Technical analysis - Page 106

July 31, 2024

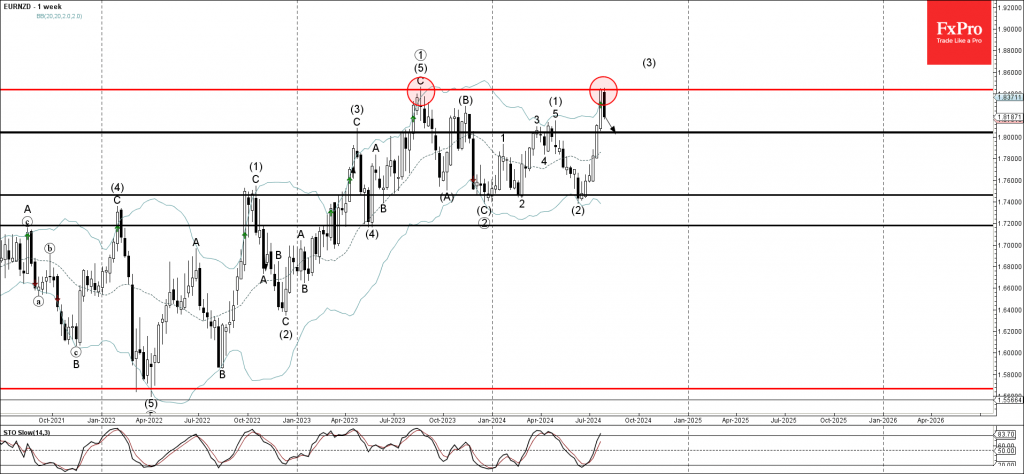

– EURNZD under bearish pressure – Likely to fall to support level 1.8045 EURNZD currency pair under the bearish pressure after the earlier downward reversal from the long-term resistance level 1.8435, which stopped the weekly uptrend in the middle of.

July 30, 2024

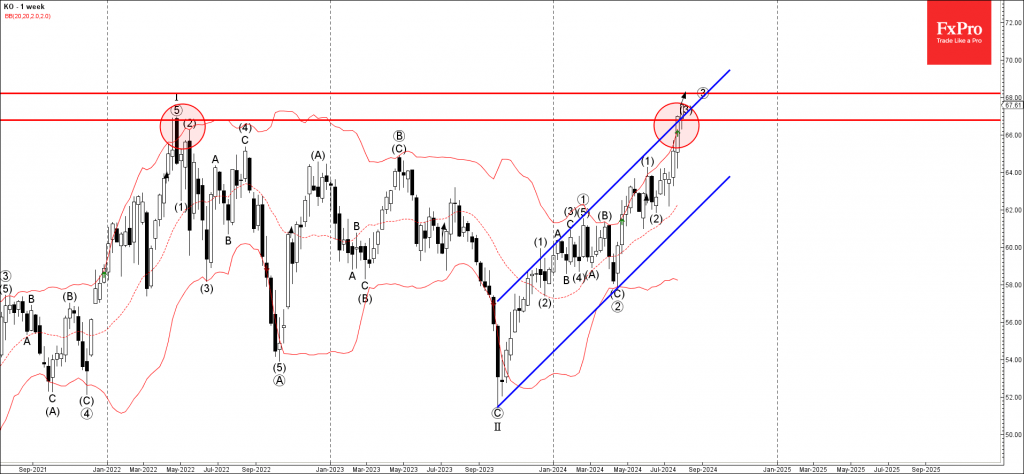

– Coca-Cola broke long-term resistance level 66.80 – Likely to rise to resistance level 68.00 Coca-Cola continues to rise strongly after the earlier breakout of the of long-term resistance level 66.80, which stopped the weekly uptrend at the start of.

