Technical analysis - Page 112

June 7, 2024

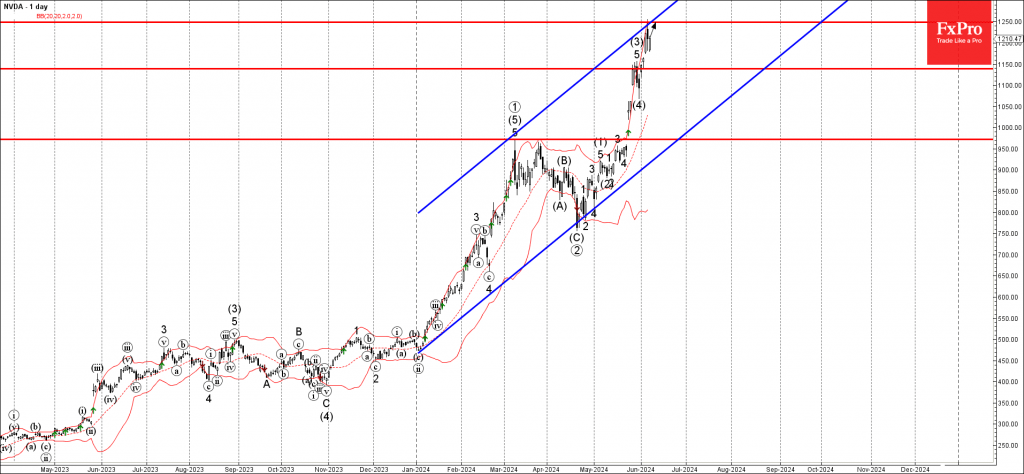

– NVIDIA under the bullish pressure – Likely to test resistance level 1250.00, NVIDIA under the bullish pressure after the earlier breakout of the resistance level 1150.00 (which stopped the previous impulse wave (3)). The breakout of the resistance level.

June 7, 2024

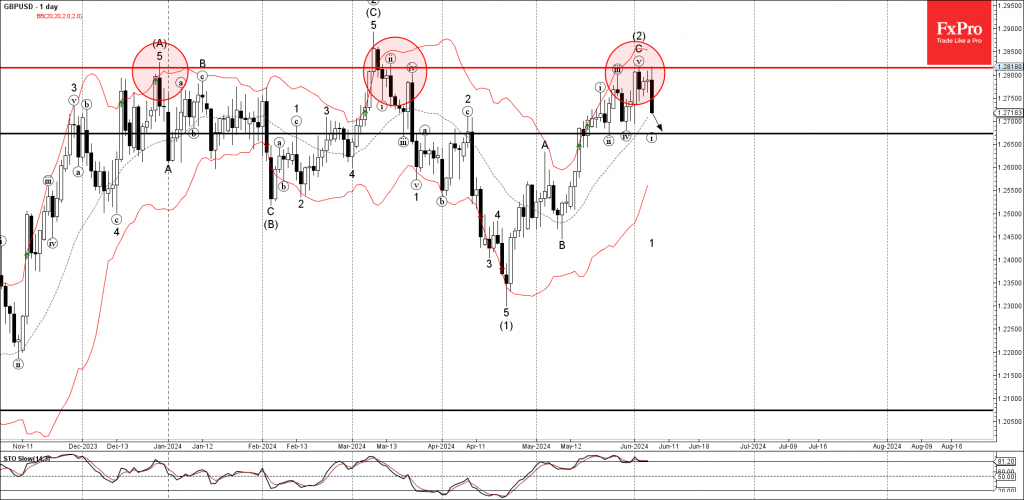

– GBPUSD reversed from resistance level 1.2800 – Likely to fall to support level 1.2675 GBPUSD currency pair recently reversed down from the key resistance level 1.2800 (which has been repeatedly reversing the price from December) standing near the upper.

