Technical analysis - Page 115

May 14, 2024

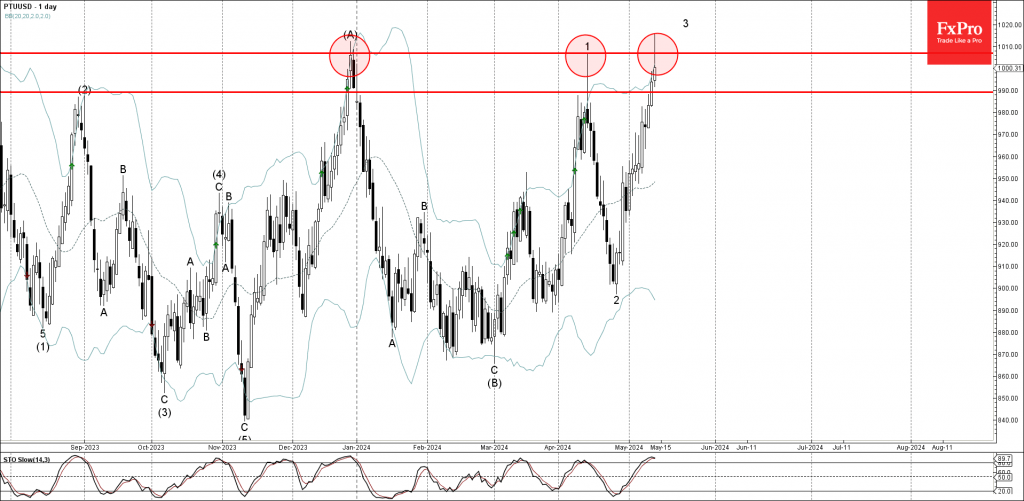

• Platinum reversed from resistance level 1010.00 • Likely to fall to support level 990.00 Platinum just reversed down from the major resistance level 1010.00, which has been reversing the price from the end of December. The resistance level 1010.00.

May 14, 2024

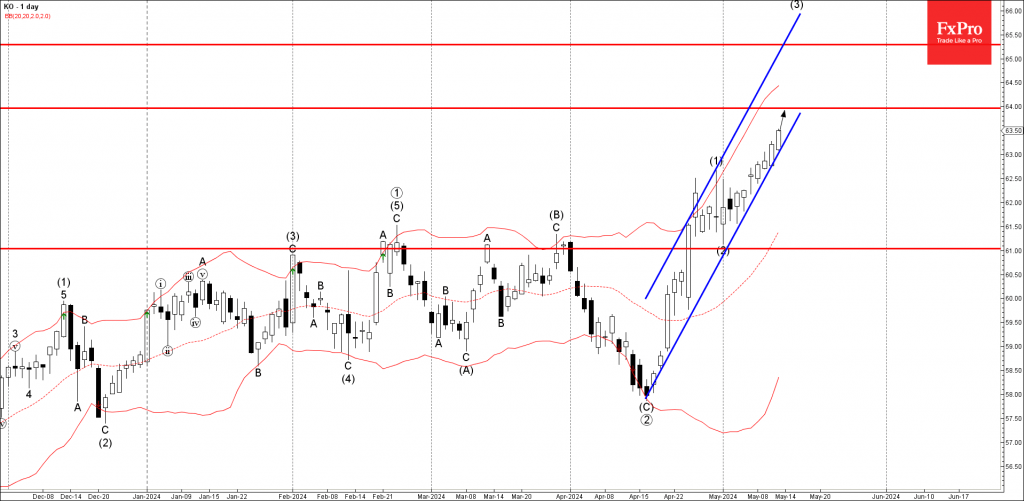

• Coca-Cola rising inside sharp impulse wave (3) • Likely to reach resistance level 64.00 Coca-Cola rising inside the sharp upward impulse wave (3), which started earlier from the key support level 61.00 (former strong resistance from February ad March)..

