Technical analysis - Page 109

July 4, 2024

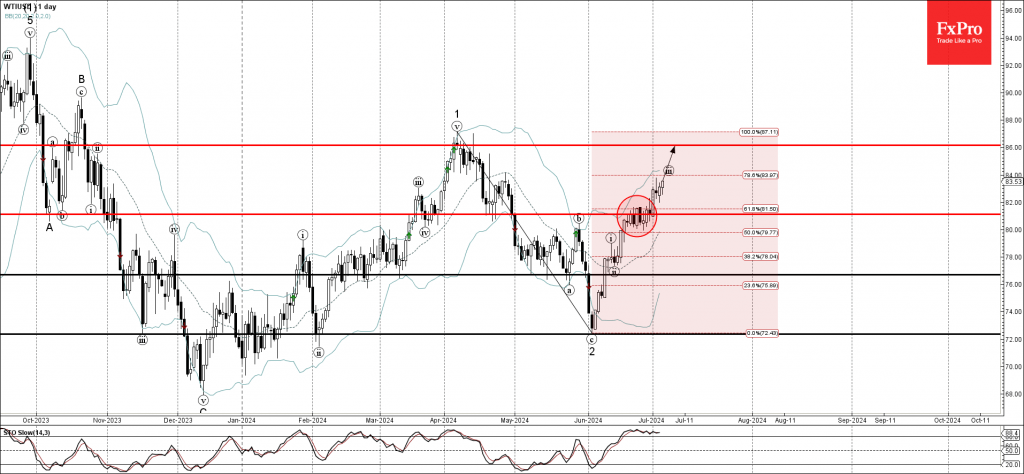

– WTI broke resistance level 81.10 – Likely to rise to resistance level 86.00 WTI crude oil recently broke the resistance level 81.10 (former top of the minor correction (b) from the end of May). The breakout of the resistance.

July 4, 2024

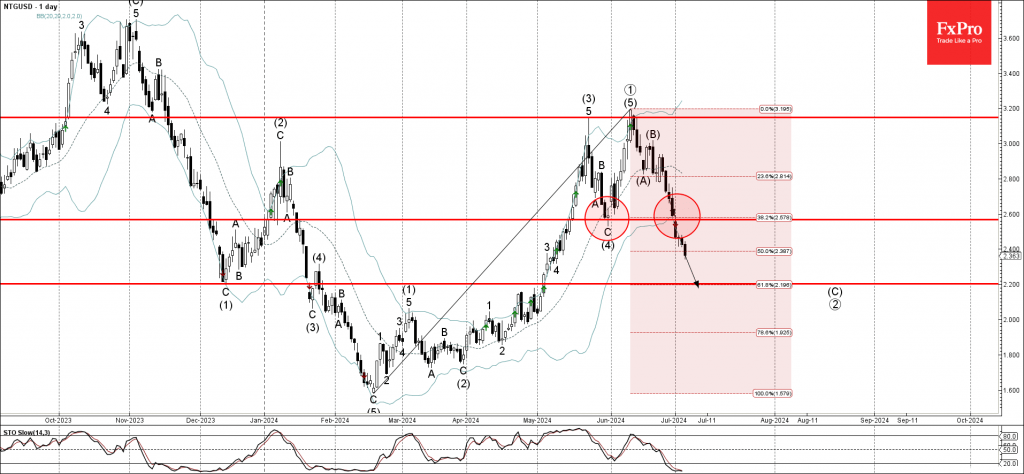

Natural gas is under bearish pressure after the earlier breakout of the key support level 2.600 (which stopped the previous medium-term ABC correction (4) from the end of May). The breakout of the support level 2.600 coincided with the breakout.

