Technical analysis - Page 104

August 16, 2024

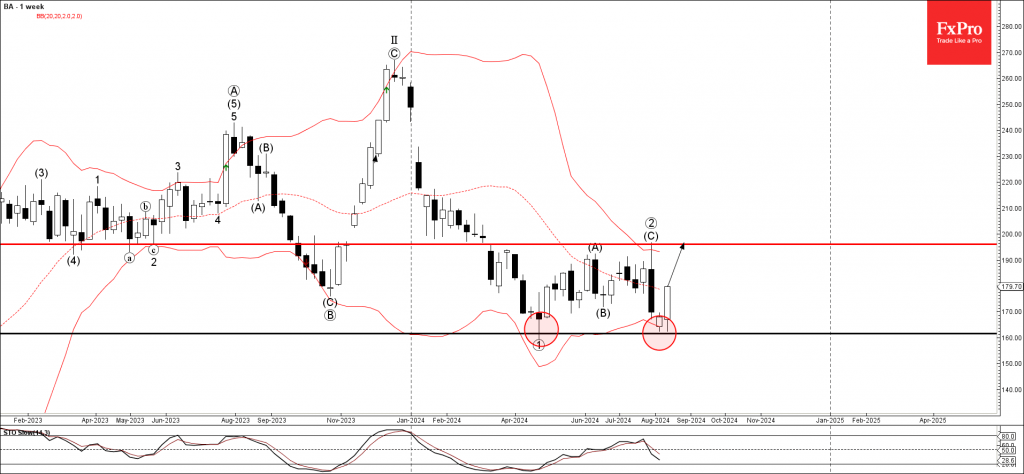

– Boeing reversed from support area – Likely to rise to resistance level 196.00 Boeing recently reversed up from the strong support area located between the support level 161.60 (which stopped the weekly wave 1 April) and the lower weekly.

August 15, 2024

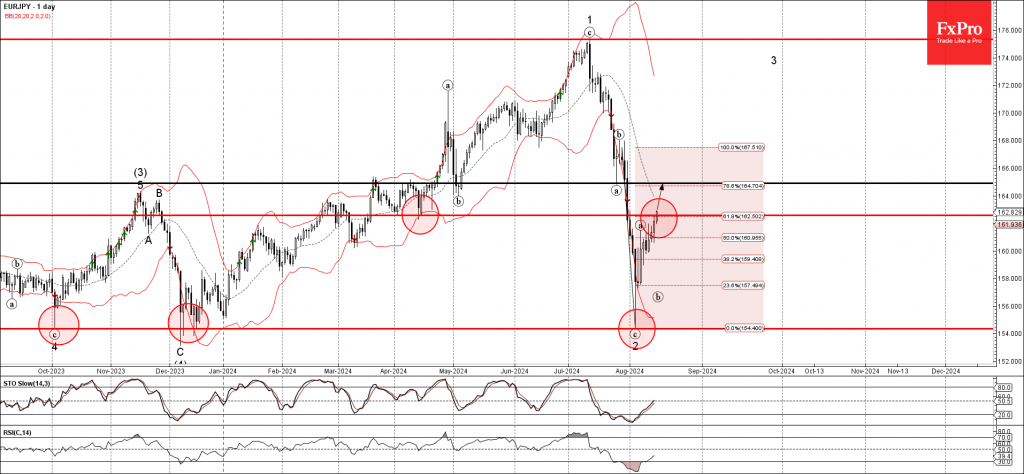

– EURJPY broke resistance area – Likely to rise to resistance level 164.90 EURJPY currency pair just broke the resistance area located between the resistance level 162.50 and the 61.8% Fibonacci correction of the earlier sharp downward impulse (c) from.

