Technical analysis - Page 113

May 30, 2024

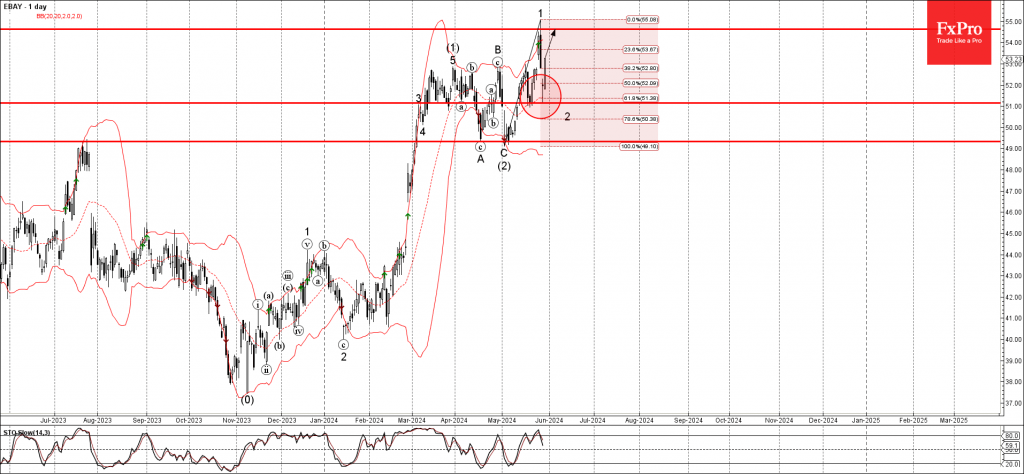

– Ebay reversed from support level 51.00 – Likely to rise to resistance level 54.60 Ebay recently reversed up from the key support level 51.00, which has been reversing the price from the middle of May. The support level 51.00.

May 29, 2024

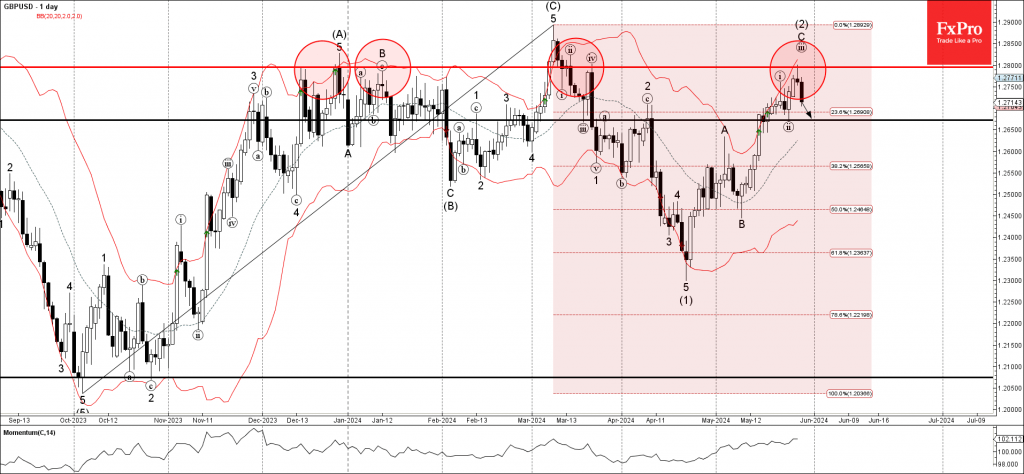

– GBPUSD reversed from resistance level 1.2800 – Likely to fall to support level 1.2675 GBPUSD currency pair recently reversed down from the key resistance level 1.2800, which has been repeatedly reversing the price from December. The downward reversal from.