July 4, 2024

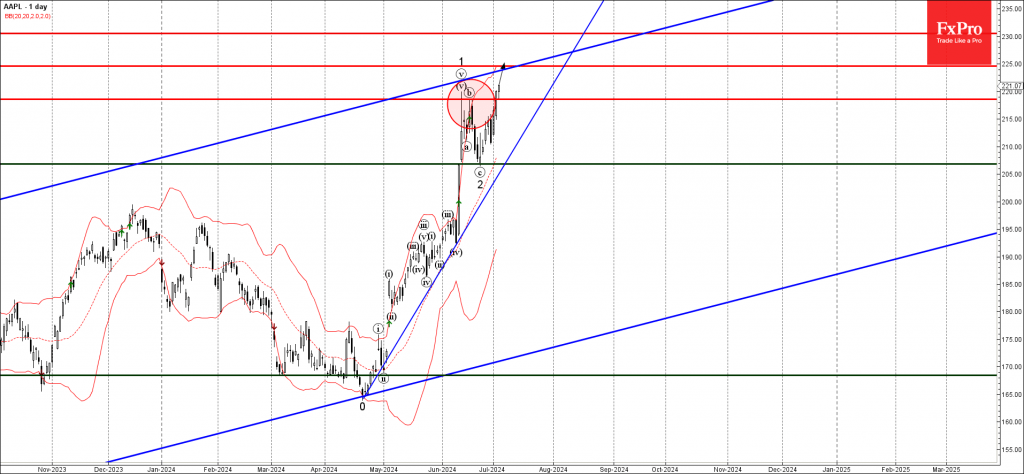

– Apple broke key resistance level 218.50 – Likely to rise to the resistance level 225.00 Apple recently broke the key resistance level 218.50 (which stopped two of the previous waves 1 and b in June, as seen from the.

July 4, 2024

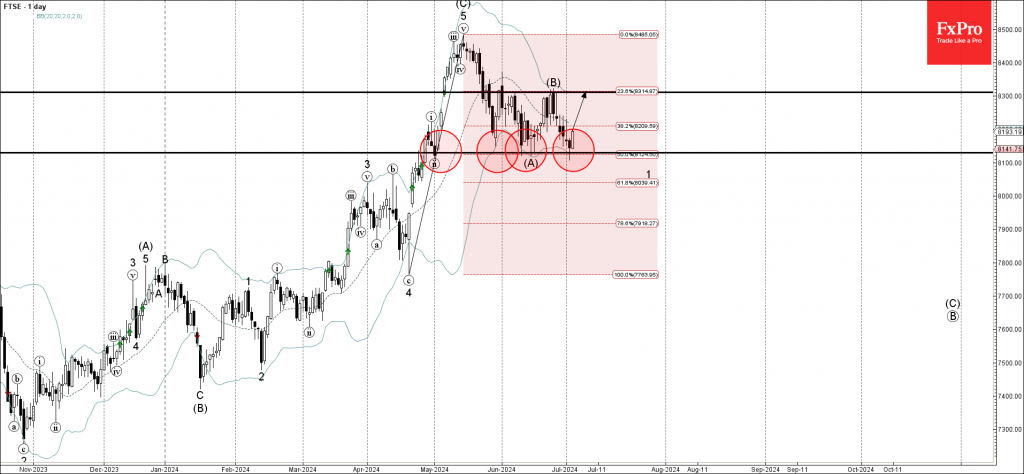

– FTSE 100 index reversed from key support level 8130.00 – Likely to rise to resistance level 8300.00, FTSE 100 index recently reversed up from the key support level 8130.00 (which has been steadily reversing the price from the end.