June 6, 2024

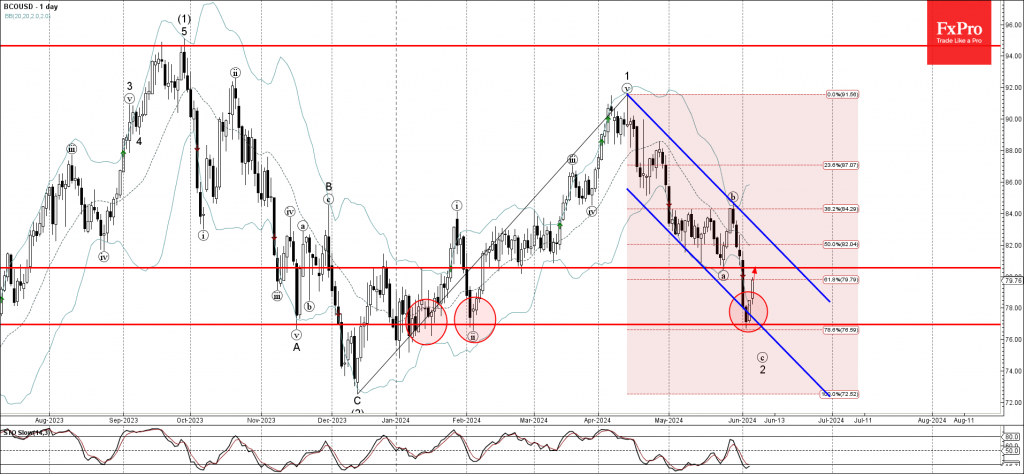

– Brent Crude oil reversed from support level 76.95 – Likely to rise to resistance level 80.55 Brent Crude oil recently reversed up from the key support level 76.95 (which has been repeatedly reversing the price from the start of.

June 6, 2024

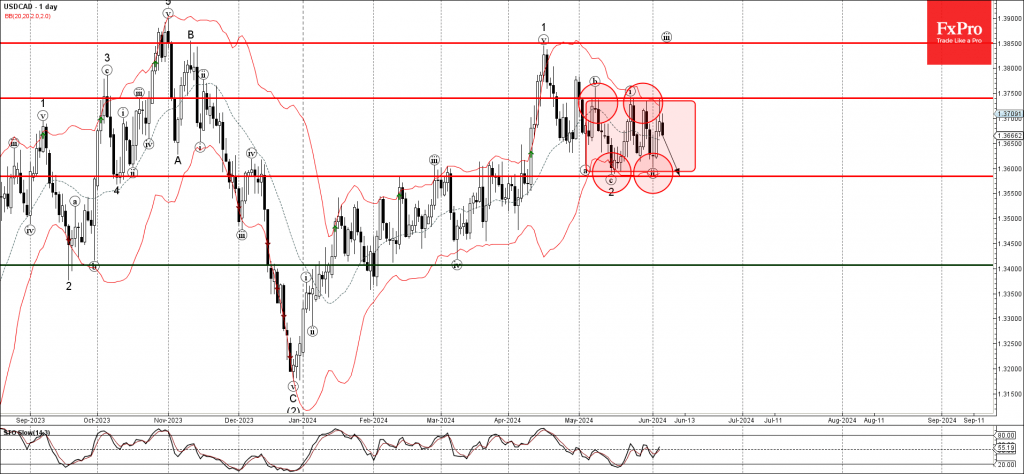

– USDCAD reversed from resistance level 1.3740 – Likely to fall to support level 1.3600 USDCAD currency pair recently reversed down from the key resistance level 1.3740 (upper boundary of the narrow sideways price range inside which the pair has.

June 5, 2024

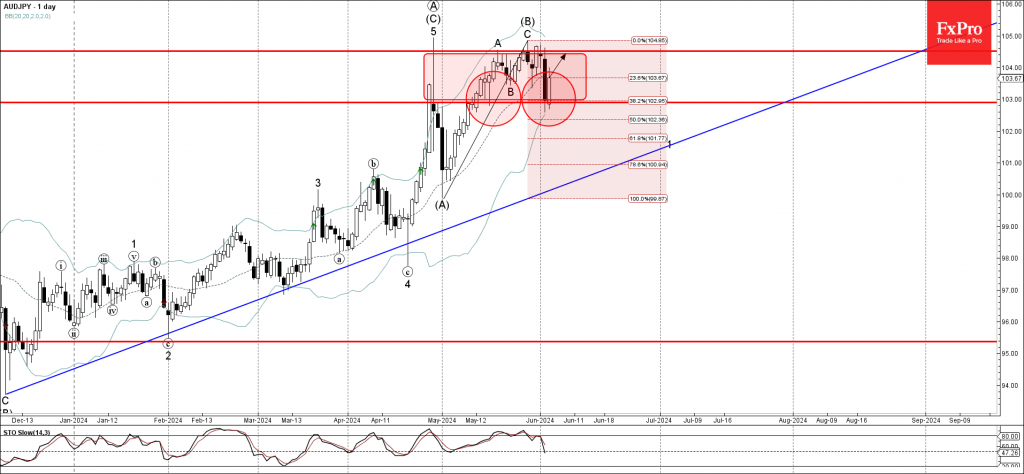

– AUDJPY reversed from support level 103.00 – Likely to rise to resistance level 104.50 AUDJPY currency pair recently reversed up from the key support level 103.00 (which has been reversing the price from the middle of May). The support.