May 29, 2024

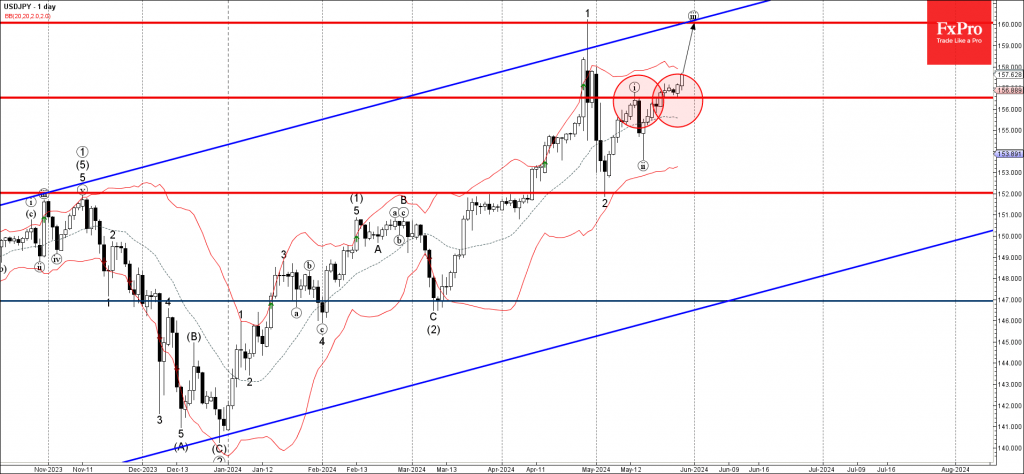

– USDJPY reversed from key support level 156.50 – Likely to rise to resistance level 160.00 USDJPY currency pair recently reversed up from the key support level 156.50, former resistance which stopped the previous minor impulse wave i at the.

May 28, 2024

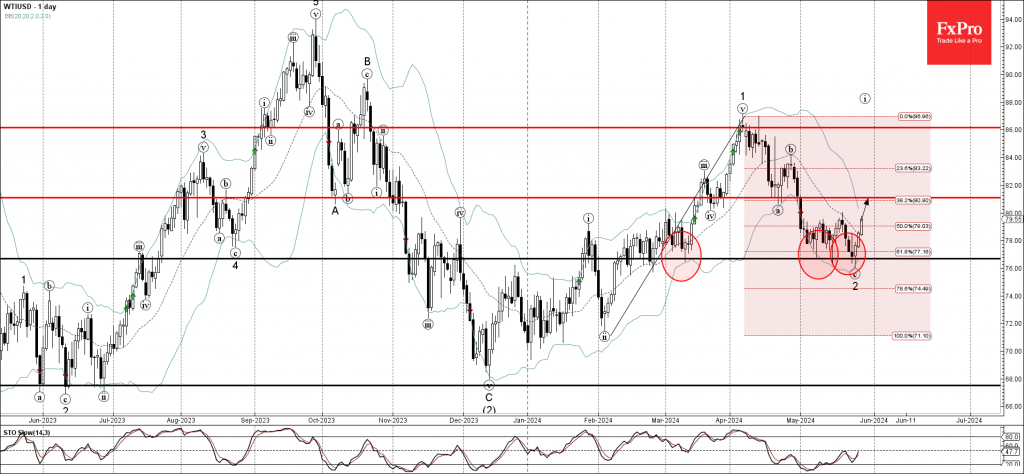

– WTI crude oil reversed from key support level 76.70 – Likely to rise to resistance level 81.10 WTI crude oil recently reversed up from the support zone located between the key support level 76.70, which has been reversing the.

May 28, 2024

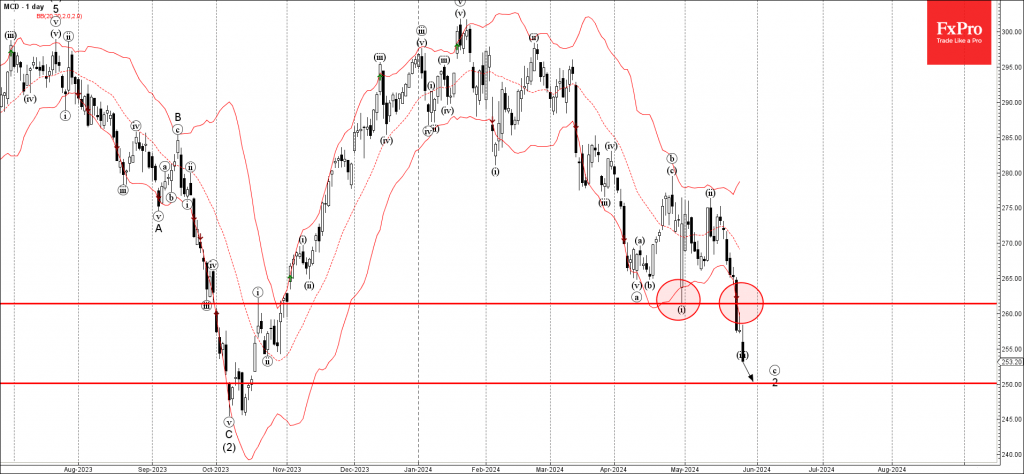

– McDonald’s under strong bearish pressure – Likely to fall to support level 250.00 McDonald’s Corp under the strong bearish pressure after the price broke the key support level 261.40, which stopped the previous minor impulse wave i at the.

