Technical analysis - Page 100

September 18, 2024

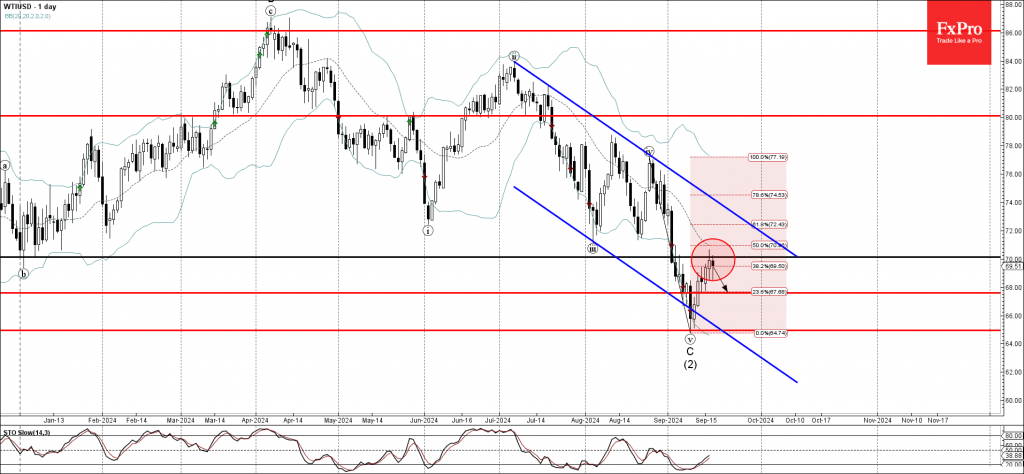

– WTI reversed from round resistance level 70.00 – Likely to fall to support level 68.00 WTI crude oil recently reversed down from the round resistance level 70.00 (former strong support from January). The resistance level 70.00 was strengthened by.

September 17, 2024

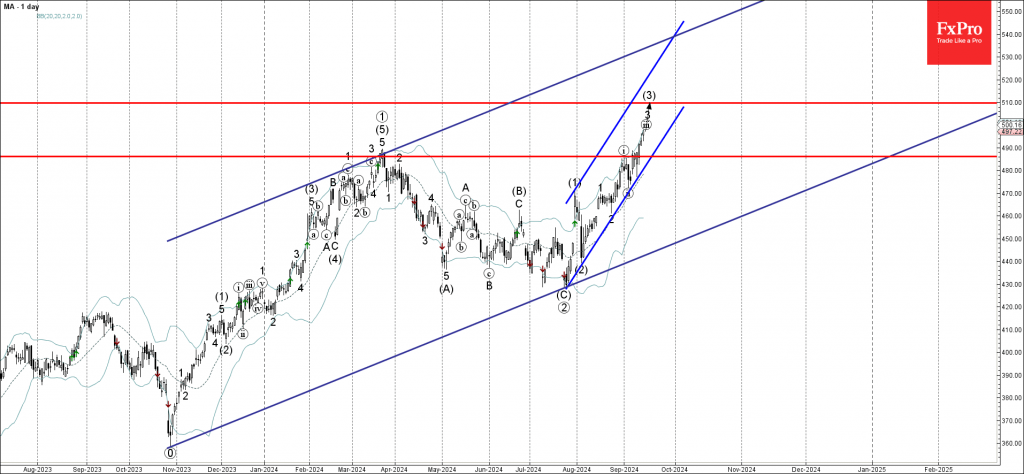

– MasterCard broke round resistance level 500.00 – Likely to rise to the resistance level 510.00 MasterCard continues to rise inside the accelerated impulse wave 3, which previously broke above the major long-term resistance level 485.00 (which stopped the weekly.