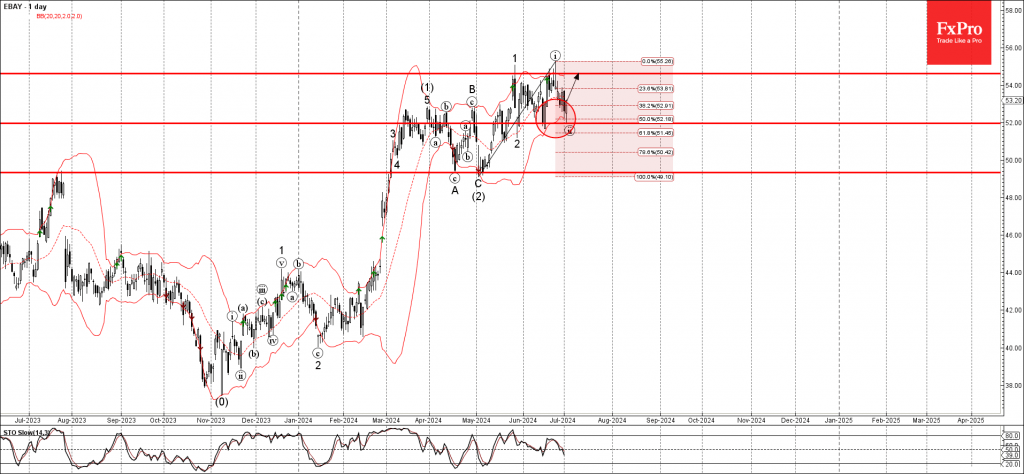

July 2, 2024

-EBAY reversed from support level 52.00 -Likely to rise to resistance level 54.60 EBAY recently reversed up from the pivotal support level 52.00 (which reversed the price twice from the end of May) – standing near the lower daily Bollinger.

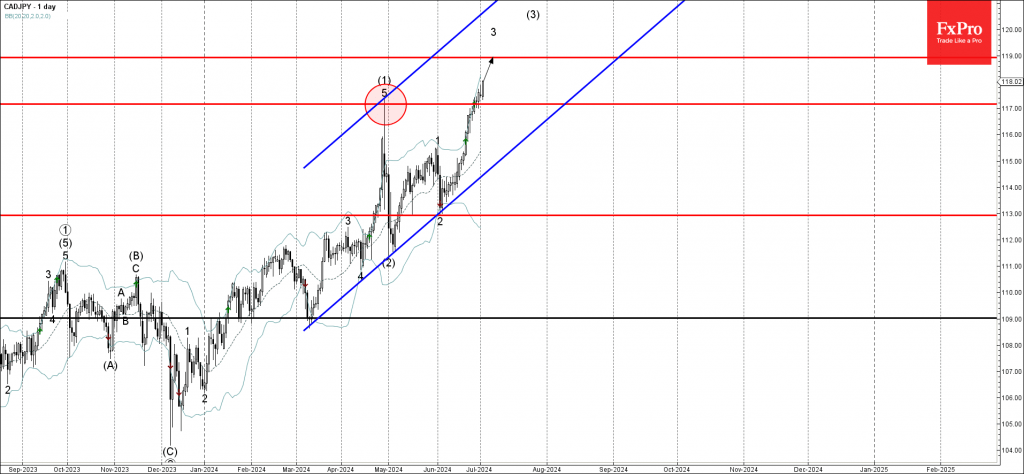

July 2, 2024

– CADJPY broke key resistance level 117.00 – Likely to reach resistance level 119.00 CADJPY currency pair recently broke through the key resistance level 117.00 (which stopped the pervious sharp upward impulse wave (1) at the end of April, as.