August 15, 2024

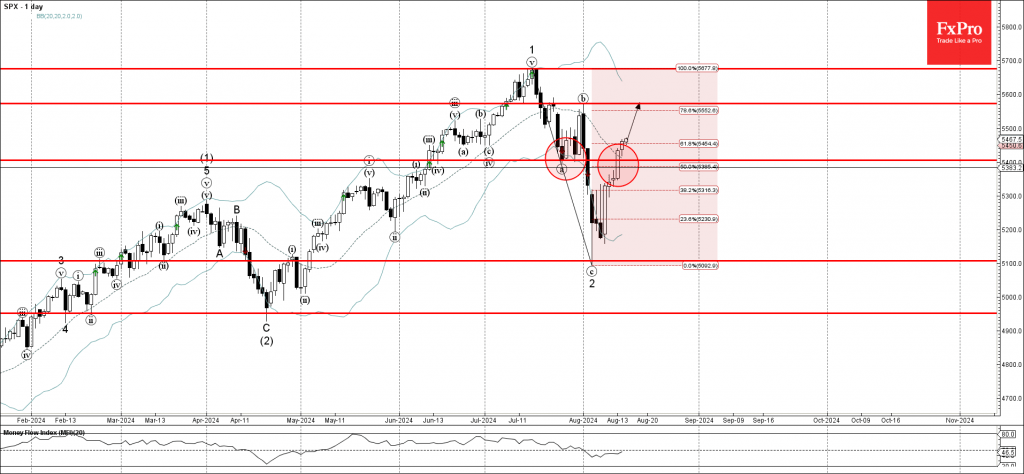

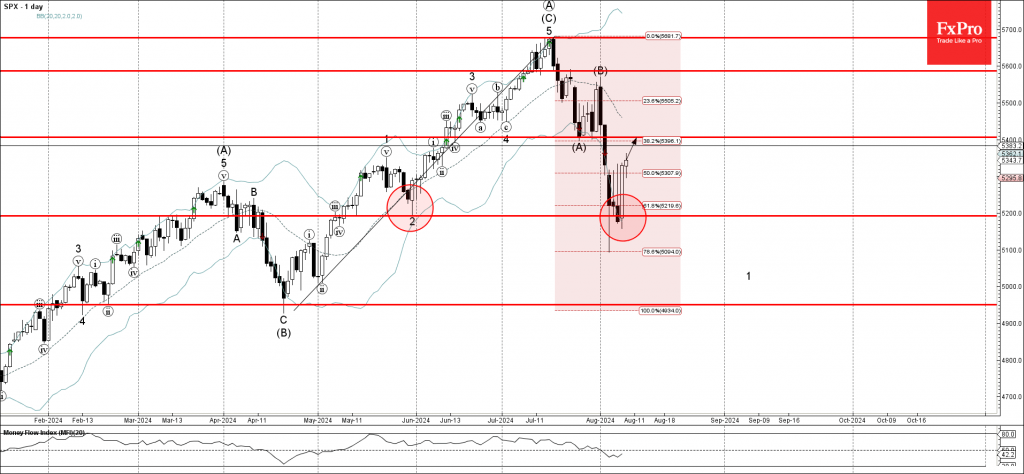

– S&P 500 index rising inside impulse wave 3 – Likely to test resistance level 5570.00 S&P 500 index recently continues to rise inside the impulse wave 3 which previously broke the resistance area located between the strong resistance level.