September 17, 2024

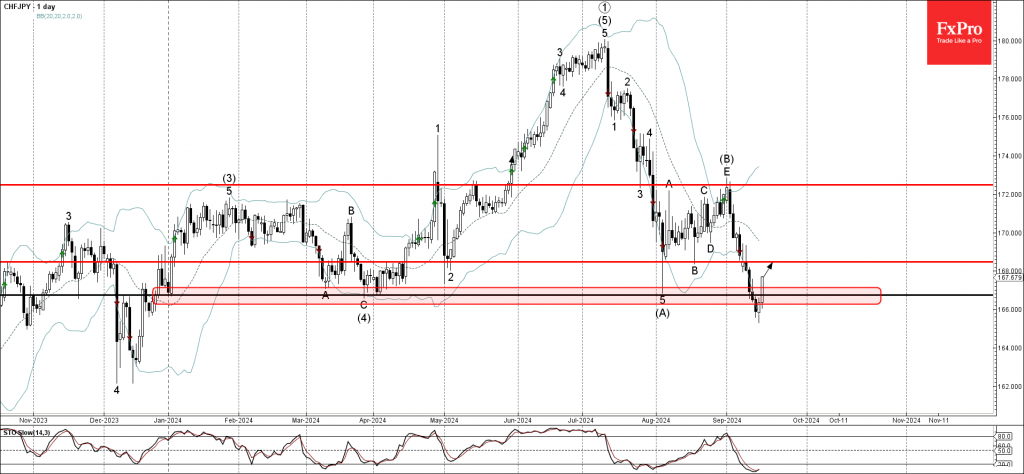

– CHFJPY reversed from support zone – Likely to rise to the resistance level 168.45 CHFJPY currency pair recently reversed up from the key support zone located between the long-term support level 166.75 (which has been reversing the price from.

September 17, 2024

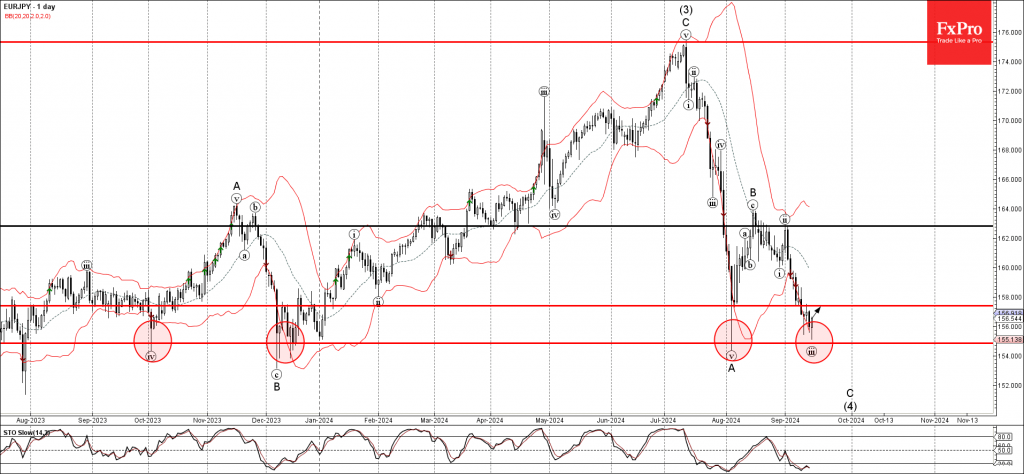

– EURJPY reversed from support zone – Likely to rise to the resistance level 157.40 EURJPY currency pair recently reversed up from the powerful support zone located between the long-term support level 154.85 (which has been reversing the price from.