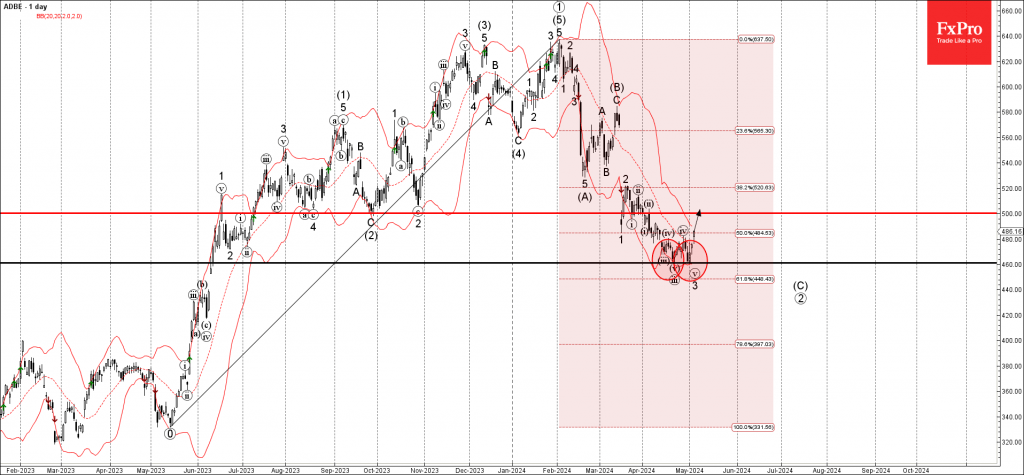

May 9, 2024

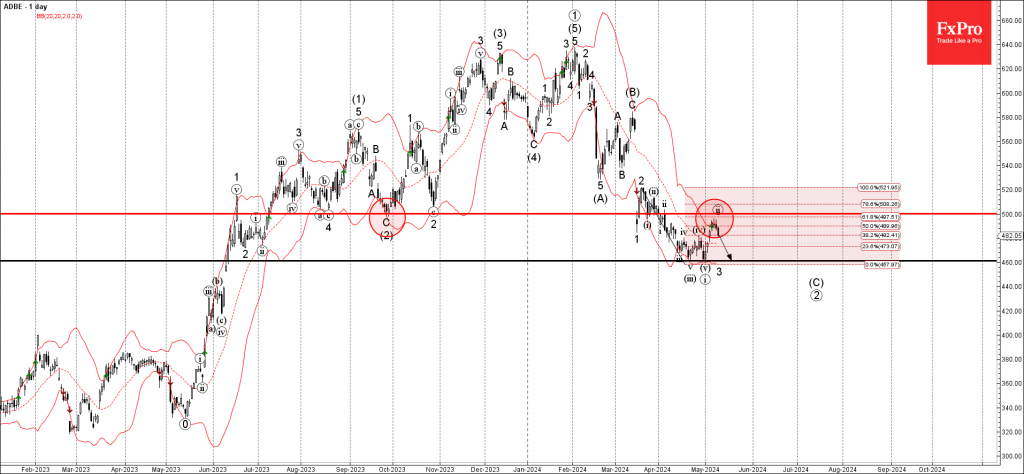

– Adobe reversed from resistance level 500.00 – Likely to fall to support level 460.00 Adobe recently reversed down from the round resistance level 500.00 (former multi-month support from September of last year). The resistance level 500.00 was strengthened by.

