Technical analysis - Page 111

June 17, 2024

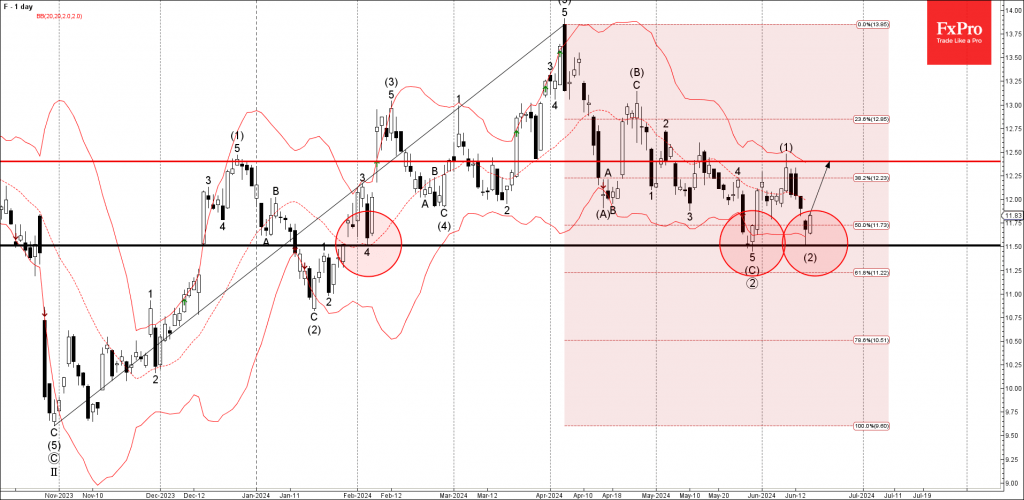

– Ford reversed from key support level 11.50 – Likely to rise to resistance level 12.40 Ford recently reversed up from the key support level 11.50 (which has been steadily reversing the price from the start of February) coinciding with the.

June 17, 2024

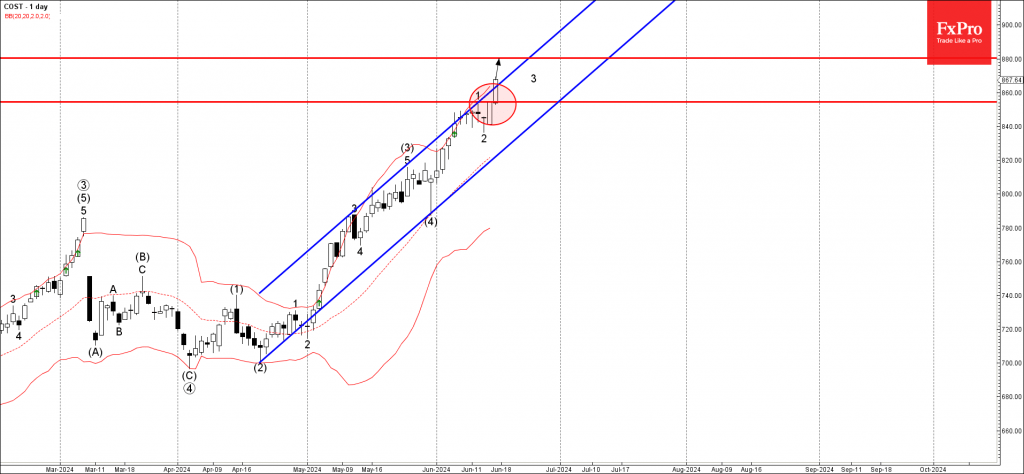

– Costco broke resistance level 855.00 – Likely to rise to resistance level 880.00 Costco recently broke the resistance level 855.00, which stopped the previous impulse wave 1at the start of June, as can be seen from the daily Costco chart.