September 17, 2024

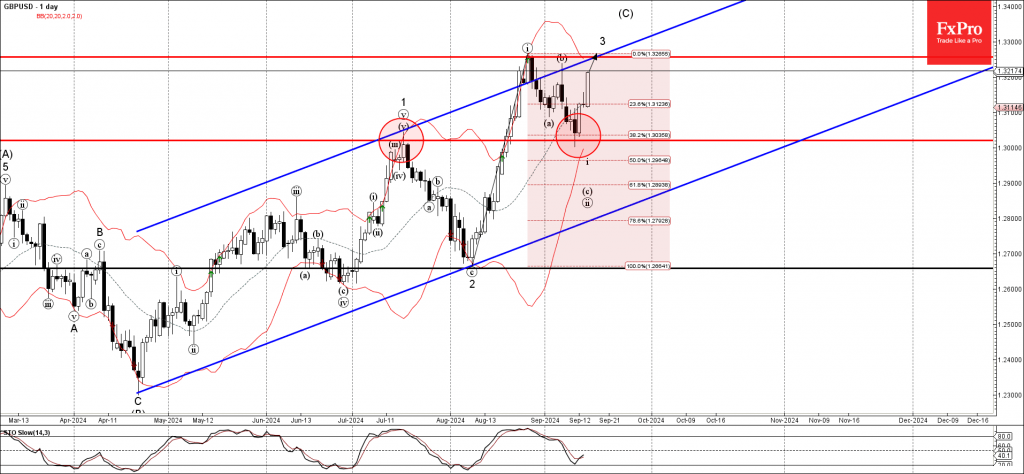

– GBPUSD reversed from support zone – Likely to rise to the resistance level 1.3255 GBPUSD currency pair continues to rise strongly after the earlier upward reversal from the support zone set between the support level 1.3020 (former resistance from.

September 13, 2024

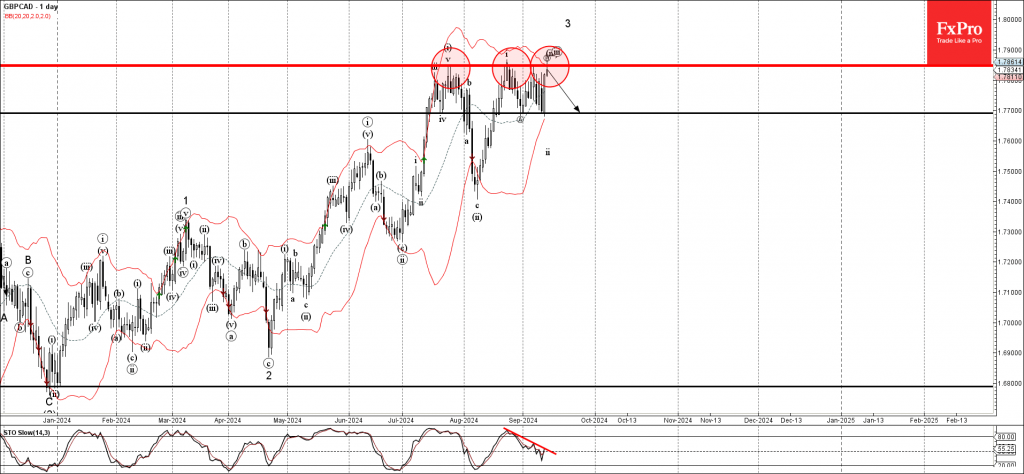

GBPCAD currency pair today reversed down from the strong resistance level 1.7850, which stopped the previous impulse waves (i) and i in July and August respectively. The resistance level 1.7850 was further strengthened by the upper daily Bollinger Band. Given.

