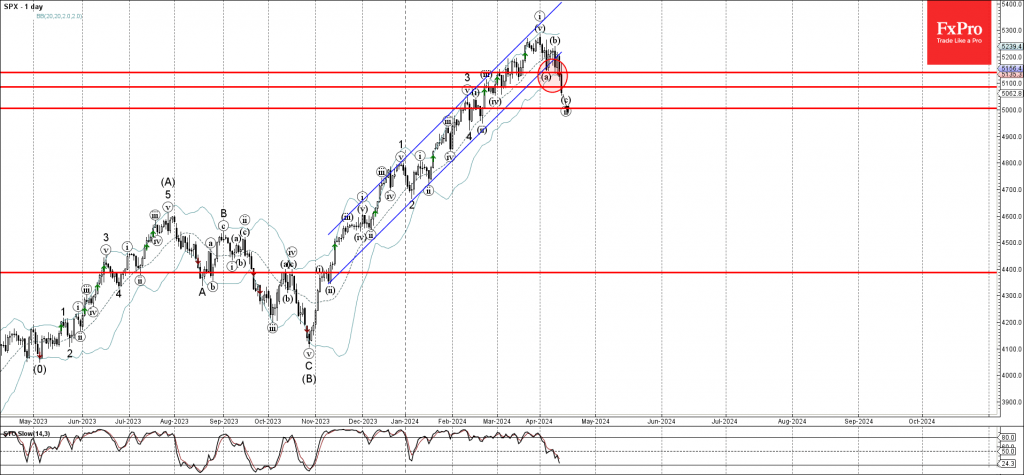

April 16, 2024

– S&P 500 falling inside sharp c-wave – Likely to fall to support level 5000.00 S&P 500 index continues to fall inside the sharp c-wave of the minor ABC correction ii from the end of last month. The price earlier.