July 30, 2024

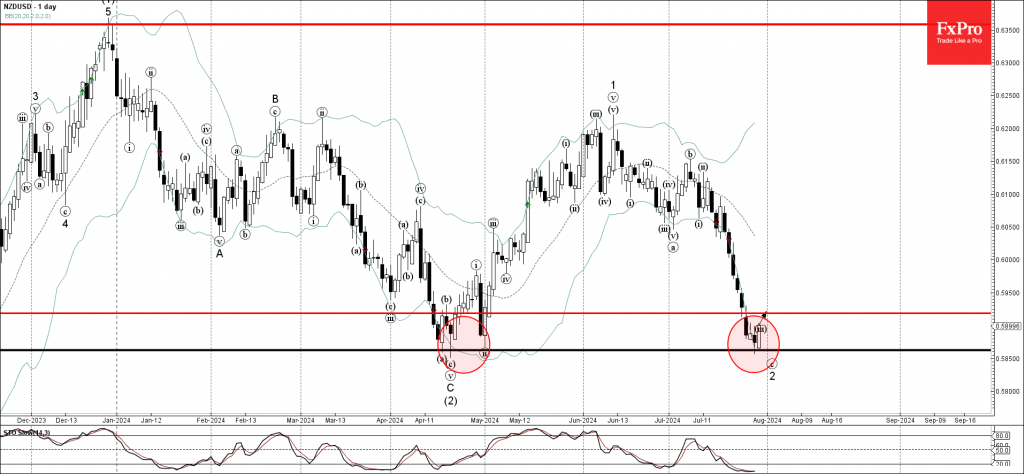

– NZDUSD reversed from support level 0.5860 – Likely to rise to resistance level 0.5920 NZDUSD currency pair recently reversed up from the pivotal support level 0.5860 (which reversed the price twice in April), standing close to the lower daily Bollinger.

July 30, 2024

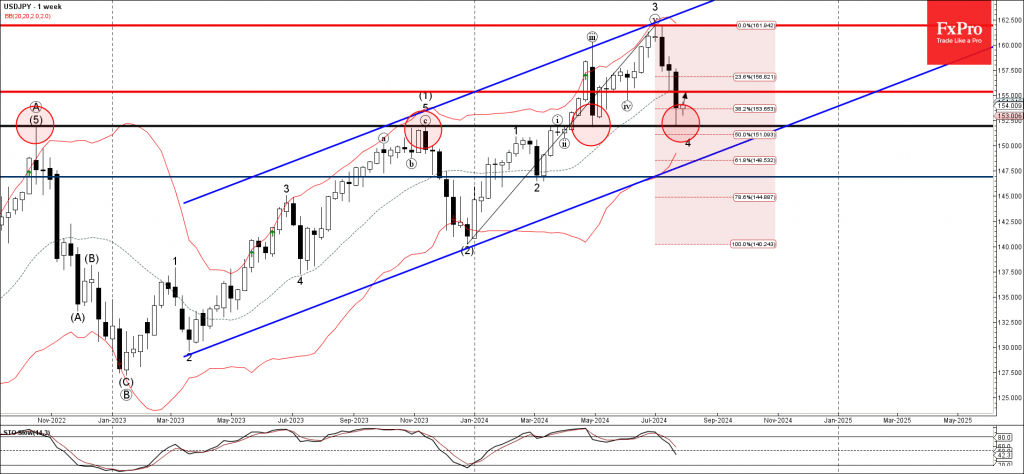

– USDJPY reversed from support level 151.95 – Likely to rise to resistance level 155.00 USDJPY currency pair recently reversed up from the powerful support level 151.95 (former major resistance from 2022 and also the yearly high from last year), standing.