September 13, 2024

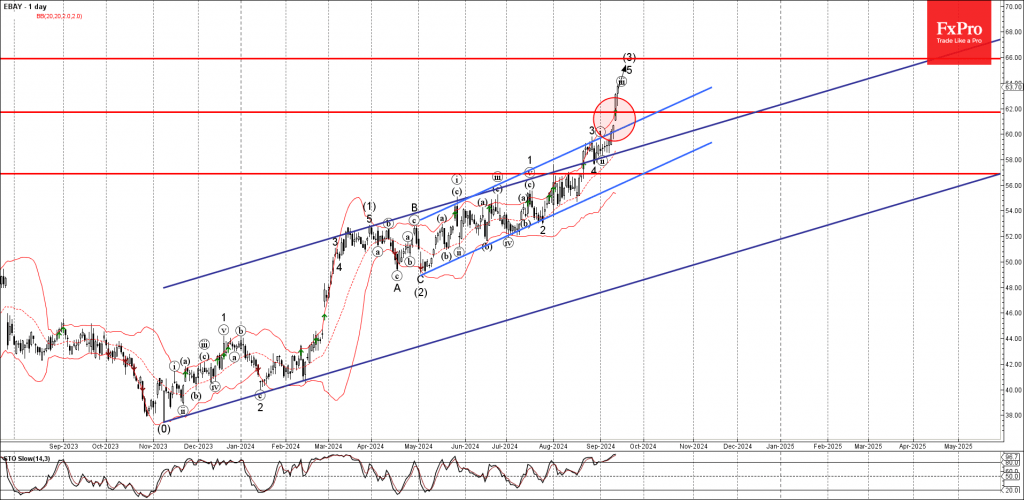

– Ebay broke resistance level 62.00 – Likely to rise to the resistance level 66.00 Ebay continues to rise sharply after breaking through the resistance level 62.00 and the resistance trendline of the narrow daily up channel from May..

September 12, 2024

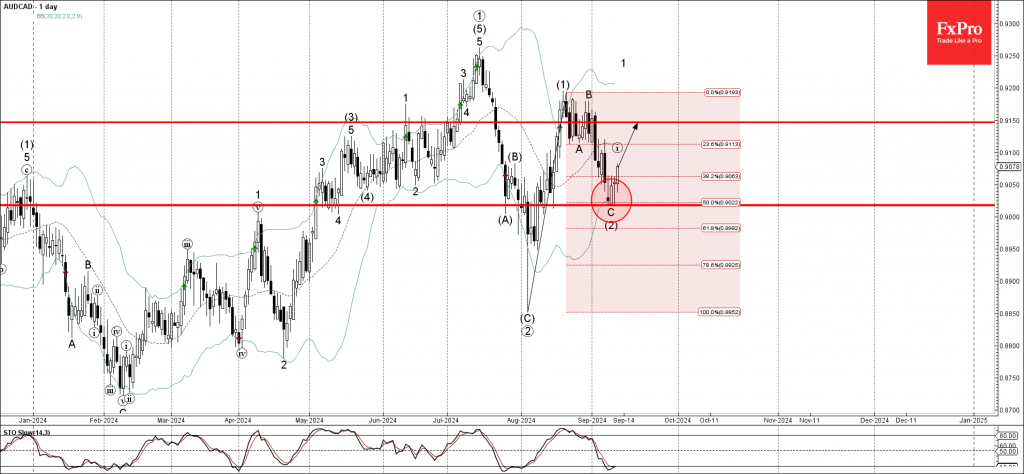

– AUDCAD reversed from support zone – Likely to rise to the resistance level 0.9150 AUDCAD recently reversed up from the support area between the support level 0.9020 (which reversed the price at the start of August) and the lower.

September 12, 2024

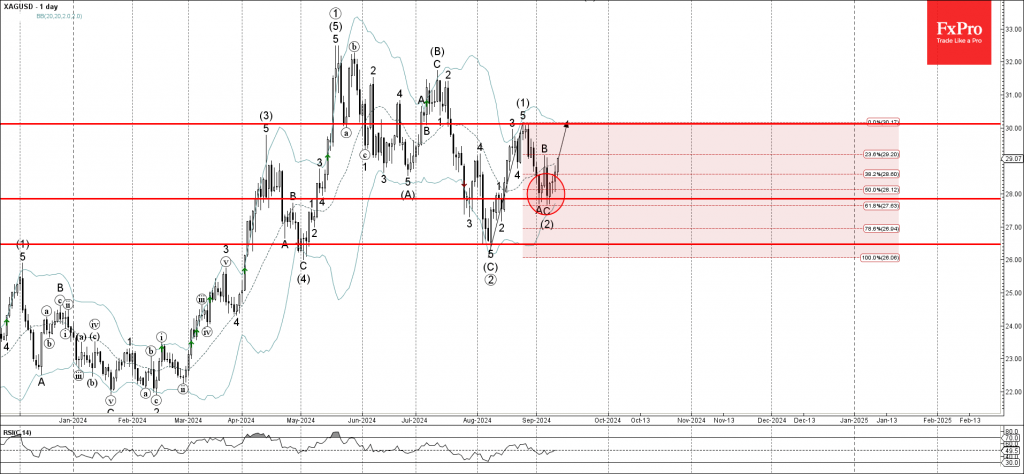

– Silver reversed from support zone – Likely to rise to the resistance level 30.00 Silver recently reversed up from the support zone set between the key support level 28.00 (which also stopped wave A at the start of September).

