Technical analysis - Page 116

June 5, 2024

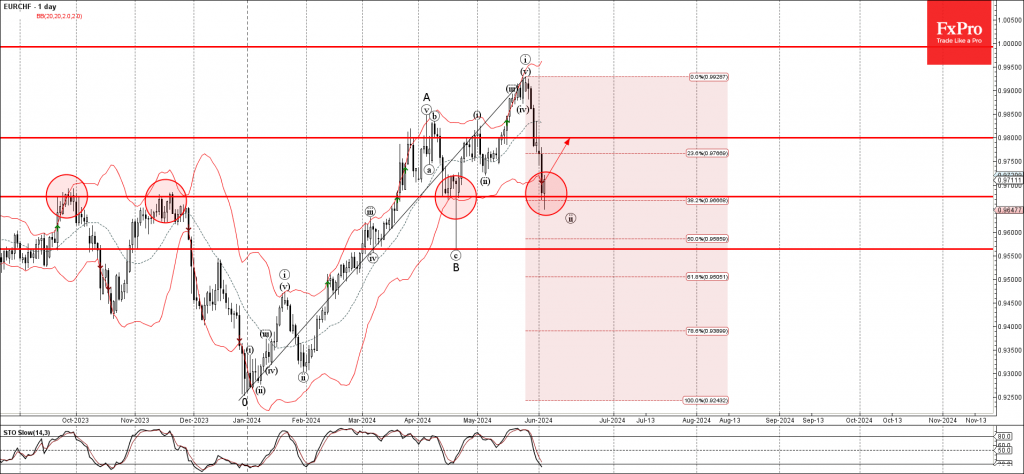

– EURCHF reversed from support level 0.9675 – Likely to rise to resistance level 0.9800 EURCHF currency pair recently reversed up from the pivotal support level 0.9675 (former resistance from November and strong support from April). The support level 0.9675.

June 4, 2024

– NZDCAD broke resistance level 0.8400 – Likely to rise to resistance level 0.8500 NZDCAD currency pair recently broke strong resistance level 0.8400 (which previously reversed the pair multiple time sin November and December). The breakout of the resistance level.

June 4, 2024

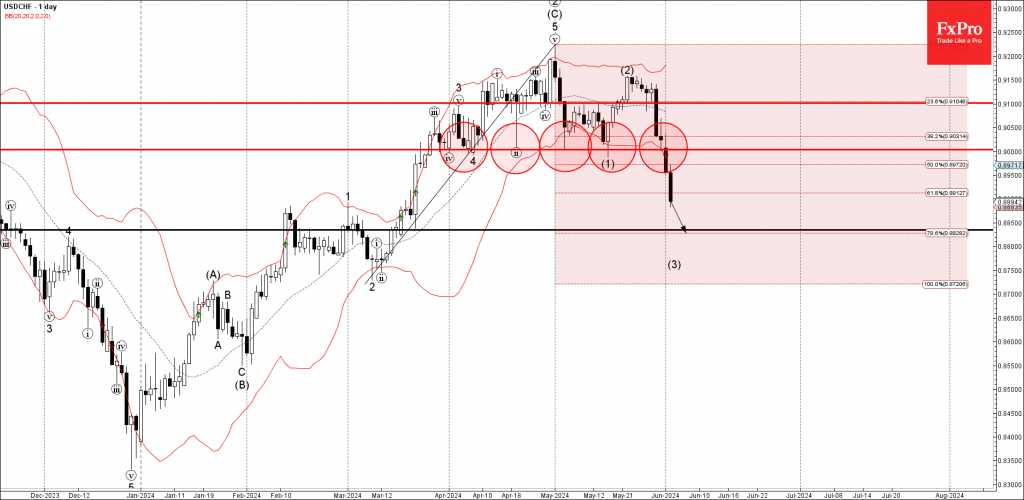

– USDCHF broke round support level 0.9000 – Likely to fall to support level 0.8850 USDCHF currency pair recently broke the round support level 0.9000 (which has been reversing the price from the start of April). The breakout of the.