July 30, 2024

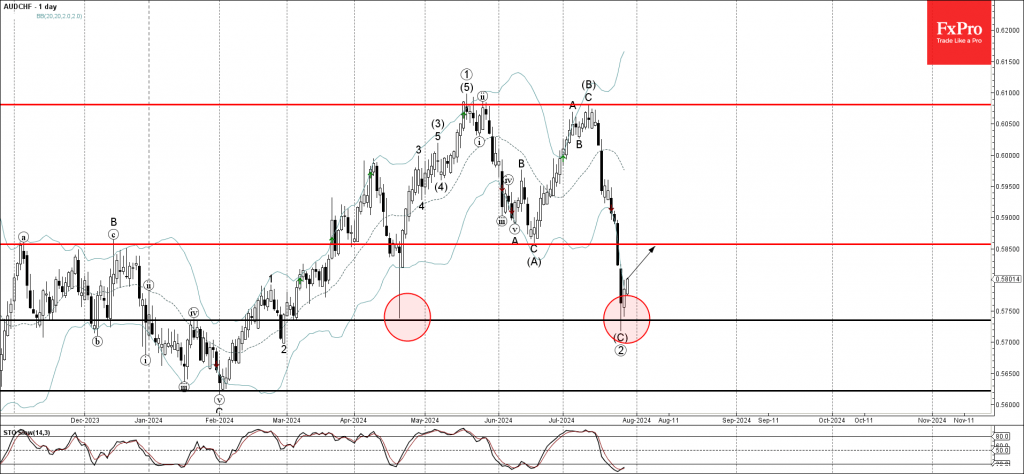

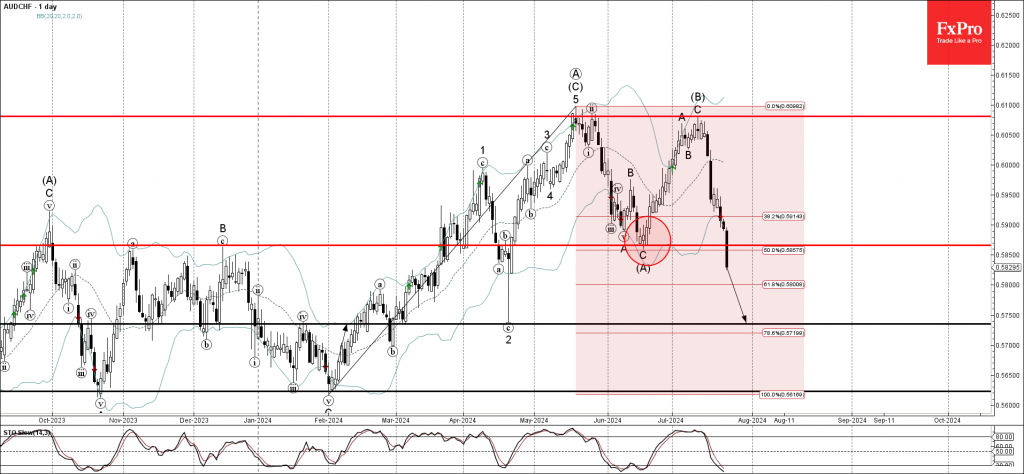

– AUDCHF reversed from key support level 0.5735 – Likely to rise to resistance level 0.5850 AUDCHF currency pair recently reversed up with the daily Japanese candlestick Piercing Line from the key support level 0.5735 (the previous monthly low from April,.