May 9, 2024

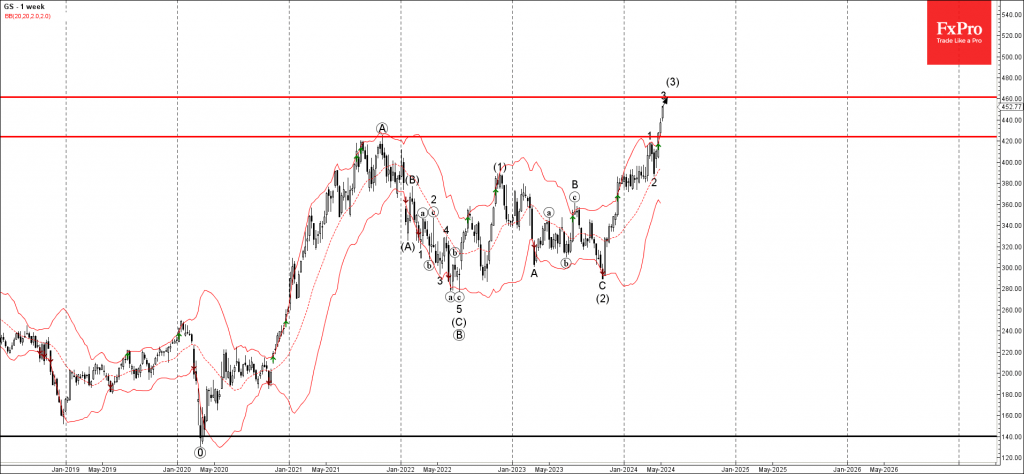

– Goldman Sachs rising inside impulse waves 3 and (3) – Likely to rise to resistance level 460.00 Goldman Sachs rising strongly after the price broke the major resistance level 424.00 (which stopped the previous sharp uptrend at the end.

May 8, 2024

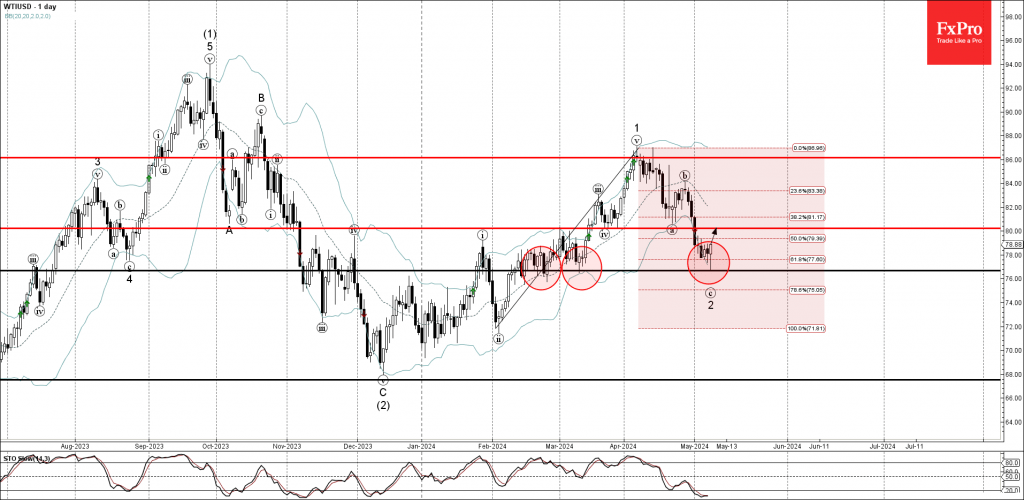

– WTI crude oil reversed from support area – Likely to rise to resistance level 80.00 WTI crude oil recently reversed up with the daily Hammer from the support area lying between the pivotal support level 77.00 (which has been.