June 4, 2024

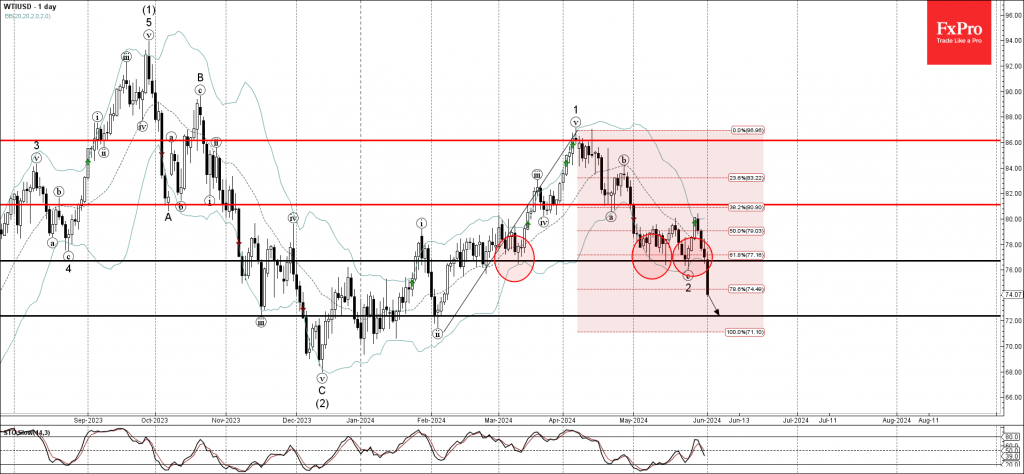

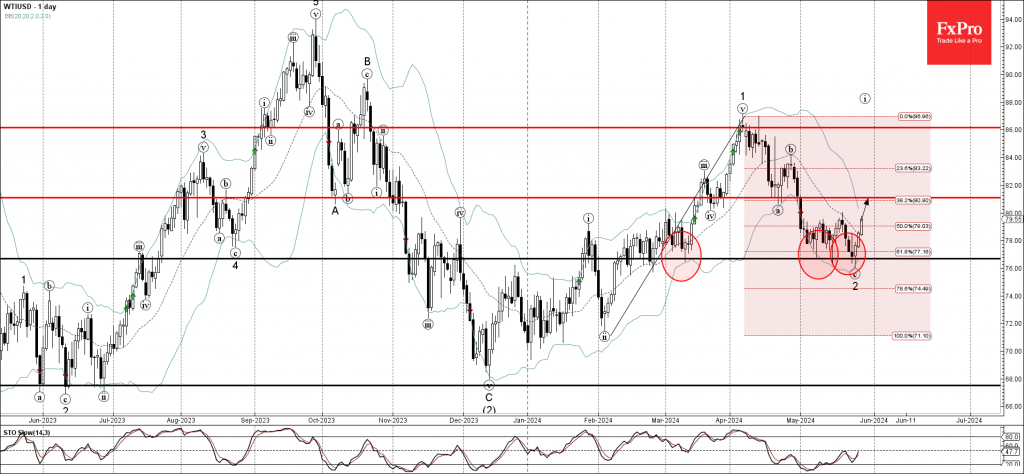

– WTI broke key support level 76.70 – Likely to fall to support level 72.00 WTI crude oil recently broke the key support level 76.70 (which has been steadily reversing the price from the middle of February). The breakout of.

June 4, 2024

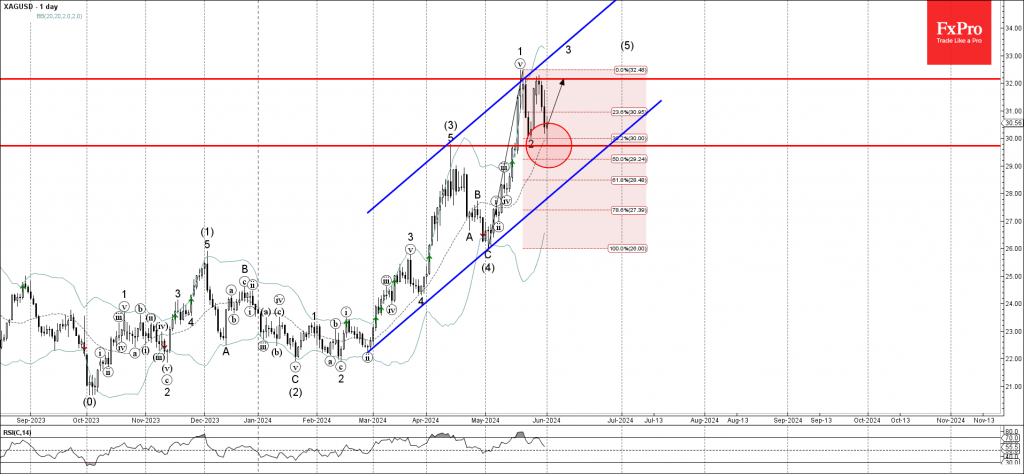

– Silver reversed from support level 29.70 – Likely to rise to resistance level 32.00 Silver recently reversed up from the key support level 29.70 (former monthly high from April), which stopped the previous intermediate impulse wave (3). The support.