May 27, 2024

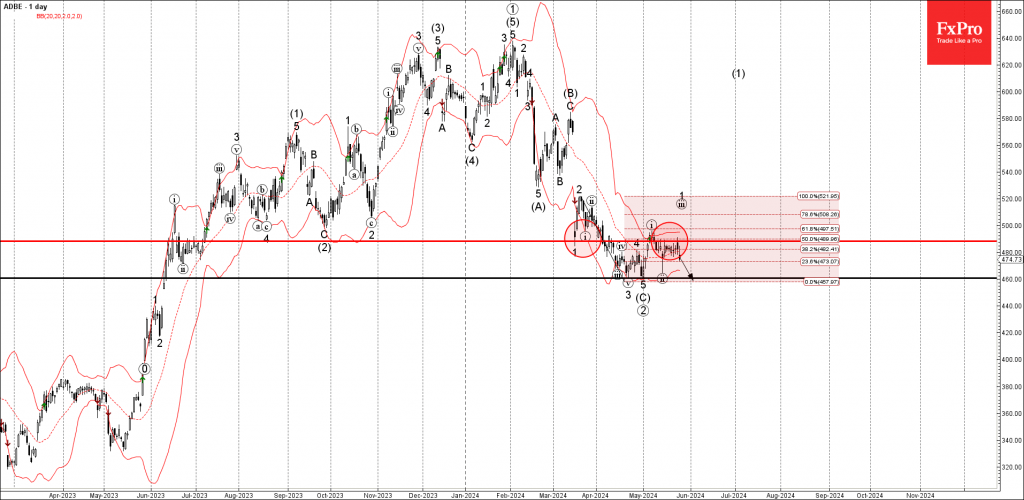

– Adobe reversed from key resistance level 490,00 – Likely to fall to support level 460.00 Adobe recently reversed down from the key resistance level 490,00, former strong support from march. The resistance level 490,00 was strengthened by the upper.

May 27, 2024

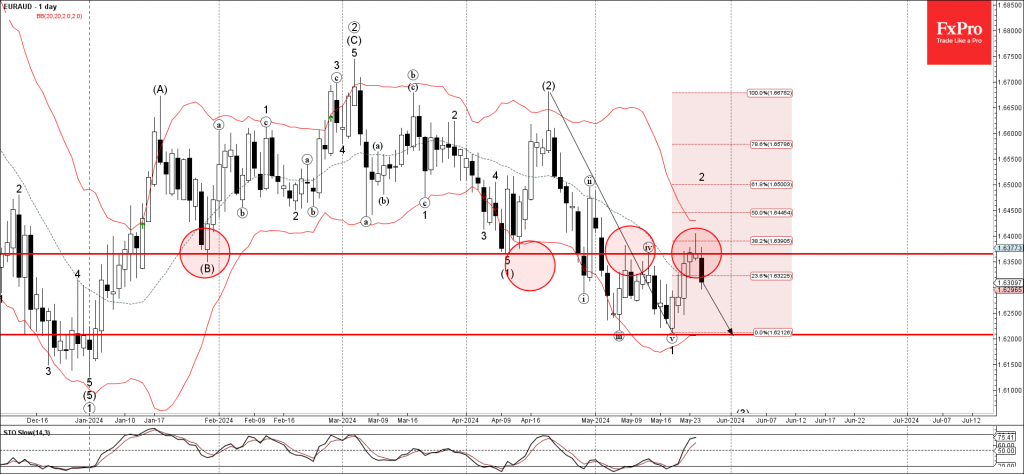

– EURAUD reversed from resistance level 1.6365 – Likely to fall to support level 1.6210 EURAUD currency pair previously reversed down from the key resistance level 1.6365, former support from April and January. The resistance level 1.6365 was strengthened by.