May 8, 2024

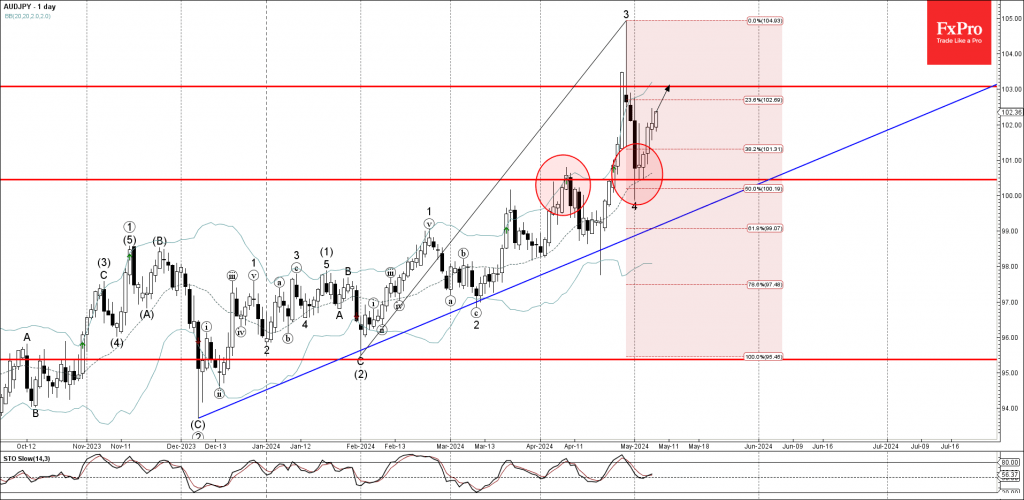

– AUDJPY reversed from support area – Likely to rise to resistance level 103.00 AUDJPY currency pair recently reversed up from the support area lying between the round support level 100.45 (former strong resistance from April), 20-day moving average and.

May 7, 2024

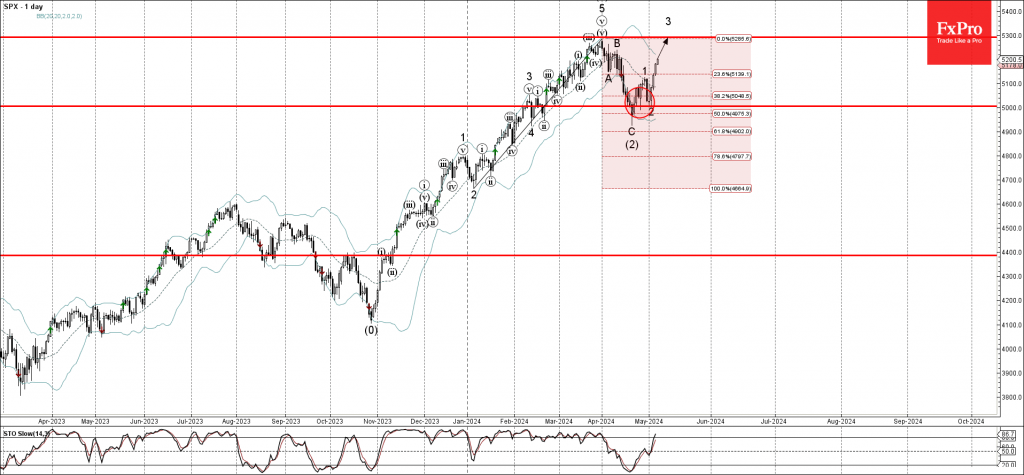

– S&P 500 reversed from support level 5000.00 – Likely to rise to resistance level 5300.00 S&P 500 index recently reversed up from the support zone lying between the round support level 5000.00 (which also stopped the previous correction (2)),.

May 7, 2024

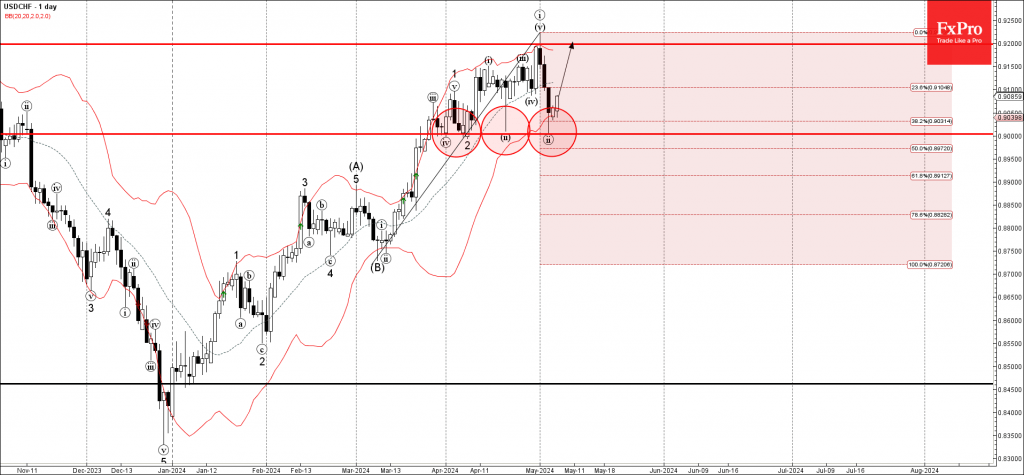

– USDCHF reversed from support zone – Likely to rise to resistance level 0.9200 USDCHF currency pair recently reversed up from the support zone lying between the round support level 0.9000 (which has been reversing the price from March), lower.

