Technical analysis - Page 101

September 10, 2024

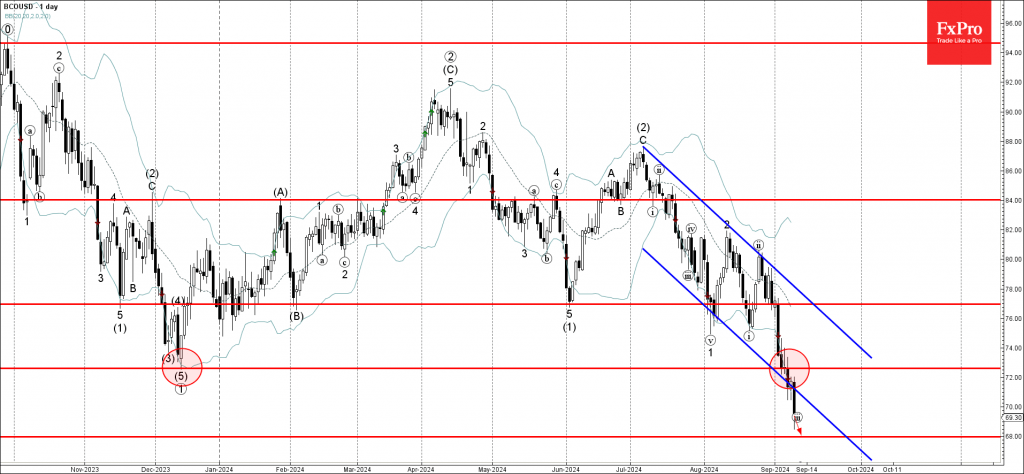

– Brent Crude oil broke key support level 72.60 – Likely to fall to support level 68.00 Brent Crude oil recently broke the support zone located between the key support level 72.60 (former multi-month support from December) and the support.

September 10, 2024

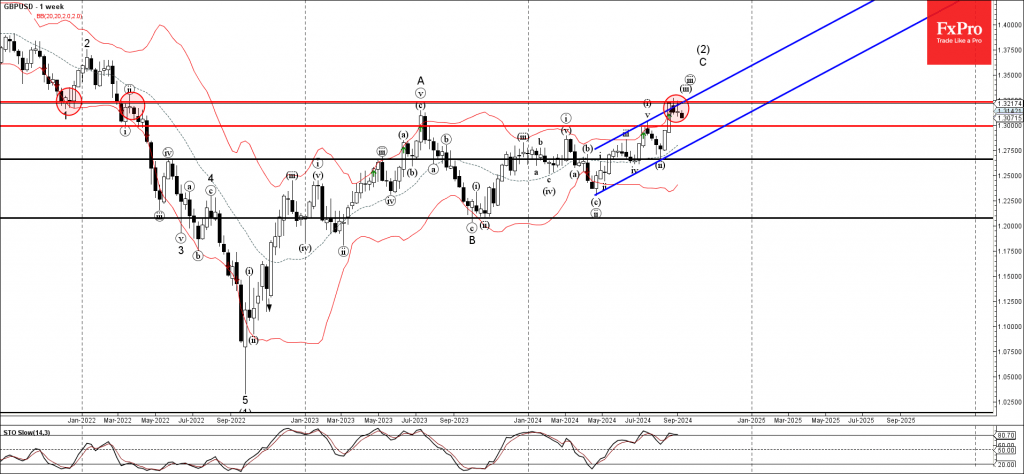

– GBPUSD reversed from strong resistance level 1.3230 – Likely to fall to support level 1.3000 GBPUSD currency pair recently reversed down from the strong resistance level 1.3230 (former strong support from the end of 2021). The resistance level 1.3230.

