Technical analysis - Page 114

May 22, 2024

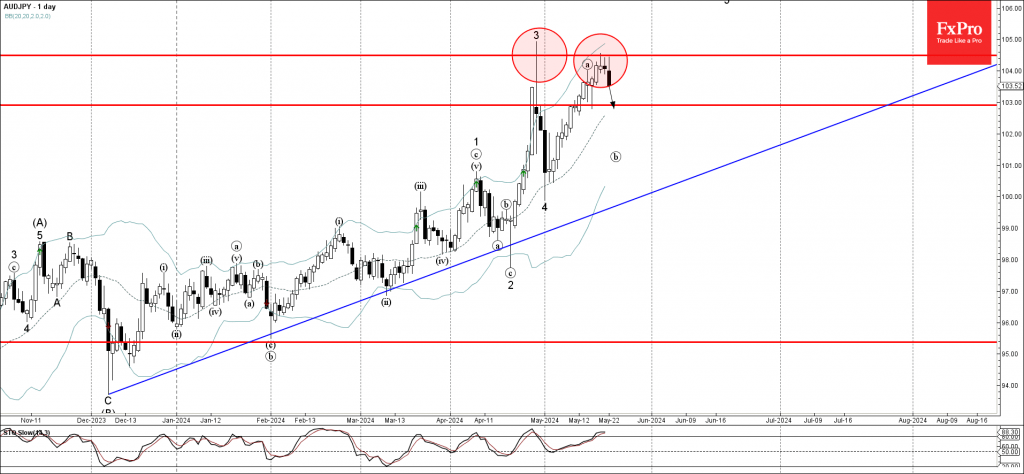

– AUDJPY reversed from resistance level 104.50 – Likely to fall to support level 103.00 AUDJPY currency pair recently reversed down from the key resistance level 104.50, which stopped the previous sharp upward impulse wave 3. The price formed two.

May 20, 2024

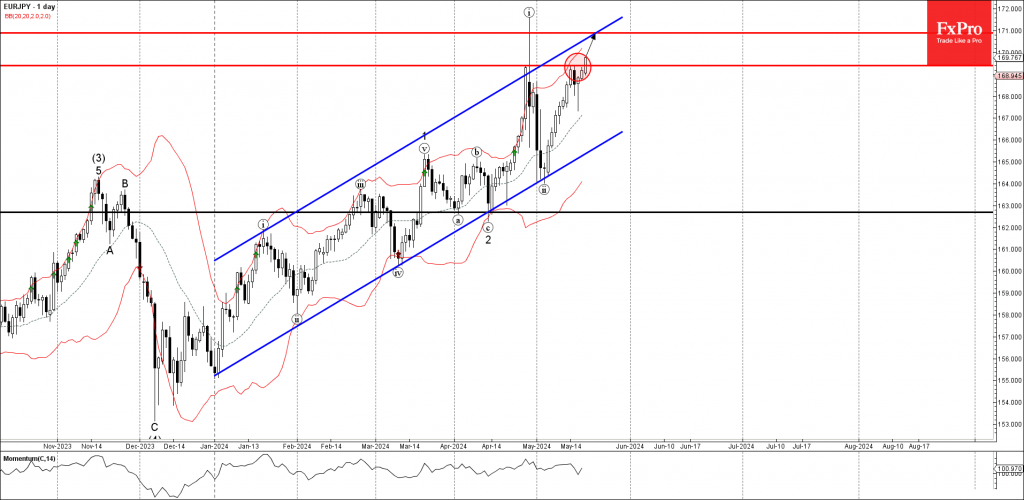

– EURJPY broke resistance level 169.40 – Likely to rise to resistance level 171.00 EURJPY is currency under the bullish pressure after the recent breakout of the minor resistance level 169.40, which reversed the price last week. The breakout of.