August 14, 2024

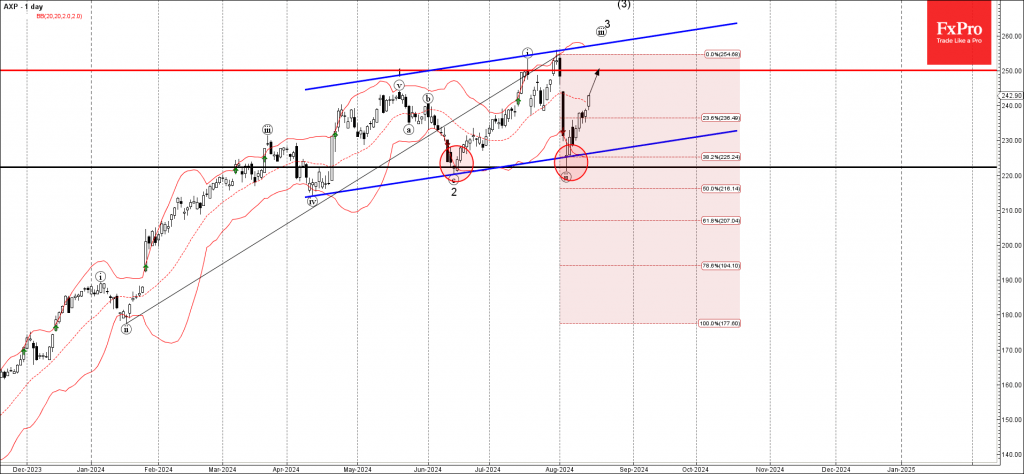

– American Express rising inside minor impulse wave iii – Likely to reach resistance level 250.00 American Express recently continues to rise inside the minor impulse wave iii, which started earlier from the support area located between the strong resistance level 222.00.

August 14, 2024

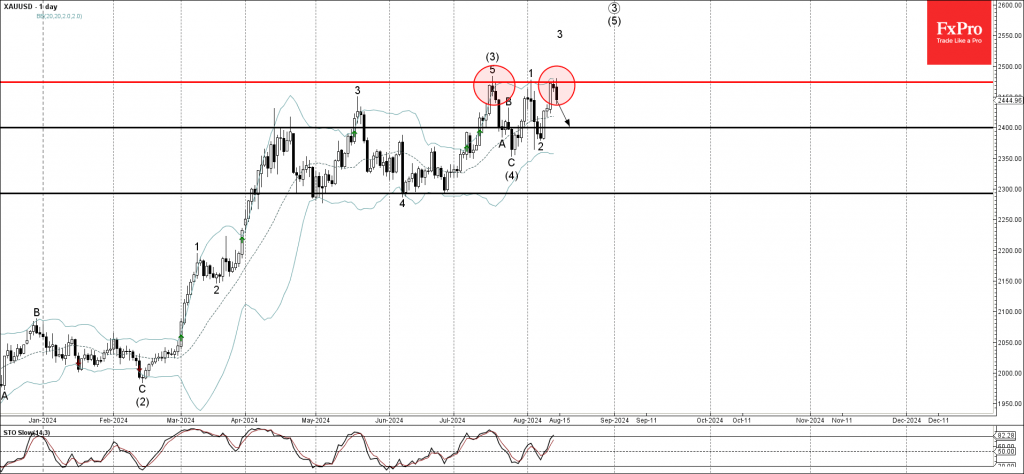

– Gold reversed from resistance zone – Likely to fall to support level 2400.00 Gold recently reversed down from the resistance area located between the strong resistance level 2475.00 (which stopped the previous impulse waves (3) and 1) and the.

August 13, 2024

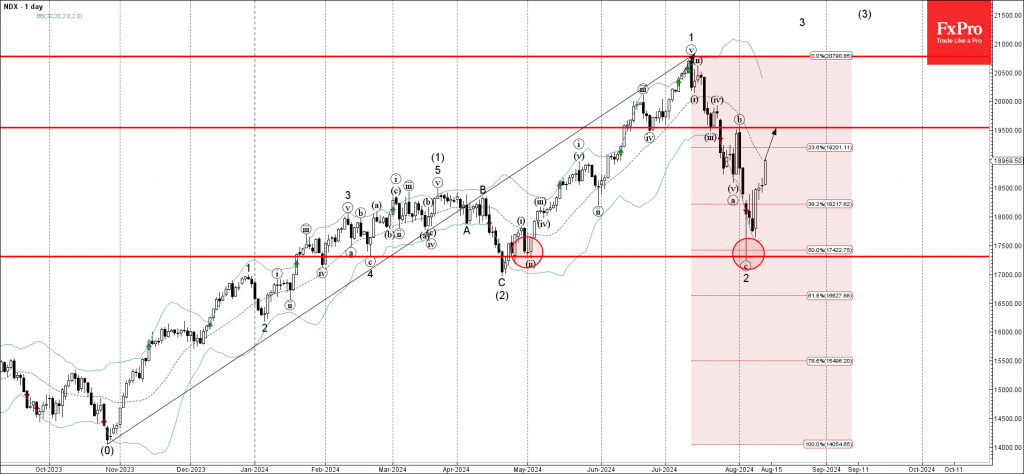

– Nasdaq-100 index reversed from support zone – Likely to rise to resistance level 19500.00 Nasdaq-100 index continues to rise inside the minor impulse wave 3, which started recently from the major support area set between the long-term support level.