July 25, 2024

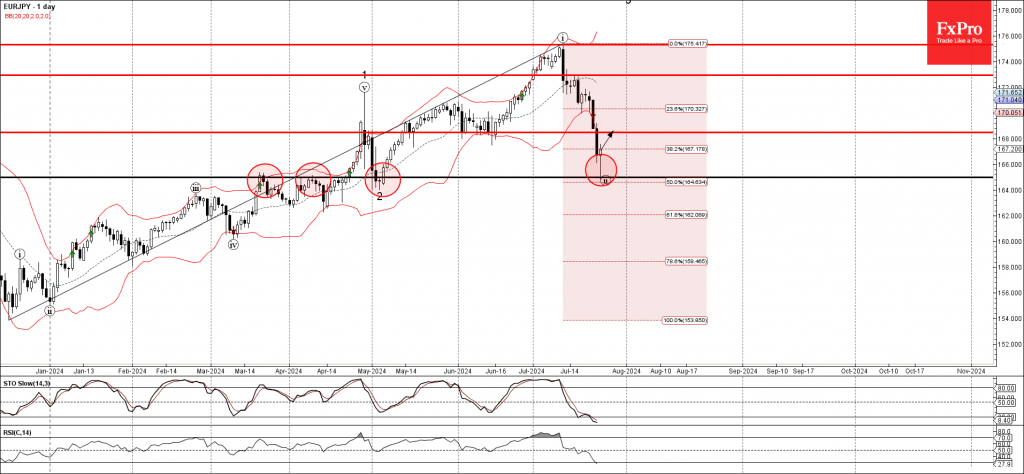

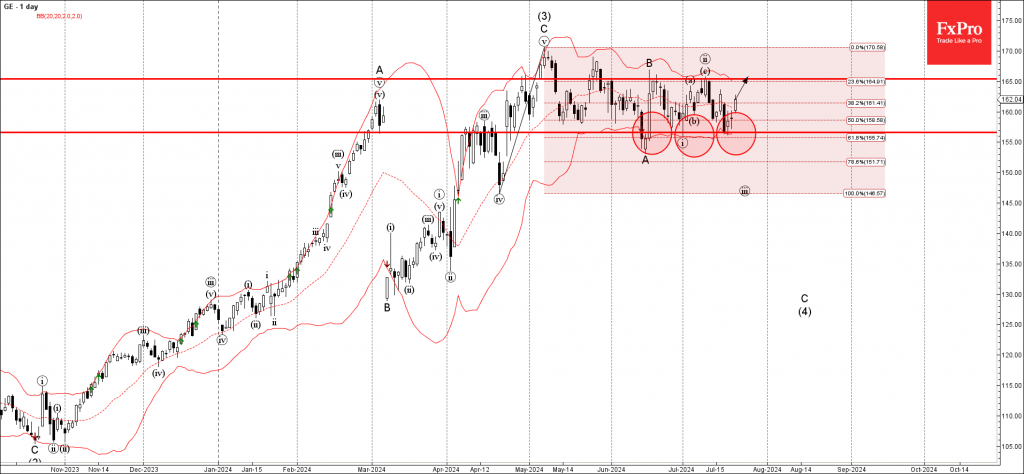

– EURJPY reversed from support level 165.00 – Likely to rise to resistance level 168.00 EURJPY currency pair recently reversed up from the pivotal support level 165.00 (former strong resistance from March and April, which also stopped the previous correction 2.

July 25, 2024

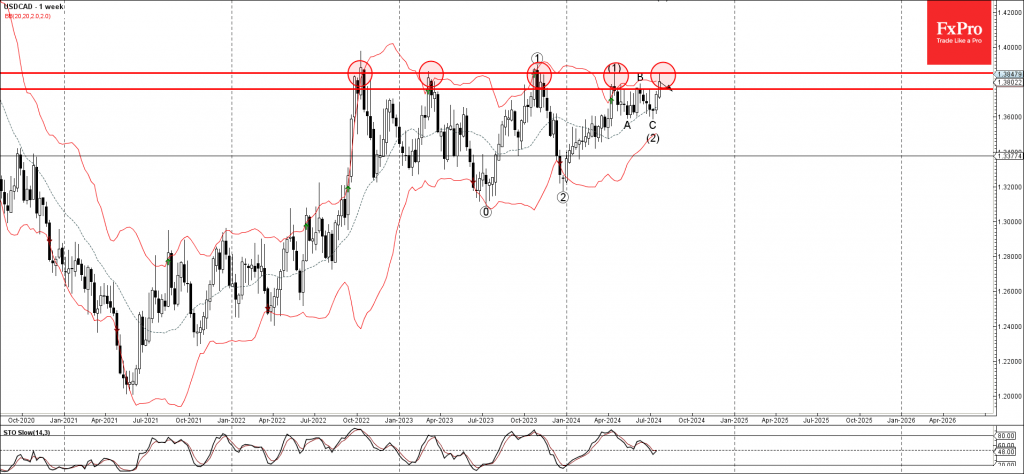

– USDCAD reversed from long-term resistance level 1.3850 – Likely to fall to support level 1.3760 USDCAD currency pair is under bearish pressure after previously reversing from the long-term resistance level 1.3850 (which has been repeatedly reversing the price from the.

July 24, 2024

– AUDCHF broke support level 0.5865 – Likely to fall to support level 0.5735 AUDCHF currency pair recently broke the key support level 0.5865 (which stopped the previous correction (A) in the middle of June). The breakout of the support level.