May 20, 2024

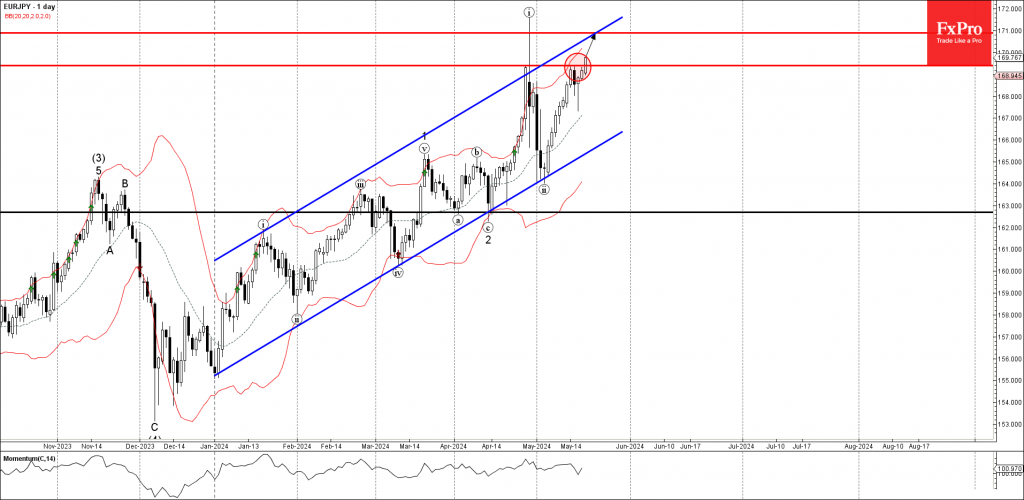

– EURJPY broke resistance level 169.40 – Likely to rise to resistance level 171.00 EURJPY is currency under the bullish pressure after the recent breakout of the minor resistance level 169.40, which reversed the price last week. The breakout of.

May 20, 2024

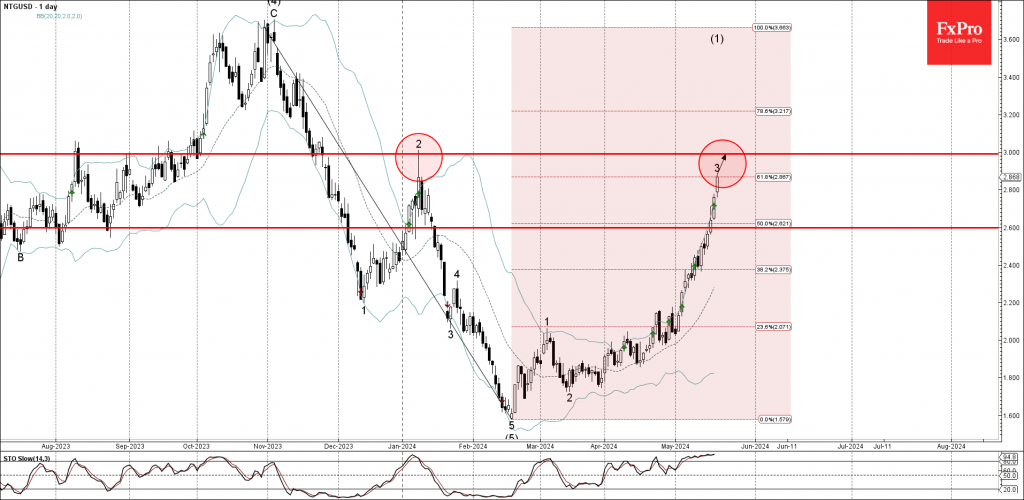

– Natural gas rising inside impulse waves 3 and (1) – Likely to reach resistance level 3.000 Natural gas continues to rise sharply after recently breaking the resistance level 2.600 intersecting with the 50% Fibonacci correction of the downtrend from.