June 14, 2024

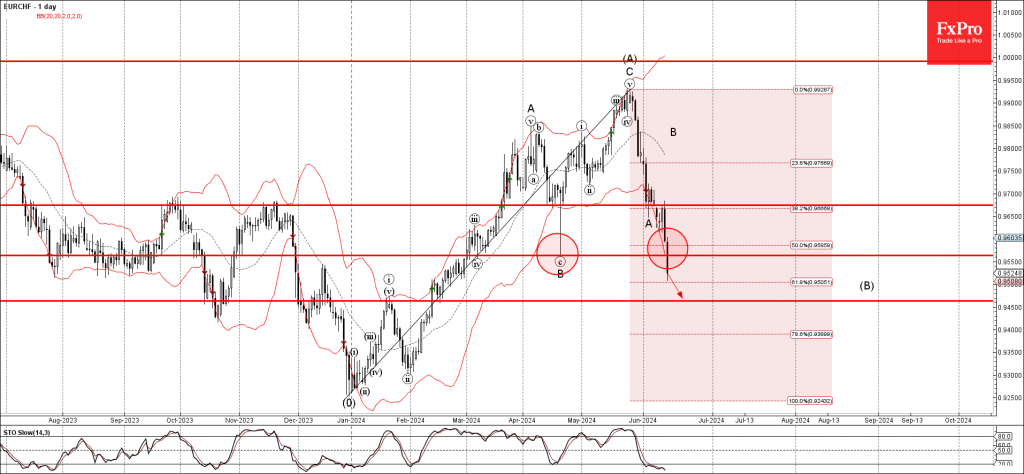

– EURCHF broke key support level 0.9565 – Likely to fall to support level 0.9450 EURCHF recently broke below the key support level 0.9565, which stopped wave B in April, as can be seen from the daily EURCHF chart below. The.

June 14, 2024

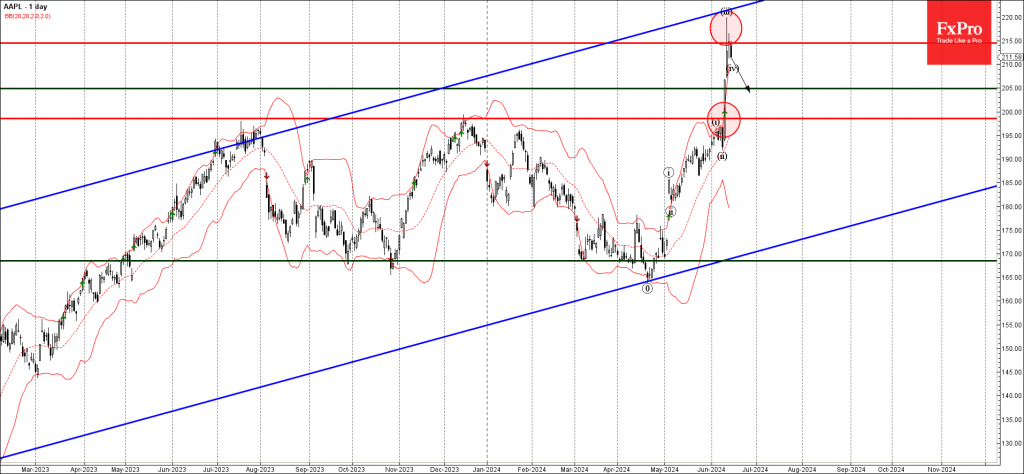

– Apple reversed from resistance zone – Likely to fall to support level 205.00 Apple recently reversed down from the resistance zone located between the resistance level 215.00 and the resistance trendline of the wide weekly up channel from last year..