September 10, 2024

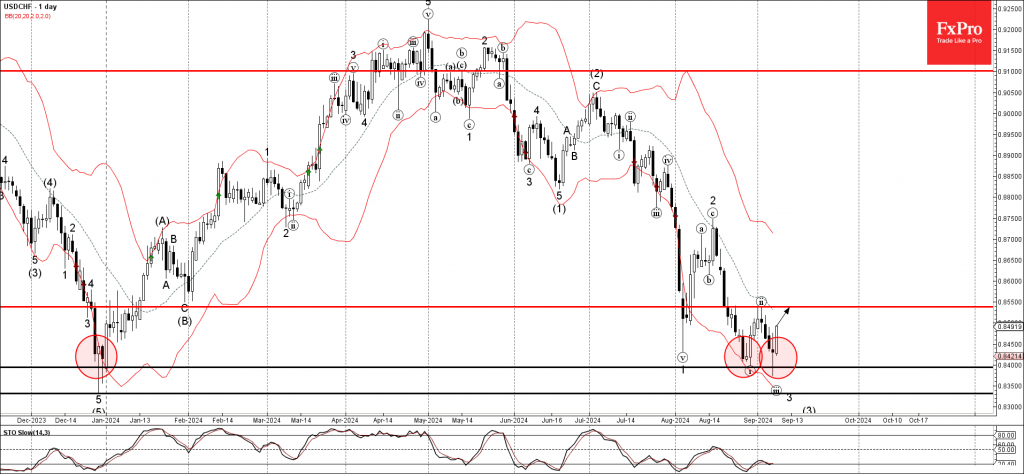

– USDCHF reversed from support level 0.8400 – Likely to rise to resistance level 0.8550 USDCHF currency pair recently reversed up from the key support level 0.8400 (which has been reversing the price since the end of last year). The.

September 6, 2024

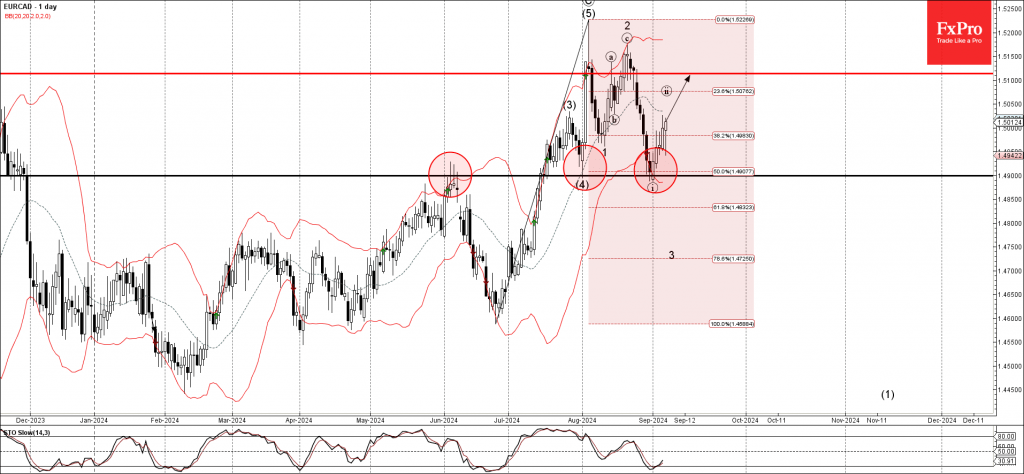

– EURCAD reversed from pivotal support level 1.4900 – Likely to rise to resistance level 1.5100 EURCAD currency pair recently reversed from the pivotal support level 1.4900 (a former monthly high from July, which stopped the previous correction (4)). The.