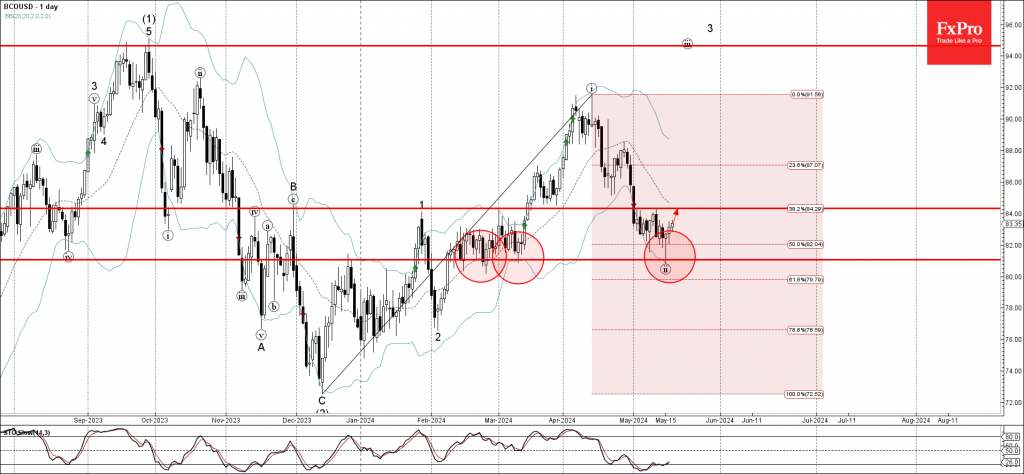

May 17, 2024

– Brent crude oil reversed from key support level 81.00 – Likely to test resistance level 84.00 Brent crude oil recently reversed up from the key support level 81.00 (which has been reversing the price from the start of February).

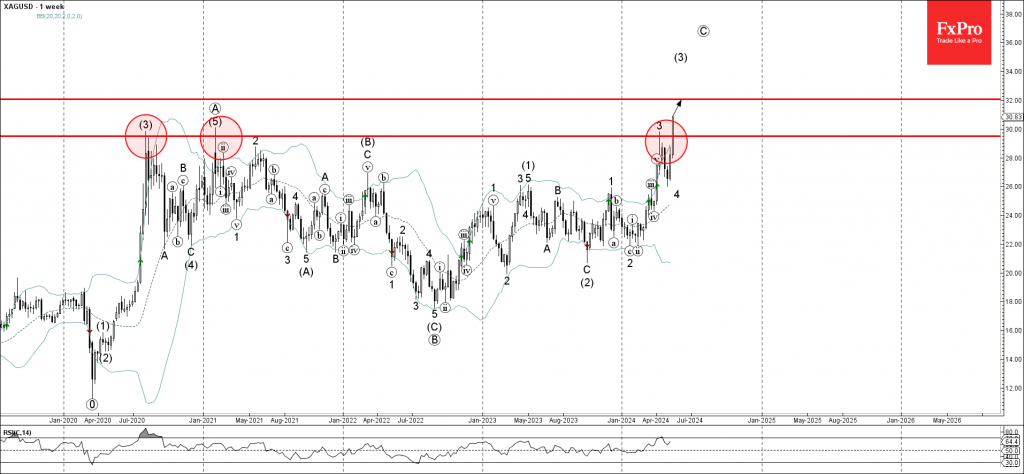

May 17, 2024

– Silver broke multi-year resistance level 29.50 – Likely to reach resistance level 32.00 Silver recently broke the key multi-year resistance level 29.50 (which has been reversing the price from the middle of 2020, as can be seen from the.