August 13, 2024

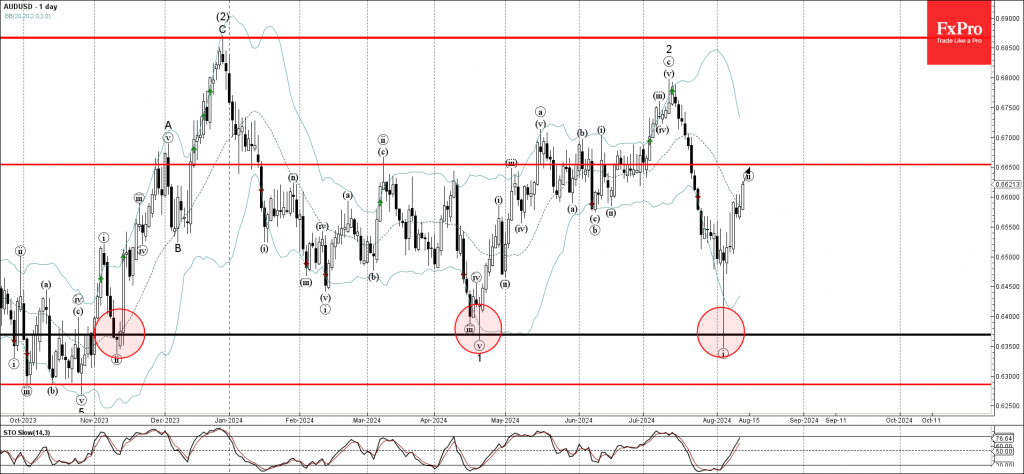

– AUDUSD reversed from support zone – Likely to rise to resistance level 0.6650 AUDUSD currency pair recently reversed up from the powerful support area located between the long-term support level 0.6370 (which has been reversing the price from last.

August 12, 2024

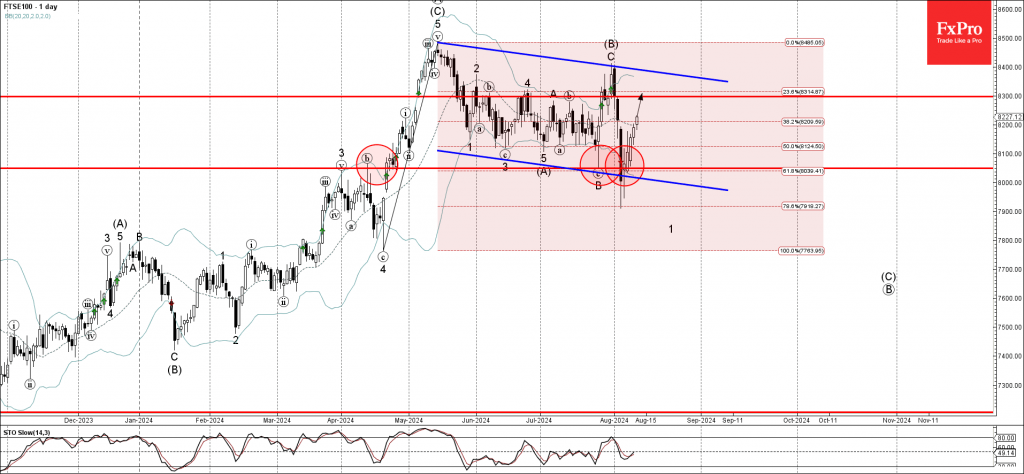

– FTSE 100 index reversed from support zone – Likely to rise to resistance level 8300.00 FTSE 100 index recently reversed up from the support area located between the pivotal support level 8050.00 (former monthly low from July), lower daily.