June 13, 2024

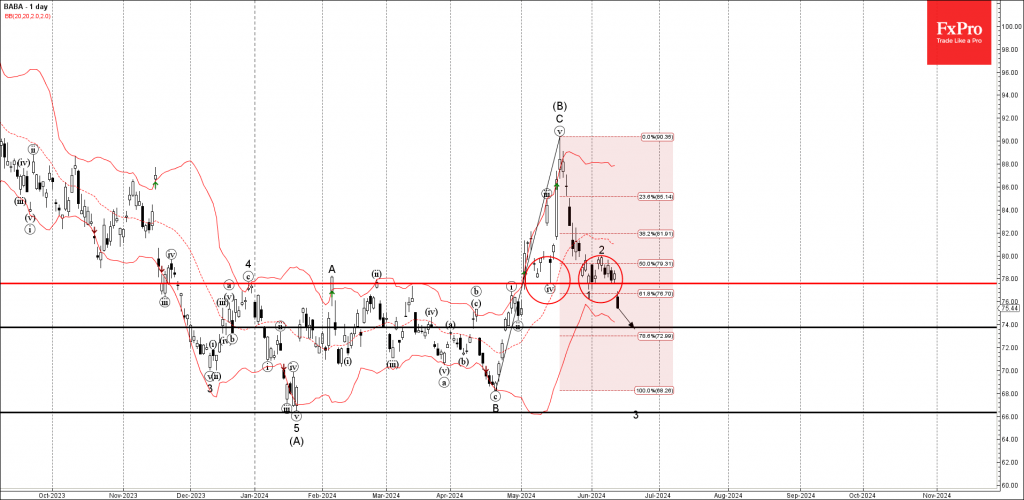

– Alibaba broke key support level 78.00 – Likely to fall to support level 74.00 Alibaba Group today opened with the downward gap breaking below the key support level 78.00 (which has been reversing the price from the middle of May)..

June 13, 2024

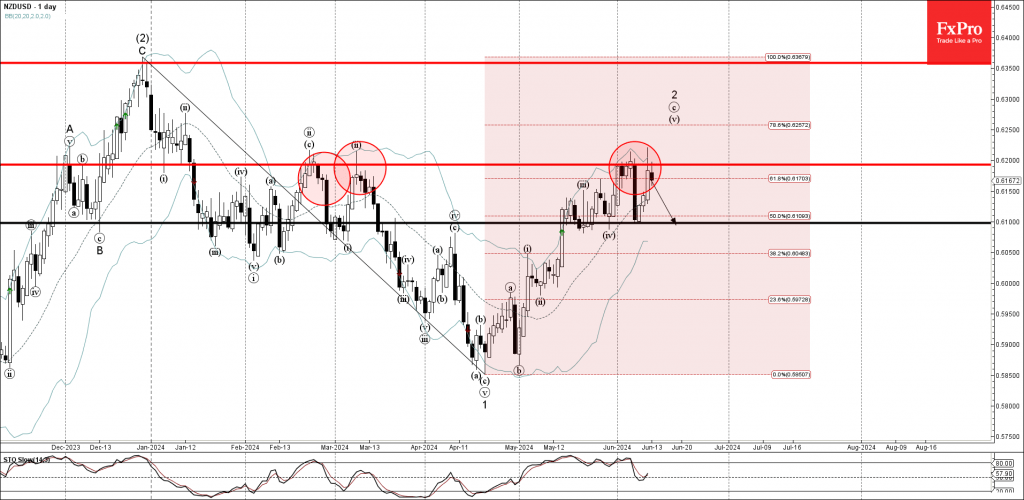

– NZDUSD reversed from key resistance level 0.6200 – Likely to fall to support level 0.6100 NZDUSD currency pair recently reversed down from the key resistance level 0.6200 (which has been reversing the price from February). The resistance level 0.6200.