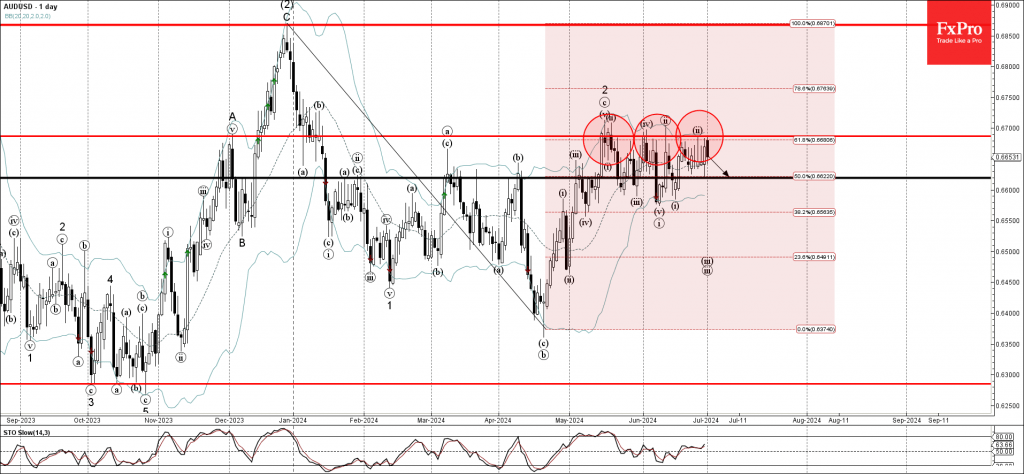

July 1, 2024

– AUDUSD reversed from strong resistance zone – Likely to fall to support level 0.6620 AUDUSD currency pair recently reversed down from the strong resistance zone located between the key resistance level 0.6685 (which has been steadily reversing the price.

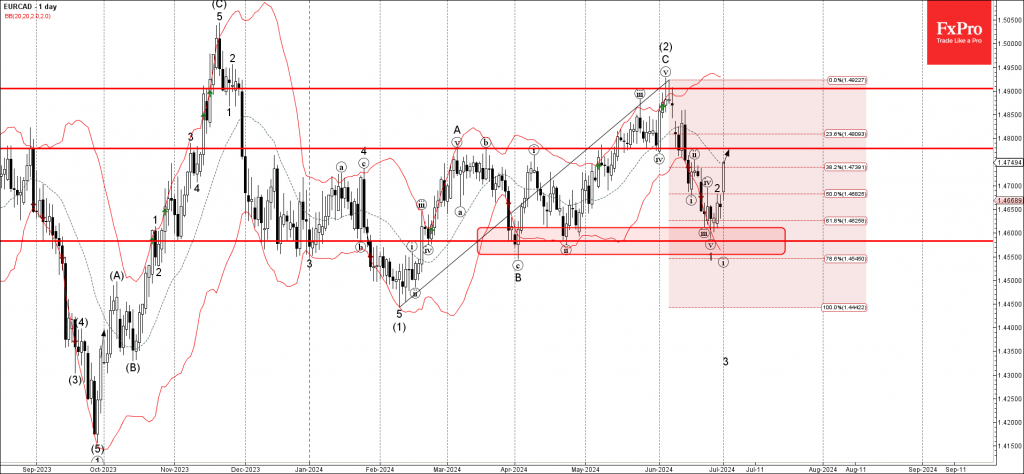

July 1, 2024

– EURCAD reversed from support zone – Likely to rise to resistance level 1.4780 EURCAD recently reversed up with the daily Hammer from the support zone located between the key support level 1.4580 (which has been reversing the price from.

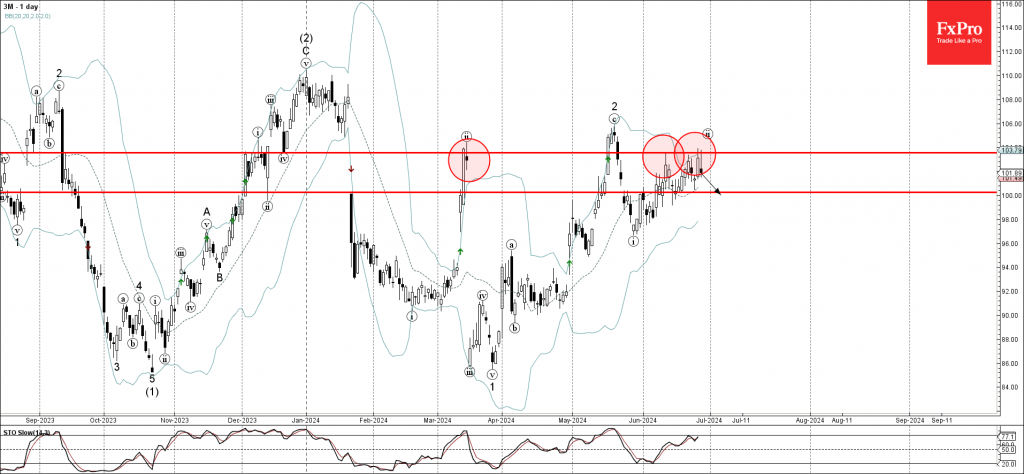

June 28, 2024

– 3M reversed from strong resistance level 103.55 – Likely to fall to support level 100.00 3M today reversed down once again from the resistance zone set between the strong resistance level 103.55 (which has been reversing the price from.