May 24, 2024

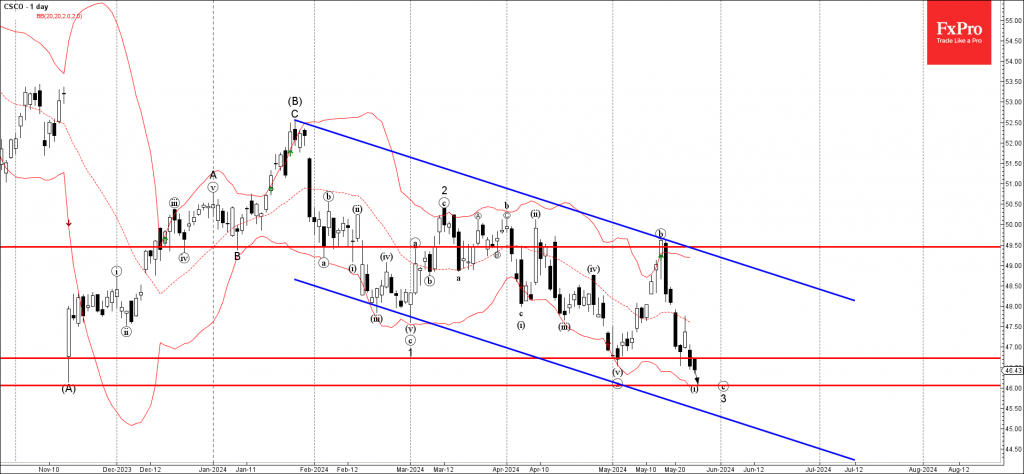

– Cisco broke support level 46.70 – Likely to fall to support level 46.00 Cisco previously broke below the support level 46.70, which stopped the previous minor impulse wave I at the start of this month. The breakout of the.

May 24, 2024

– Brent Crude oil reversed from strong support level 81.00 – Likely to rise to resistance level 84.3 Brent Crude oil recently reversed up from the support area located between the strong support level 81.00, which has been reversing the.

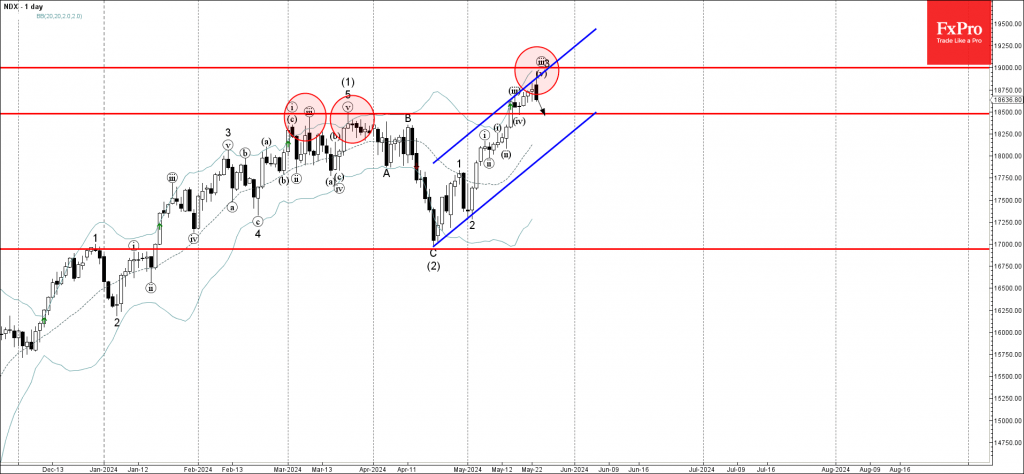

May 23, 2024

– NASDAQ 100 Index reversed from round resistance level 19000.00 – Likely to fall to support level 18500.00 NASDAQ 100 Index today reversed down from the resistance area located between the round resistance level 19000.00 and the upper daily Bollinger.

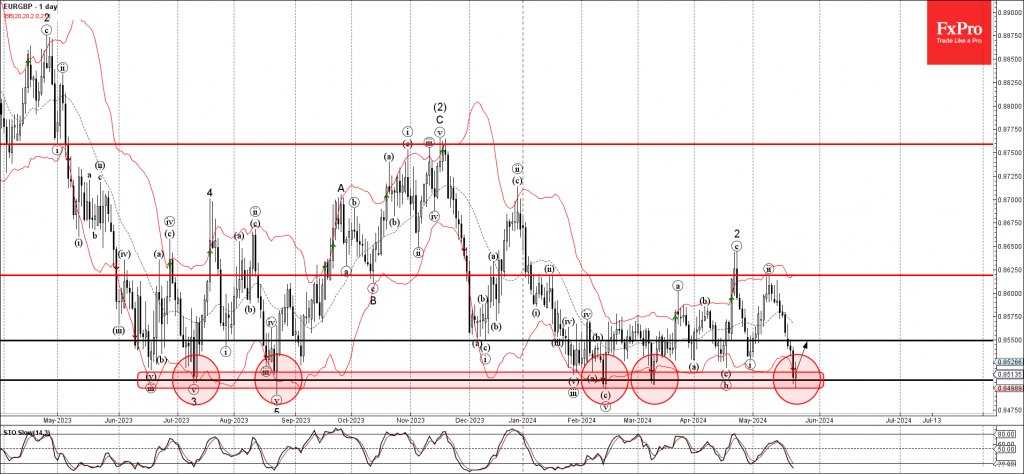

May 23, 2024

– EURGBP reversed from long-term support level 0.8500 – Likely to test resistance level 0.8550 EURGBP currency pair today reversed up from the major long-term support level 0.8500 (which has been steadily reversing all downward impulse of this pair from.