June 12, 2024

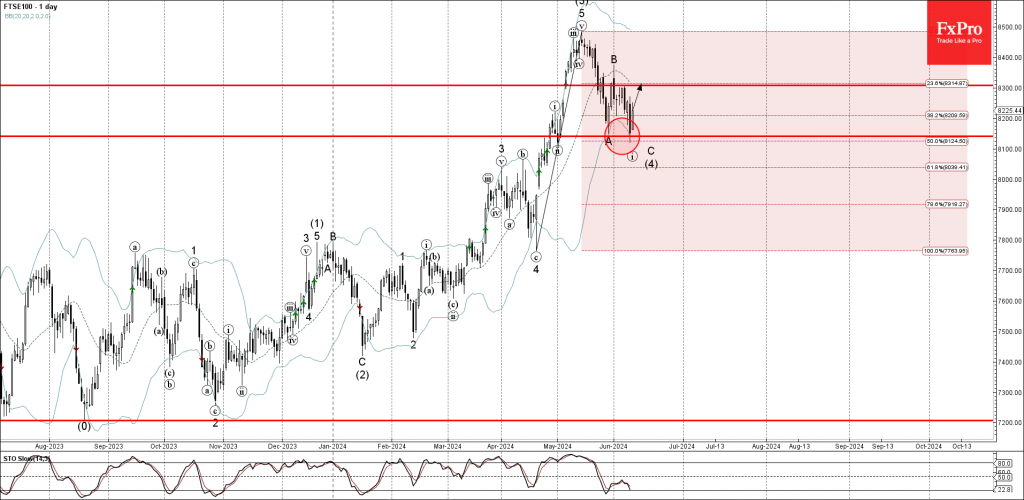

– FTSE 100 Index reversed from support level 8140.00 – Likely to rise to resistance 8300.00 FTSE 100 Index recently reversed up from the pivotal support level 8140.00 (which also stopped the previous correction A at the end of May)..

June 12, 2024

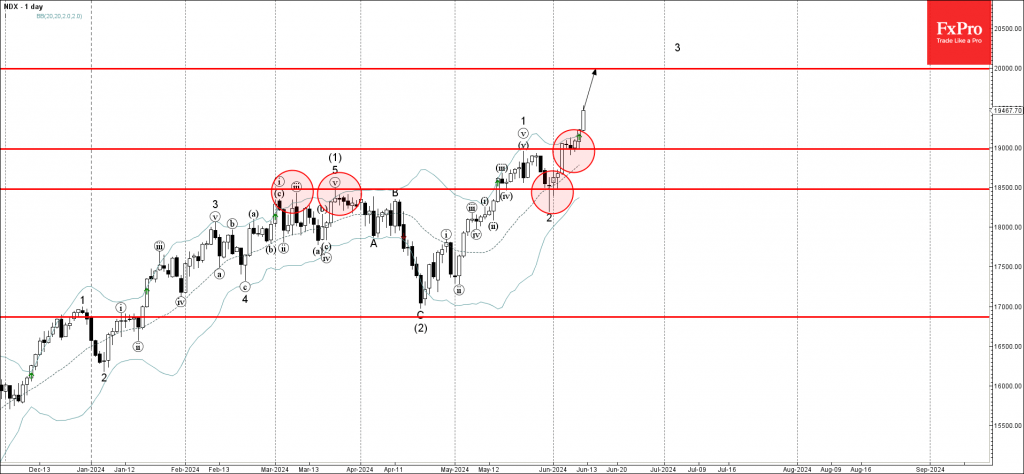

NASDAQ 100 Index recently reversed up from the support level 19000.000 (former resistance from the middle of May, acting as the support after it was broken previously). The upward reversal from the support level 19000.000 continues the active short-term impulse.

June 11, 2024

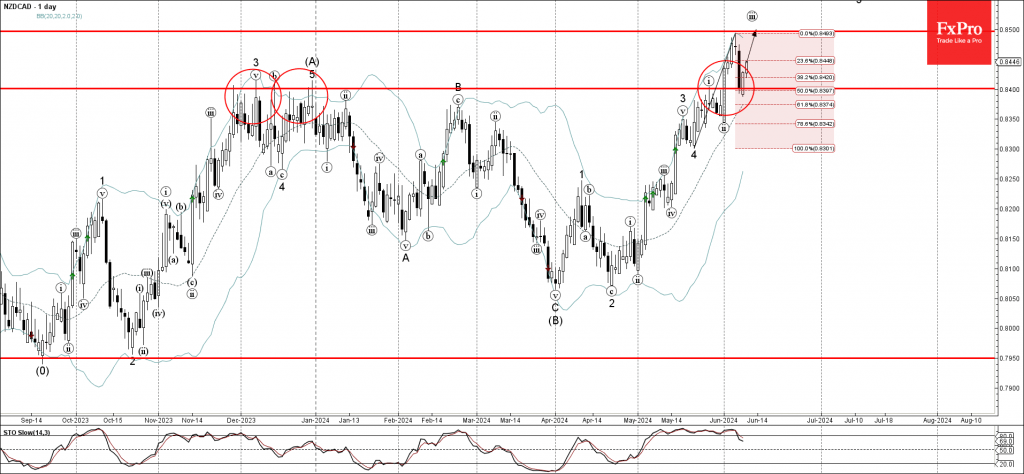

– NZDCAD reversed from support level 0.8400 – Likely to rise to resistance 0.8500 NZDCAD currency pair recently reversed up with the daily Piercing Line from the support level 0.8400 (former strong resistance from November, December and May). The support.