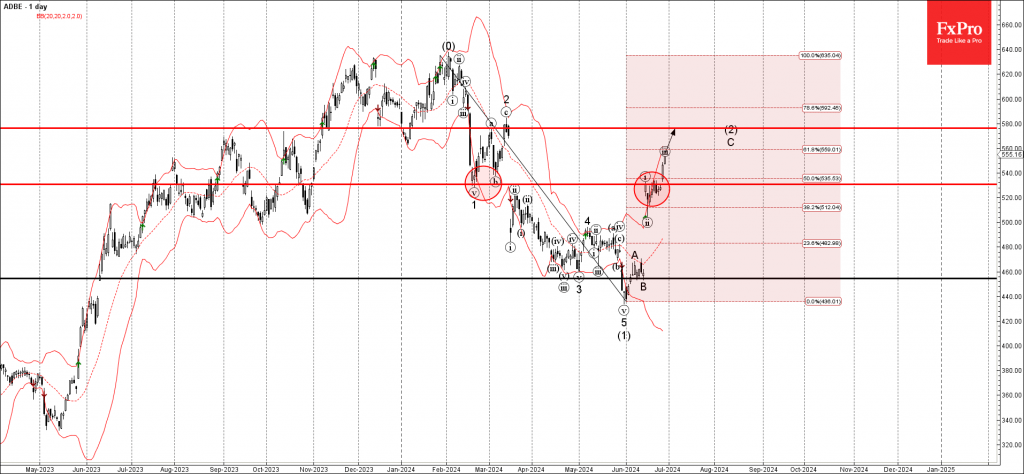

June 28, 2024

– Adobe rising in inside accelerated impulse wave C – Likely to reach resistance level 580.00 Adobe recently broke through the resistance zone located between the resistance level 530.00 and the 50% Fibonacci correction of the previous sharp downward impulse.

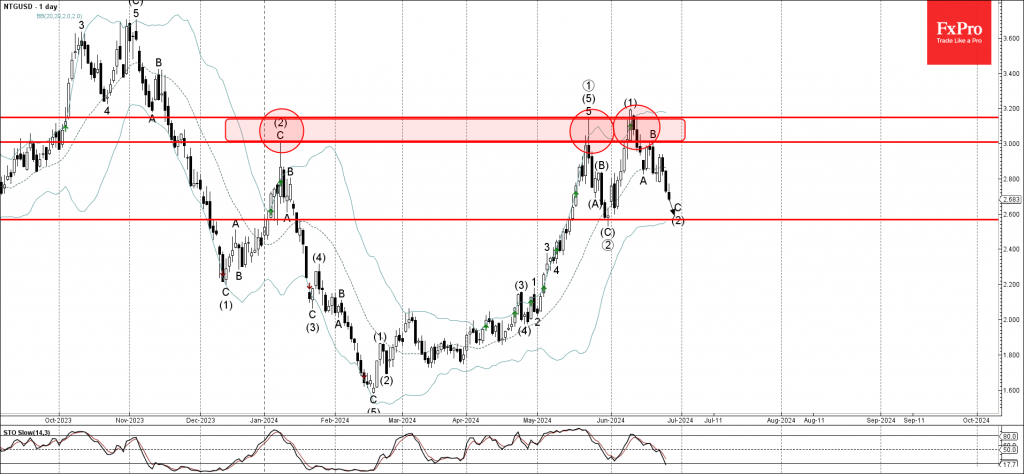

June 27, 2024

– Natural gas reversed from resistance zone – Likely to fall to support level 2.6000 Natural gas recently reversed down from the resistance zone located between the resistance levels 3.200 and 3.0000, which have been reversing the price from the.