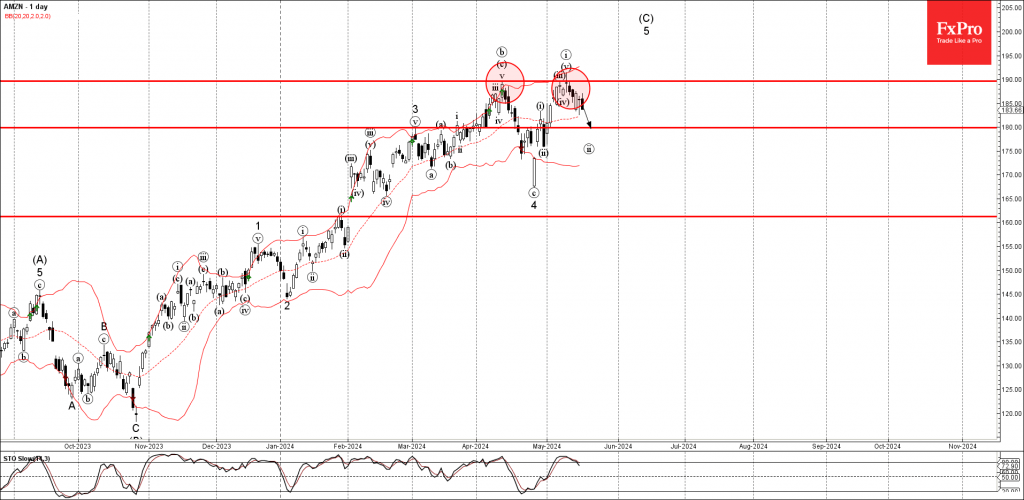

May 16, 2024

– Amazon reversed from resistance level 190.00 – Likely to fall to support level 180.00 Amazon recently reversed down from the resistance level 190.00 (previous monthly high from April), strengthened by the upper daily Bollinger Band. The downward reversal from.

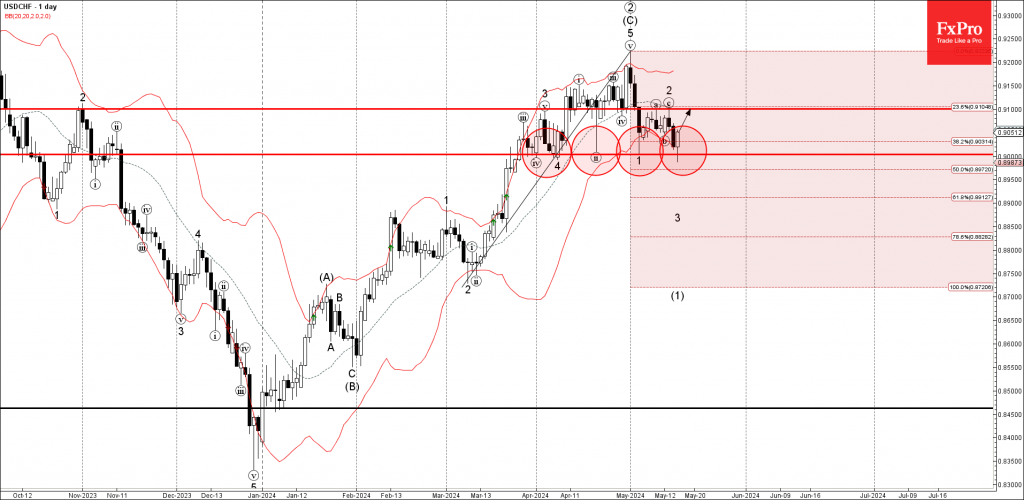

May 16, 2024

– USDCHF reversed from round support level 0.9000 – Likely to rise to resistance level 0.9100 USDCHF currency pair recently reversed up from the round support level 0.9000 (which stopped the previous corrections iv, 4 ii, 1). The support level.

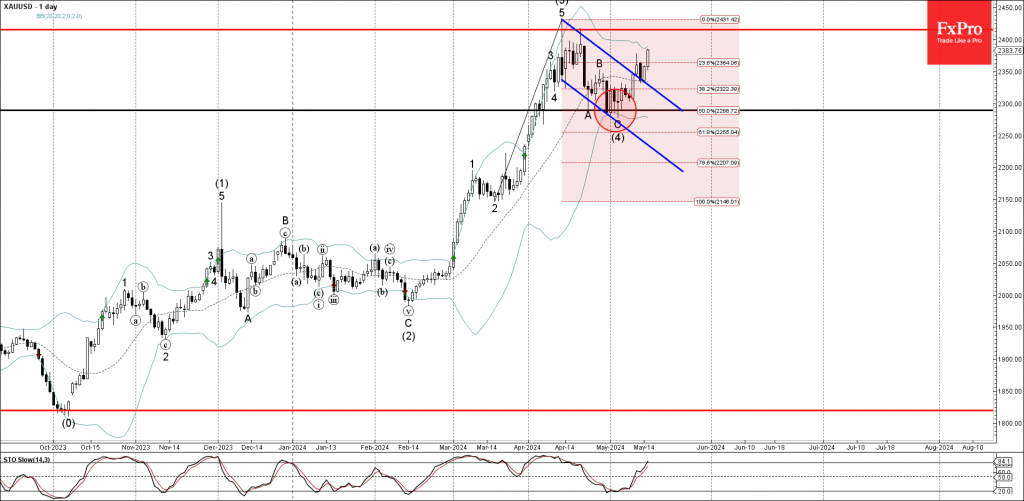

May 15, 2024

• Gold broke daily down channel • Likely to reach resistance level 2415.00 Gold recently broke the resistance trendline of the narrow daily down channel from April, which enclosed the previous ABC correction (4). The breakout of this down channel.