September 6, 2024

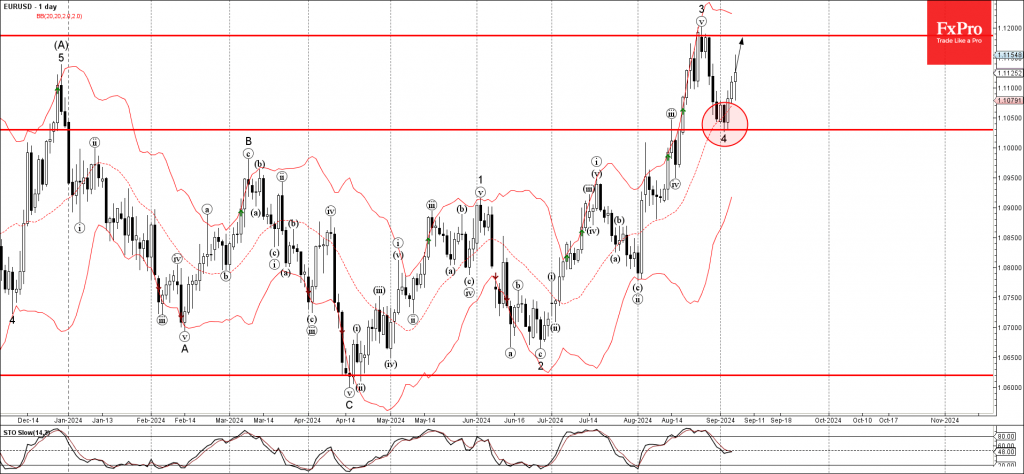

– EURUSD reversed from support level 1.1030 – Likely to rise to resistance level 1.1200 EURUSD recently reversed up from the support level 1.1030 (former resistance from August, acting as the support after it was broken by the previous impulse.

September 5, 2024

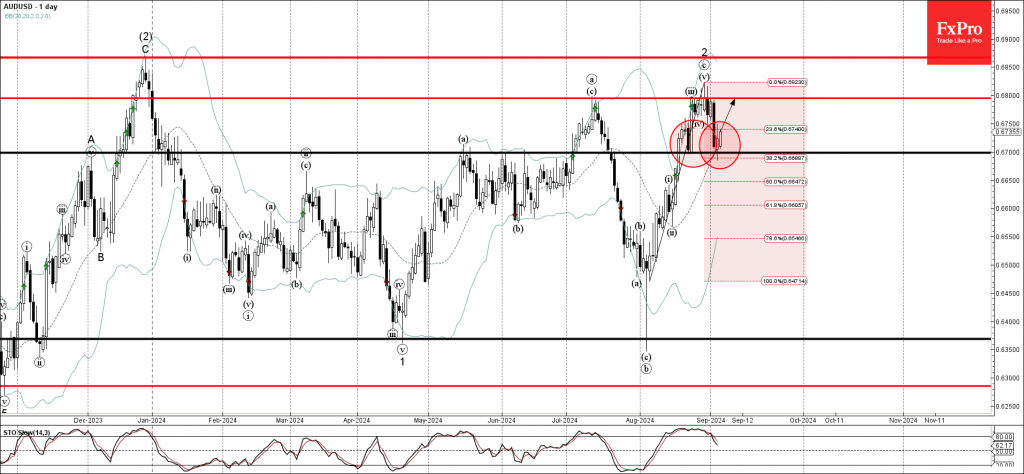

– AUDUSD reversed from support level 0.6700 – Likely to rise to resistance level 0.6800 AUDUSD currency pair recently reversed up from the support level 0.6700 (which also reversed the price at the end of August) standing near the 20-day.