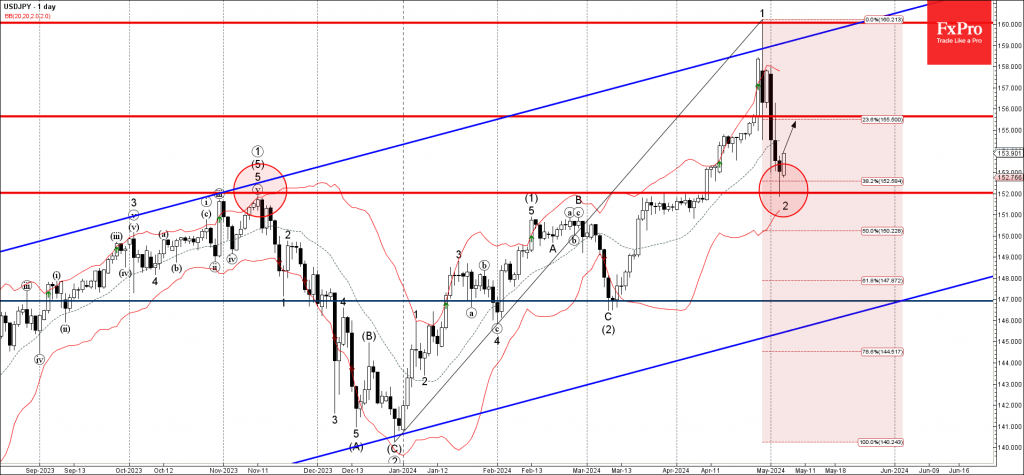

May 6, 2024

– USDJPY reversed from support zone – Likely to rise to resistance level 155.65 USDJPY currency pair recently reversed up from the support zone lying between the strong support level 152.00 (former multi-month high from November) and the 38.2% Fibonacci.

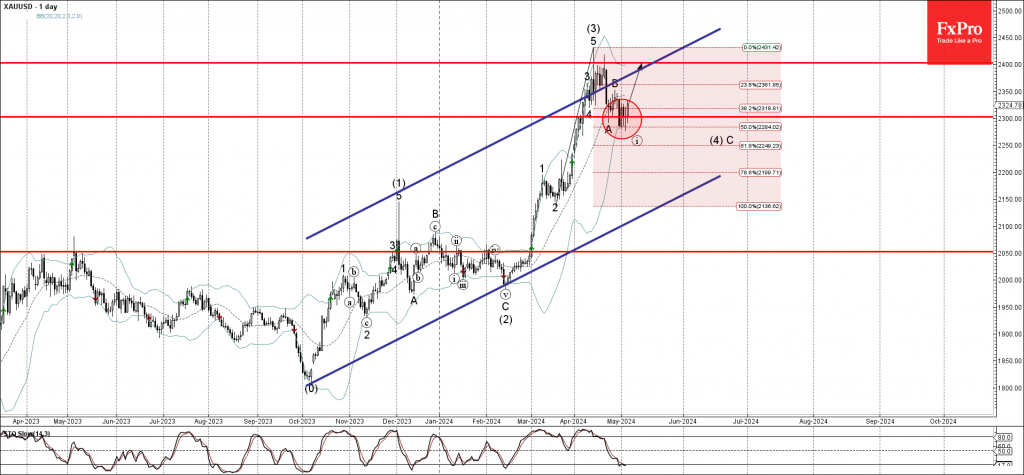

May 6, 2024

– Gold reversed from support zone – Likely to rise to resistance level 2400.00 Gold recently reversed up from the support zone lying between the support level 2300.00, lower daily Bollinger Band and the 50% Fibonacci correction of the upward.

May 3, 2024

– Adobe reversed from support zone – Likely to rise to resistance level 500.00 Adobe recently reversed up from the support zone lying between the support level 460.00, lower daily Bollinger Band and the 61.8% Fibonacci correction of the uptrend.