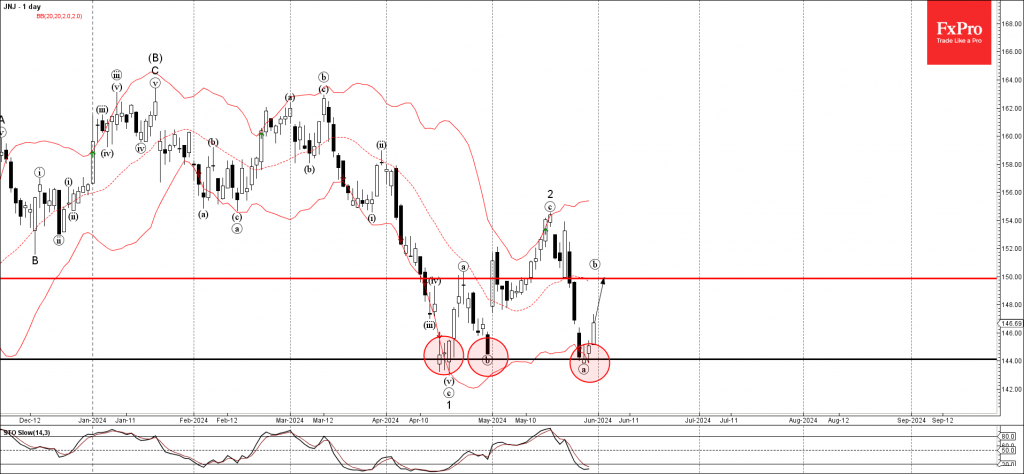

May 31, 2024

– Johnson & Johnson reversed from support level 144.00 – Likely to rise to resistance level 150.00 Johnson & Johnson recently reversed up with the daily Doji from the pivotal support level 144.00, which has been reversing the price from.

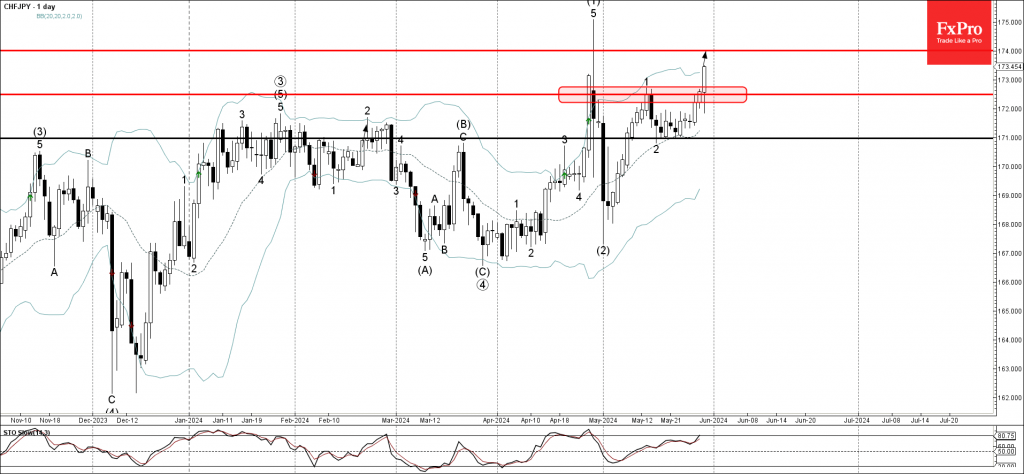

May 30, 2024

– CHFJPY broke key resistance level 172.50 – Likely to rise to resistance level 174.00 CHFJPY currency pair recently broke above the key resistance level 172.50, which has been repeatedly reversing the price from the end of April. The breakout.