August 12, 2024

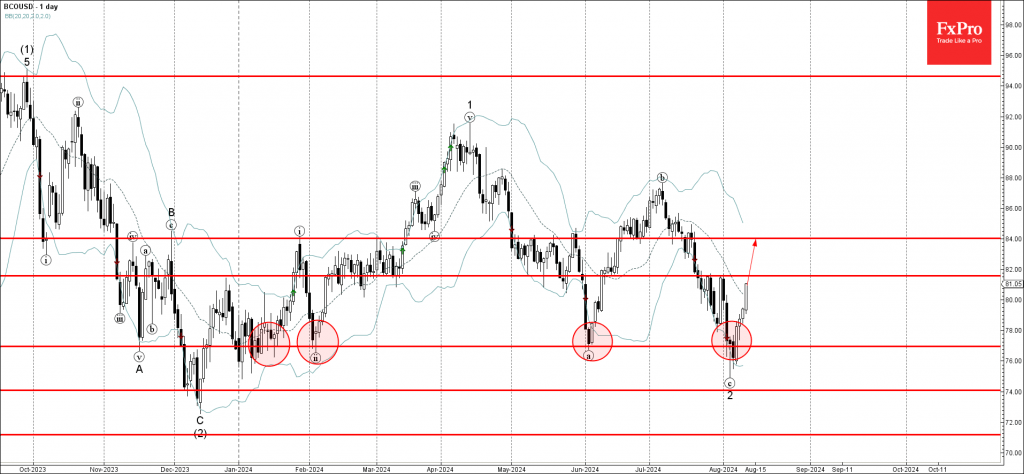

– Brent crude oil reversed from support zone – Likely to rise to resistance levels 81.60 and 84.00 Brent crude oil recently reversed up from the support zone set between the strong support level 77,00 (which has been reversing the.

August 9, 2024

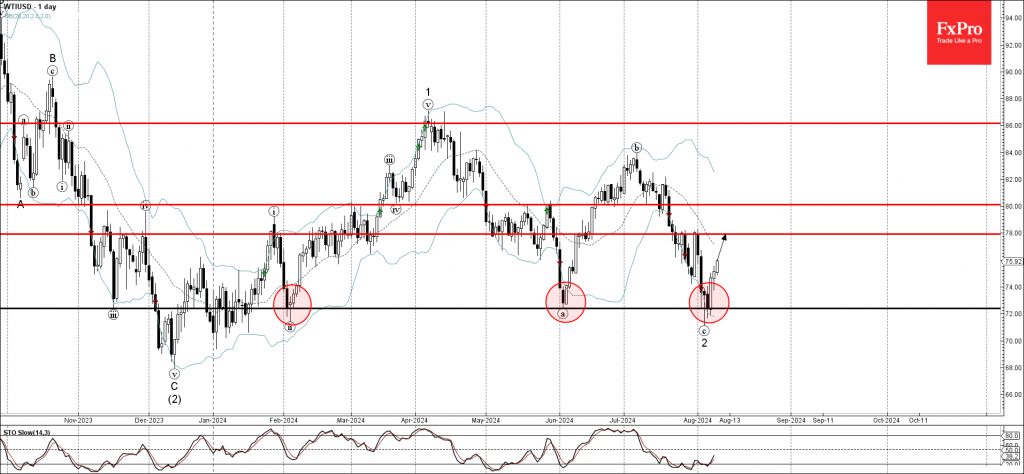

– WTI reversed from support zone – Likely to rise to resistance level 78.00 WTI crude oil recently reversed up from the support zone set between the strong support level 72.40 (which has been reversing the price from February) and.

August 9, 2024

– S&P 500 reversed from resistance zone – Likely to rise to resistance level 5400.00 S&P 500 index recently reversed up from the support zone located between the key support level 51900.00 (former low of wave 2 from May), lower.