September 5, 2024

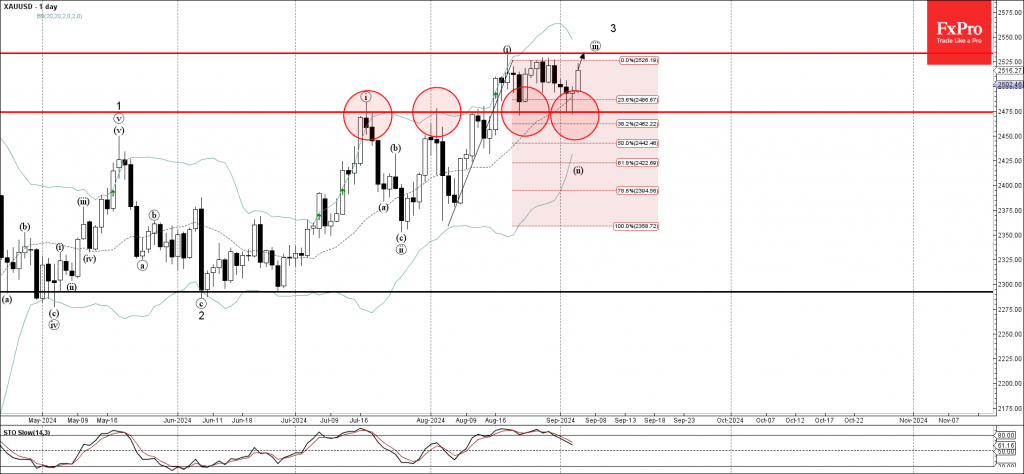

– Gold reversed from support level 2475.00 – Likely to rise to resistance level 2535.00 Gold recently reversed up from the support level 2475.00 (former monthly high from July, which has been reversing the price from August) standing near the.

September 5, 2024

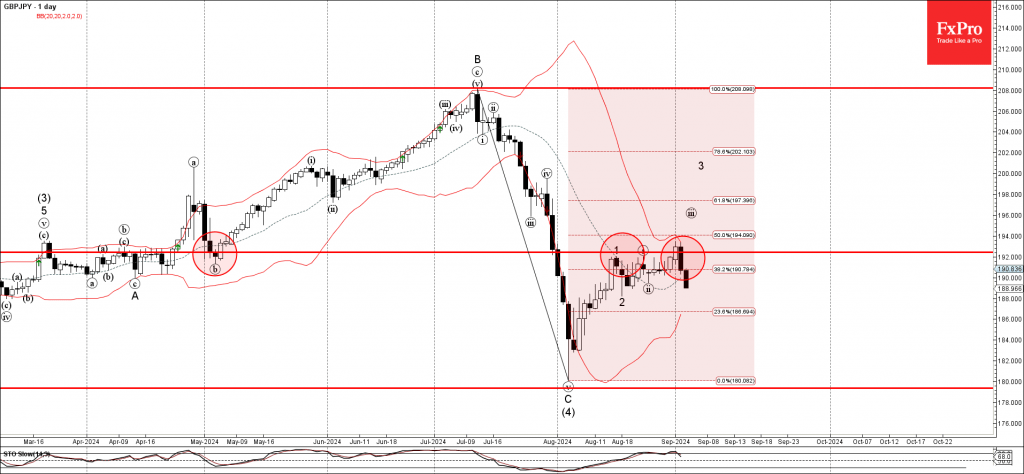

– GBPJPY reversed from resistance level 192.40 – Likely to fall to support level 188.00 GBPJPY currency pair recently reversed down from the key resistance level 192.40 (which has been reversing the price from the middle of April) standing near.

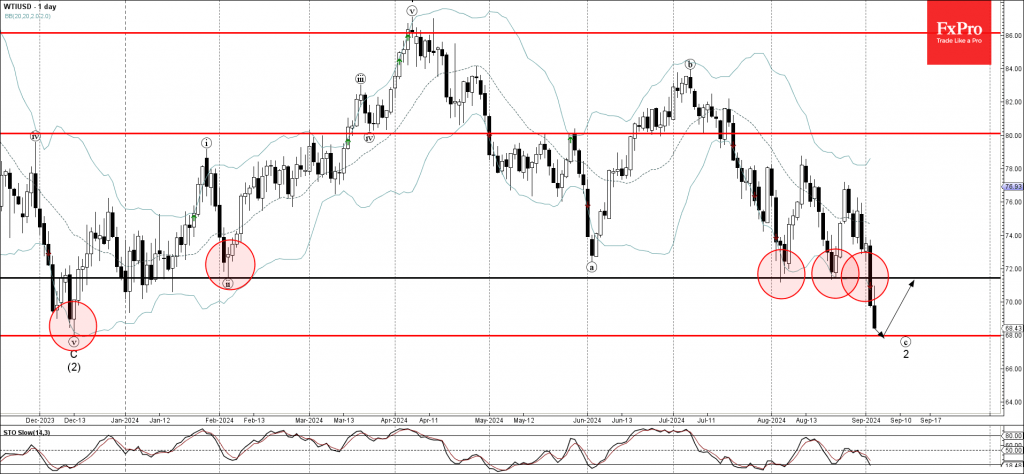

September 5, 2024

– WTI crude oil broke key support level 71.40 – Likely to fall to support level 68.00 WTI crude oil recently broke sharply below the key support level 71.40 (which has been repeatedly reversing the price from the start of.