July 24, 2024

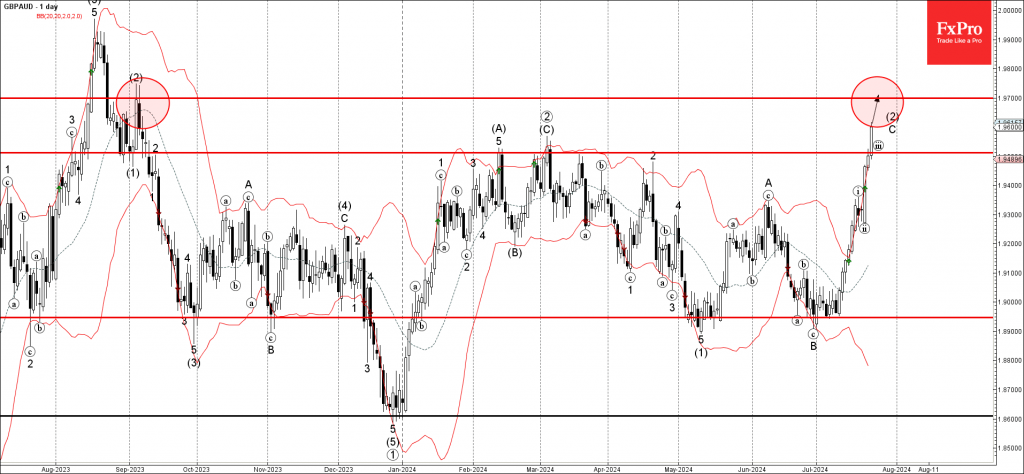

– GBPAUD broke multi-month resistance level 1.9510 – Likely to rise to resistance level 1.9700 GBPAUD currency pair recently broke above the multi-month resistance level 1.9510 (which has been reversing the price from February). The breakout of the resistance level 1.9510.

July 23, 2024

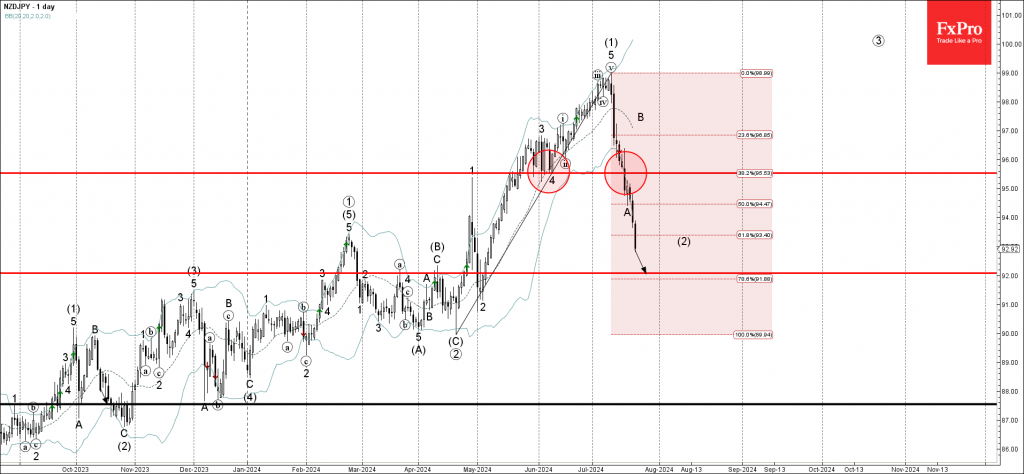

– NZDJPY falling inside ABC correction (2) – Likely to reach support level 92.00 NZDJPY currency pair falling sharply after the price broke the support area located between the support level 95.50 and the 38.2% Fibonacci retracement of the previous impulse.

July 23, 2024

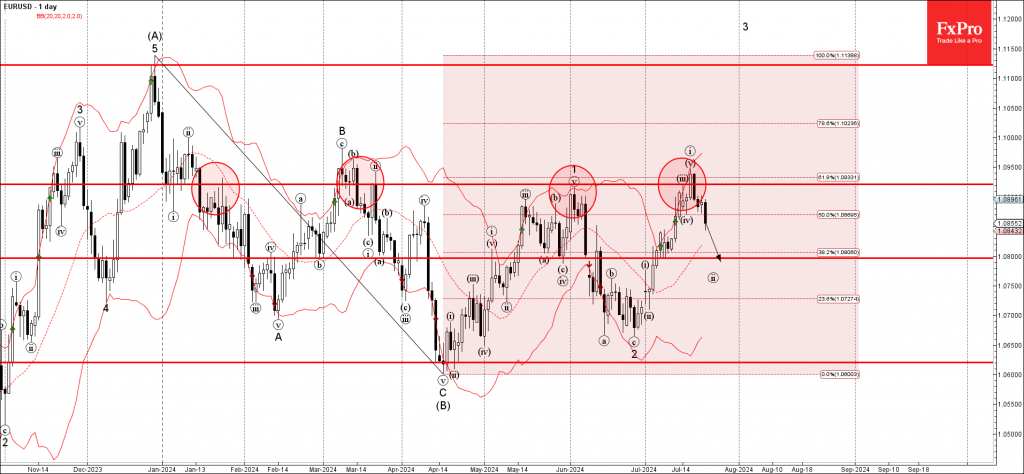

– EURUSD reversed from resistance area – Likely to fall to support level 1.0800 EURUSD currency pair recently reversed down from the resistance area set between the multi-month resistance level 1.0920 (which has been reversing the price from the start of.