June 5, 2024

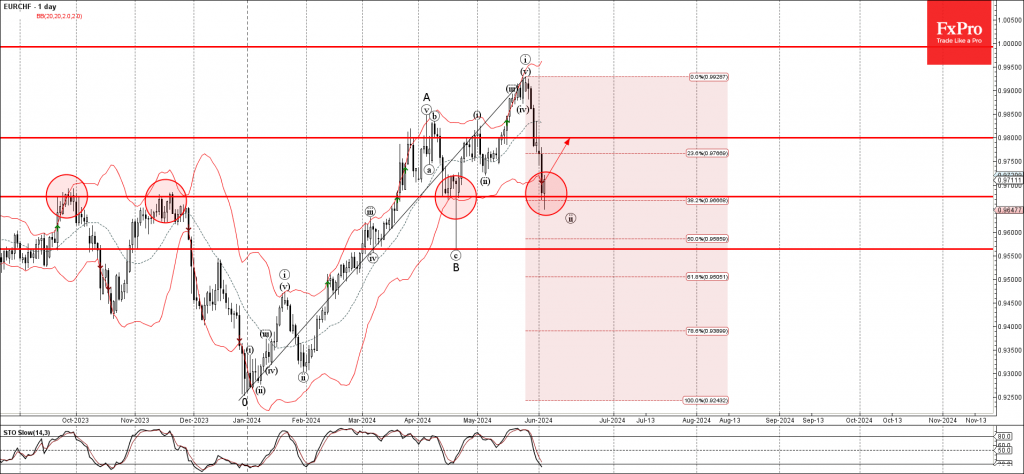

– EURCHF reversed from support level 0.9675 – Likely to rise to resistance level 0.9800 EURCHF currency pair recently reversed up from the pivotal support level 0.9675 (former resistance from November and strong support from April). The support level 0.9675.

June 4, 2024

– NZDCAD broke resistance level 0.8400 – Likely to rise to resistance level 0.8500 NZDCAD currency pair recently broke strong resistance level 0.8400 (which previously reversed the pair multiple time sin November and December). The breakout of the resistance level.

June 4, 2024

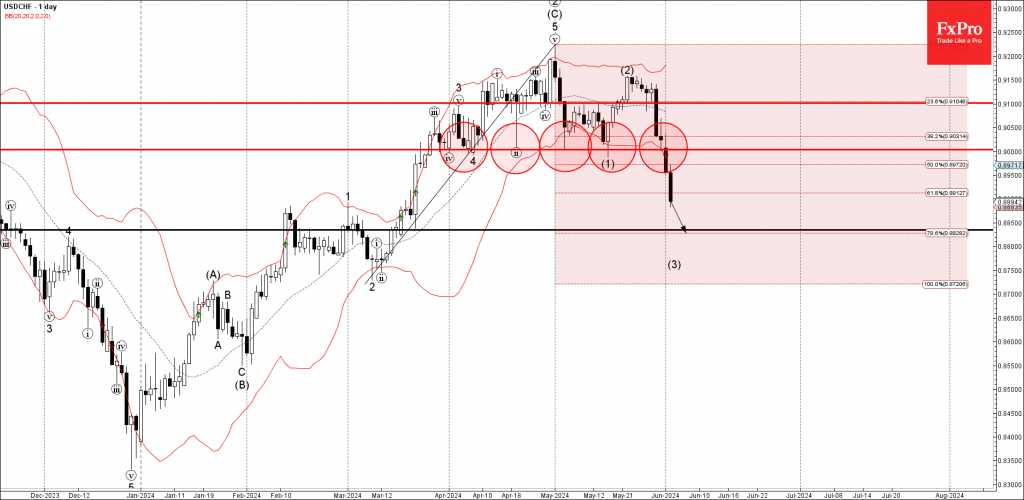

– USDCHF broke round support level 0.9000 – Likely to fall to support level 0.8850 USDCHF currency pair recently broke the round support level 0.9000 (which has been reversing the price from the start of April). The breakout of the.