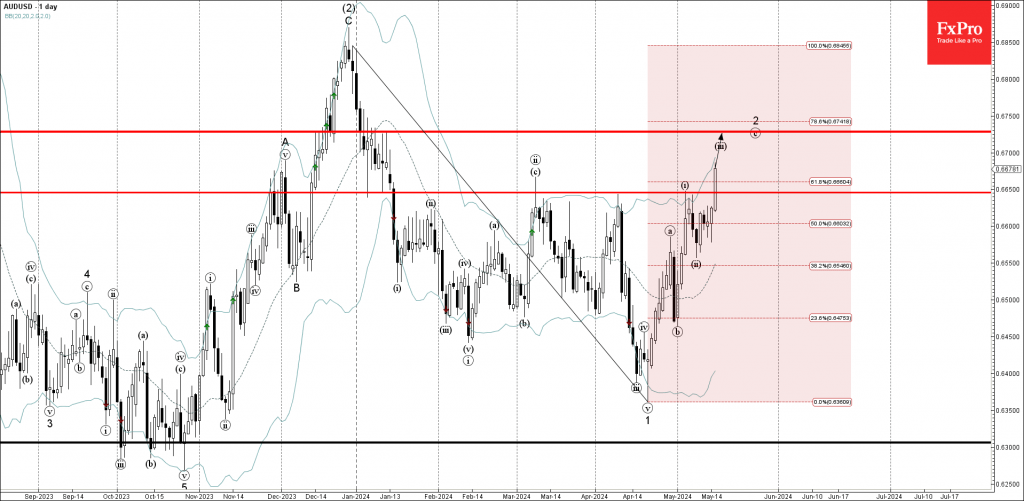

May 15, 2024

• AUDUSD broke key resistance level 0.6650 • Likely to reach resistance level 0.6760 AUDUSD currency pair recently broke the key resistance level 0.6650, which has been reversing the pair from the start of March. The breakout of the resistance.

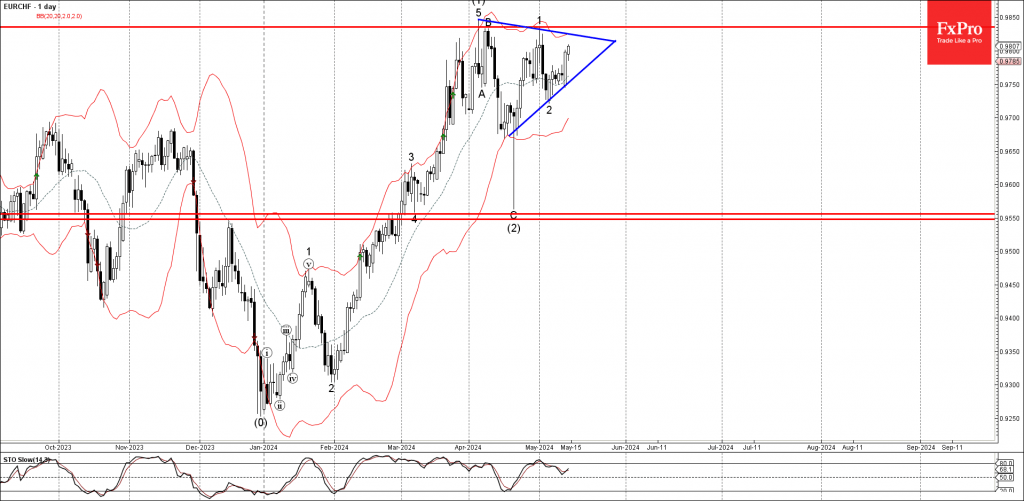

May 14, 2024

• EURCHF rising inside impulse wave 3 • Likely to reach resistance level 0.9835 EURCHF currency pair continues to rise inside the impulse wave 3, which started earlier from the support trendline of the daily Triangle from April. The active.