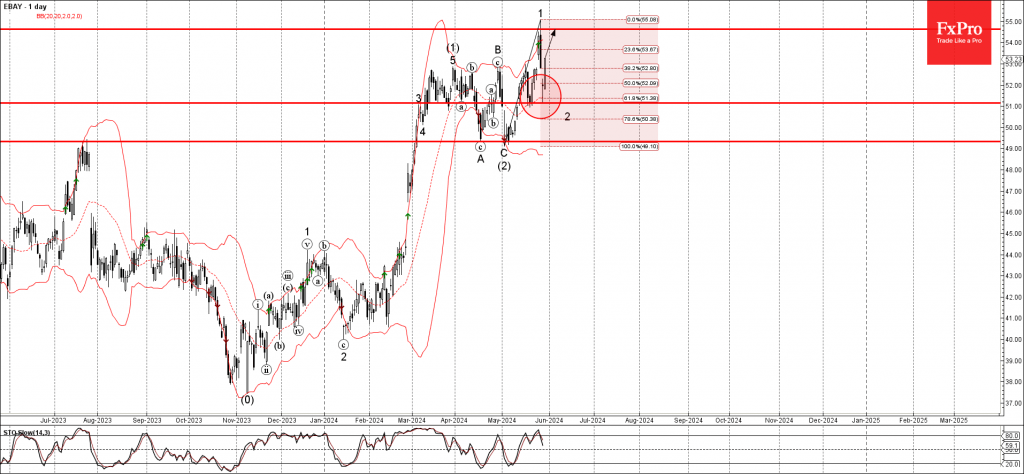

May 30, 2024

– Ebay reversed from support level 51.00 – Likely to rise to resistance level 54.60 Ebay recently reversed up from the key support level 51.00, which has been reversing the price from the middle of May. The support level 51.00.

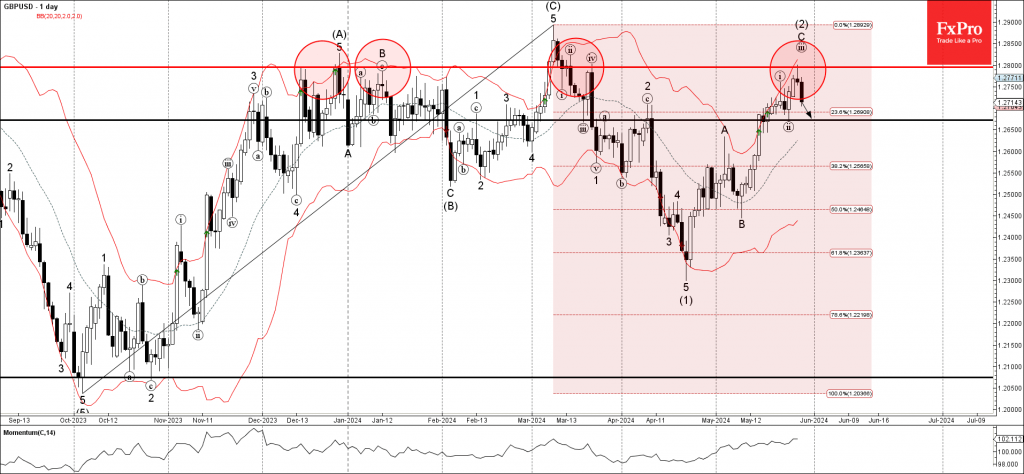

May 29, 2024

– GBPUSD reversed from resistance level 1.2800 – Likely to fall to support level 1.2675 GBPUSD currency pair recently reversed down from the key resistance level 1.2800, which has been repeatedly reversing the price from December. The downward reversal from.

May 29, 2024

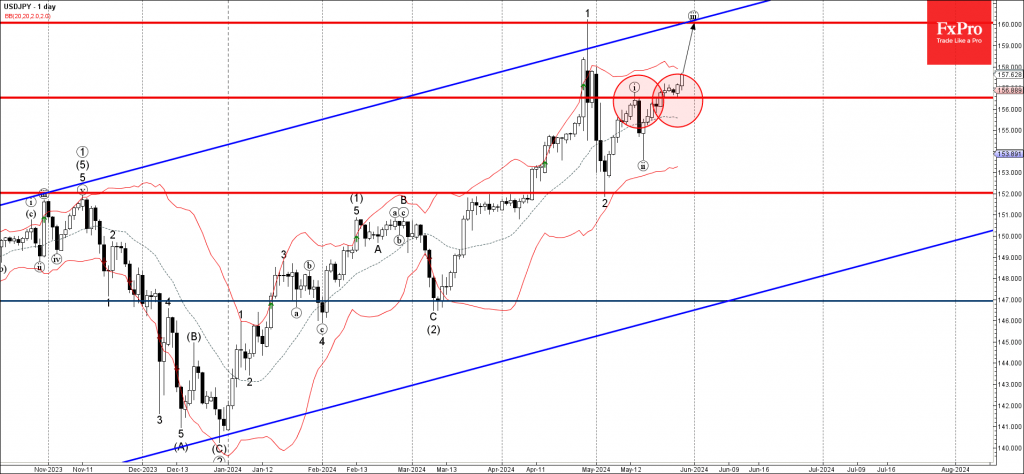

– USDJPY reversed from key support level 156.50 – Likely to rise to resistance level 160.00 USDJPY currency pair recently reversed up from the key support level 156.50, former resistance which stopped the previous minor impulse wave i at the.

May 28, 2024

– WTI crude oil reversed from key support level 76.70 – Likely to rise to resistance level 81.10 WTI crude oil recently reversed up from the support zone located between the key support level 76.70, which has been reversing the.