June 11, 2024

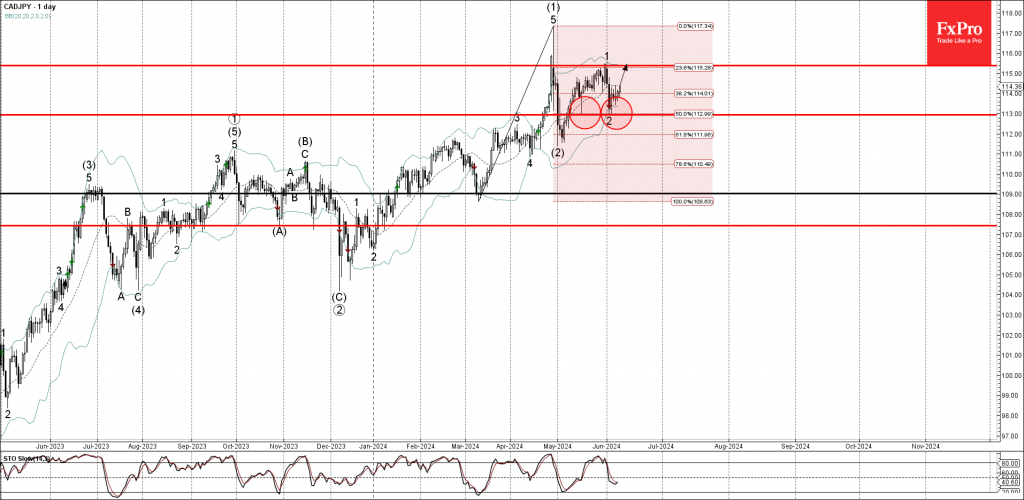

– CADJPY reversed from key support level 113.00 – Likely to rise to resistance 115.40 CADJPY currency pair recently reversed up from the key support level 113.00 (that reversed the pair with the daily Hammer in the middle of May,.

June 10, 2024

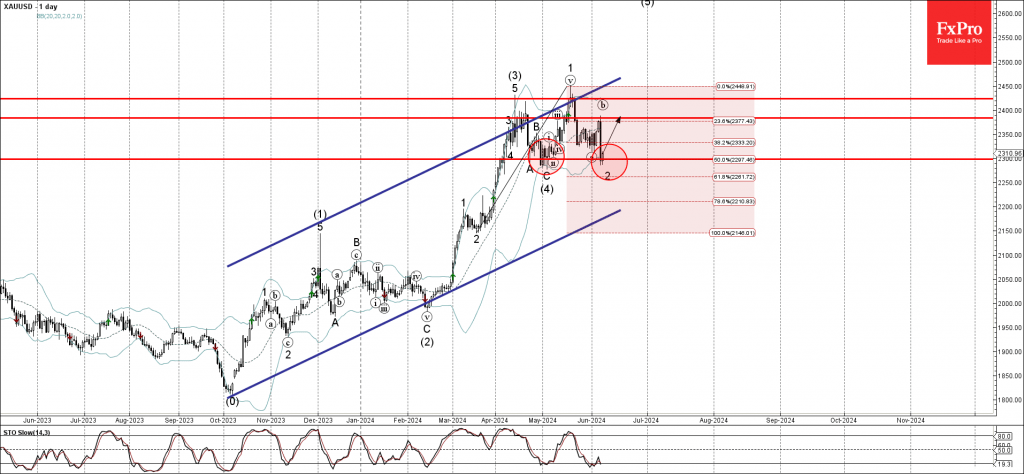

– Gold reversed from support level 2300.00 – Likely to rise to resistance 2385.00 Gold recently reversed up from the pivotal support level 2300.00 (which stopped the previous waves A, (4) and ii, as can be seen below). The support.