September 11, 2024

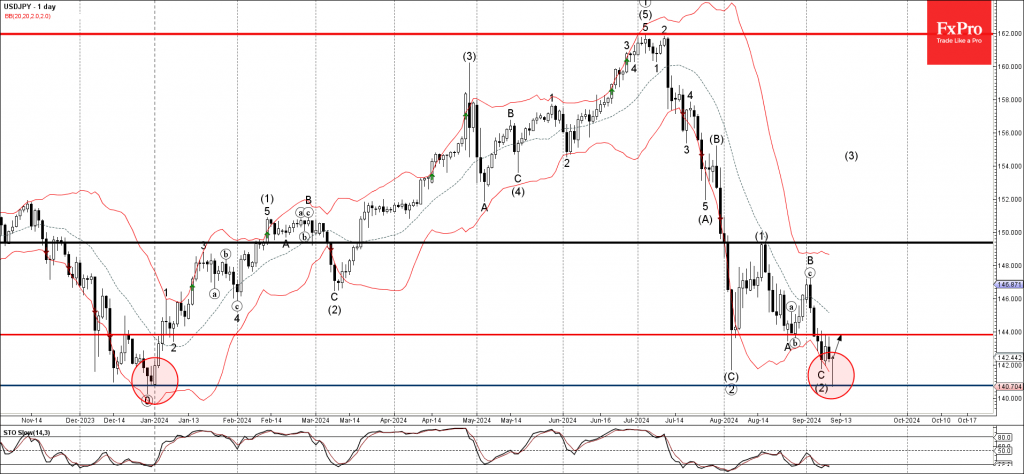

– USDJPY reversed from the support zone – Likely to rise to the resistance level 144.00 USDJPY currency pair recently reversed up from the support zone set between the pivotal support level 140.75 (which has been reversing the price from.

September 11, 2024

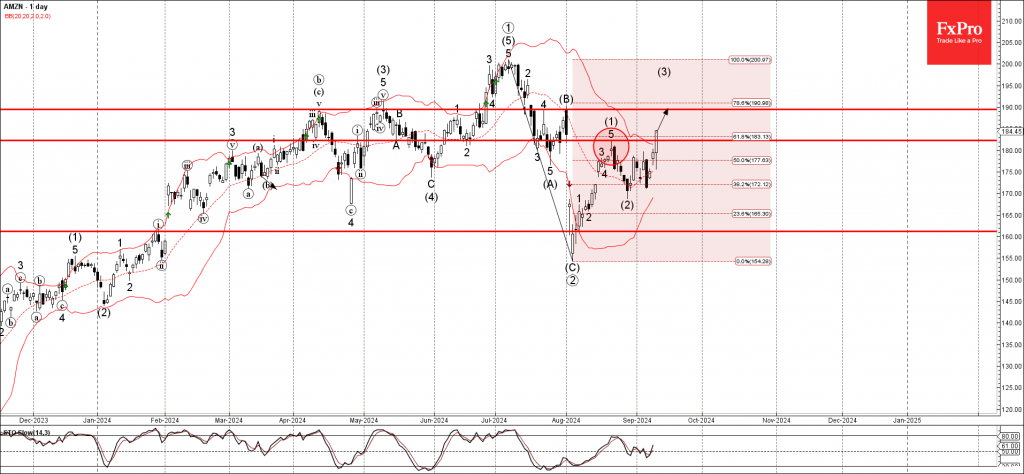

– Amazon broke resistance area – Likely to rise to resistance level 190.00 Amazon recently broke the resistance area located between the resistance level 182.30 (top of wave (1) from the middle of August) and the 61.8% Fibonacci correction of.