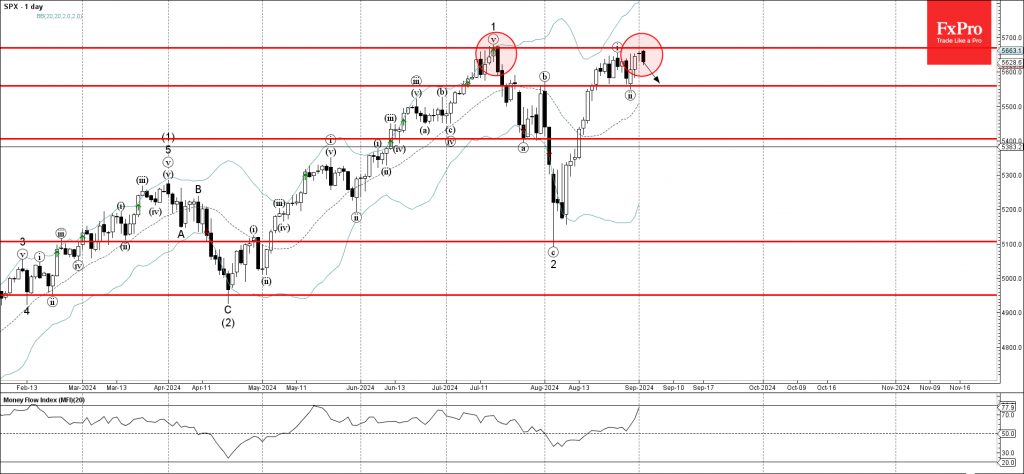

September 3, 2024

– S&P 500 reversed from resistance level 5670.00 – Likely to fall to support level 5550.00 S&P 500 index recently reversed down from the powerful resistance level 5670.00 (which stopped the previous impulse wave 1 in the middle of July).

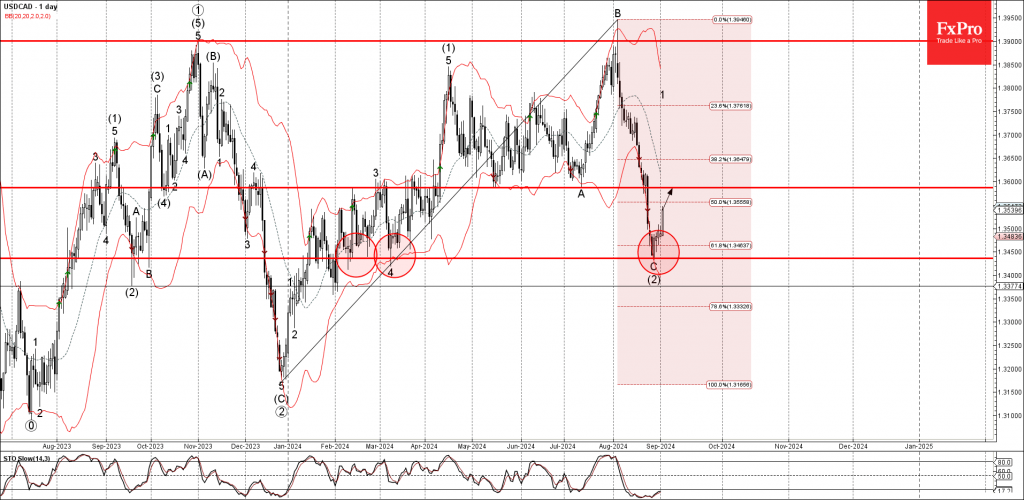

September 3, 2024

– USDCAD reversed from key support level 1.3450 – Likely to rise to resistance level 1.3600 USDCAD currency pair recently reversed up from the key support level 1.3450 (which has been reversing the price from February) standing near the lower daily.