June 4, 2024

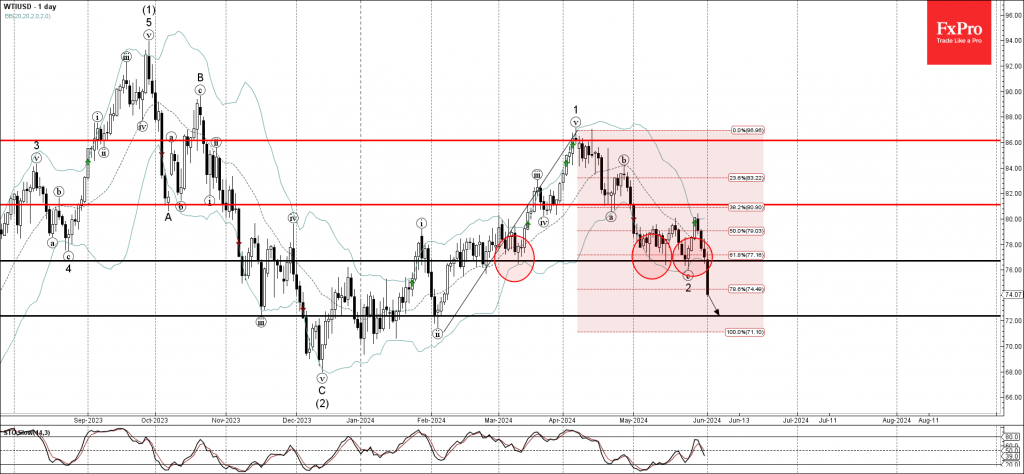

– WTI broke key support level 76.70 – Likely to fall to support level 72.00 WTI crude oil recently broke the key support level 76.70 (which has been steadily reversing the price from the middle of February). The breakout of.

June 4, 2024

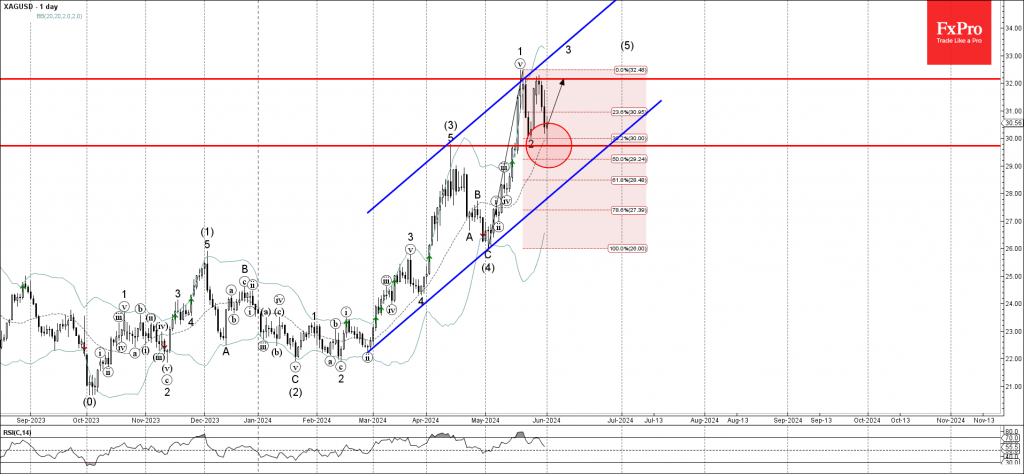

– Silver reversed from support level 29.70 – Likely to rise to resistance level 32.00 Silver recently reversed up from the key support level 29.70 (former monthly high from April), which stopped the previous intermediate impulse wave (3). The support.

May 31, 2024

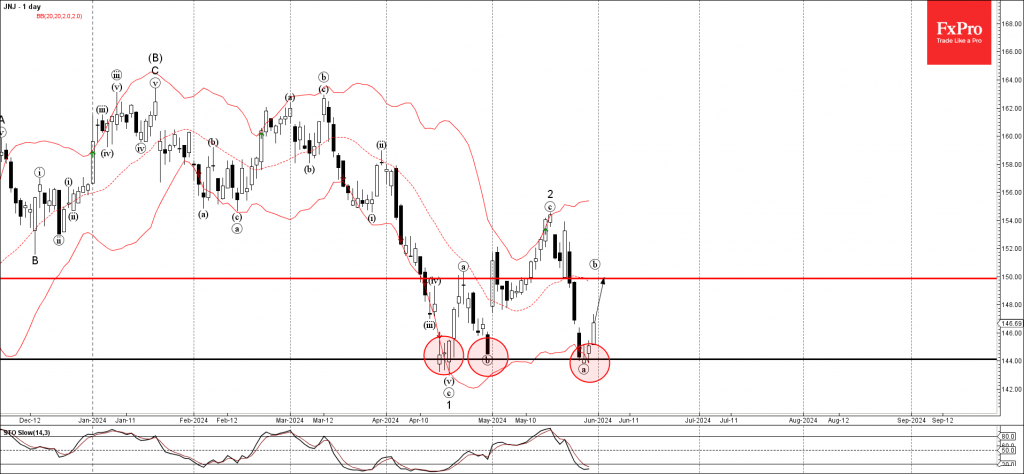

– Johnson & Johnson reversed from support level 144.00 – Likely to rise to resistance level 150.00 Johnson & Johnson recently reversed up with the daily Doji from the pivotal support level 144.00, which has been reversing the price from.